- LATEST

- WEBSTORY

- TRENDING

ANALYSIS

Is India’s deficit a concern?

As growth is returning, constricting investments to tackle the current account deficit may not work

TRENDING NOW

It’s that time of the economic cycle — merchandise trade deficits are rising (the recent monthly print showed the widest trade deficit in many years), oil prices are stubbornly high, and global capital flows are showing signs of Emerging Market (EM) fatigue. Putting all of them together, India’s Current Account Deficit (CAD) is inching lower, and is generally expected to be around 2 per cent of GDP for this fiscal year, significantly higher than the negligible level (close to zero per cent) we were at two years back. No wonder, the rupee has been under pressure, and we have a deluge of commentary around the cause and effect of the high CAD. In general, a high CAD has negative connotations, not just in the popular media, but also in real policy-making circles, and not just in India. Trade wars engendered in recent times is primarily a reaction of persistently high CAD in the US.

Which brings us to the question — is CAD something indubitably negative? Should we in India be worried every time our CAD shoots up beyond certain red-lines (the generally used marker is 2.5 per cent of GDP)? A brief outline of the basics would be a good start. The common perspective, the vanilla arithmetic one, is to add up all exports and imports (both goods and services) and arrive at the current account balance (surplus or deficit). This is generally at the crux of most of the emotional debates around CAD — exports are defined as ‘good’, while imports are ‘bad’. There is a second, somewhat rare, but quite intuitive (and empirically robust) perspective — current account balance is basically the difference between national savings and investment.

When India’s current account was in surplus in 2001 and 2002 we had the lowest GDP growth rates in the post-reform era. Thus, the obsession with CAD, especially a ‘low’ number reflecting it, means little.

A current account deficit is a reflection of a higher investment rate compared to savings, while a surplus would be a reflection of higher savings rate compared to investments. For many fast-growing countries, and India is a classic example of that, there are many more investment opportunities than can be funded only by domestic savings. Extracting more out of the world to fund domestic investment is natural in such a scenario, and results in CAD.

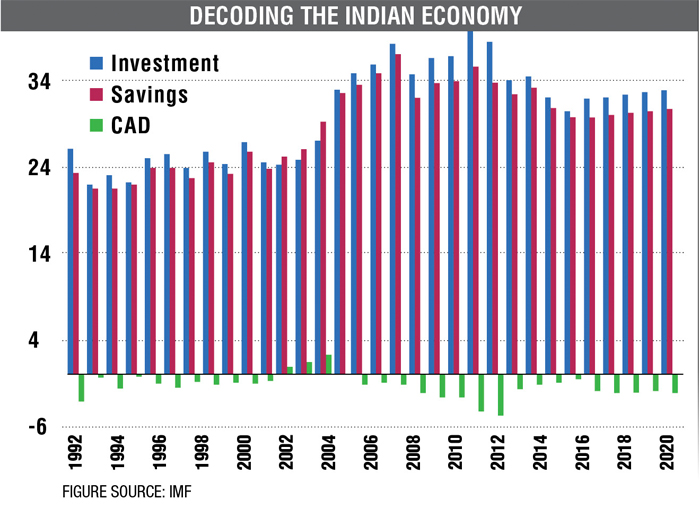

Let’s look at India’s savings, investment and CAD data, since 1990. As can be seen in the chart, whether periods of high investments or low, CAD is primarily driven by the savings-investment (S-I) gap. Since 2012, there has been significant improvement in CAD (from ~5 per cent to 2 per cent today). However, it has been driven by a significant fall in the investment rate in the economy. Both, savings and investment rates today, are lower than what they averaged between 2004 and 2012. In other words, the improvement in the current account had to be achieved by a constriction in investment and growth — not the most optimum solution for a country hungry for growth. To exemplify the point even more, the two years when India’s current account was in surplus — 2001 and 2002 — we had the lowest GDP growth rates in the post-reform era.

By itself therefore, the obsession with CAD, especially a ‘low’ number reflecting it, means little. It is merely the S-I gap. The real policy imperative is therefore not to keep the ‘I’ low, but to ensure enough capital flows come in to fund the S-I gap. In an economy that is growing fast, and with prudent macro-economic policies, capital flows would be attracted. The policy trick is in ascertaining the ‘quality’ of CAD, rather than the extent of it. A high CAD (or S-I gap) engendered by high investments would represent a highly-productive economy, presenting many investment opportunities. On the other hand, a high CAD engendered by low savings could reflect inefficient consumption or fiscal binge. India’s last external account crisis, in 2013, was likely a result of the latter — coming at the tail-end of high fiscal deficit, artificially compressed domestic fuel prices and high household consumption levels.

The situation today is largely different. Fiscal excess is in check and household consumption is coming off a low base (engendered by policy interventions like GST and demonetisation). The S-I gap is primarily a case of savings having fallen off, driven mostly by a decline in household savings in physical assets (primarily real estate). Just when growth is seemingly coming back, largely on the back of recovering consumption, the idea of constricting investments in order to tackle a high CAD is likely to be counterproductive.

There is never an ambient condition for policy-making. Irrespective of the intrinsic quality of India’s CAD today, external conditions (US interest rates, oil prices, etc.) would not always offer propitious conditions to ‘stay the path’.

Financial markets would tend to typically over-react too, putting further pressure on policy-makers. The big challenge before them is to sift the grain from the chaff, not be swayed by the noise, and make decisions that focus on the issue of growth and long term stability (and not on immediate concerns around the value of the rupee).

The author is Managing Partner of ASK Wealth Advisors. Views expressed are personal.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)