India Inc hopes the slew of measures announced by the government recently would kickstart investments and help reboot the economy over the next few quarters

After the announcement of the first-quarter GDP numbers that slipped to over six-year low, stock markets went into a tailspin over concerns of slowdown and its likely impact on the growth going ahead. To make matters worse, dwindling automobile sales over the past 6-8 months, job losses in the sector and waning consumer demand have fuelled concerns of challenging times ahead. To put growth back on the track, the government over the past few weeks announced several fire-fighting measures to revive the slowing economy.

Measures such as additional credit of Rs 70,000 crore to banks, quick clearance of pending GST refunds within 30 days to the MSME sector, enhancement of liquidity support to housing finance companies and expectations of GST cut for the struggling automobile sector are expected to give the economy a headstart, feel industry experts. With the government likely to go for big infrastructure spends in the coming quarters, the move will help create employment and boost infrastructure projects.

Vikram Kirloskar, Vice Chairman, Toyota Kirloskar Motor

The government recently announced a host of measures for encouraging growth of the Indian economy, amidst a global weakening of demand and trade slowdown. The comprehensive measures announced by the finance minister Nirmala Sitharaman is expected to provide stability to the Indian economy by enhancing investor sentiment and reviving markets.

The Indian economy in the fourth quarter of 2018-19 witnessed a modest growth of 5.8% and the set of announcements will provide a much-needed boost to revive growth. Additionally, measures announced for attracting more FDI by relaxing norms in single-brand retail, among other measures, are also expected to spur economic activity.

The stimulus package directed across multiple sectors of the economy with its six-dimensions is aimed at sectors such as MSMEs, auto, the financial sector, etc. which are key drivers of demand and growth in the economy. While industry welcomes these measures, the important point to note is that the government has consulted with multiple stakeholders including businesses and has taken care to address their different concerns related to liquidity, access to credit and demand slowdown. This is the best way to formulate policies in these challenging times when global trade factors are impacting all economies.

The government's decision to remove enhanced surcharge on foreign portfolio investment (FPI), earlier levied in the budget, is a positive move that will encourage capital markets and infuse greater investor confidence in the economy. This is in line with CII recommendations in equity markets and will help reverse the outflows that the economy witnesses post the announcement of the surcharge during the budget.

The announcement to frontload additional credit of Rs. 70,000 crores to banks as announced in the Budget will ease the liquidity squeeze and encourage greater lending at the earliest. Additional credit support for houses and vehicles is likely to kickstart investments in the economy. Taken together, these help customers to improve their spending sentiments.

A number of key measures were announced for the MSME sector including quick clearance of pending GST refunds within 30 days, which will unlock held up working capital for the MSMEs and enhance liquidity in the sector. Other measures such as online tracking of loan applications and better credit flow to the sector along with the Cabinet's decision to consider an amendment to the MSME Act to adopt a single definition of MSMEs were also announced. These address key concerns of the MSME sector.

In a bid to provide an impetus to the infrastructure sector, it was announced that delayed payments would be monitored by the Department of Expenditure. A separate financial institution for credit enhancement to the sector is also under consideration which will encourage capital expenditure in the sector.

Overall, the slew of measures announced is well thought out and address the major pain points across the sectors in the economy. These will encourage positive sentiment and go a long way towards creating necessary growth impulses. We are confident that with an ongoing reform agenda underway, demand and investments will pick up from the third quarter.

Sanjiv Bajaj, Chairman, CII Western Region Council

Several announcements were made by the finance minister at the end of last week aimed at reviving the slowing economy. These measures have had a huge impact on business sentiment even if they are not expected to turn around the economy in the immediate future. The economy grew at a modest pace of 5.8% in the last quarter of 2018-19 and may face challenges in reprising a high growth rate due to global issues. The fact that the government is listening and is willing to act has been communicated.

What has also been communicated is that the government is taking care not to pressure the fiscal deficit and to maintain macroeconomic stability. Many of the measures are aimed at better implementation of existing announcements. For example, the GST refunds are being paid out within a timeline, delayed payments to the private sector are being sorted out and a shelf of infrastructure projects is being identified for implementation. This approach is very much in line with the industry's wishes.

The announcements for the banking and NBFC sector inspire confidence that liquidity will be a high priority. Encouragement is being given to the sector to boost lending, including the issue of anxiety among bank officials. It is indeed heartening that such issues are being recognised and addressed.

The finance minister also stated that more measures are underway and in fact, since then, significant changes to the FDI regime have been announced in certain sectors, as promised. In the next round, some measures are needed to provide relief to the stressed real estate sector. CII has recommended that input tax credit be available to the entire real estate sector under GST and that the sector be given infrastructure status. Exporters are also in need of assistance and measures are needed to make exports truly free of any domestic taxes.

A new framework for direct taxes is required to provide a growth focus and make the country more attractive as an investment destination. Currently, the tax rates are too high in comparison with competitors. What is needed is a lower tax rate together with the removal of exemptions. The task force on the Direct Tax Code has submitted its recommendations to the finance minister and we are confident that these would be taken up as soon as possible.

On its part, the industry can take measures to overcome the downturn. Firms should pursue their long-term strategies to enter new markets, design innovative products and increase efficiencies. Indian firms need to look outward to reduce their dependence on domestic demand. With the current flux in global trade, this may be a good time for Indian products to increase their presence in the global market. For this, Indian firms need to raise their focus on R&D and innovation.

With both government and industry working to improve the competitiveness of Indian products, a sustained recovery in growth should be possible soon and the country can again emerge as the most promising investment hotspot in the world.

Ashishkumar Chauhan, MD & CEO, BSE

The finance minister announced a series of measures resembling a mini-budget, which included removal of enhanced surcharge on foreign and domestic equity investors, simplified KYC norms, credit support for purchase of houses, automobiles, consumption goods, exemption of start-ups from 'angel tax', a package to address distress in the auto sector and upfront infusion of Rs 70,000 crore to public sector banks, in its effort to boost economic growth. The measures touch upon both the demand and supply side, as well as long-term and short-term factors.

The capital markets have already responded positively with the benchmark S&P BSE Sensex rising 792 points or 2.2% on August 26, 2019. The transfer of Rs 1.76 lakh crore by RBI to the government will provide fiscal stimulus, as well as help in the recapitalisation of government-owned banks and funding for infrastructure. With the global economy facing headwinds and slowdown in trade, the economic package coupled with RBI surplus imparts confidence and stability to everyone in the business and sends out a clear message that this government is intent on solving all issues by discussions and taking steps that are necessary.

Funding the banks by an additional Rs 70,000 crore will go a long way in improving the market confidence on an immediate basis. The instant removal of FPI tax is a very short-term measure with a long-term impact. The enhancement of liquidity support to housing finance companies (HFCs) by an additional Rs 20,000 crore is likely to help in boosting the credit offtake and add liquidity. These steps supplemented by targeted micro measures for the unclogging of the real estate sector will revive demand in steel and cement sectors as well.

Long-term measures such as clearing the GST refund in 30 days to micro, small and medium enterprises (MSMEs) and randomised faceless e-assessments for IT need a lot of planning as well as IT prowess. These measures along with the proposed MSME payment portal will also help ease credit access for MSMEs. The formation of the inter-ministerial task force to finalise infrastructure projects by deploying Rs 100 lakh crore over the next five years will help in accelerating capital expenditure and investments in the economy, and ultimately boost growth and create jobs.

The proposal on the development of the credit default swaps (CDS) market jointly by the finance ministry, RBI and Sebi will boost market-based risk assessment. The move by RBI to bring offshore rupee market to domestic stock exchanges and permit trading of dollar-rupee derivatives in GIFT IFSC will broaden the offshore rupee market. Treating CSR violations as civil and not as criminal offenses will allow corporations to employ their CSR funds in an effective way without fear. The proposed social stock exchange could be used effectively to channelise the CSR fund spending.

Simplified KYC for financial markets in line with banks will also go a long way in improving the savings culture in India and ensure that the investors in the remotest part of India are able to avail of the financial services in a regulated environment. In absence of the formal financial institutions reaching out to the smallest towns and villages, unauthorized, unregulated, unscrupulous agencies like Ponzi schemes, chit funds, etc., took away customer money and brought a bad name to government as well as created social issues. e-KYC has enabled financial institutions to reach out to the remotest corners of

Raj Kiran Rai, MD & CEO, Union Bank of India

The slowdown in India is transient. Issues in certain sectors like NBFC and the auto industry are getting a lot of highlights. When the IL&Fs issue came to the fore last year, the NBFC sector, which was fuelling a large part of the credit growth in India, got impaired. Their access to short-term credit through commercial papers, which was an important source of funding, got stifled.

I expect the slowdown to last for one or two quarters, following which we will see the economy reviving. Low-interest rates and low growth have never lasted in India for long. The government is also pushing for big infrastructure spends, which will help in creating employment and bettering infrastructure. Our entrepreneurs, who are now worried about the debt levels of their companies and have started deleveraging, will soon resume investing.

So, if you look at the economy, the auto and NBFC sectors, which were growing at high rates, have moderated due to their own issues. In the auto industry, consumers may be postponing purchases so that they can go for the technologically upgraded versions. When the BS-VI vehicles come into the market by April 2020, we will see a strong consumer demand. Many consumers may also be waiting for huge discounts that dealers and manufacturers would give on the existing BS-IV vehicles in a bid to clear off their inventory. So the auto industry has this specific problem that will get addressed in a few months.

Real estate is another sector that is stressed but the inventory pile-up was a concern even a few years back. The unsold inventory is of developers who are saddled with incomplete projects. The companies that have completed their projects are seeing sales. If the developers manage to complete their projects on time, there is still consumer demand for houses.

The government initiatives for the NBFCs will aid demand revival in a consumption-led economy. Banks are undertaking pool purchases from NBFCs in a big way. If the portfolio turns sour, the government will reimburse 10% of the losses. So, banks are encouraged to buy loans from the NBFCs. Banks have also started undertaking joint lending activities funding retail loans and credit to small-and-medium enterprises. In fact, we are in talks with three NBFCs for co-origination of loans.

The problem for investors today is that they do not trust the corporate balance sheets. So the government has taken steps in the right direction to clean up the system. In the next phase of growth, corporate India will have stronger balance sheets with realistic future projections while a robust credit sanctioning committee is being put in place. When we get back the credibility that our economy needs, the growth drivers will restart. Now, investors are just waiting in the wings. Once the systems, processes, and people are streamlined, revival is certain.

Chandrajit Banerjee, Director General, Confederation of Indian Industry

The finance minister's announcements to ameliorate the economic situation were timely, covering multiple aspects of different sectors. The package included taxation measures meant to encourage investment as well as strong initiatives to impart confidence to wealth creators.

Sector-specific measures for automobiles, infrastructure, banks, MSMEs and NBFCs were aimed at creating demand, unclogging the bottlenecks and facilitating better flow of credit to the end-user including small and medium enterprises. It is heartening to note that the government followed up these measures with easing the FDI norms in single-brand retail, among other measures.

The package is expected to provide a cushion to growth which slowed down to 6.8% in 2018-19. With a view to reignite investment momentum in the economy, which is expected to be the key driver for pushing growth, the industry is enthused by the fact that the government has decided to remove the surcharge on FPI investments. This is expected to be a major sentiment booster for bolstering investments in the equity markets. In addition, tax measures such as alleviating angel tax on startup investors and easier long term and short-term capital gains tax also promise to re-energize investments.

The delayed payments to the private sector by many governments and public sector enterprises is an issue that CII has been flagging as it impedes the investment potential of the private sector by stemming the availability of funds. This was recognised by the government as one of the pain points of the industry. Accordingly, it was announced that delayed payments would be now monitored by the Department of Expenditure and reviewed by the Cabinet Secretariat. With this prompt action, the pipeline of funds can get flowing again.

On GST refunds, the government took a major decision to ensure the timely and time-bound flow of input tax credit to MSME. Uncertainty regarding working capital flows would now be alleviated, imparting confidence to smaller enterprises.

A key step was the announcement that 75% of the funds under arbitration for which favourable decisions have been adjudicated would be provided to the concerned companies. This is based on a Cabinet decision of 2015 which could not be implemented due to requests of guarantees from the counterpart agencies. The action on this would greatly add to investible funds.

The Reserve Bank of India (RBI) on its part too has continued its efforts of supporting growth by cutting the repo rate by a cumulative 110 basis points in the current easing cycle. Banks will now be passing these on through MCLR reduction to benefit all borrowers. To a great extent, this will reduce the cost of capital.

Taken together, the recent slew of measures announced by the government is a great start and we look forward to more such policies that will help enterprises to deal with global shocks and domestic demand moderation. It is indeed welcome that the Government is taking into account industry suggestions on a continuous basis and we look forward to the ongoing reforms process.

D K Srivastava, Chief Policy Advisor, EY India

The slowdown in the economy may continue for another three to four quarters. The underlying reasons for the slowdown are structural in nature. Unless some of these factors are attended to, it may continue for a period longer than expected.

While the actual short-term factors are cyclical in nature, there is an underlying structural change in the economy. It is due to a persistent fall in the savings and investment rates. This has a long-term impact on the Gross Domestic Product (GDP) growth rate. The potential growth rate has fallen to below 7% due to structural reasons and actual growth rate to 5%, which is below the potential growth rate, due to short-term factors.

Demand slowdown is driven by structural changes in GDP sectoral shares. A large segment of workers is dependent on the slow-growing agricultural sector. Employment has also fallen in the industrial sector. Thus, demand has considerably slowed down, as incomes are not getting generated in informal and rural sectors. These things can possibly be traced back, among other factors, to demonetisation and Goods and Services Tax (GST), the two major policy decisions of the government.

While the government has announced front-loading of the capital expenditure as one of the key measures being taken to revive the economy, its impact will be limited. The central government's budgeted capital expenditure for the current fiscal amounted to only 1.6% of the GDP. The government should increase its capital expenditure even more.

The central government should also bring on board state governments and public sector entities. An attempt should be made to increase the capital expenditure to 3-4% of the GDP. State governments are spending a little more than 2% of GDP on capital expenditure. This can be further increased by 1% point, without breaching their Fiscal Responsibility and Budget Management Act (FRBM) limits. Public Sector Undertakings (PSUs) can increase their capital expenditure more. But they should spend only on viable projects that will add to their production capacity. Otherwise, they will run into problems as it has happened in the case of the National Highways Authority of India (NHAI). In this case, the interest payments have become heavy and a good part of it may have to be borne by the Budget.

To increase public expenditure, the Centre will have to rejig budgetary expenditure by reducing revenue expenditure and increasing capital expenditure. During 2019-20, the government will, however, get a respite because of the additional dividend received from the Reserve Bank of India (RBI). It may have to amend the FRBM Act and revise the borrowing target if it proves to be difficult to reduce revenue deficit. RBI money will be largely absorbed in offsetting the expected shortfall in tax revenues. The Budget has overestimated the central tax revenues.

If all these steps are taken, it will take at least 3-4 quarters for the economy to come back on track because of the time lag involved.

The government seems to be aware of the issues and is taking measures. However, due to constraints on the fiscal front, the government may be able to increase the investment by a fraction of the required amount instead of 3-4% of the GDP.

The two sectors which have been impacted the most by the slowdown are real estate and automobile sectors. Other sectors have small weights in the overall industrial profile.

Real estate players are asking for additional liquidity and financing of the projects which are more than halfway through. But the sector wouldn't see much change in the short-term, as so much of inventory has piled up but there are no takers in the short term. It will take two to three years for the sector to recover if necessary policies are put in place. Supply-side financing will have to be provided. But consumer confidence is not getting back because of large defaults of real estate players. It will take time to recover the confidence of potential buyers.

As far as the automobile sector is concerned, the GST rate cut on cars and other vehicles would be good for the sector but some states do not appear to be in favour. It is for the GST Council to decide in its upcoming meeting on September 20 at Goa. Apart from demand slowdown due to unemployment and incomes not getting generated, habits of young urban potential buyers are also getting changed to which industry has to adjust. As long as technology-driven platforms such as Uber and Ola are available, people are not preferring to buy cars. Moreover, insurance cost has become very high and regulatory requirements have also become tough.

Secondly, with the real estate sector down, the real estate players are not buying land for new projects and land prices also remain subdued. Earlier, a lot of demand for assets was driven by people who sold their land to buy automobiles, tractors and other assets. This demand has fallen significantly.

After the budget, a number of initiatives have been undertaken for the automobile and real estate sectors. These will facilitate recovery in a few quarters.

![submenu-img]() Meet Gautam Adani’s ‘right hand’, used to work as teacher, he’s now Rs 1600000 crore…

Meet Gautam Adani’s ‘right hand’, used to work as teacher, he’s now Rs 1600000 crore…![submenu-img]() Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..

Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..![submenu-img]() Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...

Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...![submenu-img]() This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..

This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..![submenu-img]() Volkswagen Taigun GT Line, Taigun GT Plus launched in India, price starts at Rs 14.08 lakh

Volkswagen Taigun GT Line, Taigun GT Plus launched in India, price starts at Rs 14.08 lakh![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Abhishek Sharma? Hrithik Roshan's brother from Kaho Naa Pyaar Hai has become TV star, is married to..

Remember Abhishek Sharma? Hrithik Roshan's brother from Kaho Naa Pyaar Hai has become TV star, is married to..![submenu-img]() Remember Ali Haji? Aamir Khan, Kajol's son in Fanaa, who is now director, writer; here's how charming he looks now

Remember Ali Haji? Aamir Khan, Kajol's son in Fanaa, who is now director, writer; here's how charming he looks now![submenu-img]() Remember Sana Saeed? SRK's daughter in Kuch Kuch Hota Hai, here's how she looks after 26 years, she's dating..

Remember Sana Saeed? SRK's daughter in Kuch Kuch Hota Hai, here's how she looks after 26 years, she's dating..![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..

Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..![submenu-img]() Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...

Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...![submenu-img]() This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..

This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..![submenu-img]() Mumtaz urges to lift ban on Pakistani artistes in Bollywood: ‘Woh log hum logon se...'

Mumtaz urges to lift ban on Pakistani artistes in Bollywood: ‘Woh log hum logon se...'![submenu-img]() Not Kiara Advani, but this actress was first choice opposite Shahid Kapoor in Kabir Singh, she rejected because...

Not Kiara Advani, but this actress was first choice opposite Shahid Kapoor in Kabir Singh, she rejected because...![submenu-img]() IPL 2024: Yashasvi Jaiswal, Sandeep Sharma guide Rajasthan Royals to 9-wicket win over Mumbai Indians

IPL 2024: Yashasvi Jaiswal, Sandeep Sharma guide Rajasthan Royals to 9-wicket win over Mumbai Indians![submenu-img]() IPL 2024: How can RCB still qualify for playoffs after 1-run loss against KKR?

IPL 2024: How can RCB still qualify for playoffs after 1-run loss against KKR?![submenu-img]() CSK vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() RR vs MI: Yuzvendra Chahal scripts history, becomes first bowler to achieve this massive milestone in IPL

RR vs MI: Yuzvendra Chahal scripts history, becomes first bowler to achieve this massive milestone in IPL![submenu-img]() 'Yeh toh second tier ki bhi team nhi': Ramiz Raja slams Babar Azam and co. after 3rd T20I loss vs New Zealand

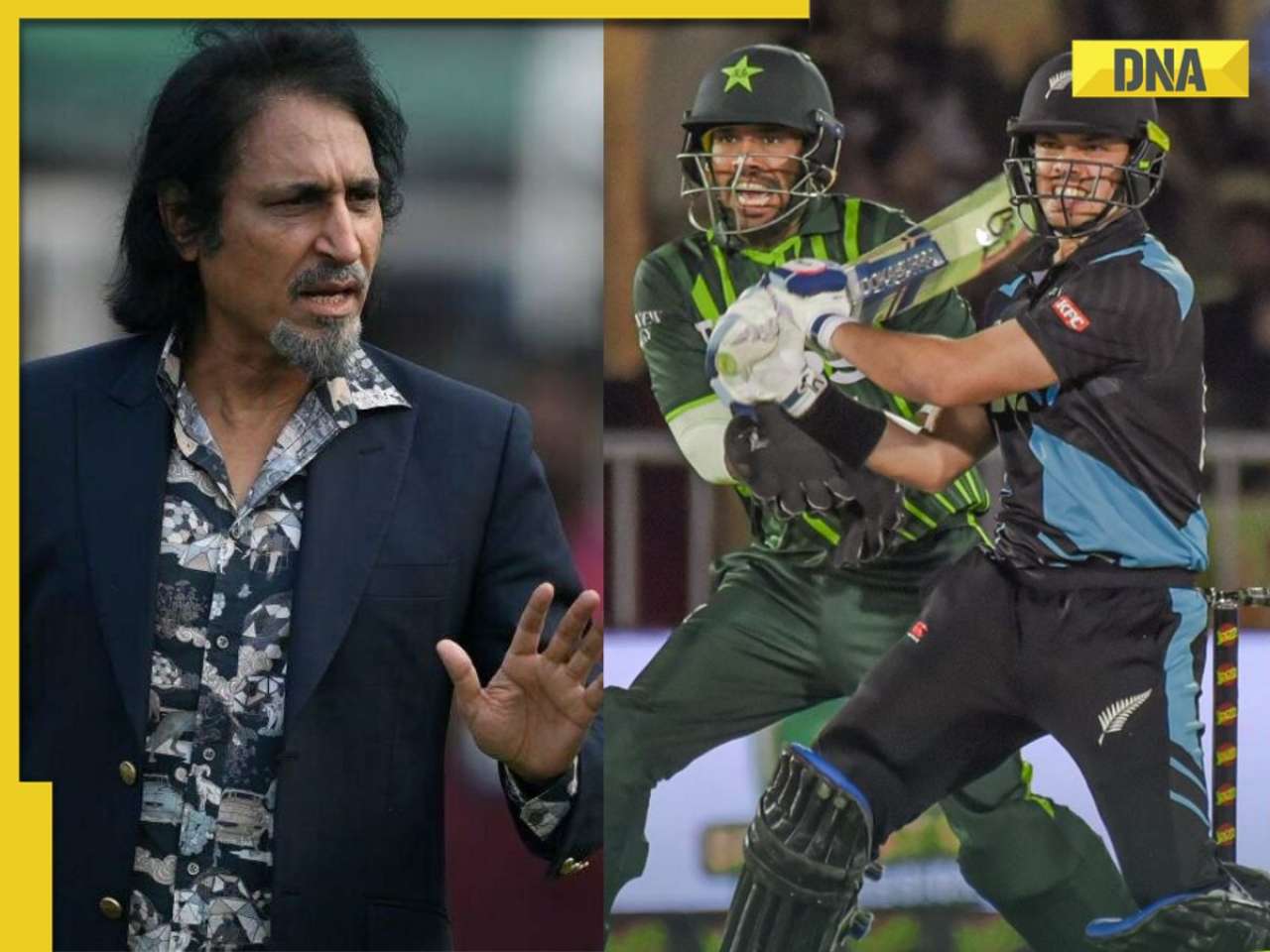

'Yeh toh second tier ki bhi team nhi': Ramiz Raja slams Babar Azam and co. after 3rd T20I loss vs New Zealand![submenu-img]() Mukesh Ambani's son Anant Ambani likely to get married to Radhika Merchant in July at…

Mukesh Ambani's son Anant Ambani likely to get married to Radhika Merchant in July at…![submenu-img]() India's most expensive wedding costs more than weddings of Isha Ambani, Akash Ambani, total money spent was...

India's most expensive wedding costs more than weddings of Isha Ambani, Akash Ambani, total money spent was...![submenu-img]() Meet Indian genius who lost his father at 12, studied at Cambridge, took Rs 1 salary, he is called 'architect of...'

Meet Indian genius who lost his father at 12, studied at Cambridge, took Rs 1 salary, he is called 'architect of...'![submenu-img]() Earth Day 2024: Google Doodle features aerial photos of planet's natural beauty, biodiversity

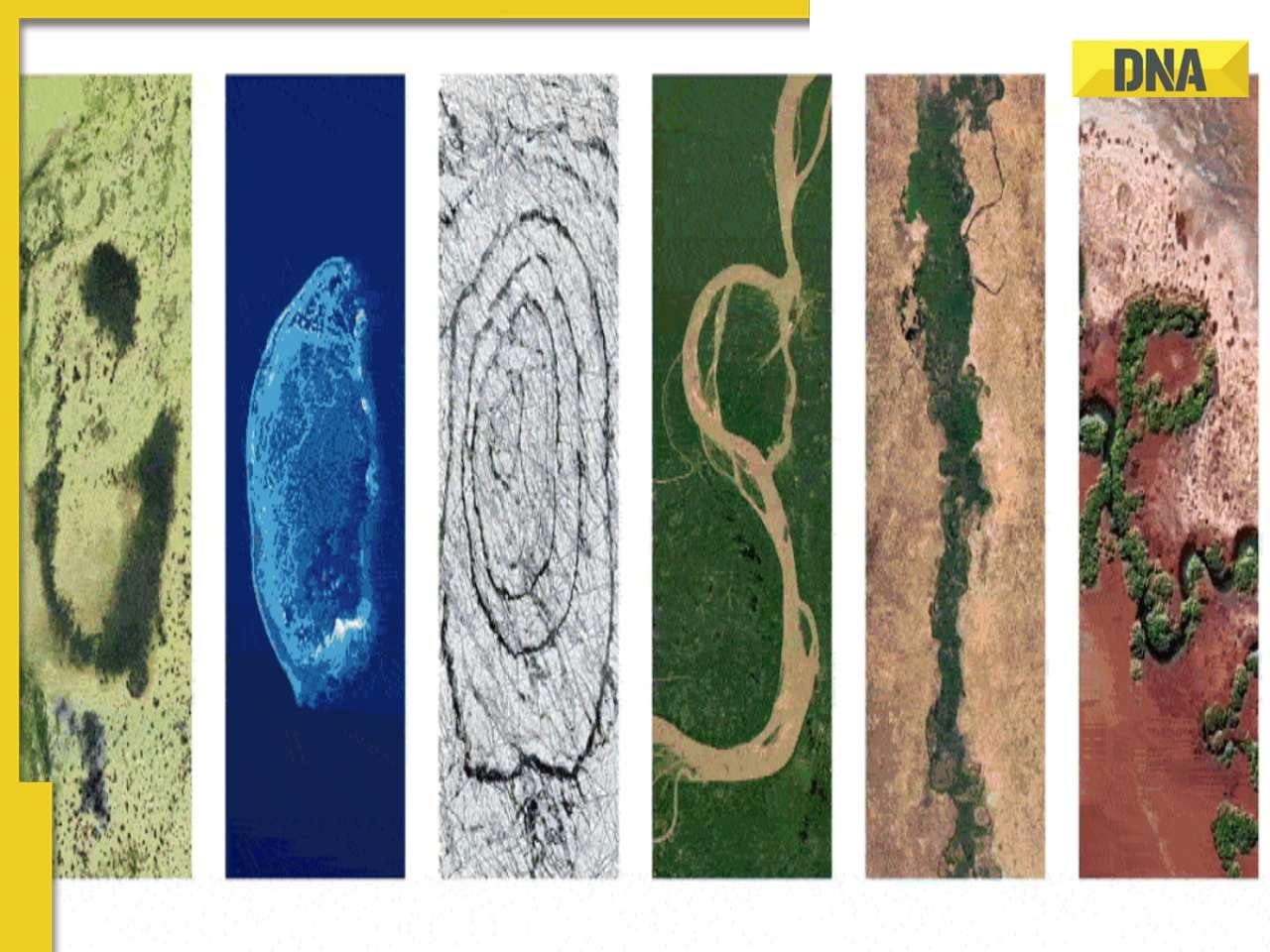

Earth Day 2024: Google Doodle features aerial photos of planet's natural beauty, biodiversity![submenu-img]() Meet India's first billionaire, much richer than Mukesh Ambani, Adani, Ratan Tata, but was called miser due to...

Meet India's first billionaire, much richer than Mukesh Ambani, Adani, Ratan Tata, but was called miser due to...

)

)

)

)

)

)

)

)

)

)

)

)

)