- LATEST

- WEBSTORY

- TRENDING

BUSINESS

Fortis Healthcare gets fresh bids from IHH Healthcare, Manipal Health Enterprises-TPG Capital

Munjal-Burman stay away; IHH's binding offer valid till July 16

TRENDING NOW

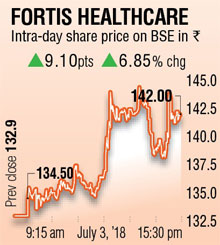

Gurugram-based Fortis Healthcare Ltd received a lukewarm response for its hospital assets with only two of the four interested bidders submitting quotation.

Sources told DNA Money that only two offers – from IHH Healthcare and MHE-TPG - were received by Fortis till Tuesday morning, which was the deadline for bid submission. The price stated by both the bidders was not known.

Post the submission of the bids, Fortis Healthcare said in a regulatory filing, “The binding bids will be evaluated by the Board of directors of the company in consultation with its advisors.”

Going by the series of submission of bids since March this year, there were four contenders – Manipal Health Enterprises-TPG Capital (MHE-TPG), IHH Healthcare, Hero Enterprise Investment Office-Burman Family Office (Munjal-Burman), and KKR-backed Radiant Life Care - in the fray to acquire India’s second largest hospital network.

The newly-formed Board of Fortis Healthcare had laid down certain conditions for participation in the binding process. The requirements included minimum investment of Rs 1,500 crore into Fortis through preferential allotment, a plan to fund RHT Health Trust’s acquisition, plan to provide exit to private equity investors of Fortis’s arm SRL, unconditional bid, disclosure of funding source in the offer and plan to retain the current management as well as employees.

The newly-formed Board of Fortis Healthcare had laid down certain conditions for participation in the binding process. The requirements included minimum investment of Rs 1,500 crore into Fortis through preferential allotment, a plan to fund RHT Health Trust’s acquisition, plan to provide exit to private equity investors of Fortis’s arm SRL, unconditional bid, disclosure of funding source in the offer and plan to retain the current management as well as employees.

On Tuesday, Malaysia’s IHH Healthcare confirmed their participation through an announcement, stating, “Based on the suitability of the offers evaluated earlier including IHH’s enhanced revised proposal, the Board of Fortis has invited IHH to participate in the process, subject to adherence with the transaction process letter issued by Fortis. Further to the above, IHH wishes to announce that IHH has on 3 July, 2018, issued a letter to the Board of Fortis setting out a binding offer, which supersedes and replaces the enhanced revised proposal.” IHH’s binding offer is valid till July 16.

The Munjal-Burman duo, whose offer was accepted by the previous Board of Fortis, did not participate in the latest round of bidding, a source said.

The difference between the latest round of bidding and the previous ones is that this time the potential buyers were allowed access to the data room for due diligence.

It is believed that the response is tepid this time due to certain facts that must have come to light as well as the latest report by Luthra & Luthra finding “systemic lapses and override of controls”.

The reconstituted Board has also announced initiation of legal action against Singh brothers – Malvinder and Shivinder – the erstwhile promoters of Fortis Healthcare, to recover around Rs 500 crore as part of the outstanding inter-corporate deposits and other advances.

Market regulator Securities and Exchange Board of India (Sebi) as well as Serious Fraud Investigation Office (SFIO) under the Ministry of Corporate Affairs are conducting an inquiry against Fortis Healthcare.

Sebi has ordered a forensic audit and SFIO suspects financial fraud of around Rs 475 crore. SFIO is expected to submit its findings to corporate affairs ministry by August.

Last week, the Board approved Fortis Healthcare’s results after several rounds of delays. The hospital chain’s quarterly loss widened from Rs 19.10 crore at the end of December quarter of last financial year to Rs 914.32 crore in the fourth quarter. As on March 31, 2017, the company posted a net profit of Rs 479.29 crore. However, after a year, it plunged into a loss of Rs 934.42 crore.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)