- LATEST

- WEBSTORY

- TRENDING

BUSINESS

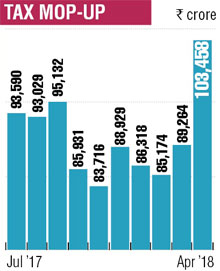

GST revenues cross Rs 1 lakh cr in April on improved compliance

Collections from Central GST and State GST were Rs 18,652 crore and Rs 25,704 crore, respectively

TRENDING NOW

The revenue collection from the Goods and Services Tax (GST) touched Rs 1.03 lakh crore in April, the finance ministry said on Tuesday. This is for the first time that the GST revenues have exceeded Rs 1 lakh crore mark since the new tax regime became operational in July last year.

Finance Minister Arun Jaitley in a tweet said, "GST collections in April exceeding Rs 1 lakh crore is a landmark achievement and a confirmation of increased economic activity as brought out by other reports."

Giving a break-up of the Rs 1.03 lakh crore GST revenue mop up in April, the government said the collections from Central GST (CGST) and State GST (SGST) were Rs 18,652 crore and Rs 25,704 crore, respectively. The tax collected from Integrated GST (IGST) was Rs 50,548 crore, whereas cess accounted for Rs 8,554 crore.

Out of a total of 87.12 lakh eligible companies, as many as 60.47 lakh have filed GSTR 3B returns, taking the compliance level up to 69.5%.

Out of a total of 87.12 lakh eligible companies, as many as 60.47 lakh have filed GSTR 3B returns, taking the compliance level up to 69.5%.

Apart from better compliance rate, quarterly returns filing by composition dealers contributed to better GST collections, the government said in a statement. April was the month for filing of quarterly returns for composition dealers. Out of 19.31 lakh composition dealers, 11.47 lakh have filed quarterly returns, contributing Rs 579 crore to the kitty. The compliance rate for composition scheme is 59.4%.

The government also said that it is usually noticed that in the last month of the financial year, people also try to pay arrears of some of the previous months. So, this month's collections cannot be taken as a trend for future, it further said.

According to ICRA's principal economist Aditi Nayar, "a portion of the GST revenue collected in April may be on account of arrears for earlier months. Therefore, the GST collections in May may provide a better gauge of likely buoyancy for FY19. The pan-India rollout of the e-way bill should help to boost collections in the coming months."

The e-way bill for the inter-state movement of goods of value exceeding Rs 50,000 was implemented from April this year. Now the state governments are rolling it out for the movement of goods within the state.

Pratik Jain, indirect tax expert and partner at PwC says, "Though there would be some impact of year-end push and adjustments, it is clear that compliance is steadily improving. With the introduction of e-way bill system now, one can expect the collection for next month to also exceed Rs 1 lakh crore."

The GST Council has set the GST collection target at Rs 12 lakh crore for 2018-19.

While the filing of 3B returns have improved and touched almost 70%, for composition dealers this continues to be less than 60%. With only Rs 579 crore coming from these dealers, the government might want to investigate it in detail, feel experts.

GST Council in its meeting scheduled for May 4 is likely to announce some new measures to improve compliance.

...& ANALYSIS

- Collections from Central GST and State GST were Rs 18,652 crore and Rs 25,704 crore, respectively

- Tax collected from Integrated GST was Rs 50,548 crore, whereas cess accounted for Rs 8,554 crore

- Apart from better compliance rate, quarterly returns filing by composition dealers contributed to better

)