- LATEST

- WEBSTORY

- TRENDING

BUSINESS

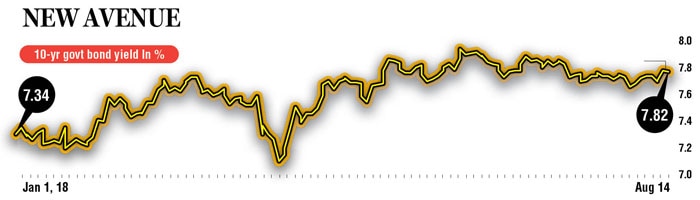

Long-term lending needs bonds

Domestic banks should be allowed to issue bonds for onward long-term lending, say experts

TRENDING NOW

Call it a legacy issue or crony capitalism, the growing bad debt of over Rs 10 lakh crore in Indian banking industry is 'very serious' but Insolvency and Bankruptcy code coming into being has at least ensured that companies will hereafter be careful and shun reckless borrowing.

Some like former advisor to Planning Commission Gajendra Haldea dubs the mounting NPAs as a banking scam. The government , however, blames the previous UPA government, describing it as a legacy issue.

Be that as it may, if one goes into the genesis of the huge banking problem, it is very clear that the mess is because of the fact that banks in early 2000 started giving loans for fixed capital requirement of industry for which they were ill-equipped.

"In 2002, 76% of bank loans to industry were for working capital requirement, which was short-term in nature. Today only 36% of loans to industry were for working capital," said renowned economist, Pronab Sen, who was formerly India's chief statistician and National Statistical Commission.

There is obviously an asset-liability mismatch in the banking industry. Banks get deposits for short-to-medium term that is up to 5 years, but lend to industry fixed capital on a long-term basis, which is of 10-20 years.

In the past, banks used to lend long-term only for retail housing, which was safe as property prices appreciated much faster than the loan liabilities.

Sen told DNA Money that banking woes started because the government disbanded development of financial institutions and did not create alternatives for lending long-term fixed capital requirements.

Corporate bonds could have been one good alternative but did not develop rapidly in India. One of the reasons could be high fiscal deficit of both the Centre and states during the past several years, which. retarded the corporate bond development in India.

"When you force banks to do something, you should provide them with instruments," Sen said citing the example of advanced countries where commercial banks are allowed to raise bonds for lending long term.

In India, banks can raise bonds only for raising their own capital but not for onward lending.

In fact, as early as Tenth five-year plan (2002-07), Insolvency and bankruptcy code was mooted. The SARFAESI Act (The Securitisation and Reconstruction of Financial Assets and Enforcement of Securities) had recommended dealing with errant borrowers provided it was a case of one lender and one borrower. The act could not deal with those cases where a consortium of lenders gives money to one borrower and hence the need for a comprehensive banking code.

More than the corruption, as feared in certain quarters for the huge NPAs, the adoption of a lending pattern, for which the commercial banks were not designed, is to be blamed for the mess. "Banks today lend thousands of crores for 20 years but accept deposits, which on an average is for 3 years," Sen said pointing out at the huge asset-liability mismatch in the banking system.

More than the corruption, as feared in certain quarters for the huge NPAs, the adoption of a lending pattern, for which the commercial banks were not designed, is to be blamed for the mess. "Banks today lend thousands of crores for 20 years but accept deposits, which on an average is for 3 years," Sen said pointing out at the huge asset-liability mismatch in the banking system.

"In Europe and Japan, banks are allowed to issue bonds for lending onwards for long term. Corporate bonds are meant for large companies. Banks raise bonds to lend to medium and small players for long term. All these have been discussed in the 10th and 11th plan," Sen said implying these have not been implanted even a decade after it was suggested.

Development finance institutions (DFIs) used to follow this model and banks should have been armed with this instrument when DFIs were disbanded.

In a discussion paper titled 'Sub-prime infrastructure: Crony capitalism in public sector banks', Haldea, however, blamed reckless lending for sub-prime infrastructure projects. Gold plating of costs in power and highways sectors, apparently due to widespread corruption is the root cause of the mess that the public sector banks were facing. As much as Rs 9 lakh crore was given as loans to power and infrastructure projects.

The crisis in the banking sector is one of the reasons for bank deposits growth falling to as low as 6-7% last year, lowest ever since 1963. Luckily, it is now inching ahead.

China faced a similar crisis in their banking system in the 1990s due to overleveraging for infrastructure development. They overcame the mess by massive recapitalisation of banks through the issue of state bonds and using its massive foreign exchange reserves, now at over $3.5 trillion.

Lately, there are suggestions from certain quarters that India too should use its $400 billion foreign exchange reserves to recapitalise banks.

China's forex reserves are largely due to its current account surplus. But India still runs a substantial current account deficit, which meant it is borrowed money and hence cannot be used for the recapitalisation of banks. Also, forex reserves cannot provide a shield if the fundamentals are wrong.

)