- LATEST

- WEBSTORY

- TRENDING

BUSINESS

RBI sees a Goldilocks economy: Lower inflation, higher growth

EMIs may not go up as central bank likely to hold rates for a year

TRENDING NOW

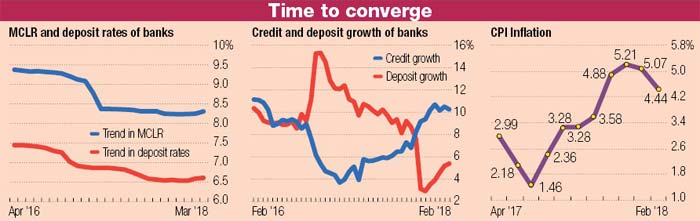

Your equated monthly installments (EMIs) are unlikely to go up as Reserve Bank of India (RBI) continues to hold on to its neutral stance despite heightened worries on food and other commodities. Some economists said they even expect a reduction in rates if the inflation is lower than anticipated.

Majority of bankers and economists expect the central bank to continue with a neutral stance with a hike being a likelihood only by the end of the financial year.

Praveen Kumar Gupta, managing director, State Bank of India (SBI), told DNA Money, "The interest rates on all loans will remain where they are unless there is a tightness in liquidity. We do not expect any liquidity issues in the banking system for the next six months."

Some of the smaller banks may hike their deposit rates depending on the liquidity situation. But with the first quarter generally showing a lacklustre demand for credit, banks are unlikely to raise the interest rates.

Indian Overseas Bank (IOB), meanwhile, hiked interest rates on its fixed deposit (FDs) across various tenures by 10-80 basis points (bps), effective April 5. IOB has hiked rates for tenures ranging from one week to five years and above, up to less than Rs 1 crore and will now earn between 4.5 % and 6.8 %.

In March, after increasing the deposit rates by 0.10% to 0.75%, SBI increased the one-year MCLR by 0.20% to 8.15% from 7.95%, whereas ICICI Bank raised one-year MCLR by 0.10% from 8.20% to 8.30%. While most banks link their lending rates to retail customers to the one year MCLR, ICICI Bank and Kotak Mahindra bank link their retail loans to the six month MCLR. ICICI Bank also hiked its six month MCLR by 0.10% from 8.15% to 8.25%.

SBI had increased its MCLR across most maturities in March. SBI also raised the 1-year MCLR to 8.15 %from 7.95 %, other lenders like ICICI Bank and Punjab National Bank followed suit and raised their MCLR, by 0.15%.

Interest rates on corporate loans is also expected to remain at existing levels with RBI insisting on a loan commitment by a company under the cash credit facility.

Under the present system, working capital requirements of borrowing entities are met by banks through a cash credit limit which is a revolving facility. "The cash credit facility places undue burden on the banks in managing their liquidity requirements. Currently, banks do not charge any commitment fee and do not maintain any capital on the undrawn portion of the cash credit because it is classified as an unconditionally cancellable facility," said N S Vishwanathan, deputy governor, RBI.

"We, therefore, want to control the possible volatility in utilisation of cash credit limits by making it mandatory to have a working capital demand loan portion in the working capital facility," he said. This is expected to bring down the cost of corporate loans, but banks are unlikely to pass on lower rates considering that resolution of non-performing assets continues to eat into the profits of banks.

Large companies keep the working capital limits open with various banks and may not utilise it. However, banks are mandated to set aside capital on sanctioned amount of working capital loan. Under the new norm, borrowers will have to commit to withdraw a fixed amount of the sanctioned limit.

The other big relief for banks was the postponement of the implementation of the Indian Accounting Standards (IndAS) from 1 April 2018, which could have potentially ballooned the provisions by another 30%. These new accounting norms that insist on provisions from the time the loan is originated will now be implemented in 2020. They currently follow Indian generally accepted accounting principles (GAAP) standards.

POLICY HIGHLIGHTS

- Reserve Bank of India (RBI) keeps key lending rate (repo) on hold at 6%

- Reverse repo rate stands at 5.75%, bank rate at 6.25%

- Inflation projection revised downwards to 4.7-5.1% in H1 of FY19

- Recent volatility in crude prices imparted uncertainty on inflation

- RBI flag risks to inflation from fiscal slippages at the level of states

- GDP growth projected to strengthen from 6.6% in FY18 to 7.4% in FY19

- GDP growth projected at 7.3-7.4% in H1 of FY19 & 7.3-7.6% in H2

- Clearer signs of revival in investment activities; exports to get a boost

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)