- LATEST

- WEBSTORY

- TRENDING

BUSINESS

Retail investors eye NCDs as bank deposit rates drop

In the first four months of this fiscal, companies have raked in over Rs 3,600 crore through public debt issues, show numbers from Prime Database

TRENDING NOW

It's not just equity markets that are on fire.

Thanks to the increase in participation from retail investors, corporate debt issuances in the form of non-convertible debentures (NCD) are on the rise as investors seek better returns, companies aim to lower credit costs and banks struggling with bad loans turn wary of corporate exposure.

Shying away from more bank funding, non-banking finance companies (NBFCs) with business interests in housing, equipment, gold and transport are tapping the public NCD issue route regularly. For investors, such offerings are quite attractive amid a secular drop in interest rates for bank deposits.

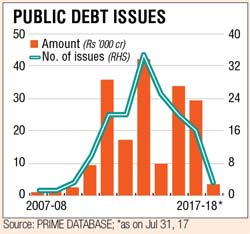

In the first four months of this fiscal, companies have raked in over Rs 3,600 crore through public debt issues, show numbers from Prime Database. In the last financial year, firms had mopped up Rs 29,547 crore through 16 such issues. Compare this to FY2006 and FY2007, when there were no public debt issues. In FY2008 and FY2009, the amount raised was just Rs 1,000 crore and Rs 1,500 crore, respectively.

A testimony to retail investors' appetite for NCDs is a recent offering by Kerala-based firm Kosamattam Finance, which is into gold loan financing.

A testimony to retail investors' appetite for NCDs is a recent offering by Kerala-based firm Kosamattam Finance, which is into gold loan financing.

The firm, which hit the market with Rs 110 crore retail bond issue, plans to close it early this week as compared to its notified closing date of September 1, said a media report quoting a company official.

Kosamattam's issue was oversubscribed last Wednesday. While the NBFC did not get a single bid from the Category I investors due to lack of interest among major institutional investors, it got a robust response from retail investors, for its offering that has been rated 'BBB-' by India Ratings. The company offers a coupon rate of between 9% and 10% for various maturities.

Besides Kosamattam, two Srei group companies have mopped up nearly Rs 1,400 crore via NCD offerings between January 30 and July 31 this year. Others like Mahindra & Mahindra Financial and Muthoot Finance have also raised funds.

Experts say secured or unsecured NCDs generally offer coupon rates of 8-12%, with unsecured ones offering higher returns for higher risks. The interest income on any such investment is taxable, but with bank fixed deposits offering taxable income of 6-6.5% now, NCDs make more money for investors that have a stomach for the risk appetite.

For many companies DNA Money spoke to, the reliance on bank funding is high at 60-70%. To balance funding resources, many have tapped the NCD route to bring it down to 40-50% levels. In this way, NCDs have become a viable alternative. "If you see, we have brought out an NCD issue once every quarter. Not only do NCDs help deepen bond market, but it shows the emergence of a new avenue for fundraising," said Sanjeev Kumar, senior vice-president and head – resource mobilisation (retail liabilities), Srei.

Last year, a Rs 4,000 crore NCD issue from Dewan Housing Finance in August 2016 raked in applications worth Rs 19,000 crore. Such has been the response that in many cases NCD issues were pre-closed as in the Rs 3500 crore NCD offer by Indiabulls Housing in mid-September. Such NCD offerings not only established a strong yield curve for NCD instruments in the market but have also helped the issuers reposition their borrowing portfolio into a more balanced mix.

Investment bankers DNA Money spoke to said that it's expected that many more companies will line-up their NCD issues if the general interest rates stay low. "Many top companies are looking to refinance their debt, or raise money. They are exploring tapping the NCD route because it helps in getting a better maturity profile," said an investment banker.

Shankar Raman, CIO-Third Party Products, Centrum Wealth Management, said: "Many of these companies can't get enough bank funding at a lower cost. Banks are also a bit cautious, given the overall rise of NPAs in the economy. Hence, the companies have found a viable alternative in the form of NCDs. Such fundraising helps them lower credit costs, and also get money for the long term."

NBFCs can raise money both through public issues and private placements of NCDs. When companies raise money through a public NCD issue, they are in fact subject to Securities and Exchange's tighter 2008 regulations on debt securities (similar to stringent norms for IPOs).

With bank FD fetching just 6%-6.5% annually today from 8-9% three years ago, NCDs are being lapped up by HNI investors. NCDs offer interest rates that are a 1-2% above prevailing bank deposit rates. "However, NCDs are not for everyone. Most people make a straight comparison of NCD interest rates with bank FDs. Please remember NCDs are only as safe as the financial position of the NCD issuer company," Pradeep Sharma, a financial and tax consultant, said.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)