- LATEST

- WEBSTORY

- TRENDING

BUSINESS

Share buyback may be taxed in Budget

A ministry source told DNA that the "government is very serious about such tax leakage" and "may change the rule of Section 115QA in the Budget."

TRENDING NOW

Share buybacks will no more be a tool to avoid dividend tax for listed companies as the Finance Ministry is planning to plug this tax loophole in the Union Budget, to be presented on February 1. A ministry source told DNA that the "government is very serious about such tax leakage" and "may change the rule of Section 115QA in the Budget."

Currently, only unlisted domestic companies are liable to pay additional income tax at the rate of 20 per cent on any amount of distributed income paid by them on a buyback under Section 115QA. This rule is likely to extend to listed companies as well.

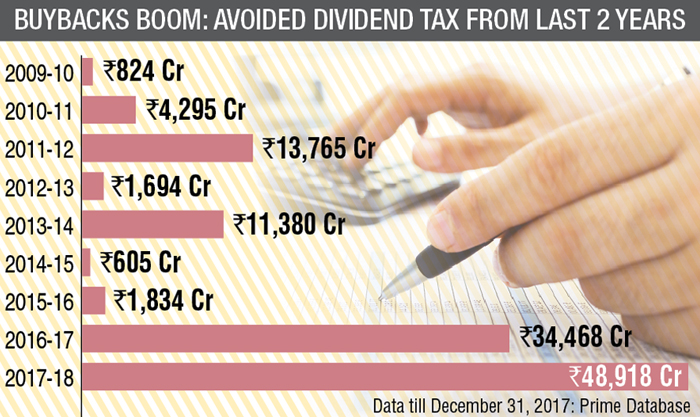

The government has found that company promoters are allotting cash to shareholders, including themselves, through buyback without paying any tax. In the 2016 Budget, the government had introduced 10 per cent tax on dividend of over Rs 10 lakh. After this, the listed companies turned share repurchases as a tool for tax-planning. After the dividend tax levied, share buybacks spiked more than 1,700 per cent in FY 2016, as compared to the year before.

Listed companies these days are announcing consideration of buyback of shares, something which has not been a common phenomenon earlier. "It is evident that the scales have been significantly tilted in favour of buyback of shares by listed companies, as against payment of dividends, on account of the recent changes in the tax laws," tax expert Manish Garg told DNA.

According to Prime Database, an equity research firm, 2017 has created history in the capital market with a record Rs 489.18 billion buybacks (see chart). As many as 32 companies exercised repurchase offers till December 2017.

"We think a large number of buybacks are only because it's more tax efficient for promoters as compared to paying dividend. This is largely because promoters get more than Rs 10 lakhs as dividend and therefore have to pay another 10% tax on it. It is a better way to pay out," said Deepak Shenoy, founder and MD, Capitalmind. Promoters have two options - either share the profit through dividend or buy back.

For cash-rich companies, this has meant that a buyback is more prudent than giving dividends, which is subject to tax.

Once a company is listed in the stock market and shares issued to the public, promoters and top management often jump into the game of buybacks in order to raise the 'value' of the company. Instead of making new long-term productive investments, the companies are pressed to pay out its profit as dividends or buy back shares.

In case of listed companies, buyback of shares is subject to capital gains tax. Long-term capital gains on transfer of equity shares (on which STT is paid), where the equity shares have been held for more than 12 months, is exempt from tax. Similarly, short-term capital gains arising on transfer of equity shares, on which STT is paid, is subjected to tax at 15% (effectively 17.77%).

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)