2015 was the worst year for global economy after the financial crisis and global recession of 2008. Going by the present trends, 2016 is likely to be very challenging. Commodity prices, particularly crude, have witnessed one of the worst crashes in history. U S interest rates are northbound with huge implications for capital flows and the global economy. The Chinese slowdown has the potential to impact global growth in 2016.

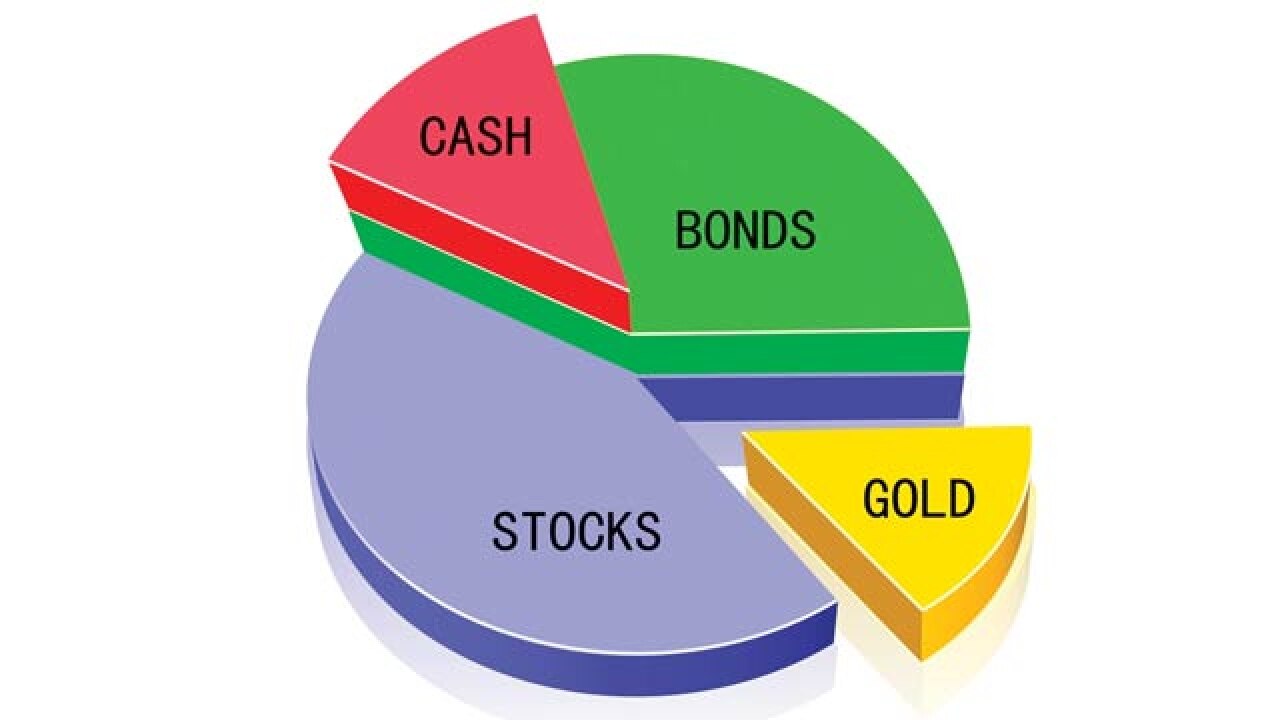

The cumulative impact of these factors is pulling the market down. What should retail investors do in such a difficult environment?

Debt funds are attractive

Debt funds yield good returns when interest rates are trending down. The superior returns are due to the rising price of bonds. (Bond prices move inversely to interest rates.) People who need regular income may consider MIPs (Monthly Income Plans). Apart from yielding superior returns, debt funds are highly tax-efficient. The long-term tax rate (if held for minimum 36 months) is only 10% without indexation and 20% with indexation. The deflating is done using the CPI index. Investors in the high-income bracket will benefit substantially from investment in debt funds.

Gold losing its glitter

Gold, which gave excellent returns during 2008-2012, is a poorly performing asset class now. Return from gold has been negative during the last three years. With US interest rates firming up, gold is unlikely to perform well in 2016, barring unforeseen geopolitical issues, which might ignite safe haven buying in gold. Therefore, only a small part of the investible funds should be invested in gold. Those who desire to invest in gold may opt for the gold bonds yielding 2.75 % interest. Here, there is the risk of price decline.

Short-term headwinds for real estate

Real estate was another asset class that gave very good returns during 2004-13. Real estate is not a standard asset; it is location specific. Therefore returns vary. Liquidity is a major problem now. Though investment in real estate can yield superior returns in the long term, the prospects are not bright during the short to medium term. The industry is plagued by excess supply and weak demand. The rental yield from property is too low to sustain the present level of prices.

Stocks are volatile but attractive

The market is presently weak and bearish due to the reasons explained earlier. We feel the market has almost bottomed out even though another 5% correction cannot be ruled out. Once the present headwinds recede, the market will resume its uptrend. Even though reforms like the GST didn't go though, the government is on the right track. There have been reforms in coal and spectrum through transparent auctions. The Uday programme is a good reform to address the power distribution companies' debt problems. The government is spending hugely on projects like road construction. Further reforms can be expected in the budget, which is likely to be a market moving reform event. Therefore, retail investors should continue to invest.

Invest systematically

The Indian stock market has the potential to yield superior returns, provided investors have a time horizon of three years. There is a consensus today that India will be the fastest growing economy in the world for many rears to come. Among emerging markets India is the most stable and the most promising. According to many think tanks including Harvard Research, India is likely to emerge as a

$10 trillion economy by 2030. By then, India's stock market will multiply several times, creating phenomenal wealth. The best way of participating in this coming wealth creation is to invest in stocks. It is difficult to predict the returns from stock market in 2016; but there is no doubt stocks will beat all other asset classes from a medium to long-term perspective. This is the lesson from the financial history of the last 100 years. Therefore, an ideal investment strategy would be to invest in stocks systematically, either directly or through the mutual fund route. Long-term investors should give the highest weightage to equity in 2016; but they should look beyond 2016. The investments in 2016 will reap rich rewards in 2 to 3 years' time.

The writer is investment strategist, Geojit BNP Paribas