Tata group is the new entrant on the online grocery retailing space.

Trent Ltd, the group's retail arm that operates an equal joint venture with UK retail major Tesco called Trent Hypermarket Ltd, is testing the waters with an online grocery retailing pilot. The grocery e-commerce platform www.my247market.com is owned and operated by Fiora Hypermarket Ltd, a subsidiary instituted by Trent in March 2014, which also operates four stores in Gujarat and Tamil Nadu that have barred foreign direct investment (FDI) in supermarkets.

Noel Tata, chairman of Trent and managing director of Tata International, and Jamshed Daboo, CEO, Trent Hypermarket, could not be reached for a comment. Queries emailed to Tata group's media agency remained unanswered.

The Trent management has been tight-lipped about the online grocery retailing foray. “I do know they were planning something on these lines but was not aware that a pilot stage has been reached already. It will be interesting to see how the model gets rolled out in the coming months,” said an executive from one of the existing online grocery retailing platforms.

Though Trent operates supermarkets under the Star Bazaar banner, its association with grocery e-commerce platform is restricted to just being a supply chain partner for www.my247market.com. Fiora Hypermarket said on its website, “Our association with Star Bazaar is limited to sourcing our products from Star Bazaar. We also sell Star Bazaar and Tesco's own label products.”

In fact, customers will also not be able to earn or redeem Star Bazaar Clubcard loyalty programme points nor will be able to use Star Bazaar’s gift card/cash card to pay for purchases made on the e-commerce platform.

Given that fresh food forms a large part of customer order, deliveries will be made using temperature controlled vans to ensure right quality and freshness. The platform is currently only delivering to four pin codes (mainly in areas in and around Andheri) in Mumbai.

Among products being sold on the e-commerce platform include, fruits, vegetables, staples, meat, bakery and dairy products. This apart, there is a wide selection of packaged food, beverages, confectionery, baby care products, personal care products, home need products and pet care products. While there is a threshold for minimum order at Rs 750, if the total value of goods bought exceed Rs 1,500 deliveries will be free-of-charge else there will be Rs 50 (plus taxes) in terms of a delivery charge. In case of returns, the platform has a no questions returns policy whereby customers can return any product not to their satisfaction to the delivery associate at the time of delivery.

The Indian online grocery retailing space has seen significant action in the past few weeks where in India's largest e-marketplace Flipkart was reportedly said to be working on adding new categories particularly the grocery section. This apart, other e-marketplace operators – Amazon and Snapdeal – have taken initiatives to have fresh produce and grocery among various offerings on the platform.

Taking the neighbourhood kirana store online Amazon launched 'Kirana Now', an express delivery platform in partnership with mom-and-pop stores, while Snapdeal has got on board Godrej Group's food retail arm Godrej Nature's Basket that features 700-odd products particularly gourmet food to cater to food and grocery requirements. In fact, Godrej Nature's Basket on Monday said it has also partnered Amazon to sell its products through the e-commerce giant's platform in India.

Another major player is Mukesh Ambani promoted Reliance Retail that is already testing the online grocery retailing space with www.reliancefreshdirect.com across different pockets in Mumbai. Among other players operating as a pure-play e-commerce platform include BigBasket.com, Localbanya.in, go4fresh.in, ZopNow.com and Grocermax.com.

Commenting on the overall scenario in the online grocery retailing space and its possible impact on the offline / brick-and-mortar retailers, Arvind Singhal, chairman, Technopak – a domestic retail consulting firm, said that within the grocery segment, share of the organised players is the least. “In fact, share of modern retail in the grocery retailing space is the least as the unorganised segment continues to be the biggest.

"Given this scenario, I don't think online grocery retailing will have any impact on the business of offline players because the business hasn't even taken-off well in the organised category. The economy is growing and so is consumption so people will need to access these products offline or online. Besides, the pie-itself is so large that we have a huge room for everyone to grow in the coming years,” said Singhal.

He said that the total number of supermarkets in the country is between 1,000 and 1,500 while the total turnover is Rs 15,000 crore as against an overall food and grocery market size of Rs 20 lakh crore. “If the economy continues to grow at say 6% to 8% every year we will be adding $20 to $30 billion in growth primarily through food and grocery consumption. Online alone will never be able to address this growth in overall consumption in the country right now hence I don't think there will any impact on the food and grocery retailing sector going forward,” he said adding that this will drive other players like Bharti, Spencer's Retail and Aditya Birla Retail going forward.

![submenu-img]() 'What was that?': Aparshakti Khurana got angry phone call from Amar Kaushik for 'PR game' remark on Stree 2 credit war

'What was that?': Aparshakti Khurana got angry phone call from Amar Kaushik for 'PR game' remark on Stree 2 credit war![submenu-img]() Afghanistan vs New Zealand, One-off Test: Date, time, venue, live streaming, tickets - All you need to know

Afghanistan vs New Zealand, One-off Test: Date, time, venue, live streaming, tickets - All you need to know![submenu-img]() This college turned down Gautam Adani’s application, after 46 years called to honour him

This college turned down Gautam Adani’s application, after 46 years called to honour him![submenu-img]() Is Flipkart Minutes the new Santa? Bengaluru man gets free PS5 with TV order

Is Flipkart Minutes the new Santa? Bengaluru man gets free PS5 with TV order![submenu-img]() Deepika Padukone, Ranveer Singh visit Mumbai hospital with families; spark speculations about baby's birth

Deepika Padukone, Ranveer Singh visit Mumbai hospital with families; spark speculations about baby's birth![submenu-img]() भारत ने पैरालंपिक खेलों में अपने नाम किए दो और मेडल, नवदीप सिंह ने जीता सिल्वर पर जानें क्यो दिया गया उन्हें गोल्ड

भारत ने पैरालंपिक खेलों में अपने नाम किए दो और मेडल, नवदीप सिंह ने जीता सिल्वर पर जानें क्यो दिया गया उन्हें गोल्ड![submenu-img]() Haryana Elections 2024: बजरंग पूनिया का बृजभूषण सिंह को चै�लेंज, 'हिम्मत है तो विनेश के...'

Haryana Elections 2024: बजरंग पूनिया का बृजभूषण सिंह को चै�लेंज, 'हिम्मत है तो विनेश के...' ![submenu-img]() Mangesh Yadav Encounter पर राहुल गांधी ने योगी सरकार को घेरा, 'लोगों के जीने-मरने का कर रहे फैसला'

Mangesh Yadav Encounter पर राहुल गांधी ने योगी सरकार को घेरा, 'लोगों के जीने-मरने का कर रहे फैसला'![submenu-img]() Kolkata Rape Case: रेप और हत्या करने के बाद क्या कर रहा था आरोपी संजय रॉय, पॉलीग्राफ टेस्ट में उगला सच

Kolkata Rape Case: रेप और हत्या करने के बाद क्या कर रहा था आरोपी संजय रॉय, पॉलीग्राफ टेस्ट में उगला सच ![submenu-img]() Telangana Floods: तेलंगाना में बारिश और बाढ़ के कहर में 29 की मौत, अगले दो दिन भी राहत के आसार नहीं

Telangana Floods: तेलंगाना में बारिश और बाढ़ के कहर में 29 की मौत, अगले दो दिन भी राहत के आसार नहीं ![submenu-img]() Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…

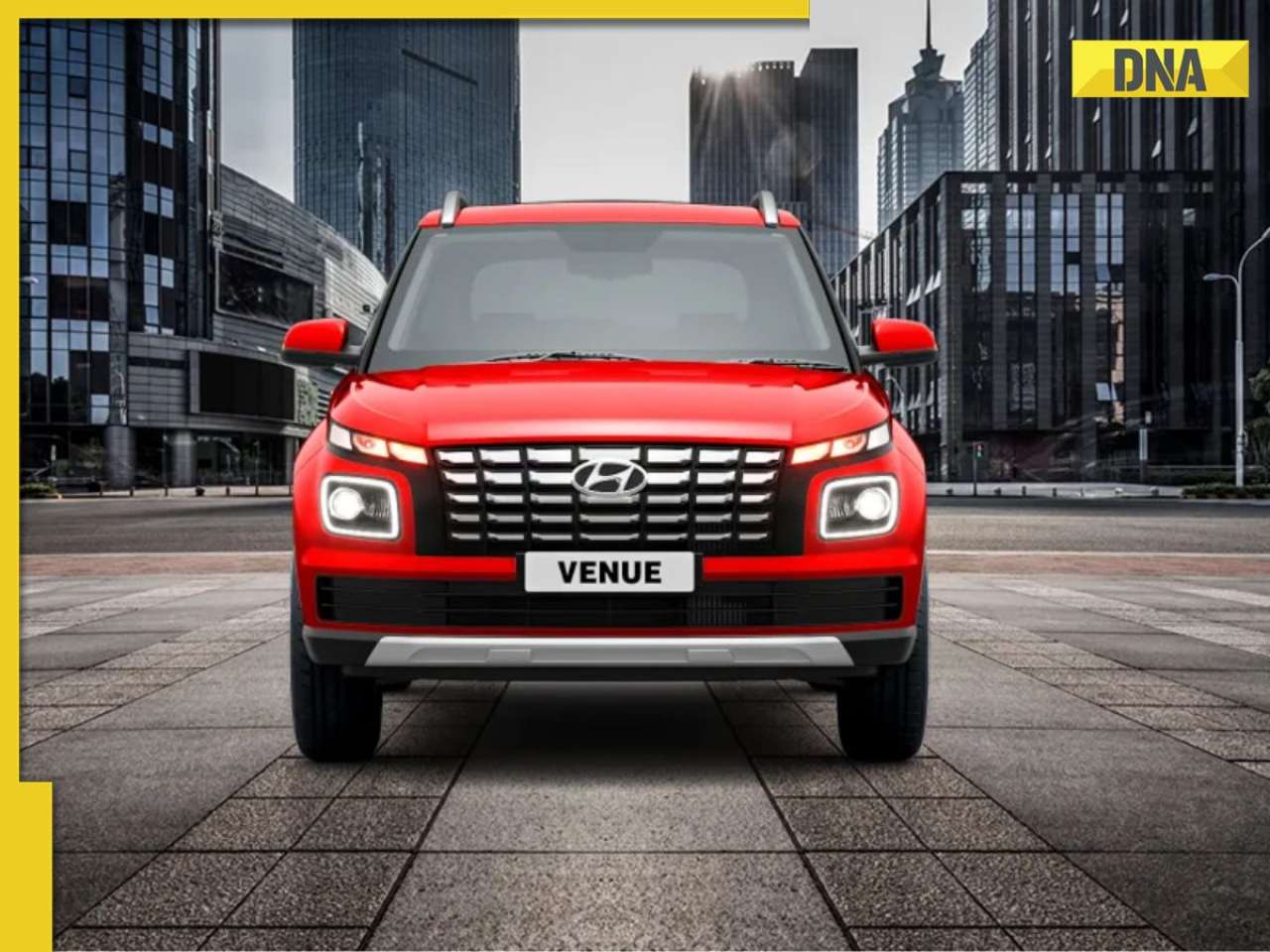

Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…![submenu-img]() Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…

Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…![submenu-img]() DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() DNA Auto Awards 2024: Hyundai Alcazar Facelift nominated for ‘CAR OF THE YEAR’; check details

DNA Auto Awards 2024: Hyundai Alcazar Facelift nominated for ‘CAR OF THE YEAR’; check details![submenu-img]() Hyundai Creta Knight Edition launched in India: Check price, features, design

Hyundai Creta Knight Edition launched in India: Check price, features, design![submenu-img]() Meet IIT topper who left corporate job to become IAS officer, failed four times in UPSC exam, he is...

Meet IIT topper who left corporate job to become IAS officer, failed four times in UPSC exam, he is...![submenu-img]() BIG UPDATE! UGC NET answer key 2024 to be released soon at...

BIG UPDATE! UGC NET answer key 2024 to be released soon at...![submenu-img]() Meet woman, mill worker’s daughter who lost mother during UPSC preparations, still cracked it with AIR 14, she is now...

Meet woman, mill worker’s daughter who lost mother during UPSC preparations, still cracked it with AIR 14, she is now...![submenu-img]() Meet man, 54-year-old engineer who left his high-paying job to crack NEET exam but there's a twist

Meet man, 54-year-old engineer who left his high-paying job to crack NEET exam but there's a twist![submenu-img]() Meet IIT-JEE topper with AIR 1, who quit IIT Bombay after a year due to...

Meet IIT-JEE topper with AIR 1, who quit IIT Bombay after a year due to...![submenu-img]() Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed

Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed![submenu-img]() 'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project

'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project![submenu-img]() Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure

Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here

Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here![submenu-img]() This college turned down Gautam Adani’s application, after 46 years called to honour him

This college turned down Gautam Adani’s application, after 46 years called to honour him![submenu-img]() Business heartthrob Vaibhav Maloo pursues his childhood dreams in the digital world by launching InfoProfile

Business heartthrob Vaibhav Maloo pursues his childhood dreams in the digital world by launching InfoProfile ![submenu-img]() Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…

Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…![submenu-img]() This Mukesh Ambani Reliance share plummets 30% in weeks, investors caught in lower circuit trap

This Mukesh Ambani Reliance share plummets 30% in weeks, investors caught in lower circuit trap![submenu-img]() Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…

Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…![submenu-img]() Meet Yesha Sagar, Indian-Canadian model and actress making waves as cricket presenter

Meet Yesha Sagar, Indian-Canadian model and actress making waves as cricket presenter![submenu-img]() Meet actress who never got lead roles, still turned superstar, one rumour ruined her career, became second wife of...

Meet actress who never got lead roles, still turned superstar, one rumour ruined her career, became second wife of...![submenu-img]() Sundar Pichai to Mark Zuckerberg: 10 tech leaders from Time's 2024 AI 100 list

Sundar Pichai to Mark Zuckerberg: 10 tech leaders from Time's 2024 AI 100 list![submenu-img]() Meet actress worth Rs 10000 cr, among youngest billionaires ever, once had no money for gas, now richer than SRK, Salman

Meet actress worth Rs 10000 cr, among youngest billionaires ever, once had no money for gas, now richer than SRK, Salman![submenu-img]() Top six signs of high cholesterol on face that you must not ignore

Top six signs of high cholesterol on face that you must not ignore ![submenu-img]() Is Flipkart Minutes the new Santa? Bengaluru man gets free PS5 with TV order

Is Flipkart Minutes the new Santa? Bengaluru man gets free PS5 with TV order![submenu-img]() CM Himanta Biswa Sarma sets this condition for new Aadhaar card applicants in Assam

CM Himanta Biswa Sarma sets this condition for new Aadhaar card applicants in Assam![submenu-img]() Government discharges Ex-IAS Trainee Puja Khedkar over examination fraud with immediate effect

Government discharges Ex-IAS Trainee Puja Khedkar over examination fraud with immediate effect ![submenu-img]() Kolkata doctor rape-murder case: DNA report suggests Sanjay Roy lone accused, CBI to file chargesheet

Kolkata doctor rape-murder case: DNA report suggests Sanjay Roy lone accused, CBI to file chargesheet![submenu-img]() This city is all set to get India's fastest metro train service; check route, timeline, distance, top speed and more

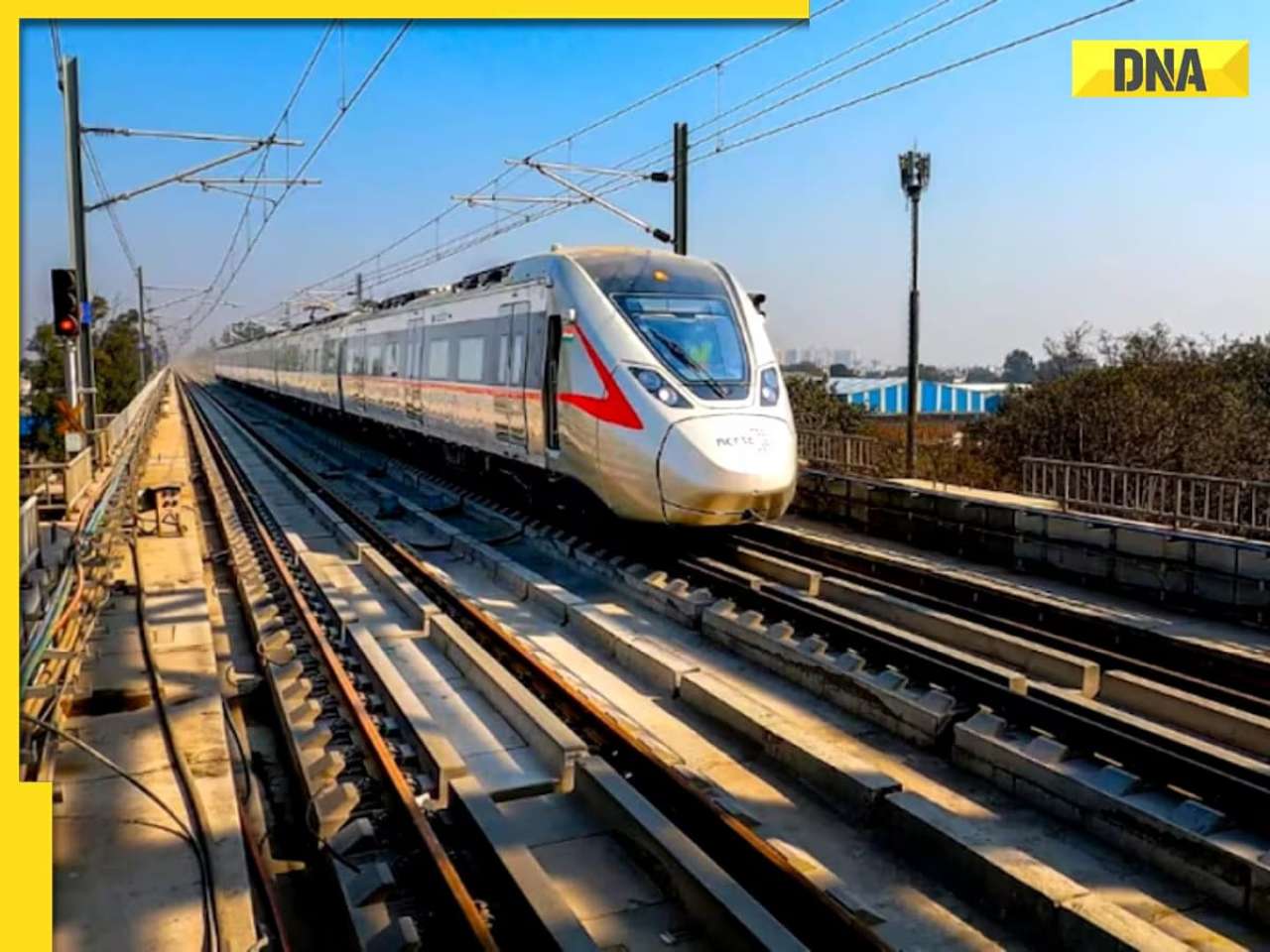

This city is all set to get India's fastest metro train service; check route, timeline, distance, top speed and more

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)