MUMBAI: The Sensex has touched 9000 and as the analysts like to say another psychological barrier has been broken. So where does it go from here?

There are analysts who have gone to town about the Sensex surpassing the 10,000 mark. A weekly news magazine and a Securities and Exchange Board of India member even predicted that the Sensex will touch 16,000 in the days to come.

But every yin has a yang to it. At the same time many analysts have been saying that a correction is long overdue. Some of them have been talking about a correction happening since the Sensex first touched the 6000 mark in January 2004, almost two years back.

But the party with a few bloopers here and there has gone on for quite sometime. Basically most people, analysts included, are not really sure as to where is the Sensex headed to. And how about the corrections? Well on that your guess is as good as mine. Given this, investors should keep certain things in mind while investing in the stock market.

The question bothering most of the investors is what do they do now? Stay on and ride the wave or make the best of the present situation, sell off and get out. Well to this there is no standard answer. We all have to make our own answers to this open-ended question.

What is important in such situations is to know what your investment destination is. It's very important for an investor to have a target return in mind. Both for his overall portfolio and individual investments.

Economic theory through the law of demand tells us, when the prices are rising, demand falls and when prices are falling demand increases. A stock market doesn't quite work like that.

As the stock prices go up, the more stocks appeal to investors. Making use of this factor a lot of public offerings have been very aggressively priced in the recent past.

Companies which have made profits for just one quarter or few quarters have issued shares at price to earnings ratios of greater than Rs 100. Investors need to be vary of such companies as the trend is likely to continue in days to come.

The best strategy for investing in a lot of these companies is to apply for the public offer and get out of the stock on the day of listing. As data for this year's public offer returns proves, the chances of making money on such stocks is greater if the investor is lucky enough to get shares when he applies for the PO. Investors who buy the stock on the day of listing generally lose money in a majority of cases.

If the idea is to speculate and try and ride the market then the best way out is to have a certain percentage of the total investment separately earmarked for it. "How much loss the investor is ready to bear", if an investor can answer this question, he knows how much money he should earmark for speculation.

Another rule that investors should keep in mind is what Benjamin Graham recommends in his book, the Intelligent Investor "We have suggested as a fundamental guiding rule that the investor should never have less than 25% or more than 75% of his funds in common stocks, with a consequent inverse range of between 75% and 25% in bonds".

He further says "According to the tradition the sound reason for increasing the percentage in common stocks would be the appearance of the "bargain price" levels created in a protracted bear market. Conversely, sound procedure would call for reducing the common stock component below 50% when in the judgment of the investor the market level has become dangerously high".

Bear in mind

It's important for an investor to have a target return in mind for his overall portfolio and individual investments

Investors need to be vary of public offerings issued at very high price to earning ratios

As markets start reaching what an investor thinks are unrealistic proportions its time to move some part of investment from stocks to fixed income instruments

![submenu-img]() This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...

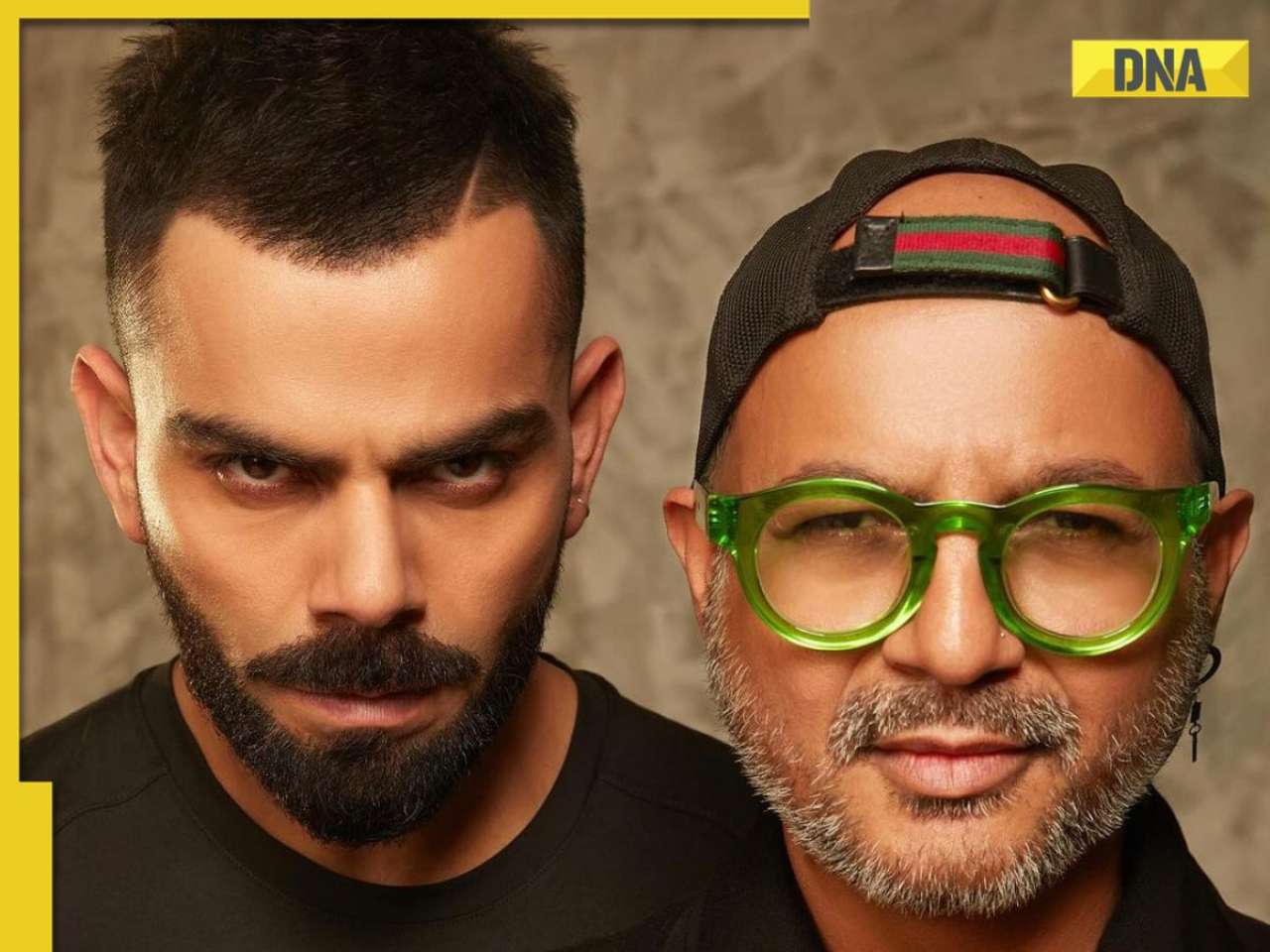

This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...![submenu-img]() Virat Kohli’s new haircut ahead of RCB vs CSK IPL 2024 showdown sets internet on fire, see here

Virat Kohli’s new haircut ahead of RCB vs CSK IPL 2024 showdown sets internet on fire, see here![submenu-img]() BCCI bans Mumbai Indians skipper Hardik Pandya, slaps INR 30 lakh fine for....

BCCI bans Mumbai Indians skipper Hardik Pandya, slaps INR 30 lakh fine for....![submenu-img]() 'Justice must prevail': Former PM HD Deve Gowda breaks silence in Prajwal Revanna case

'Justice must prevail': Former PM HD Deve Gowda breaks silence in Prajwal Revanna case![submenu-img]() India urges students in Kyrgyzstan to stay indoors amid violent protests in Bishkek

India urges students in Kyrgyzstan to stay indoors amid violent protests in Bishkek![submenu-img]() Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…

Meet IIT graduates, three friends who were featured in Forbes 30 Under 30 Asia list, built AI startup, now…![submenu-img]() Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...

Meet woman who cracked UPSC in fourth attempt to become IAS officer, secured AIR...![submenu-img]() Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…

Meet IIT JEE 2024 all-India girls topper who scored 100 percentile; her rank is…![submenu-img]() Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…

Meet PhD wife of IIT graduate hired at Rs 100 crore salary package, was fired within a year, he is now…![submenu-img]() Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...

Meet woman not from IIT, IIM or NIT, cracked UPSC exam in first attempt with AIR...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch

Streaming This Week: Madgaon Express, Zara Hatke Zara Bachke, Bridgerton season 3, latest OTT releases to binge-watch![submenu-img]() Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’

Sunanda Sharma exudes royalty as she debuts at Cannes Film Festival in anarkali, calls it ‘Punjabi community's victory’![submenu-img]() Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'

Aishwarya Rai walks Cannes red carpet in bizarre gown made of confetti, fans say 'is this the Met Gala'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...

This singer helped BCCI when it had no money to award 1983 World Cup-winning Indian cricket team, raised 20 lakh by...![submenu-img]() This film had 3 superstars, was unofficial remake of Hollywood classic, was box office flop, later became hit on...

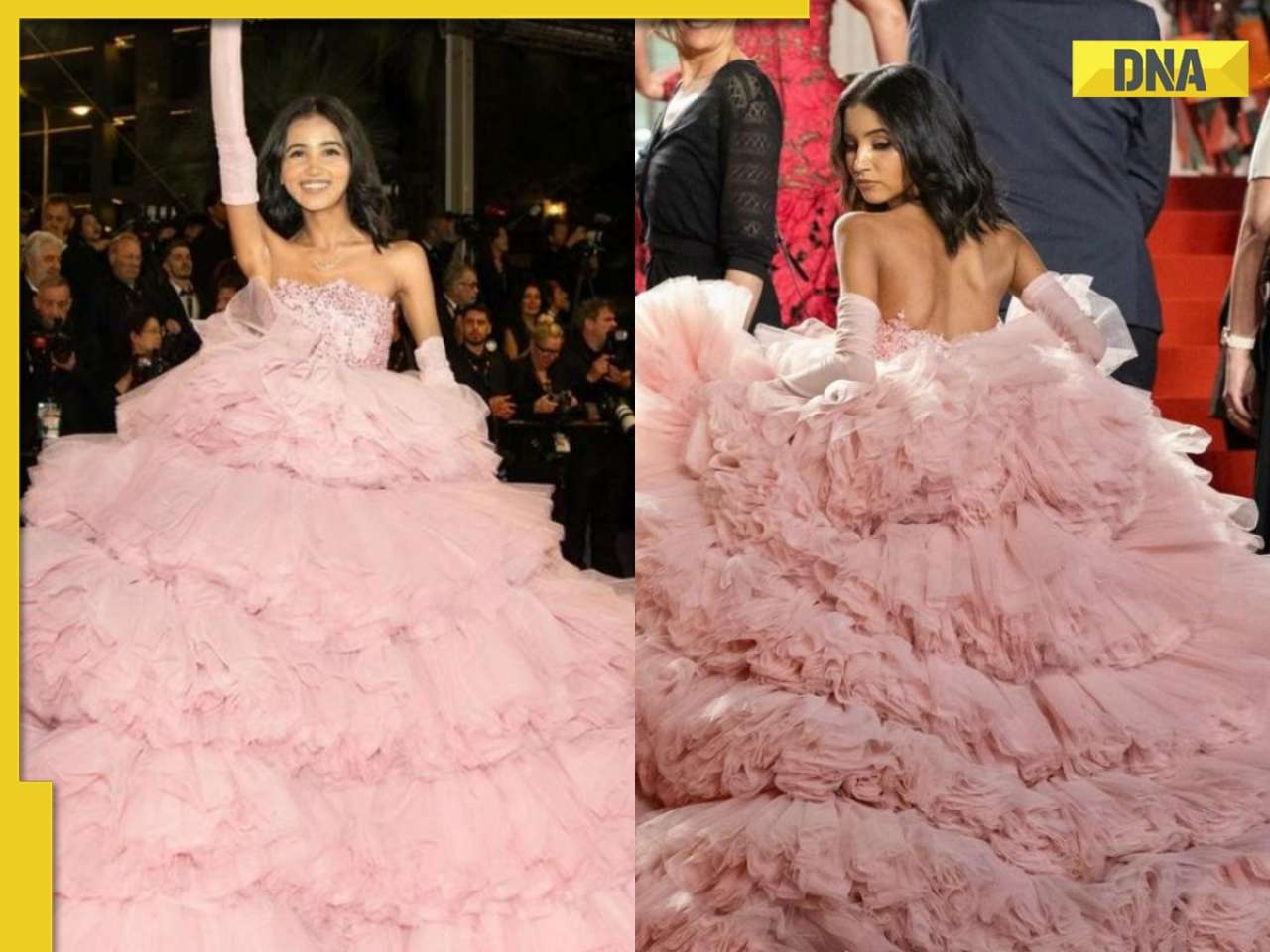

This film had 3 superstars, was unofficial remake of Hollywood classic, was box office flop, later became hit on...![submenu-img]() Meet Nancy Tyagi, Indian influencer who wore self-stitched gown weighing over 20 kg to Cannes red carpet

Meet Nancy Tyagi, Indian influencer who wore self-stitched gown weighing over 20 kg to Cannes red carpet![submenu-img]() Telugu actor Chandrakanth found dead days after rumoured girlfriend Pavithra Jayaram's death in car accident

Telugu actor Chandrakanth found dead days after rumoured girlfriend Pavithra Jayaram's death in car accident![submenu-img]() Meet superstar who faced casting couch at young age, worked in B-grade films, was once highest-paid actress, now..

Meet superstar who faced casting couch at young age, worked in B-grade films, was once highest-paid actress, now..![submenu-img]() Viral video: Flood-rescued dog comforts stranded pooch with heartfelt hug, internet hearts it

Viral video: Flood-rescued dog comforts stranded pooch with heartfelt hug, internet hearts it![submenu-img]() Dubai ruler captured walking hand-in-hand with grandson in viral video, internet can't help but go aww

Dubai ruler captured walking hand-in-hand with grandson in viral video, internet can't help but go aww![submenu-img]() IPL 2024: Virat Kohli drops massive hint on MS Dhoni’s retirement plan ahead of RCB vs CSK clash

IPL 2024: Virat Kohli drops massive hint on MS Dhoni’s retirement plan ahead of RCB vs CSK clash![submenu-img]() Do you know which God Parsis worship? Find out here

Do you know which God Parsis worship? Find out here![submenu-img]() This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete

This white marble structure in Agra, competing with Taj Mahal, took 104 years to complete

)

)

)

)

)

)