- LATEST

- WEBSTORY

- TRENDING

BUSINESS

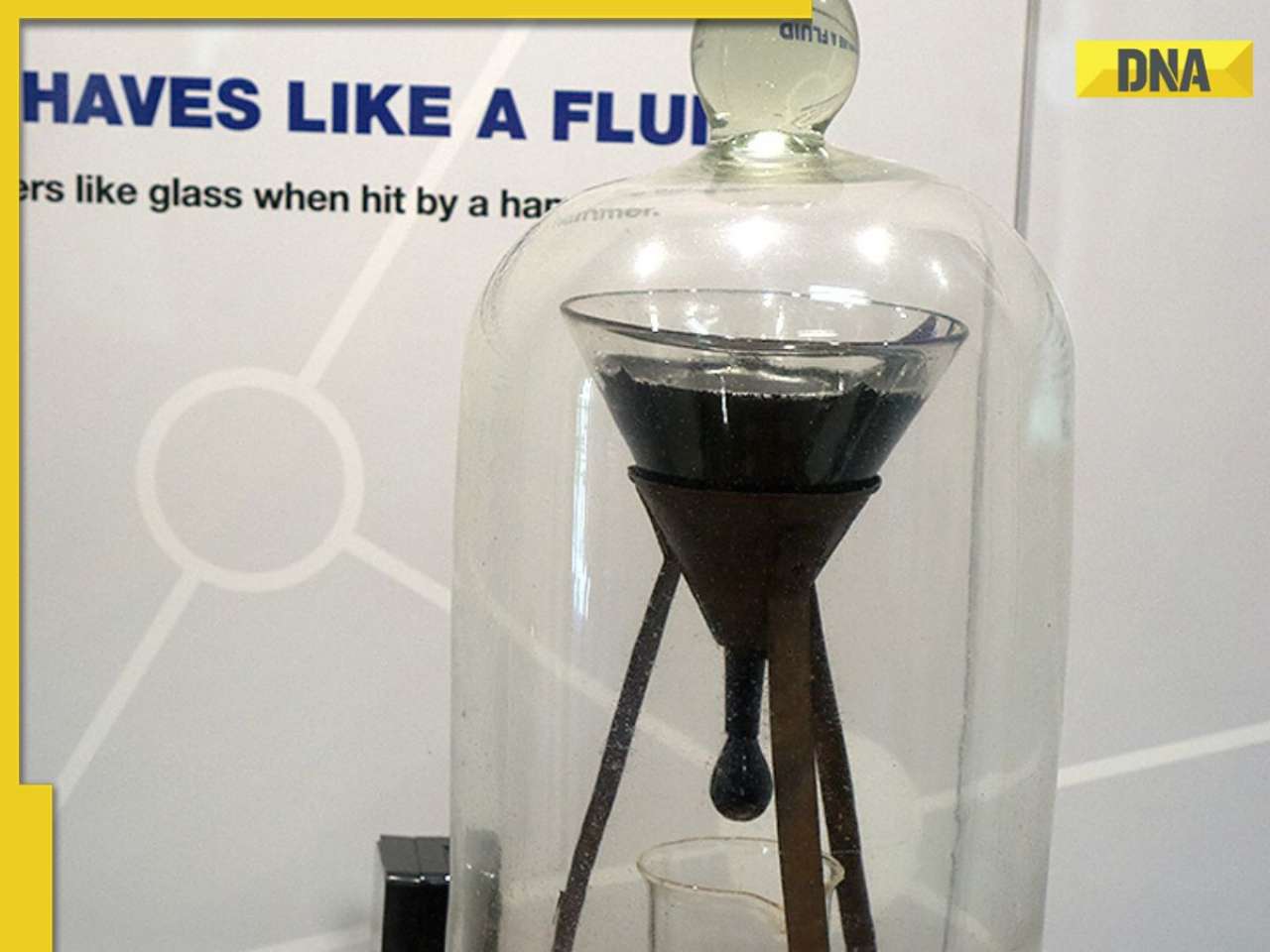

Liquidity eased for now, but lending?

Saturday’s triple dose of liquidity injection bears the thinking on Mint Street: First is that the Reserve Bank of India is comfortable with the rapidly sliding inflation

TRENDING NOW

RBI’s moves are more to fix the widening Fx hole than to prop growth, say experts

MUMBAI: Saturday’s triple dose of liquidity injection bears the thinking on Mint Street: First is that the Reserve Bank of India is comfortable with the rapidly sliding inflation, and is trying to gun for growth. That should be a positive for bond yields.

The second is that all the cuts are nothing more than liquidity measures. Which reveals the bad news: the hole being created by foreign exchange moving out is getting so large, all moves by the RBI look like desperate fixing jobs.

Forex reserves last week fell by $15.5 billion or around Rs 77,000 crore (assuming Rs 49.5/$). So the central bank decided to cut the cash reserve ratio (CRR) by 100 basis points to 5.5%, and made permanent the 100 bps reduction in statutory liquidity ratio to 24%.

Both these moves are expected to add around Rs 80,000 crore to the banking system, or the rupee equivalent of what has been drained from India’s forex reserves. “So where is the money to lend for growth going to come from?” asks Arjun Parthasarathy, senior fund manager (fixed income), IDFC Mutual Fund. “These are all reactive measures, not proactive. Unless things change in the global markets, and the pressure of money flowing out of the country abates, the problems will persist,” he said.

But what’s behind the huge drop in reserves? Surjit Bhalla, managing director of Oxus Research and Investments, a New Delhi-based economic research firm, says apart from outflows, there is also significant punting on the rupee.

“The drop in the forex reserves is because people are speculating on the rupee. Just a few months ago people were expecting the rupee to rise to 33/$1. The RBI should act whether the rupee is at 39 or 49 because the fair value for the rupee is 44-46. Besides speculation, FIIs have also pulled out $12 billion and probably NRIs are also bringing in less money which we will know in the next 2-3 months,” Bhalla said.

Indranil Pan, chief economist at Kotak Mahindra Bank, said some ECBs must have matured, FCCBs are not being converted and short-term debts are maturing. “This is adding to the outward gusher,” Pan said. He doesn’t expect the move to have any major impact on liquidity and hence lending and borrowing rates for banks.

Dharmakirti Joshi, principal economist with Crisil, doesn’t see banks being persuaded to increase lending to corporates. “The SLR cut means that banks no longer will be forced to lend to the government and that they are free to lend to companies. But my sense is that in times of lower growth people prefer keeping money with the government because it is the least risky. So banks could be reluctant to lend to companies. This was also seen when there was a slowdown between 2000 and 2003.”

Gaurav Kapur, senior economist, ABN Amro Bank, says the cuts, apart from offsetting RBI’s forex intervention, also facilitate government borrowings. “The SLR has stood the test of time. It’s a buffer in the economy, which is now being released to ensure that capital outflows do not create overwhelming pressure on liquidity and growth,” Kapur said.

The sudden spikes in inter-bank lending rates had forced banks to become more conservative in proffering credit to companies. To ease the clog, the RBI also cut the repo rate by 50 bps to 7.5%, signalling to banks that lending rates have to be lowered.

It won’t be easy for banks since their cost of money remains high. But Siddharth Teli, banking analyst with ICICI Securities, says the sheer amount of measures from the RBI will force banks to cut lending rates. “It’s good that they have provided liquidity. Interest rates will have to come down. It will also give a fillip to bank margins,” Teli said.

IDFC Mutual’s Parthasarathy is not convinced lending will spike anytime soon. “There has been ample moral suasion by authorities but it hasn’t translated into increased lending yet.”

Banks also have to fund their dollar balance-sheets, with about $50 billion coming up for repayment over the next couple of months.

Clearly, the problems are far from over.

r_joel@dnaindia.net

n_raj@dnaindia.net

Bankers rush to assuage MF investors

IBA chief executive K Ramakrishnan also met with the Association of Mutual Funds in India (AMFI) before the RBI rate cut on Friday.

“The IBA will continue to play a proactive role and will mediate between banks and NBFCs/MFs,” Ramakrishnan said.

Besides Ramakrishnan, Union Bank of India chairman and managing director (CMD) M V Nair and Bank of Baroda chief M D Mallya were also present at the press meet. Nair expects that the pressure on banks to raise deposits will ease, which could lead to a reduction in prime lending rates of banks.

“There was a shortage of funds so deposit rates went up followed by lending rates. Now that liquidity has come back deposit rates will come down and lending rates may also be re-priced,” he said.

But bankers denied that they were conservative about lending, pointing out to the high 29% credit growth as per RBI data. RBI’s focus is productive sectors and they won’t be denied credit, bankers said.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)