CCD owner VG Siddhartha's body was found after a massive search operation carried out by the Karnataka police with more than 200 officials and divers on about 25 boats who were trying to trace Siddhartha since Tuesday.

India's 'coffee king', owner of Cafe Coffee Day (CCD) VG Siddhartha's body was found today on the banks of Netravati river near in Mangaluru. The Coffee Day MD and son-in-law of former Karnataka Chief Minister SM Krishna was missing since Monday night.

The 58-year-old VG Siddhartha was reported missing mysteriously since Monday night when he was en route to Mangaluru. He was last seen on the Ullal bridge over the Netravati river.

Siddhartha's body was found after a massive search operation carried out by the Karnataka police with more than 200 officials and divers on about 25 boats who were trying to trace Siddhartha since Tuesday.

Amidst all this, a letter written by Coffee Day owner Siddhartha had surfaced after he went missing in which he alleged harassment by Income Tax officials.

In the same letter, Siddhartha also mentioned that he failed as an entrepreneur ... and couldn't bear the pressure anymore. However, the Income Tax department denied claims made by Siddhartha and said signature on note does not tally with Siddhartha's signature in annual reports.

Here's how the Income Tax department countered Siddhartha's final letter:

1. Harassed by previous DG Income Tax: Siddhartha alleged in his letter

)

Alleging harassment by I-T officials, Cafe Coffee Day owner VG Siddhartha in a letter marked to the board of Cafe Coffee Day on 27th July, said "there was a lot of harassment from the previous DG Income Tax in the form of attache our shares on two separate occasions to block our Mindtree deal and then taking position of our Coffee Day shares, although the revised returns have been filed by us."

"This was very unfair and has lead to the serious liquidity crunch," he added.

2. Income Tax department doubts authenticity of Coffee Day owner's letter

)

Responding after Coffee Day owner Siddhartha's letter, the Income Tax department said that the authenticity of the note allegedly written by founder-owner of CCD is not known and the signature on it does not match with Siddhartha's signature as available in his annual reports.

"A note said to be written by VG Siddhartha (VGS) of CCD is doing the rounds. Among others, it was mentioned in the note about the attachment of Coffee Day shares by the Income Tax Department. The authenticity of the note is not known and the signature does not tally with VGS's signature as available in his annual reports," read a statement from Bengaluru I-T office.

The Income Tax Department stated that the investigation in a case pertaining to Siddhartha and Cafe Coffee Day (CCD) "arose from the search in the case of a prominent political leader of Karnataka. "It (the case) is based on the unearthing of credible evidence of financial transactions done by the CCD in a concealed manner."

The Income Tax Department stated that a person holding Singapore citizenship was also covered in the search action. He was found with unaccounted cash of Rs 1.2 crore and admitted that the cash belonged to Siddhartha.

3. Siddhartha admitted having unaccounted income: I-T department

)

The Income Tax department further said, "In the search action, after considering the evidence gathered by the department, Siddhartha admitted the unaccounted income of Rs 362.11 crore and Rs 118.02 crore, in the hands of Siddhartha and Coffee Day Enterprises Ltd respectively in the sworn statement."

"Siddhartha subsequently filed the return of income but did not offer the above-undisclosed income as admitted in the sworn statement in both the cases except the sum of around Rs 35 crore in his individual case. Further, one of the group company Coffee Day Global Ltd has not paid the Self-Assessment Tax of Rs 14.5 crore on the returned income. Coffee Day Enterprises Ltd did not offer the admitted income in its part," I-T statement added.

4. I-T department on Siddhartha's Mindtree deal

)

The I-T Department stated that on January 21 earlier this year media reports suggested that Siddhartha is planning to sell the equity shares of Mindtree Ltd held by him and his company immediately.

"Based on this report, immediate verification of the facts was carried out. It was found that the assessees VG Siddhartha, Coffee Day Enterprises Ltd, and Coffee Day Trading Ltd together held nearly 21 percent of the shareholding in Mindtree Ltd. It was also gathered that the deal for sale of shares is set to be finalised in January 2019," the statement read.

"The tax effect along with interest and penalty based on the outcome of the search action runs into hundreds of crores. On the other hand, there was no application filed by the assessees concerned before the assessing officer as required under the statutory provision before transferring any assets when the income tax proceedings are pending," the statement added.

The I-T Department stated that in order to protect the interests of revenue, the "provisional attachment of 74,90,000 shares of Mindtree Limited owned by VG Siddhartha and Coffee Day Enterprises Ltd under Section 281 of the Income Tax Act was made (though they together held 2,29,31,518 shares). This action is a normal requirement to protect the interests of revenue."

When Siddhartha filed a request letter to release Mindtree shares and in turn offered other security of shares of Coffee Day Enterprises Ltd against the expected demand, his request was accepted and the attachment of Mindtree shares were revoked on February 13, 2019 with specific condition that the sale proceeds will be utilised only for repayment of loans availed against the Mindtree Ltd shares by opening escrow account and the remaining balance will be provided for attachment under Section 281B against the tax liability to arise, the statement stated.

"The alternate attachment of 46,01,869 unencumbered shares and 2,04,43,055 encumbered shares of Coffee Day Enterprises Ltd under section 281B was also made on February 13 and 14," the statement read.

"The assessees had transferred the Mindtree Ltd shares to L&T Infotech Ltd 28.04.2019 and received around Rs 3,200 crore.

Out of this consideration, the assessee had repaid the loan of around Rs 3,000 crore and paid expenses related to transfer of 154 crore and the balance of Rs 46 crore was paid towards the first installment of Advance Tax of estimated MAT liability of around Rs 300 crore in the case of shares of Coffee Day Enterprises Ltd.

As against the balance MAT liability of Rs 250 crore and tax liability arising based on search findings to the tune of approx 400 crore, the provisional attachment made by the department is less than 40 per cent of the likely tax liability," the statement added.

It went on to add that the provisional attachment was made to "protect the interests of revenue out of the income admitted by assesse based on credible evidence gathered in a search action."

"The Income Tax department has acted as per the provisions of Income Tax Act," the statement from I-T Department concluded.

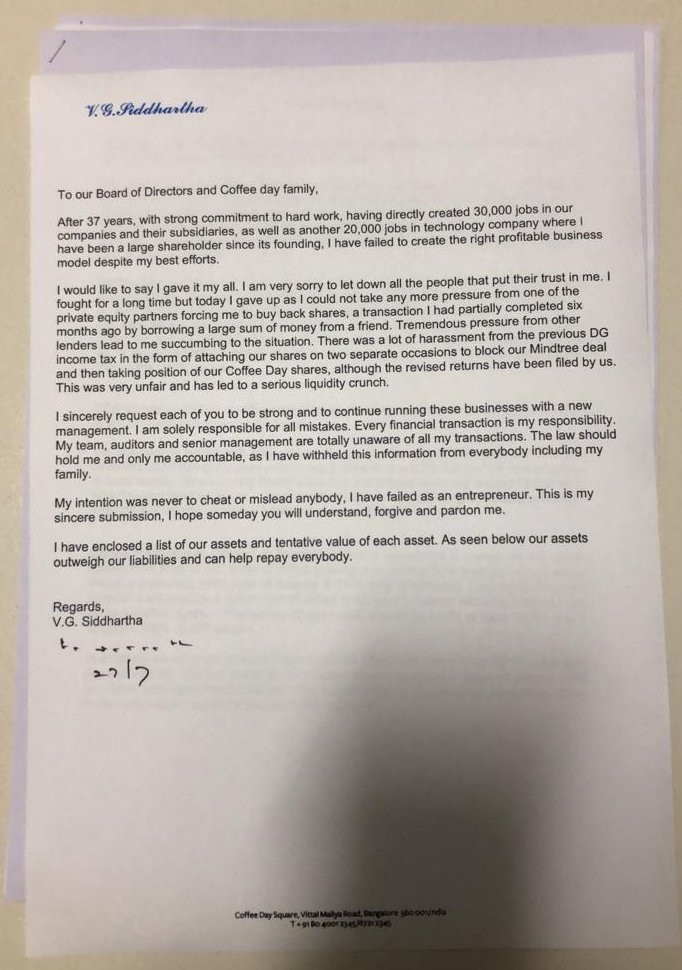

5. Full text of CCD owner VG Siddhartha's 'final' letter

)

Here's the full text of Cafe Coffee Day owner VG Siddhartha's viral letter:

After 37 years, with strong commitment to hardwork, having directly clearly 30,000 jobs in our companies and their subsidiaries, as well as another 20,000 jobs in technology companies where I have been a large shareholder since its founding, I have failed to create the write profitable business model despite my best efforts.

I would like to say I gave it my all. I am very sorry to let down all the people that put their trust in me. I fought for a long time but today I gave up as i couldn't take any more pressure from one of the private equity partners forcing me to buyback shares, a transaction I had partially completed six months ago by borrowing a large sum of money from a friend. Tremendous pressure from other vendors let to me succumbing to the situation. There was a lot of harassment from the previous DG Income Tax in the form of attache our shares on two separate occasions to block our Mindtree deal and then taking position of our Coffee Day shares, although the revised returns have been filed by us. This was very unfair and has lead to the serious liquidity crunch.

I sincerely request each of you to be strong into continue running these businesses with new management. I am solely responsible for all mistakes. Every financial transaction is my responsibility. My team, auditors and senior management are totally unaware of all my transactions. The law should hold me and only me accountable, as I have withheld this information from everybody including my family.

My intention was never to cheat or mislead anybody, I have failed as an entrepreneur. This is my sincere submission, I hope someday you will understand, forgive and pardon me.

I have enclosed a list of our assets and tentative value of each assets. As seen below, our assets outweigh our liabilities and can help repay everybody.