Actions such as bank and business bailouts and rate cuts will need to be reversed.

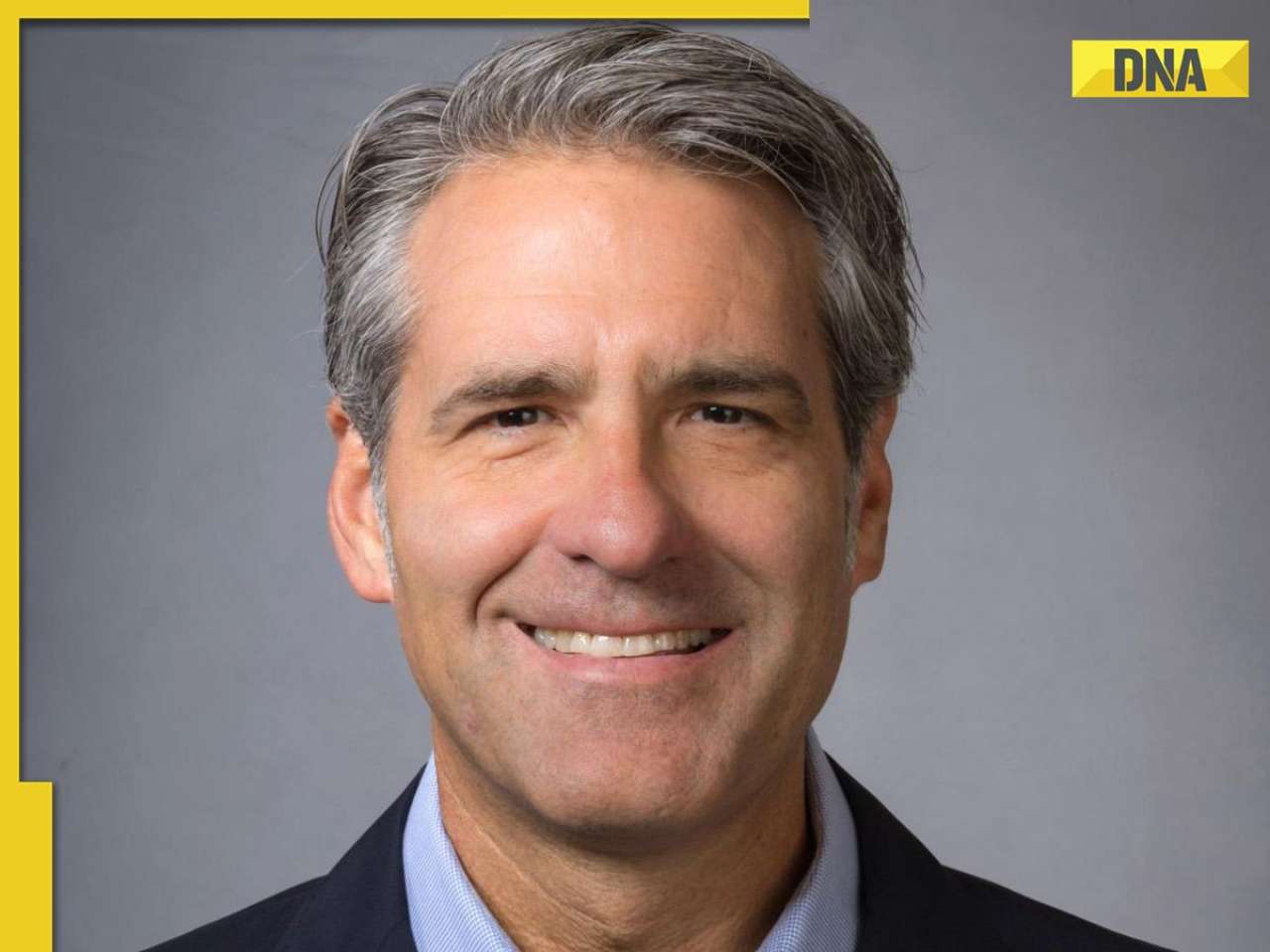

As he looks forward to a second term as chairman of the Federal Reserve, Ben S Bernanke’s biggest challenge will be to undo much of what made him a hero during his first term.

In nominating Bernanke on Tuesday, President Barack Obama praised the Fed chairman for his “bold action and out-of-the-box thinking,” saying it had helped avoid a repeat of the Great Depression.

But most of those bold actions — lending hundreds of billions of dollars to banks and businesses, slashing overnight interest rates to nearly zero, having the Fed almost single-handedly finance the mortgage market — will have to be reversed or rolled back over the next few years.

If the Fed shifts too quickly from the role of saviour to that of strict disciplinarian, it risks aborting the recovery and tipping the nation back into a recession, essentially repeating mistakes made in 1937 after the economy had begun to rebound. If the Fed moves too slowly, it risks the kind of intractable inflation it experienced in the 1970s and fuelling another bubble.

Compounding the problem is the government’s fiscal woes, made clear by an announcement on Tuesday that the budget deficit would be greater than previously projected. For the first time in almost 20 years, the Fed may soon have to make unpopular decisions that raise the cost of borrowing even when the economy still feels weak. It has already decided it must tolerate high unemployment, which the Obama administration said Monday would exceed 10%, through at least the end of next year. It is already phasing out smaller programs to provide emergency credit, and will have to decide when to scale back bigger ones.

At some point next year, the Fed may well need to raise interest rates —- possibly rapidly and sharply, given how far it cut them last year —- and in the process raise the cost of things like credit cards, mortgages and business loans.

Any or all of those actions will probably restrain economic growth and keep unemployment rates high, potentially putting the Bernanke Fed on a collision course with the Obama White House.

The federal government’s enormous fiscal problem makes that clash more likely. The White House estimated on Tuesday that the government faced a $9 trillion budget shortfall over the next 10 years. The annual deficits will exceed $1 trillion through 2011, the administration said, and the annual cost of paying interest on the debt will exceed $600 billion in 2019.

The government’s enormous borrowing needs will probably put pressure on the private sector after the economy begins to expand. If that happens, investors may demand higher interest rates on Treasury securities and ultimately drive up borrowing costs for government and businesses alike.

The Fed has faced that kind of conflict before, and the politics were not pretty. Paul A Volcker, the Fed chairman who tamed inflation in the early 1980s after pushing the federal funds rate to 20%, came under attack from businesses, farmers and the White House under President Ronald Reagan.

Alan Greenspan faced considerable pressure in the early 1990s, when President George H W Bush wanted him to cut interest rates more quickly. To this day, many alumni of the Bush administration blame Greenspan for Bush’s re-election defeat.

What worries some experts, including Bernanke, is that the Fed’s expanding role during the financial crisis exposes it to political pressure. Lawmakers, having seen the Fed bail out corporations and extend credit to entire industries, have prodded the central bank to help out other constituencies, like recreational vehicle manufacturers.

At the same time, the Fed’s political critics are multiplying. A bill sponsored by Representative Ron Paul, Republican of Texas, would empower the Government Accountability Office to “audit” the Fed’s decisions on interest rates. Bernanke and other Fed officials have warned that that would damage the Fed’s independence. Still, the measure has been signed by more than 250 lawmakers in both parties. Obama, announcing his decision to nominate Bernanke for another term, vowed to “continue to maintain a strong and independent Federal Reserve.”

And in supporting Bernanke, a Republican first appointed by President George W Bush, Obama signalled that he was willing to rise above party loyalties. “Ben approached a financial system on the verge of collapse with calm and wisdom,” Obama said.

Unless a disaster erupts out of nowhere, Bernanke’s Senate confirmation appears certain.

“While I have had serious differences with the Federal Reserve over the past few years, I think reappointing Chairman Bernanke is probably the right choice,” said Senator Christopher J Dodd, Democrat of Connecticut and chairman of the Senate Banking Committee, in a statement on Tuesday.

Dodd, who has frequently accused the Fed of failing to rein in reckless mortgage lending, added that Bernanke had “ultimately demonstrated effective leadership” in the crisis.

At the Fed’s annual symposium in Jackson Hole, Wyoming, last weekend, some analysts criticized Bernanke for sending contradictory signals.

“The Fed is simultaneously promising to keep interest rates low for an extended period, while also promising to keep inflation from rising,” said Carl E Walsh, a professor of economics at the University of California, Santa Cruz, in a paper delivered at the conference. Fed officials disagreed with his assessment, countering that inflation was, if anything, at risk of being lower than they would like.

“The low interest rates are designed to keep inflation from falling, and falling persistently below where we want them to be,” said Donald L Kohn, vice chairman of the Federal Reserve.

For the moment, Bernanke has some breathing room. Even though the federal government is borrowing at a staggering pace, American businesses and consumers have slowed their own borrowing so much that the United States total is down from previous years.

Foreign investors seeking a haven have ploughed vast amounts of money into Treasury securities. As a result, interest rates on long-term Treasury bonds, which directly influence interest rates on corporate loans and home mortgages, remain low.

But as business activity picks up around the world, the competition among debt issuers is likely to increase and interest rates could rise. Clashing priorities are not hard to imagine. The Obama White House might want to lift a sluggish recovery by keeping interest rates low. And the Bernanke Fed may want to head off inflation — before it is too late. NYT

![submenu-img]() Anil Kapoor, Aditya Roy Kapur's The Night Manager becomes only entry from India to secure nomination at Emmy Awards 2024

Anil Kapoor, Aditya Roy Kapur's The Night Manager becomes only entry from India to secure nomination at Emmy Awards 2024![submenu-img]() Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...

Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...![submenu-img]() This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani

This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani![submenu-img]() Ranbir Kapoor's sister, Riddhima's 'maybe it's a house help' remark leaves netizens furious: 'Uneducated rich brats'

Ranbir Kapoor's sister, Riddhima's 'maybe it's a house help' remark leaves netizens furious: 'Uneducated rich brats'![submenu-img]() Mumbai man orders iPhone 16 online after standing in queue for hours, then..

Mumbai man orders iPhone 16 online after standing in queue for hours, then..![submenu-img]() Hezbollah pager ब्लास्ट में क्यों आ रहा केरल में जन्मे इस बिजनेसमैन का नाम, जांच में क्या खुलासा हुआ?

Hezbollah pager ब्लास्ट में क्यों आ रहा केरल में जन्मे इस बिजनेसमैन का नाम, जांच में क्या खुलासा हुआ?![submenu-img]() 'तिरुपति में लड्डुओं की पवित्रता अब बेदाग', TTD बोर्ड ने जारी किया बयान

'तिरुपति में लड्डुओं की पवित्रता अब बेदाग', TTD बोर्ड ने जारी किया बयान ![submenu-img]() अमेरिका दौरे पर निकले PM Modi, क्वाड की बैठक में लेंगे हिस्सा, राष्ट्रपति बाइडेन से होगी मुलाकात

अमेरिका दौरे पर निकले PM Modi, क्वाड की बैठक में लेंगे हिस्सा, राष्ट्रपति बाइडेन से होगी मुलाकात ![submenu-img]() IND vs BAN 1st Test Day 3 Live Score: ऋषभ पंत के बाद शुभमन गिल ने भी ठोका शतक, टीम इंडिया की बढ़त 450 के पार

IND vs BAN 1st Test Day 3 Live Score: ऋषभ पंत के बाद शुभमन गिल ने भी ठोका शतक, टीम इंडिया की बढ़त 450 के पार![submenu-img]() Atishi Delhi CM: दिल्ली को मिलेगा नया सीएम, आज शाम होगा शपथग्रहण

Atishi Delhi CM: दिल्ली को मिलेगा नया सीएम, आज शाम होगा शपथग्रहण![submenu-img]() Ford to return to India after 2 years with reopening of....

Ford to return to India after 2 years with reopening of....![submenu-img]() Maruti Suzuki launches new Swift CNG, check price, mileage, other features

Maruti Suzuki launches new Swift CNG, check price, mileage, other features![submenu-img]() ‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...

‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...![submenu-img]() In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…

In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…![submenu-img]() World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…

World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…![submenu-img]() Meet man who passed JEE Advanced with AIR 1, completed B.Tech from IIT Bombay, is now pursuing…

Meet man who passed JEE Advanced with AIR 1, completed B.Tech from IIT Bombay, is now pursuing…![submenu-img]() Meet man, whose father's death encouraged him to quit IAS job, create multi-crore company, he is...

Meet man, whose father's death encouraged him to quit IAS job, create multi-crore company, he is...![submenu-img]() Meet woman, who scored 97% in class 12, secured 705 out of 720 marks in NEET exam, her AIR is...

Meet woman, who scored 97% in class 12, secured 705 out of 720 marks in NEET exam, her AIR is...![submenu-img]() NEET UG Counselling 2024: Round 2 seat allotment result declared at mcc.nic.in, check direct link here

NEET UG Counselling 2024: Round 2 seat allotment result declared at mcc.nic.in, check direct link here![submenu-img]() Meet IPS officer who has resigned after serving for 18 yrs due to...

Meet IPS officer who has resigned after serving for 18 yrs due to...![submenu-img]() Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical

Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical![submenu-img]() Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval

Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval![submenu-img]() Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?

Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?![submenu-img]() One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0

One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0![submenu-img]() Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed

Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed![submenu-img]() This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani

This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani![submenu-img]() Meet man who started as intern at Nike, is now its CEO after 32 years, his salary is Rs...

Meet man who started as intern at Nike, is now its CEO after 32 years, his salary is Rs...![submenu-img]() Meet man who received gift worth Rs 15000000000 from Mukesh Ambani, is referred to as his 'right hand', he is...

Meet man who received gift worth Rs 15000000000 from Mukesh Ambani, is referred to as his 'right hand', he is...![submenu-img]() Elon Musk, Oracle CEO once begged this company to take their money, know what had happened

Elon Musk, Oracle CEO once begged this company to take their money, know what had happened![submenu-img]() 'Office was filled with…': Ashneer Grover on why he left EY in one day despite having package of Rs…

'Office was filled with…': Ashneer Grover on why he left EY in one day despite having package of Rs…![submenu-img]() Luxurious homes to swanky cars: Most expensive things owned by Virat Kohli

Luxurious homes to swanky cars: Most expensive things owned by Virat Kohli![submenu-img]() Akshay Kumar's biggest flop film was remake of a Malayalam blockbuster, still broke Guinness World Record set by...

Akshay Kumar's biggest flop film was remake of a Malayalam blockbuster, still broke Guinness World Record set by...![submenu-img]() Exploring Uttarakhand: 6 breathtaking destinations in scenic state

Exploring Uttarakhand: 6 breathtaking destinations in scenic state![submenu-img]() From Puga Valley to Hanle: Must-visit places in Ladakh

From Puga Valley to Hanle: Must-visit places in Ladakh![submenu-img]() Meet Himachal officer who has been transferred without posting, as popular as IAS Tina Dabi on social media, she is...

Meet Himachal officer who has been transferred without posting, as popular as IAS Tina Dabi on social media, she is...![submenu-img]() Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...

Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...![submenu-img]() Tirupati Laddoo Row: Jagan Reddy says he will write to PM Modi, CJI to take action against...

Tirupati Laddoo Row: Jagan Reddy says he will write to PM Modi, CJI to take action against...![submenu-img]() AAP demands government accommodation for outgoing Delhi CM Arvind Kejriwal, says he is...

AAP demands government accommodation for outgoing Delhi CM Arvind Kejriwal, says he is...![submenu-img]() 'Samples highly adulterated, we will...': Tirupati Temple Trust issues first statement on laddoo row

'Samples highly adulterated, we will...': Tirupati Temple Trust issues first statement on laddoo row![submenu-img]() NEET UG 2024: CBI files second-chargesheet against six accused in paper leak case

NEET UG 2024: CBI files second-chargesheet against six accused in paper leak case

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)