- LATEST

- WEBSTORY

- TRENDING

BUSINESS

India Inc’s new mantra: float and grow

Conglomerates discover that letting smaller business fly on their own can be healthy for the mother company and the offspring.

TRENDING NOW

MUMBAI: It’s time to let them fly the coop. Many Indian conglomerates are discovering that letting smaller business fly on their own can be healthy, both for the mother company and the offspring. The earlier idea of building synergy within the organisational fold is now giving way to a different thought: subsidiaries need space and independence to grow wealth.

S Subramaniam, head of investment banking at Enam Financial Consultants, an investment banker, calls this trend a “value maximisation strategy where conglomerates go on a journey to discover the (true) value of their unlisted businesses.”

Just look at the arithmetic. Mahindra & Mahindra recently listed two of its subsidiaries, M&M Financial Services Ltd and Tech Mahindra. The move has paid off in spades for the utility vehicle and tractor maker. As a group, M&M had a market cap of Rs 11,909 crore at the start of 2006. Now, the figure has more than doubled to Rs 23,971 crore. The group’s shareholder wealth has risen by Rs 6,269 crore following the listing of Tech Mahindra, its joint venture with British Telecom. And another Rs 1,955 crore came by way of the listing its non-banking subsidiary, M&M Financial Services.

The idea has spread. Companies such as Zee Telefilms, Tata Motors, Hinduja TMT and Pantaloon Retail are all said to be scrambling to list their subsidiaries. Analysts say a separate float can also lend more comfort to joint venture partners. But more than that, it’s a sign of the coming of age of the incubated business.

Says Yagnesh Sanghrajka, global chief financial officer of the Hinduja group, which last week announced plans to hive off one of its businesses: “A lot of businesses in the past were nurtured under one umbrella entity. So the market valuation of the entity did not reflect the real value of the businesses of those specific sectors.” M&M’s recent success could prod it to list more subsidiaries - especially its hospitality venture and auto components business.

“Hiving off into standalone entities allows the stockmarkets to offer better price multiples to the resultant companies,” Sanghrajka says. Such a move also helps managements to “focus better on the specific lines of business.” An example is Hinduja TMT’s cable business, which last year turned around profitably.

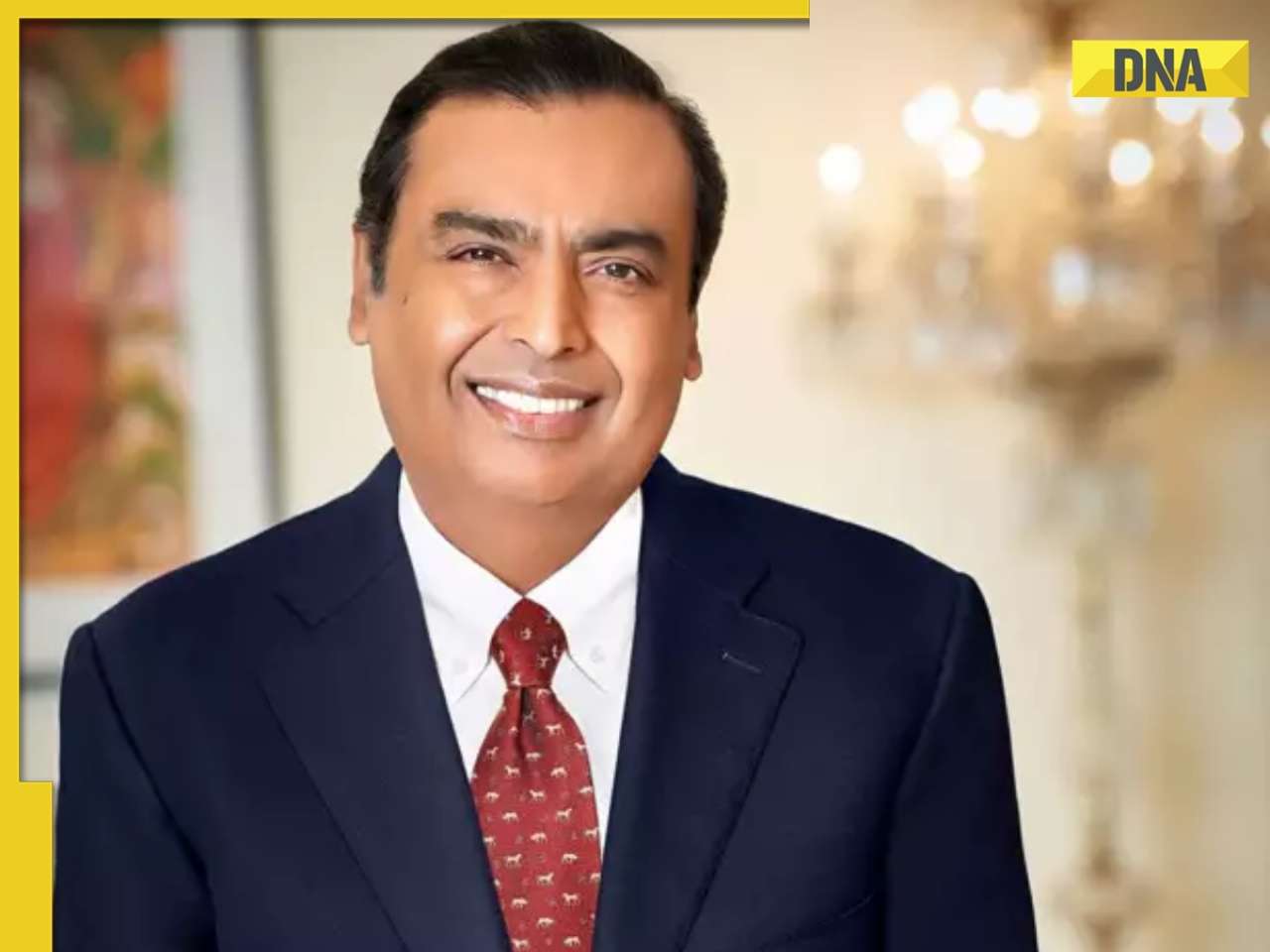

The realisation that a sum of the parts can sometimes be greater than the whole dawned on India Inc after India’s largest private sector company, Reliance Industries, demerged into four to settle what was essentially a family dispute resulting from “sibling rivalry”. The spilt enriched shareholders so much, it has surprised stockmarket mavens.

Subramaniam sees an additional logic for separations. In some cases the parent (company) may not have enough capital to grow faster. “But more than the capital, sometimes the subsidiary is not a core business and it makes better sense to be listed separately,” he says.

Larsen & Toubro, for example, had to be practically forced to hive off its cement business. But once it did, partly to ward off a takeover threat, the value of both businesses soared. L&T’s market capitalisation was quoting at a bargain basement rate of Rs 7,904 crore at the time of the cement hiveoff in 2004. Now, it has peaked at Rs 45,654 crore, a more than four-fold gain over two years since the demerger. Ultra Tech, the company which now holds L&T’s former cement businesses, has, under the ownership of the Aditya Birla group, also gained by improving margins. It’s market-cap is now larger than the unified L&T in 2004 at Rs 9,903 crore as on September 6.

Tata Motors is also expected to hive off as many as four subsidiaries by diluting part of its stake to the public through an initial public offering (IPO). HV Axles and HV Transmissions will be the first off the block as the Tatas undertake a larger corporate restructuring programme to tap alternate options of raising resources to part-fund expansion plans.

Company officials say that they are “open to considering the induction of strategic partners or make a public float for the two subsidiaries to unlock value.” No timeframe has been set for the hiveoff, but analysts say the listing of the two subsidiaries makes sense. Market sources say Tata Technologies and Telco Construction Equipment are two other Tata group subsidiaries ready to float.

Kishore Biyani’s Pantaloon Retail is getting ready to fight the entry of heavyweights like Reliance and Bharti in retailing by hiving off three of its subsidiaries — Central Depot, Home Solutions and Future Media. This could be a strategy for raising resources even as the parent company may be chary of diluting more equity than necessary.

Reliance, which listed Reliance Petroleum in May, is incubating its retail venture currently. But Mukesh Ambani is expected to float separate listed entities for Reliance Retail and the special economic zone businesses when the ideas take concrete shape.

Hinduja TMT has already declared its intention to demerge its information technology and IT-enabled services undertaking into a separate entity called HTMT Technologies. The new entity will be more aggressive in making acquisitions abroad.

Another example is Aditya Birla Minerals, the mining subsidiary of Hindalco with mining assets in Australia. The Australian bourses give better valuations to mining firms than Indian ones and the company has had a great run since listing in July in Sydney.

In the near future, the public issue (IPO) markets may also see a slew of insurance subsidiaries of banks and non-banking finance companies getting listed. ICICI Bank and HDFC will look at unlocking value from their insurance subsidiaries, ICICI Prudential and HDFC Standard Life.

HDFC is also eyeing an IPO for Intelenet, a joint venture business processing outsourcing (BPO) with Barclays. A listed unit will be able to bring better focus and raise funds in the markets for growth, it is believed.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)