RBI has maintained status quo on policy rates to support domestic growth. It hiked the inflation projection for this financial year to 5.7% from 4.5%.

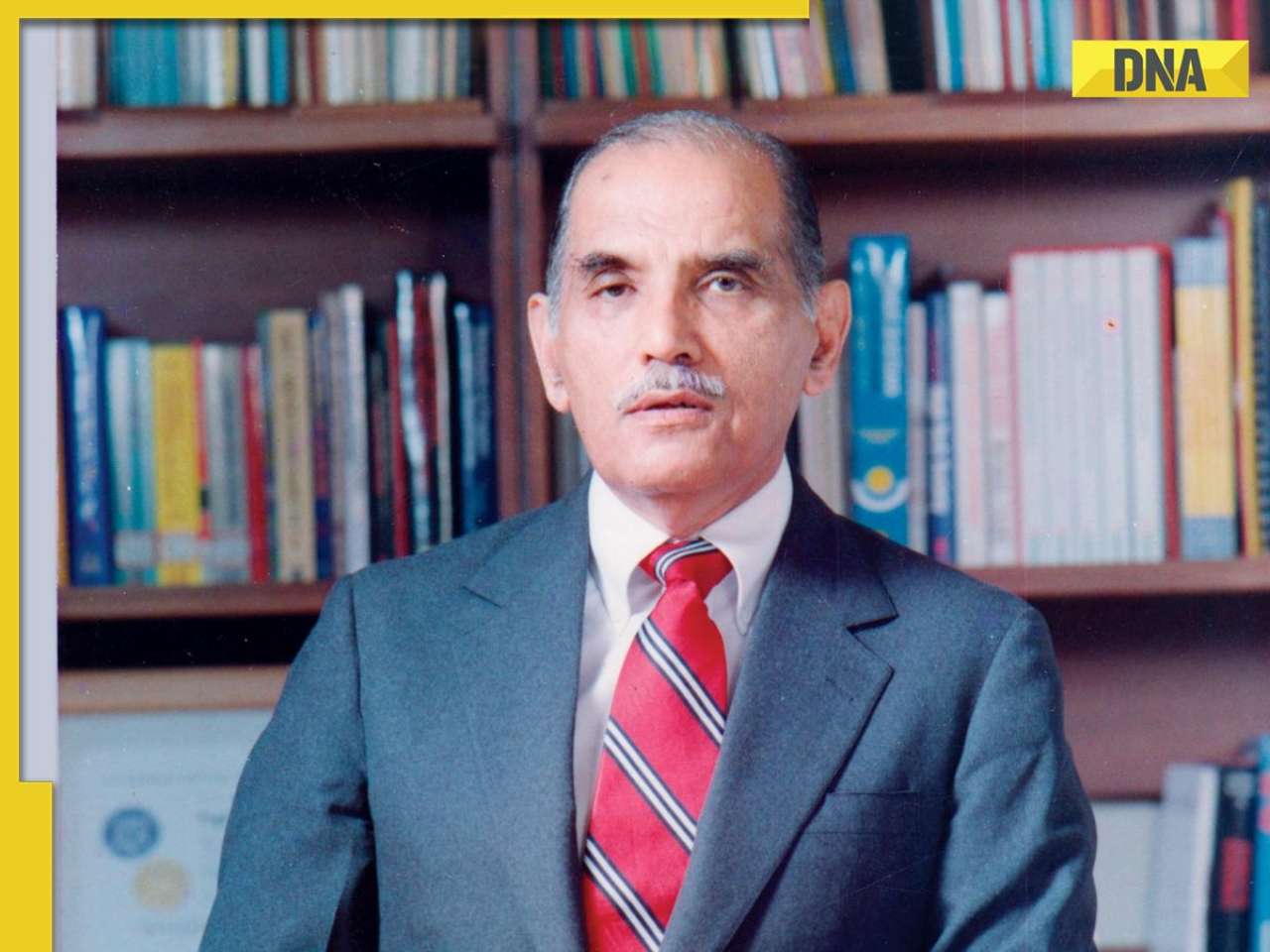

Amid increasing inflation in India, former Reserve Bank of India (RBI) Governor Raghuram Rajan, in a post on LinkedIn, said the nation's central bank will have to raise rates like global peers. He added that it should not be seen as against the interests of the economy.

"At such times, politicians and bureaucrats will have to understand that the rise in policy rates is not some anti-national activity benefiting foreign investors, but is an investment in economic stability, whose greatest beneficiary is the Indian citizen," Rajan said.

"No one is happy when rates have to be raised," he added, addressing the criticism that higher rates held back the economy during his term. Correct facts are important to guide future policy. He said, "It is essential the RBI does what it needs to, and the broader polity gives it the latitude that it needs to."

Read | RBI Monetary Policy: 17 things you should know about Repo Rate

The Reserve Bank has maintained the status quo on policy rates to support domestic growth. The central bank has hiked the inflation projection for this financial year to 5.7% from 4.5%. It has also cut back its growth forecast to 7.2% from 7.8%, making inflation a priority.

Raghuram Rajan cited an example from the past to make people understand his point. Citing an instance of his tenure, Rajan said when he took charge, India was in the midst of a full-blown currency crisis with the rupee depreciating sharply. Inflation was at 9.5% then.

The RBI raised the repo rate from 7.25% in September 2013 to 8%, before bringing it to 6.5% when inflation consequently fell. This was accompanied with an inflation-targeting framework signed with the government. He added that these actions not only helped stabilise the economy and the rupee, they also enhanced growth.

Praising RBI, Rajan said that the central bank has calmed financial markets despite the rise in oil prices. This is unlike the crisis in 1990-91, which was also precipitated by higher oil prices, he said. India's Foreign exchange reserves is over USD 600 billion, according to the central bank data.

![submenu-img]() Israel launches strikes on Yemeni Houthi targets after killing dozens of Hezbollah members in Lebanon

Israel launches strikes on Yemeni Houthi targets after killing dozens of Hezbollah members in Lebanon![submenu-img]() Haryana Elections 2024: BJP expels 8 rebels, including Sandeep Garg, for contesting as Independents

Haryana Elections 2024: BJP expels 8 rebels, including Sandeep Garg, for contesting as Independents![submenu-img]() IPL 2025: How much salary will MS Dhoni earn if CSK retain him as uncapped player?

IPL 2025: How much salary will MS Dhoni earn if CSK retain him as uncapped player?![submenu-img]() UPI QR code is down, this is how SBI is fixing the problem

UPI QR code is down, this is how SBI is fixing the problem![submenu-img]() Shocking! Viral influencer who married herself dies by suicide at 26

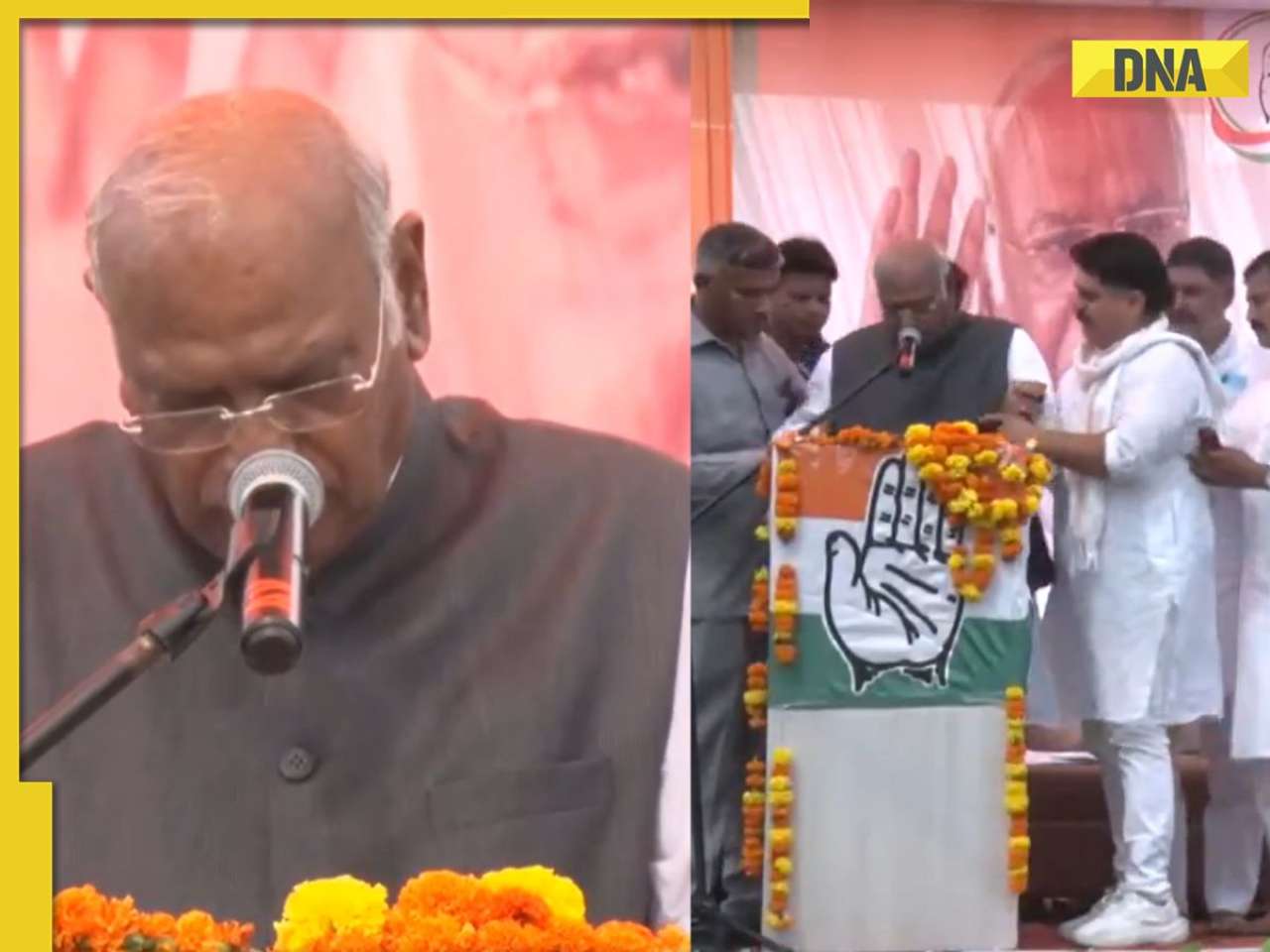

Shocking! Viral influencer who married herself dies by suicide at 26![submenu-img]() PM Modi ने कांग्रेस अध्यक्ष मल्लिकार्जुन खड़गे को किया फोन, पूछा सेहत का हाल, रैली में बिगड़ी थी तबीयत

PM Modi ने कांग्रेस अध्यक्ष मल्लिकार्जुन खड़गे को किया फोन, पूछा सेहत का हाल, रैली में बिगड़ी थी तबीयत ![submenu-img]() हरियाणा चुनाव से पहले BJP ने इन 8 नेताओं को किया बाहर, पूर्व मंत्री रणजीत चौटाला का भी नाम है शामिल

हरियाणा चुनाव से पहले BJP ने इन 8 नेताओं को किया बाहर, पूर्व मंत्री रणजीत चौटाला का भी नाम है शामिल![submenu-img]() इजराइल के बाद अब अमेरिका की सीरिया एयरस्ट्राइक, अलकायदा और IS के 37 आतंकी किए ढ़ेर

इजराइल के बाद अब अमेरिका की सीरिया एयरस्ट्राइक, अलकायदा और IS के 37 आतंकी किए ढ़ेर![submenu-img]() Karanveer Mehra बने Khatron Ke Khiladi 14 के विनर, ट्रॉफी के साथ मिला इतना कैश प्राइज

Karanveer Mehra बने Khatron Ke Khiladi 14 के विनर, ट्रॉफी के साथ मिला इतना कैश प्राइज ![submenu-img]() Swiggy CEO Hustle Culture: ऑफिस में ओवरटाइम से कुछ नहीं होता, परिवार को टाइम दो.., हसल कल्चर पर स्विगी सीईओ

Swiggy CEO Hustle Culture: ऑफिस में ओवरटाइम से कुछ नहीं होता, परिवार को टाइम दो.., हसल कल्चर पर स्विगी सीईओ![submenu-img]() Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…

Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…![submenu-img]() Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...

Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...![submenu-img]() Tata launches Nexon iCNG, check price, mileage, other features

Tata launches Nexon iCNG, check price, mileage, other features![submenu-img]() This Indian car brand set to acquire 50% stake in Skoda Auto Volkswagen India, deal will cost Rs…

This Indian car brand set to acquire 50% stake in Skoda Auto Volkswagen India, deal will cost Rs…![submenu-img]() Ford to return to India after 2 years with reopening of....

Ford to return to India after 2 years with reopening of....![submenu-img]() This man was behind IT giant valued at over Rs 13.78 lakh crore, born in Peshawar, also known as father of...

This man was behind IT giant valued at over Rs 13.78 lakh crore, born in Peshawar, also known as father of...![submenu-img]() Meet woman, who scored highest marks in UPSC interview history, not Tina Dabi, Smita Sabharwal, she is...

Meet woman, who scored highest marks in UPSC interview history, not Tina Dabi, Smita Sabharwal, she is...![submenu-img]() Meet India's youngest woman to crack UPSC exam at age 21, secured AIR 13, but didn't become IAS due to...

Meet India's youngest woman to crack UPSC exam at age 21, secured AIR 13, but didn't become IAS due to...![submenu-img]() Meet India’s first female IAS officer, also second woman to crack UPSC exam, she was posted at...

Meet India’s first female IAS officer, also second woman to crack UPSC exam, she was posted at...![submenu-img]() Meet man, bangle seller who cracked UPSC exam despite being specially abled, becomes IAS officer with AIR...

Meet man, bangle seller who cracked UPSC exam despite being specially abled, becomes IAS officer with AIR...![submenu-img]() After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon

After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon![submenu-img]() Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War

Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War![submenu-img]() Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain

Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain![submenu-img]() Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts

Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts![submenu-img]() Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir

Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir![submenu-img]() Big relief for GST taxpayers: Clear old dues without extra costs; here’s how

Big relief for GST taxpayers: Clear old dues without extra costs; here’s how![submenu-img]() Learn to play the Reliance way, Mukesh Ambani ready to disrupt the toy market

Learn to play the Reliance way, Mukesh Ambani ready to disrupt the toy market![submenu-img]() Ratan Tata's BIG move as Tata Sons set to buy 13% in...

Ratan Tata's BIG move as Tata Sons set to buy 13% in...![submenu-img]() Meet Anuradha who has come out of husband Anand Mahindra's shadow, this is what she does

Meet Anuradha who has come out of husband Anand Mahindra's shadow, this is what she does ![submenu-img]() Mukesh Ambani's BIG gift to shareholders, Reliance earns Rs 53652 crore in just 5 days

Mukesh Ambani's BIG gift to shareholders, Reliance earns Rs 53652 crore in just 5 days![submenu-img]() Haryana Elections 2024: BJP expels 8 rebels, including Sandeep Garg, for contesting as Independents

Haryana Elections 2024: BJP expels 8 rebels, including Sandeep Garg, for contesting as Independents![submenu-img]() Tamil Nadu cabinet rejig: MK Stalin's son Udhayanidhi Stalin is Deputy CM, Senthil Balaji back as minister

Tamil Nadu cabinet rejig: MK Stalin's son Udhayanidhi Stalin is Deputy CM, Senthil Balaji back as minister![submenu-img]() Chandrayaan-3 might have landed in moon's crater, 'ejecta' will reveal secrets

Chandrayaan-3 might have landed in moon's crater, 'ejecta' will reveal secrets![submenu-img]() J-K Elections 2024: Congress chief Mallikarjun Kharge’s health deteriorates during poll rally in Kathua - watch

J-K Elections 2024: Congress chief Mallikarjun Kharge’s health deteriorates during poll rally in Kathua - watch![submenu-img]() Hapur Horror: 5-year-old boy gang raped, assault captured on video, circulated online

Hapur Horror: 5-year-old boy gang raped, assault captured on video, circulated online

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)