- LATEST

- WEBSTORY

- TRENDING

PERSONAL FINANCE

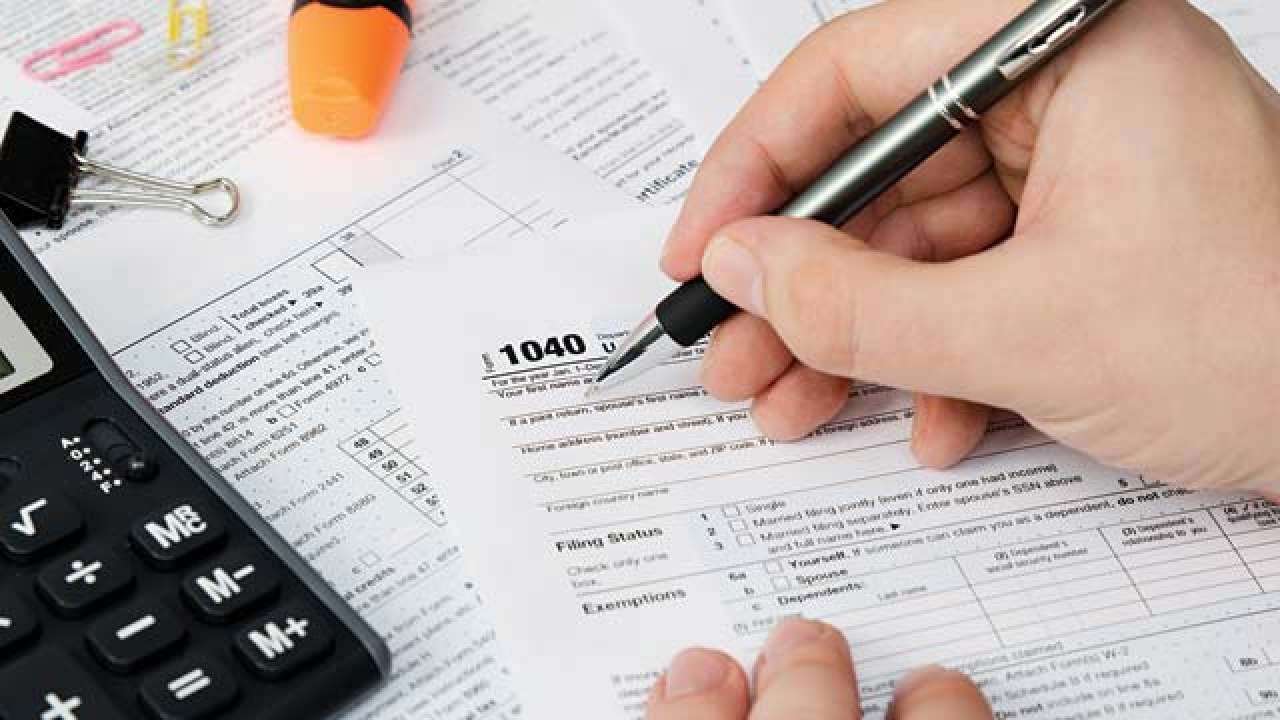

Earning from social media! MUST know this ITR filing rule

Those people who earn a substantial income from social media platforms also need to file their ITR, if their annual turnover is Rs 50 lakh or more.

DNA Web Team | Jan 23, 2021, 04:39 PM IST

1.Last date of ITR filing was January 10, 2021

The last date of income tax return (ITR) filing for FY 2019-20 (AY 2020-21) was extended to January 10, 2021 due to the COVID-19 pandemic.

(Image Source: Twitter/@IncomeTaxIndia)

2.Tax and TP audit last due date is February 15, 2021

However, for tax audit and TP audit the last due date is February 15, 2021. Those people who earn a substantial income from social media platforms like YouTube, Facebook, Twitter, etc., also need to file their ITR if their annual turnover is Rs 50 lakh or more.

(Image Source: Twitter/@IncomeTaxIndia)

3.ITR filing for earnings from social media platforms

According to tax and investment experts, if somebody is earning from social media platforms, despite having a regular source of income, they have to showcase it during filing of the ITR.

(Image Source: File Photo)

4.Earnings from YouTube, Facebook, Twitter is taxable

Experts say that one's earnings from YouTube, Facebook, Twitter, or any other social media platform has to be mentioned during ITR filing.

(Image Source: File Photo)

TRENDING NOW

5.For annual turnover of Rs 50 lakh or more, income tax audit must

However, for a person who is running a huge income network, need to get the income tax audit done at the end of financial year if their net annual turnover is Rs 50 lakh or more.

(Image Source: File Photo)

6.Expenses have to be deducted from net turnover

Experts say that during ITR filing process regarding one's income from social media platforms, expenses have to be deducted from the net turnover while calculating annual social media income.

(Image Source: File Photo)

7.Income from social media falls under purview of service sector

Income from social media falls under the purview of service sector and hence the income tax audit becomes mandatory if one's net annual turnover is Rs 50 lakh or above.

(Image Source: File Photo)

8.Expenses to be deducted while calculating net income

However, it doesn't mean one needs to pay income tax on Rs 50 lakh. One's expenses have to be deducted while calculating the net income from the social media.

(Image Source: File Photo)

)

)

)

)

)

)