India currently imports three million barrels of oil a day, however, because of the sanctions, India has reduced its oil imports from Iran over the past few years and moved to African oil; this event gives it a chance to strengthen its oil trade with Iran once again.

The intense negotiations between major powers and Iran are finally over, with a deal being reached between the two. What does this deal mean for India and its oil security?

It is likely to put pressure on oil prices further. Immediately after the announcement that a deal had been made, oil prices fell globally.

Brent crude oil was trading at $56.86, down by nearly 1.7% and oil prices on NYMEX fell 2%.

Reuters reported that stock prices of oil-related companies fell in European stock markets after the deal was announced.

According to estimates, Iran currently exports nearly 1.3 million barrels of oil per day as against over two million barrels, before the sanctions were put in place by the US, European Union and the United Nations.

Iran currently produces nearly 2.8 million barrels of oil a day, which is nearly half of its peak production in the 1970s.

With the sanctions being lifted gradually and Iranian oil coming into the market, oil prices are likely to be depressed further.

Oil prices have already fallen since July 2014, and reached a low of $45 a barrel before stabilising at over $60 a barrel. This has also brought down India's oil import bill by nearly 50%.

HDFC Securities, in a note dated July 14 said, "The deal, as and when it is signed, augurs well for India." It further said that an additional 5,00,000 barrels of oil could hit the market within a month of signing the deal, and another 10,00,000 barrels after six months.

Following the sanctions, heightened tensions between the US and Iran, and pressure from the US, India cut its oil imports from Iran to merely 6% of its total needs in 2013. Oil imports from Iran jumped four times last year when major powers and Iran had reached an interim nuclear deal, which set in motion the current final deal.

India's oil imports from Iran stood at 11 million tonne in 2013-14 as against over 13 million in 2012-13.

India currently imports three million barrels of oil a day, however, because of the sanctions, India has reduced its oil imports from Iran over the past few years and moved to African oil; this event gives it a chance to strengthen its oil trade with Iran once again.

According to Reuters, Nigeria came on top of India's oil import list in the month of May.

The Chabahar Port

India has also signed a contract with Iran to build Chabahar Port in Southeast Iran. The agreement was signed in 2003 but went into cold storage because of the sanctions.

In May this year, Transport Minister Nitin Gadkari said that the port will be operational by December 2016.

The work on the project is already underway, and a draft agreement is expected to be signed soon.

India is expected to lease two berths at the port for 10 years, which will be used to export oil to Kandla and JNPT ports in Gujarat and Mumbai, respectively.

Natural gas

It is also estimated that Iran has one of the largest natural gas reserves in the world.

India had plans of buying five million tonnes of natural gas per year as per the deal signed in 2005, between National Iranian Gas Export Company and India's GAIL, Indian Oil Ltd and BPCL.

India and Iran also had a deal about the Farzad-B field, but according to certain reports, Iran had cancelled the deal.

ONGC Videsh, together with Oil India and Indian Oil Corporation Ltd, have already invested over $100 million in the field, and discovered oil way back in 2008. According to estimates, the field holds 13 trillion cubic feet of reserves.

Iran wants India to increase its oil imports from Iran and resumption of investment in this block will be a key to negotiate a deal.

Indian refiners, who cut imports from Iran, will have to scale up their oil imports from Iran once again.

Payment in rupees

India's oil bill is nearly $150 billion, which puts immense pressure on the current account deficit and forex reserves.

Iran had agreed to accept all payments in Indian Rupees following the sanctions, but in October 2013 it went back on its word and resumed the old system of accepting only 45% of the bills in Indian currency.

Iran would not want to continue this deal, now with the sanctions being lifted -- and the country coming on the map of global banking, thereby making it easier for it to accept and spend money on goods and services.

However, if India manages to convince Iran to continue with the current deal, then with increasing imports from Iran coupled with more payments in Indian Rupees, India's forex reserves will get a positive boost.

![submenu-img]() Anand Tiwari talks about his series Cadets, reveals if Go Goa Gone 2 is still possible: 'They want...' | Exclusive

Anand Tiwari talks about his series Cadets, reveals if Go Goa Gone 2 is still possible: 'They want...' | Exclusive![submenu-img]() Rahul Dravid officially appointed as Rajasthan Royals head coach ahead of IPL 2025

Rahul Dravid officially appointed as Rajasthan Royals head coach ahead of IPL 2025![submenu-img]() Fan invades field, touches India star’s feet during Duleep Trophy match; pic goes viral

Fan invades field, touches India star’s feet during Duleep Trophy match; pic goes viral![submenu-img]() Mumbai-Frankfurt Vistara flight diverted to Turkey due to bomb threat

Mumbai-Frankfurt Vistara flight diverted to Turkey due to bomb threat![submenu-img]() Ganesh Chaturthi 2024 shubh muhurat: Check city wise puja timings, visarjan date, and bhog for Ganpati Bappa

Ganesh Chaturthi 2024 shubh muhurat: Check city wise puja timings, visarjan date, and bhog for Ganpati Bappa![submenu-img]() Hathras Accident: यूपी के हाथरस में बड़ा सड़क हादसा, 15 लोगों की मौत, कई घायल

Hathras Accident: यूपी के हाथरस में बड़ा सड़क हादसा, 15 लोगों की मौत, कई घायल![submenu-img]() J-K विधानसभा चुनाव: 'आर्टिकल 370 को हम कभी वापस नहीं आने देंगे', अमित शाह ने जारी किया BJP का संकल्प पत्र

J-K विधानसभा चुनाव: 'आर्टिकल 370 को हम कभी वापस नहीं आने देंगे', अमित शाह ने जारी किया BJP का संकल्प पत्र![submenu-img]() Kanhaiya Lal Murder: कन्हैयालाल हत्याकांड में दूसरे आरोपी जावेद को भी मिली बेल

Kanhaiya Lal Murder: कन्हैयालाल हत्याकांड में दूसरे आरोपी जावेद को भी मिली बेल![submenu-img]() Assembly Election 2024: हरियाणा में भाजपा नेताओं के बगावती तेवर, कहीं बिगड़ न जाए जीत का समीकरण

Assembly Election 2024: हरियाणा में भाजपा नेताओं के बगावती तेवर, कहीं बिगड़ न जाए जीत का समीकरण![submenu-img]() Viral Video: Indigo की फ्लाइट में बंद हो गया एसी, गर्मी से परेशान यात्री हो गए बेहोश

Viral Video: Indigo की फ्लाइट में बंद हो गया एसी, गर्मी से परेशान यात्री हो गए बेहोश ![submenu-img]() DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() DNA Auto Awards 2024: Hyundai Alcazar Facelift nominated for ‘CAR OF THE YEAR’; check details

DNA Auto Awards 2024: Hyundai Alcazar Facelift nominated for ‘CAR OF THE YEAR’; check details![submenu-img]() Hyundai Creta Knight Edition launched in India: Check price, features, design

Hyundai Creta Knight Edition launched in India: Check price, features, design![submenu-img]() DNA Auto Awards 2024: Citroen Basalt nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Citroen Basalt nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() DNA Auto Awards 2024: Tata Curvv nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Tata Curvv nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() UPSC topper IAS Shruti Sharma's marksheet goes viral on social media, check her scores in different subjects

UPSC topper IAS Shruti Sharma's marksheet goes viral on social media, check her scores in different subjects![submenu-img]() Meet man, who lost his mother in childhood, worked as milk seller, cracked NEET exam with AIR...

Meet man, who lost his mother in childhood, worked as milk seller, cracked NEET exam with AIR...![submenu-img]() Meet man who failed 35 exams, cracked UPSC exam twice, first became IPS then quit due to...

Meet man who failed 35 exams, cracked UPSC exam twice, first became IPS then quit due to...![submenu-img]() Meet man, who was forced into child marriage at 11, cracked NEET exam with AIR...

Meet man, who was forced into child marriage at 11, cracked NEET exam with AIR...![submenu-img]() Meet woman who cracked UPSC exam in first attempt without coaching at 22, got AIR 31, she is now posted as…

Meet woman who cracked UPSC exam in first attempt without coaching at 22, got AIR 31, she is now posted as…![submenu-img]() Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed

Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed![submenu-img]() 'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project

'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project![submenu-img]() Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure

Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here

Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here![submenu-img]() Mukesh Ambani set to challenge Adani, ITC with his Rs 3900 crore plan for...

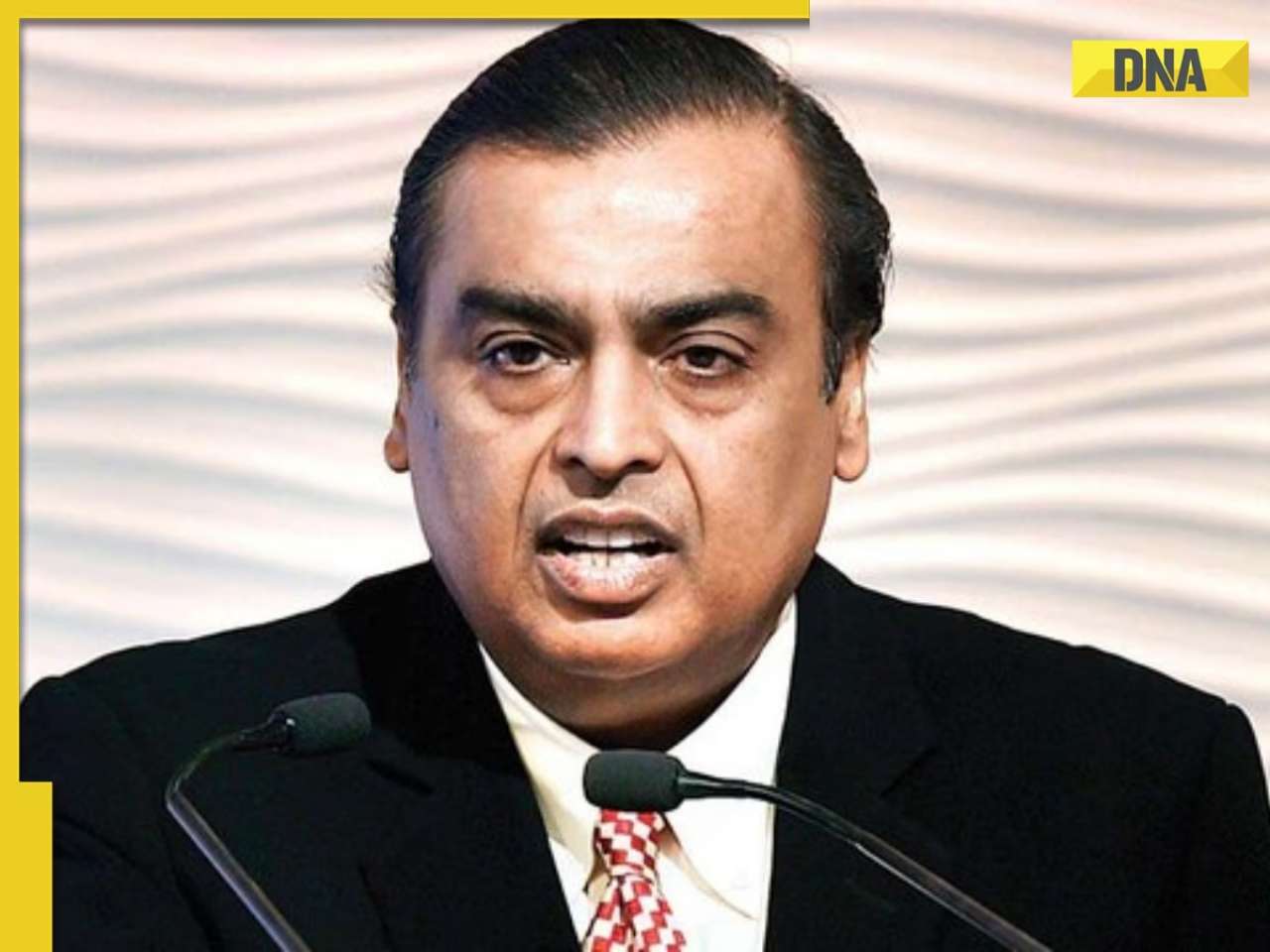

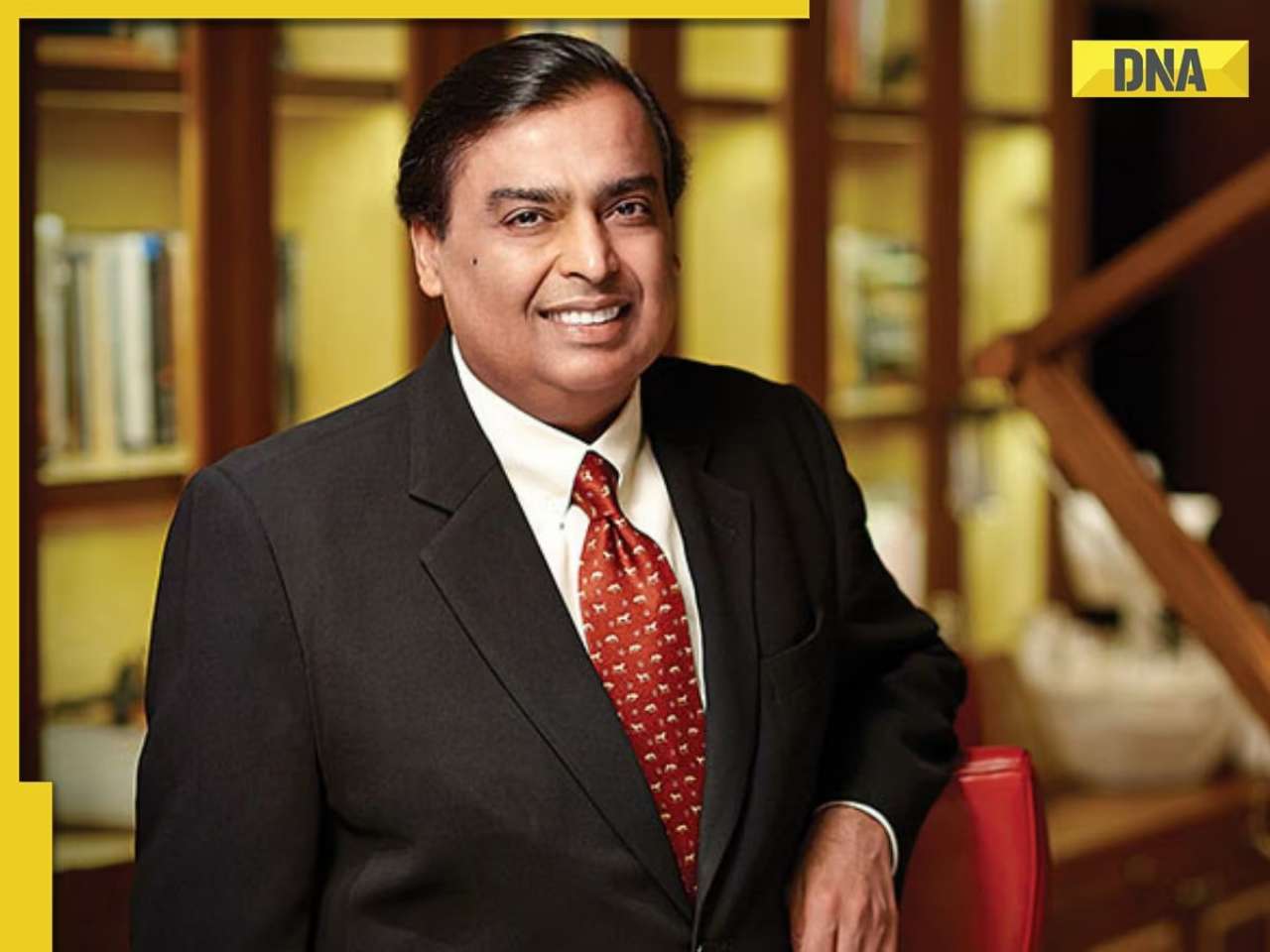

Mukesh Ambani set to challenge Adani, ITC with his Rs 3900 crore plan for...![submenu-img]() NPCI launches 'UPI circle', check what it is and how it works

NPCI launches 'UPI circle', check what it is and how it works![submenu-img]() Mukesh Ambani's Reliance Jio to give tough competition to BSNL with this plan, it offers 5G data at just Rs...

Mukesh Ambani's Reliance Jio to give tough competition to BSNL with this plan, it offers 5G data at just Rs...![submenu-img]() This company repays Rs 20000 crore debt for... and it has a Ratan Tata connection

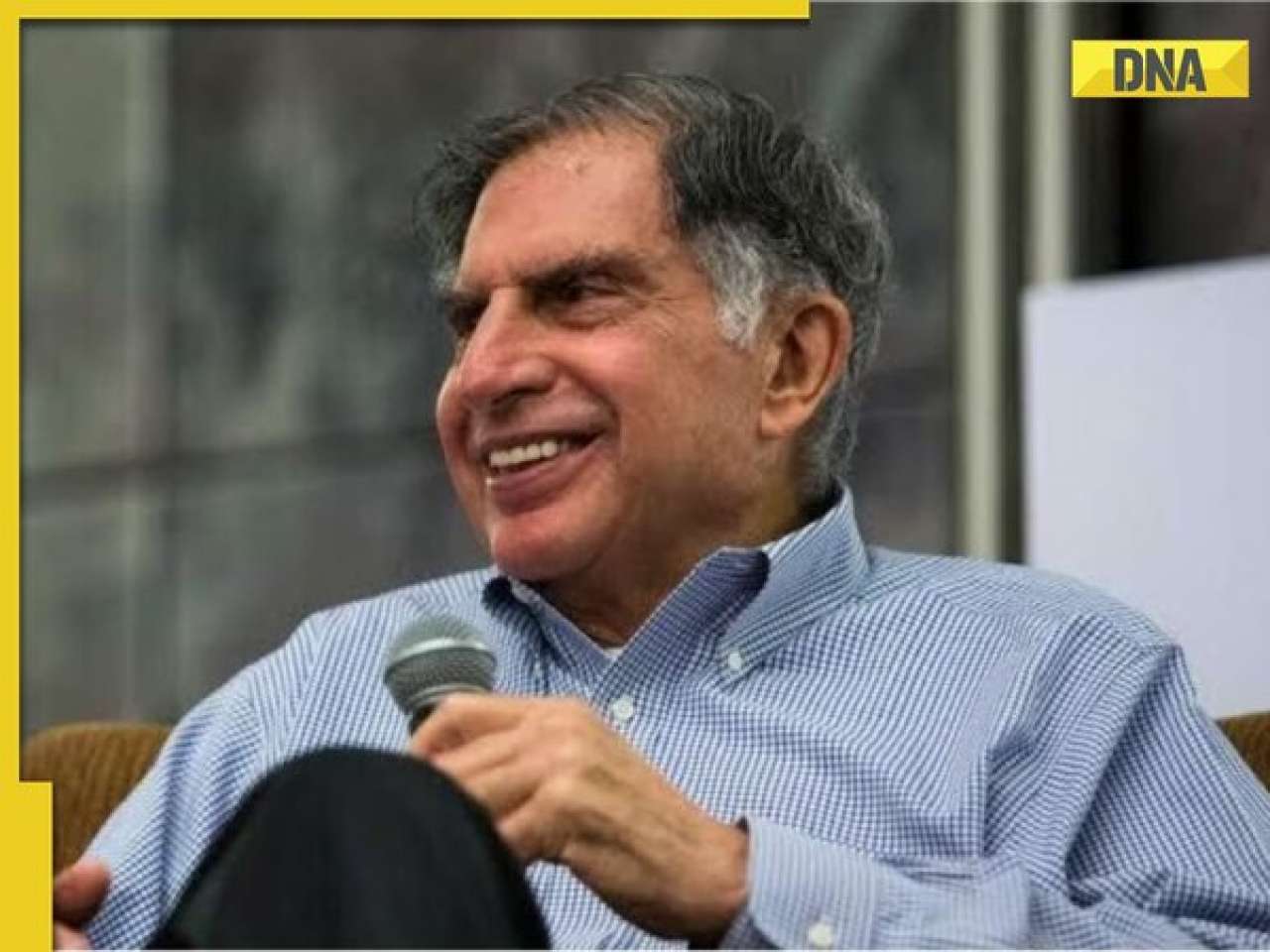

This company repays Rs 20000 crore debt for... and it has a Ratan Tata connection![submenu-img]() Meet woman, billionaire's daughter, who studied in London, now leads Rs 1124 crore company as...

Meet woman, billionaire's daughter, who studied in London, now leads Rs 1124 crore company as...![submenu-img]() From Cristiano Ronaldo to Virat Kohli: List of highest-paid athletes in last 12 months

From Cristiano Ronaldo to Virat Kohli: List of highest-paid athletes in last 12 months![submenu-img]() Meet actor who worked as waiter, sold tea, namkeen for 14 years, debuted in Bollywood at 42; now his net worth is...

Meet actor who worked as waiter, sold tea, namkeen for 14 years, debuted in Bollywood at 42; now his net worth is...![submenu-img]() Parents-to-be Deepika Padukone, Ranveer Singh seek blessings at Siddhivinayak with families days before baby's arrival

Parents-to-be Deepika Padukone, Ranveer Singh seek blessings at Siddhivinayak with families days before baby's arrival![submenu-img]() Gout remedies: 7 natural ways to lower uric acid levels in the body

Gout remedies: 7 natural ways to lower uric acid levels in the body ![submenu-img]() Active players with most centuries in international cricket

Active players with most centuries in international cricket ![submenu-img]() Mumbai-Frankfurt Vistara flight diverted to Turkey due to bomb threat

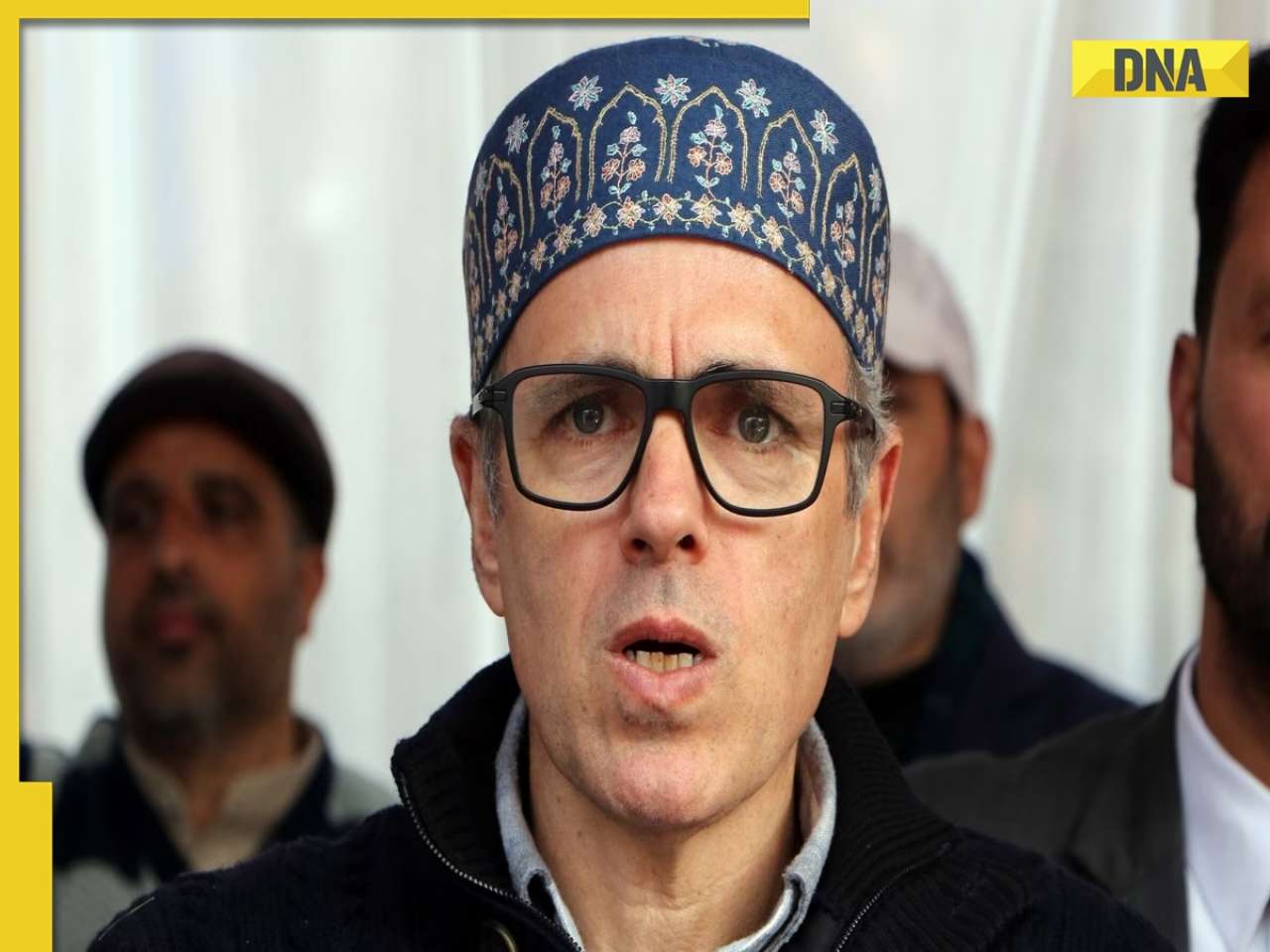

Mumbai-Frankfurt Vistara flight diverted to Turkey due to bomb threat![submenu-img]() 'Leaders in Delhi never liked me…’ Omar Abdullah alleges poll 'conspiracy'

'Leaders in Delhi never liked me…’ Omar Abdullah alleges poll 'conspiracy'![submenu-img]() Over 200 Patients celebrate freedom from diabetes in Madhavbaug's nationwide campaign 'Azadi Diabetes Se'

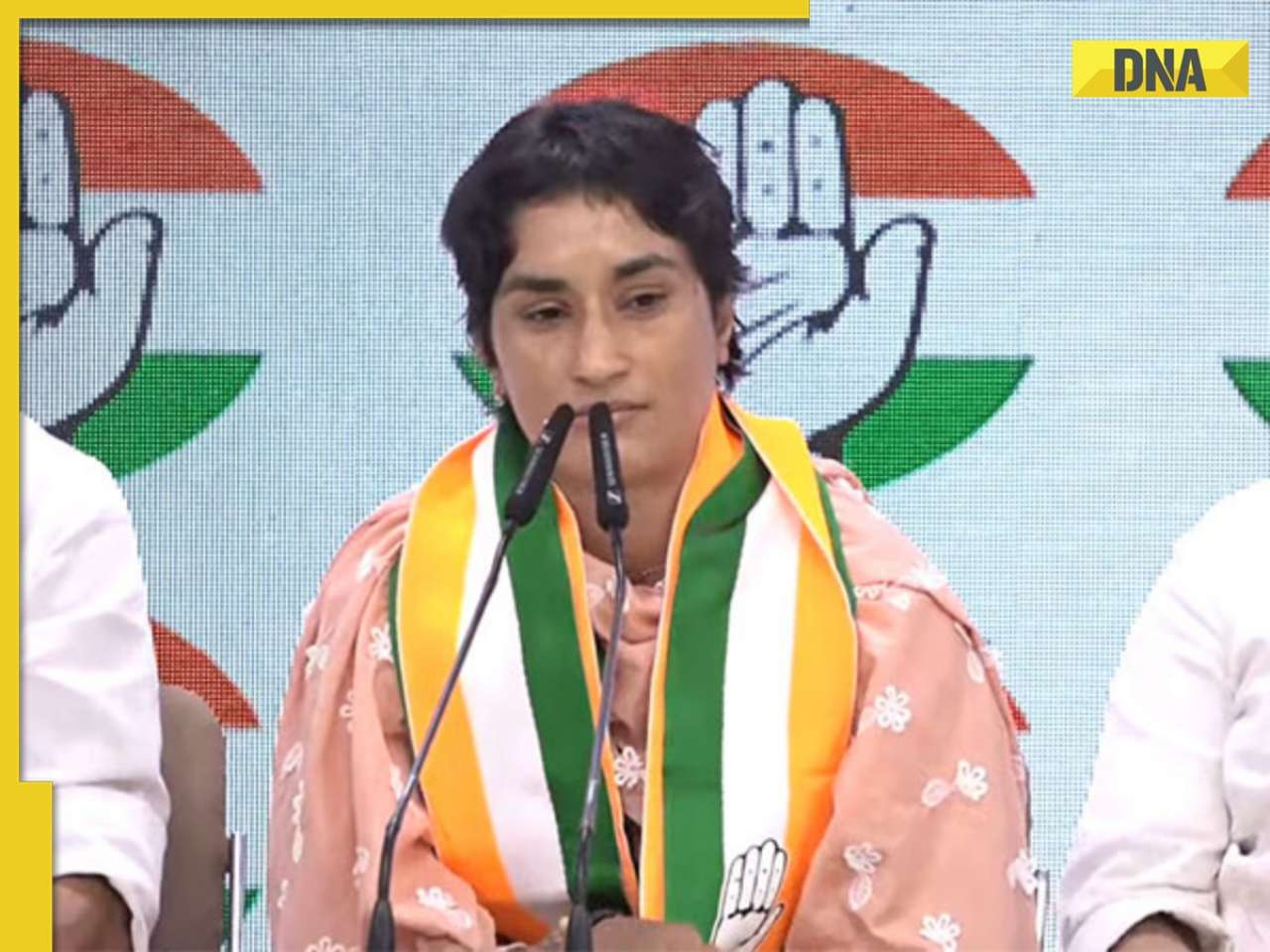

Over 200 Patients celebrate freedom from diabetes in Madhavbaug's nationwide campaign 'Azadi Diabetes Se'![submenu-img]() 'When we were dragged on roads...': Wrestler Vinesh Phogat slams BJP

'When we were dragged on roads...': Wrestler Vinesh Phogat slams BJP![submenu-img]() India emerges as second-largest global 5G smartphone market, overtakes...

India emerges as second-largest global 5G smartphone market, overtakes...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)