- Home

- Latest News

![submenu-img]() This Indian company is world's strongest brand, it's not Reliance, TCS, Wipro, Infosys or Adani Group

This Indian company is world's strongest brand, it's not Reliance, TCS, Wipro, Infosys or Adani Group![submenu-img]() This Mughal emperor was called 'Zinda Peer' because...

This Mughal emperor was called 'Zinda Peer' because...![submenu-img]() Dinesh Karthik names Rohit Sharma's opening partner for Champions Trophy 2025, it's not Yashasvi Jaiswal

Dinesh Karthik names Rohit Sharma's opening partner for Champions Trophy 2025, it's not Yashasvi Jaiswal![submenu-img]() ‘National Space Day, 2024’: Tribute to India’s Stellar Footprints and Catalyst for Future Exploration

‘National Space Day, 2024’: Tribute to India’s Stellar Footprints and Catalyst for Future Exploration![submenu-img]() Badlapur sexual assault case: Internet suspended, 72 arrested amid massive protest

Badlapur sexual assault case: Internet suspended, 72 arrested amid massive protest

- Webstory

- DNA Hindi

![submenu-img]() Kolkata Rape-Murder Case: प्रदर्शनकारियों की मांग के आगे झुकी ममता सरकार, हॉस्पिटल के प्रिंसिपल को हटाया

Kolkata Rape-Murder Case: प्रदर्शनकारियों की मांग के आगे झुकी ममता सरकार, हॉस्पिटल के प्रिंसिपल को हटाया![submenu-img]() 'भारत पर परमाणु बम फेंक देता क्योंकि...' ब्रिटिश यूट्यूबर के इंडियंस पर नस्लभेदी कमेंट्स ने मचाया हंगामा

'भारत पर परमाणु बम फेंक देता क्योंकि...' ब्रिटिश यूट्यूबर के इंडियंस पर नस्लभेदी कमेंट्स ने मचाया हंगामा![submenu-img]() Petrol-Diesel Price Today: गुरुवार की सुबह जारी हुए पेट्रोल-डीजल के लेटेस्ट रेट्स, जानें 22 अगस्त को क्या हैं दाम

Petrol-Diesel Price Today: गुरुवार की सुबह जारी हुए पेट्रोल-डीजल के लेटेस्ट रेट्स, जानें 22 अगस्त को क्या हैं दाम![submenu-img]() Weather Update: Delhi-NCR में जारी रहेगी मानसूनी बारिश, जानें यूपी-बिहार समेत इन राज्यों का हाल

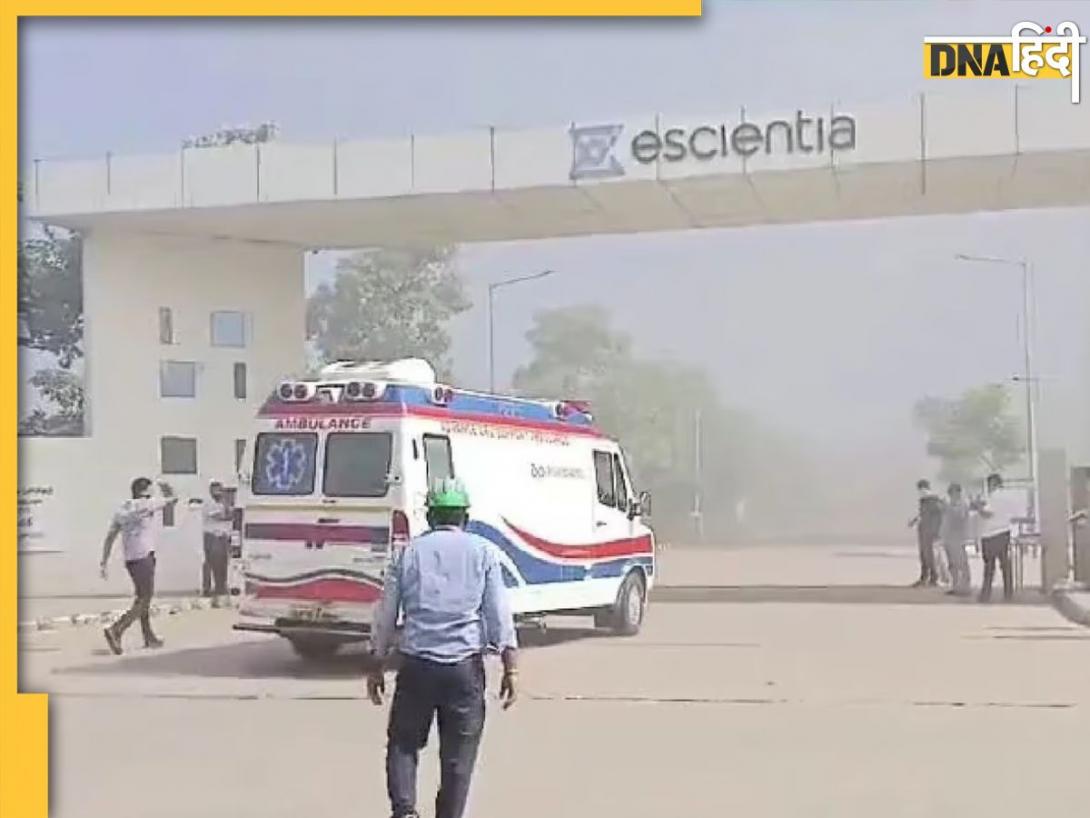

Weather Update: Delhi-NCR में जारी रहेगी मानसूनी बारिश, जानें यूपी-बिहार समेत इन राज्यों का हाल ![submenu-img]() Andhra Pradesh Explosion: आंध्र प्रदेश की दवा फैक्टरी ब्लास्ट में अबतक 18 की मौत, 40 घायल, पढ़ें ताजा अपडेट्स

Andhra Pradesh Explosion: आंध्र प्रदेश की दवा फैक्टरी ब्लास्ट में अबतक 18 की मौत, 40 घायल, पढ़ें ताजा अपडेट्स

- Education

![submenu-img]() Meet taxi driver's son, who was humiliated by police, cracked UPSC exam, then become...

Meet taxi driver's son, who was humiliated by police, cracked UPSC exam, then become...![submenu-img]() Meet Indian boy who became world’s youngest surgeon at 7, studied at IIT, he is now...

Meet Indian boy who became world’s youngest surgeon at 7, studied at IIT, he is now...![submenu-img]() Meet woman who lost her father at young age battled society's doubts, then transformed a cinema hall into...

Meet woman who lost her father at young age battled society's doubts, then transformed a cinema hall into...![submenu-img]() Meet man, who left high-paying job to crack UPSC exam, first become IPS, then IAS with AIR...

Meet man, who left high-paying job to crack UPSC exam, first become IPS, then IAS with AIR...![submenu-img]() 5 high-paying jobs in India without a college degree, check here

5 high-paying jobs in India without a college degree, check here

- Videos

![submenu-img]() Kolkata Doctor Murder: BJP Asks CM Mamata Banerjee To Resign Over Kolkata Murder-Rape Case

Kolkata Doctor Murder: BJP Asks CM Mamata Banerjee To Resign Over Kolkata Murder-Rape Case![submenu-img]() Kolkata Doctor Murder: Chirag Paswan Questions CM Mamata’s Protest Rally Over Kolkata Doctor Murder

Kolkata Doctor Murder: Chirag Paswan Questions CM Mamata’s Protest Rally Over Kolkata Doctor Murder![submenu-img]() Kolkata Doctor Murder: Kolkata Doctor's Autopsy Reveals Details Of Injuries And Sexual Assault

Kolkata Doctor Murder: Kolkata Doctor's Autopsy Reveals Details Of Injuries And Sexual Assault![submenu-img]() Kolkata Doctor Murder: WB Governor Slams CM Mamata, Says Not Society But Present Govt. Failed Women

Kolkata Doctor Murder: WB Governor Slams CM Mamata, Says Not Society But Present Govt. Failed Women![submenu-img]() Uttarakhand Bus Stand Rape: Five Held After Girl Gang-Raped In A Bus At Dehradun ISBT

Uttarakhand Bus Stand Rape: Five Held After Girl Gang-Raped In A Bus At Dehradun ISBT

- Olympics 2024

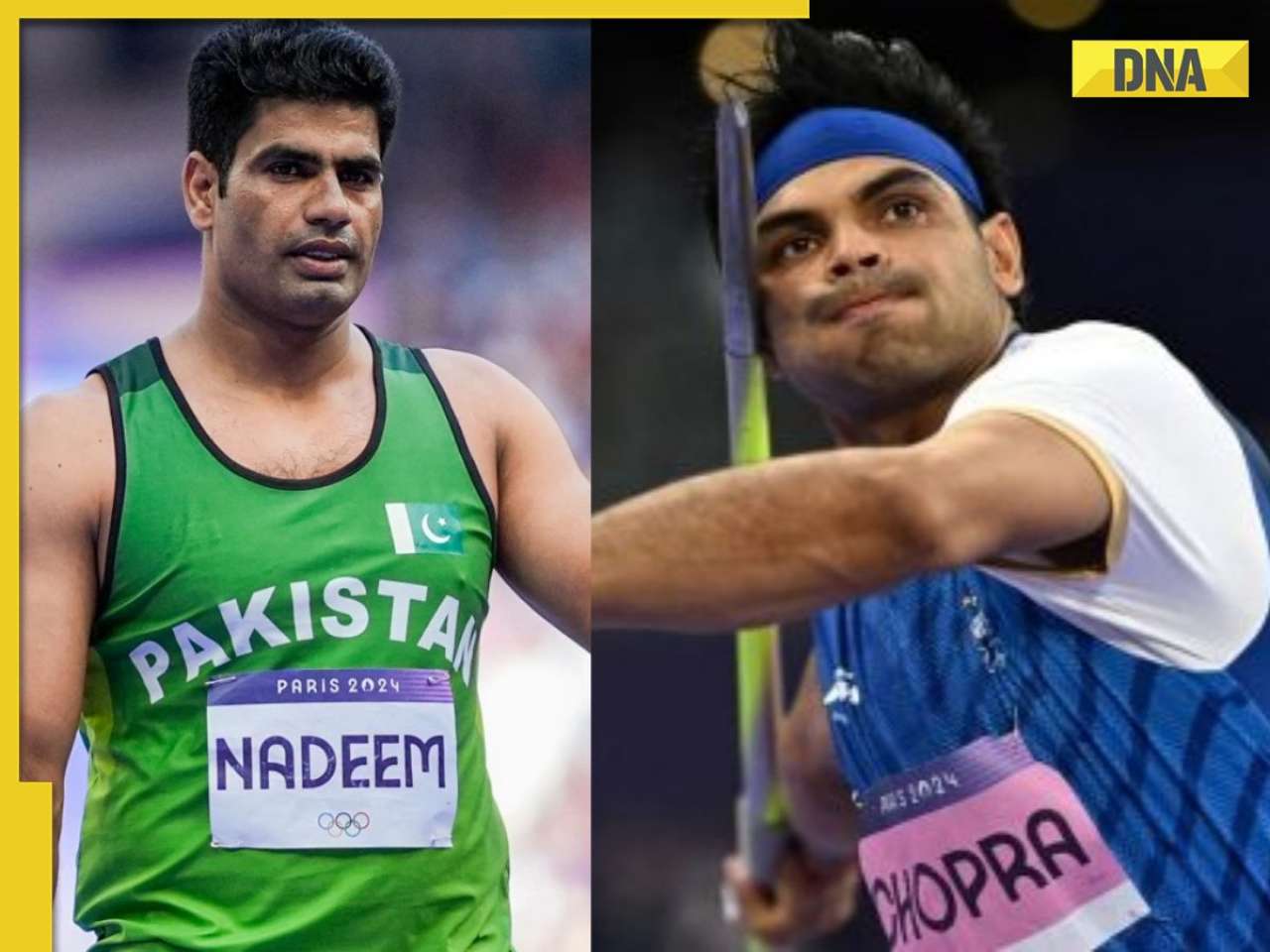

![submenu-img]() Where is Olympics Gold medalist Arshad Nadeem? Will he challenge Neeraj Chopra at Diamond League?

Where is Olympics Gold medalist Arshad Nadeem? Will he challenge Neeraj Chopra at Diamond League?![submenu-img]() Vinesh Phogat to enter politics? Report says she is likely to contest against...

Vinesh Phogat to enter politics? Report says she is likely to contest against...![submenu-img]() Arshad Nadeem's net worth was just Rs 80 lakh before Gold medal win, his current net worth is Rs...

Arshad Nadeem's net worth was just Rs 80 lakh before Gold medal win, his current net worth is Rs...![submenu-img]() Haryana govt awards Rs 5 crore to Olympics medallist Manu Bhaker, check how much Neeraj Chopra, Vinesh Phogat got

Haryana govt awards Rs 5 crore to Olympics medallist Manu Bhaker, check how much Neeraj Chopra, Vinesh Phogat got![submenu-img]() Vinesh Phogat finally smiles again as she receives gold medal after Paris Olympics heartbreak

Vinesh Phogat finally smiles again as she receives gold medal after Paris Olympics heartbreak

- Photos

![submenu-img]() Eat these healthy vegan foods if you want to lose weight

Eat these healthy vegan foods if you want to lose weight![submenu-img]() In: 5 beautiful places you must visit in Kalka-Shimla

In: 5 beautiful places you must visit in Kalka-Shimla![submenu-img]() Meet Salman Khan's 'niece' who worked in TV, became star at 7, was called 'mini Katrina Kaif'; then left films, now...

Meet Salman Khan's 'niece' who worked in TV, became star at 7, was called 'mini Katrina Kaif'; then left films, now...![submenu-img]() Countries with highest number of vegetarians

Countries with highest number of vegetarians![submenu-img]() This Amitabh flop was rejected by Dilip Kumar, had 4 stars, its failure was celebrated by film industry, earned only..

This Amitabh flop was rejected by Dilip Kumar, had 4 stars, its failure was celebrated by film industry, earned only..

- India

![submenu-img]() ‘National Space Day, 2024’: Tribute to India’s Stellar Footprints and Catalyst for Future Exploration

‘National Space Day, 2024’: Tribute to India’s Stellar Footprints and Catalyst for Future Exploration![submenu-img]() Badlapur sexual assault case: Internet suspended, 72 arrested amid massive protest

Badlapur sexual assault case: Internet suspended, 72 arrested amid massive protest ![submenu-img]() What Sebi can learn from Pinochet case in conflict and propriety

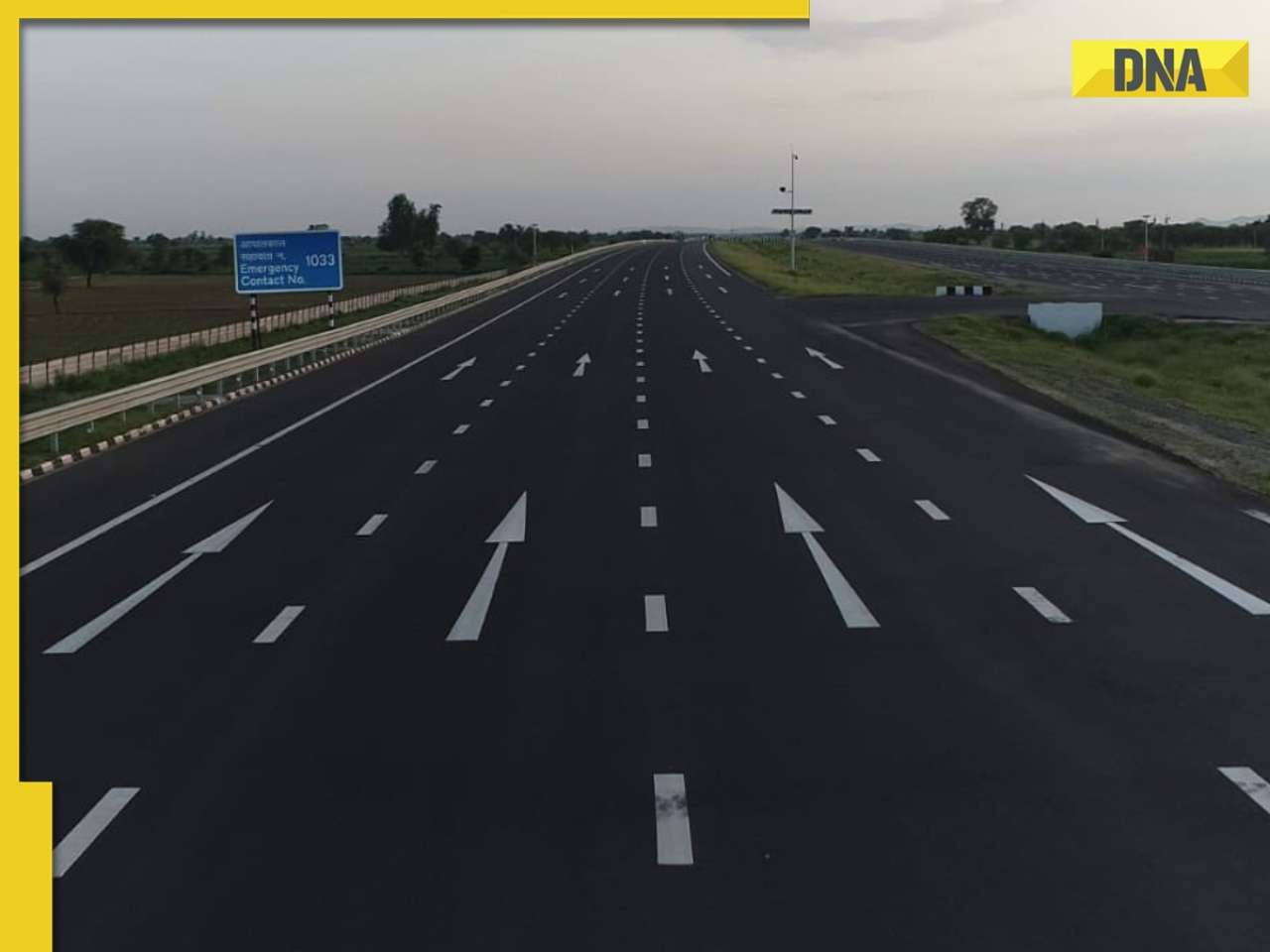

What Sebi can learn from Pinochet case in conflict and propriety![submenu-img]() Raipur-Hyderabad Expressway: Check travel time, distance, route, status and more

Raipur-Hyderabad Expressway: Check travel time, distance, route, status and more![submenu-img]() PM Modi arrives in Poland, first visit by Indian PM in 45 years

PM Modi arrives in Poland, first visit by Indian PM in 45 years

- DNA Explainers

![submenu-img]() Jammu and Kashmir Assembly elections: What is delimitation that paved the road for these Elections?

Jammu and Kashmir Assembly elections: What is delimitation that paved the road for these Elections?![submenu-img]() Wings of Refuge: Rafales escort Hasina to safety

Wings of Refuge: Rafales escort Hasina to safety![submenu-img]() Bangladesh in a crisis: A coup, protests and a fleeing Prime Minister

Bangladesh in a crisis: A coup, protests and a fleeing Prime Minister![submenu-img]() DNA Explainer: What is Waqf Board Act and why does Modi government want to amend it?

DNA Explainer: What is Waqf Board Act and why does Modi government want to amend it?![submenu-img]() DNA Explainer: Why is Bangladesh burning again?

DNA Explainer: Why is Bangladesh burning again?

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)