- LATEST

- WEBSTORY

- TRENDING

BUSINESS

Dollar-rupee may trade between 63.50 and 64.50 this year

With the appreciation of rupee against dollar, the Indian economy probably would have grown at more than 15% in 2017 in dollar terms

TRENDING NOW

The year 2017 ended with a bang for the Indian markets except the rate market.

The exception has been too important to ignore as the benchmark 10-year yield closed at 7.32%, about 88 basis points higher than its close in the previous year. This had been contributed by various factors, all leading to the assumption that the central government may not be able to meet its fiscal deficit target of 3.2% of GDP. It all started in August 2017 with the declaration of the dividend figure of RBI for the central government being lower by about Rs 30,000 crore vis-a- vis the budgeted number. That was followed by the falling revenue numbers of the goods and services tax (GST) collections month after month. It may be a temporary phase till the GST Council puts all the moving parts in place. Moving to ‘one nation one tax’ had been a major step forward as it had already been delayed by more than two decades when compared with the peers (competing major economies).

However, in a large economy with federal structure of taxation, it was bound to have the teething issues despite preparations. Another hole in the revenue bag was created with shifting of quite a few items from 28% to 18% slab. Rationalisation of GST rates as a move to lower number of slabs would certainly reduce the complexity and the resultant litigation, but its immediate fallout had been a reduced revenue generation since the middle of November.

There have also been some reports of tax evasion. Hopefully, the tax evasion would be curbed to some extent with introduction of e-way bill system in the early part of the fourth quarter.

Ultimately, the lower than budgeted generation of tax revenue together with lower receipt of dividend income led to the market expectation of fiscal slippage. This was further corroborated by the announcement of additional market borrowing of Rs 50,000 crore through dated securities and another Rs 23,000 crore through incremental issuance of Treasury bills. Put together, the amount adds up to 0.5% of the projected GDP for fiscal 2018. The only silver lining in revenue generation is seen in non- tax category through disinvestment as the all-time high budgeted amount of Rs 72,500 crore is quite likely to be achieved keeping in view the progress during the first three quarters. Assuming that the last quarter of the fiscal may witness some expenditure contraction as the capital expenditure was front-loaded to a greater extent, the fiscal slippage could occur between 30 to 50 basis points with the resultant fiscal deficit at 3.5 to 3.7% of GDP. The announcement of additional issuances pushed the benchmark closing yield to 7.40% on the penultimate trading day of the quarter.

However, with part cancellation of the auctions on December 29 which also happened to be the last trading day of the calendar, the yield fell to a closing level of 7.32%. There appears to be a lot more clarity now with the acknowledgement of the need to raise higher amount through market borrowing. The present levels of the yield curve are quite elevated and offer an opportunity to investors, with spread between the policy rate (Repo rate) and 10 year benchmark rate closing at 132 bps for the year. A part of fresh allocations of the foreign portfolio investors in the debt segment for the year 2018 may find some avenue in the Indian debt instruments. Consumer inflation may start receding from February onwards, partly due to base effect. The expected budgeted numbers for fiscal deficit for FY19 and hopefully other major macro indicators as well may bring cheers to the rate traders. The benchmark yield is expected to correct to 7% by the end of the fiscal year despite additional supply.

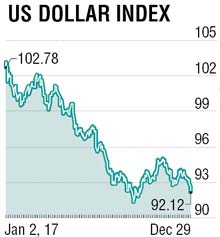

The rupee appreciated nearly 5.5% against US dollar during 2017. Assuming a nominal GDP growth (real growth plus inflation) of nearly 10% and with the appreciation of rupee against dollar, the Indian economy probably would have grown at more than 15% in 2017 in dollar terms. As pound and euro have also appreciated against the dollar considerably, Indian economy could not jump to the coveted fifth place overtaking UK and France despite probably touching the ‘$2.5 trillion’ mark. With the economy likely to gather further pace in 2018 after having left behind the temporary drags in the form of demonetisation and the initial teething problems of GST implementation, the attractive growth rate may invite more capital flows. The year 2017 ended with the highest ever forex reserves for the economy at more than $405 billion at more than 10 months’ imports, much above the IMF recommended level of six months’ imports. The augmentation of $45 billion in the level of forex reserves in the calendar 2017 (of which $35 billion have accrued since April 2017 itself) suggests that the RBI had been intermittently intervening in the forex markets to check the volatility in the USD-INR parity and partly to prevent appreciation of the domestic currency to support exports to some extent. If the trend of capital inflows continues in search of higher yield backed by stable if not ever appreciating currency and for visible capital gains on equity and debt investments, the dollar-rupee parity may trade between 63.50 and 64.50 during 2018 despite moderate interventions.

THE RUPEE LIFT

- With the appreciation of rupee against dollar, the Indian economy probably would have grown at more than 15% in 2017 in dollar terms.

- As pound and euro have also appreciated against the dollar considerably, Indian economy could not overtake the UK and France

The writer is executive director, Federal Bank

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)