A senior SBI official said: "We have showcased bad loans of about Rs 2,400 crore in the first quarter and have sold a part of it. It was mostly corporate accounts."

Banks have showcased bad loans to the tune of Rs 30,000 crore Asset Reconstruction Companies (ARCs) during April-June as lenders strive to clean up their balance-sheet by selling debt at a deep discount.

Banks are in a hurry to make good of the Reserve Bank of India (RBI) regulation that allows them to write off losses in eight quarters instead of bad loans impacting the balance-sheet immediately.

A senior SBI official said: "We have showcased bad loans of about Rs 2,400 crore in the first quarter and have sold a part of it. It was mostly corporate accounts."

Siby Antony, chief executive officer and managing director at Edelweiss Asset Reconstruction Company, a leading private ARC, said, "Though a large number of loans were showcased, the sales were only about 10% and it was skewed only to one or two players. Banks are now allowed to write off losses over eight quarters and this leeway comes to an end by March 2016."

A senior PNB official said, "Bad loans will continue for a few quarters. Most infrastructure loans are still stressed. We are trying to sell bad loans wherever possible."

The central bank has now allowed commercial banks to spread losses on the sale of bad loans to ARCs up to March 2016.According to existing norms, if the sale of bad loans to ARCs are at a price below the net book value (which is the book value minus the provisions held), then the shortfall could be debited to the profit and loss (P&L) account over the two-year period, subject to necessary disclosures.

RBI's financial stability report released on June 25 says that NPAs increased to 4.5-4.6% in March from 4.5% in September last year. It adds that it will further rise to 4.8% in September this year and the decline to 4.7% by end of the current financial year (March 2016).

The RBI report showed that five sectors — mining, iron & steel, textiles, infrastructure and aviation — that together constituted 24.8% of the total advances of commercial banks, has a share of 51.1% in the total stressed advances.

![submenu-img]() Central government makes bold move, lifts ban on agricultural sector for…

Central government makes bold move, lifts ban on agricultural sector for…![submenu-img]() BCCI announces 15-member squad for Bangladesh T20Is, pace sensation Mayank Yadav earns maiden call-up

BCCI announces 15-member squad for Bangladesh T20Is, pace sensation Mayank Yadav earns maiden call-up![submenu-img]() Meet man, who started company after sending drunk text to boss, not from IIT, IIM, his worth is Rs...

Meet man, who started company after sending drunk text to boss, not from IIT, IIM, his worth is Rs...![submenu-img]() Sanjay Gandhi, Bhindranwale's conversation to Sikhs firing: CBFC wants these cuts from Kangana Ranaut's Emergency

Sanjay Gandhi, Bhindranwale's conversation to Sikhs firing: CBFC wants these cuts from Kangana Ranaut's Emergency ![submenu-img]() Watch: Karisma Kapoor recreates ‘Sona Kitna Sona’ song with Zaheer Iqbal, Sonakshi Sinha's reaction goes viral

Watch: Karisma Kapoor recreates ‘Sona Kitna Sona’ song with Zaheer Iqbal, Sonakshi Sinha's reaction goes viral![submenu-img]() Hssan Nasarullah की जगह लेगा यह शख्स, Hezbollah ने किया नए नेता के नाम का ऐलान

Hssan Nasarullah की जगह लेगा यह शख्स, Hezbollah ने किया नए नेता के नाम का ऐलान![submenu-img]() Delhi Road Rage: दिल्ली के नांगलोई में कॉन्सटेबल की कुचलकर हत्या, कई मीटर तक घसीटा

Delhi Road Rage: दिल्ली के नांगलोई में कॉन्सटेबल की कुचलकर हत्या, कई मीटर तक घसीटा![submenu-img]() IND vs BAN 2nd Test Day 3 Live Score: क्या तीसरे दिन भी बारिश बनेगी विलेन, यहां पढ़ें लाइव अपडेट्स

IND vs BAN 2nd Test Day 3 Live Score: क्या तीसरे दिन भी बारिश बनेगी विलेन, यहां पढ़ें लाइव अपडेट्स ![submenu-img]() Haryana Assembly Elections 2024: चुनाव से पहले हुआ फेर-बदल, AAP के फरीदाबाद उम्मीदवार ने थामा BJP का हाथ

Haryana Assembly Elections 2024: चुनाव से पहले हुआ फेर-बदल, AAP के फरीदाबाद उम्मीदवार ने थामा BJP का हाथ ![submenu-img]() MP News: मध्य प्रदेश के मैहर में बस-ट्रक की भीषण टक्कर में 9 की मौत, 24 घायल

MP News: मध्य प्रदेश के मैहर में बस-ट्रक की भीषण टक्कर में 9 की मौत, 24 घायल![submenu-img]() Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…

Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…![submenu-img]() Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...

Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...![submenu-img]() Tata launches Nexon iCNG, check price, mileage, other features

Tata launches Nexon iCNG, check price, mileage, other features![submenu-img]() This Indian car brand set to acquire 50% stake in Skoda Auto Volkswagen India, deal will cost Rs…

This Indian car brand set to acquire 50% stake in Skoda Auto Volkswagen India, deal will cost Rs…![submenu-img]() Ford to return to India after 2 years with reopening of....

Ford to return to India after 2 years with reopening of....![submenu-img]() Meet India's youngest woman to crack UPSC exam at age 21, secured AIR 13, but didn't become IAS due to...

Meet India's youngest woman to crack UPSC exam at age 21, secured AIR 13, but didn't become IAS due to...![submenu-img]() Meet India’s first female IAS officer, also second woman to crack UPSC exam, she was posted at...

Meet India’s first female IAS officer, also second woman to crack UPSC exam, she was posted at...![submenu-img]() Meet man, bangle seller who cracked UPSC exam despite being specially abled, becomes IAS officer with AIR...

Meet man, bangle seller who cracked UPSC exam despite being specially abled, becomes IAS officer with AIR...![submenu-img]() Meet man who passed AIIMS exam at 16, cracked UPSC exam at 22, later resigned as IAS officer to build...

Meet man who passed AIIMS exam at 16, cracked UPSC exam at 22, later resigned as IAS officer to build...![submenu-img]() Meet man who lost his legs, cracked JEE Advanced, completed B.Tech from IIT Madras, is now working at…

Meet man who lost his legs, cracked JEE Advanced, completed B.Tech from IIT Madras, is now working at…![submenu-img]() IIFA Awards 2024: Date, Time, Venue And Where To Watch - All You Need To Know

IIFA Awards 2024: Date, Time, Venue And Where To Watch - All You Need To Know![submenu-img]() Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical

Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical![submenu-img]() Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval

Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval![submenu-img]() Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?

Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?![submenu-img]() One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0

One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0![submenu-img]() Meet man, who started company after sending drunk text to boss, not from IIT, IIM, his worth is Rs...

Meet man, who started company after sending drunk text to boss, not from IIT, IIM, his worth is Rs...![submenu-img]() Meet woman, who started business with two sewing machines, now styles Nita Ambani, Alia Bhatt, Priyanka Chopra

Meet woman, who started business with two sewing machines, now styles Nita Ambani, Alia Bhatt, Priyanka Chopra![submenu-img]() Ratan Tata's iPhone manufacturing company plans to take big step, as they are about to hire....

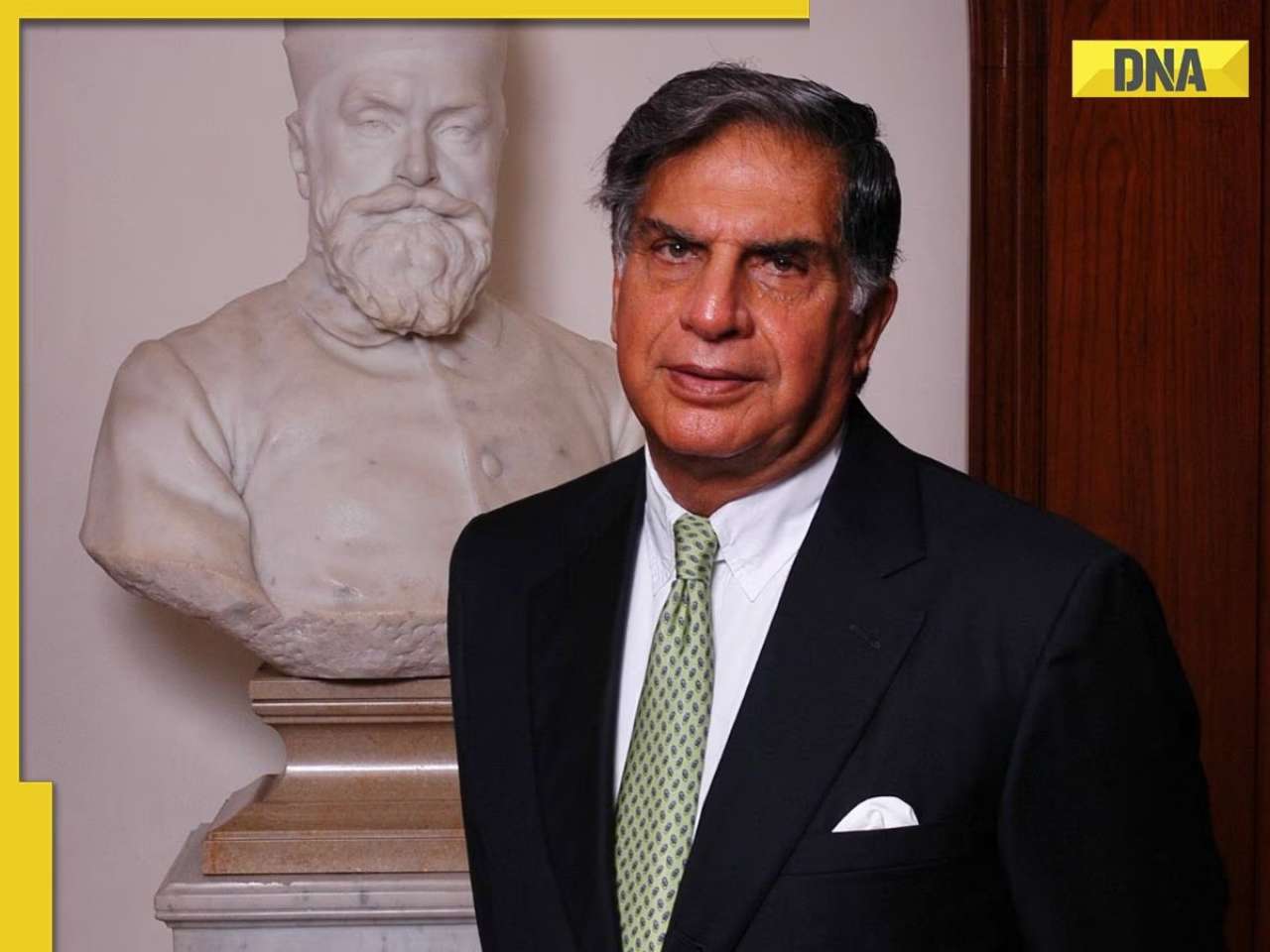

Ratan Tata's iPhone manufacturing company plans to take big step, as they are about to hire....![submenu-img]() Alia Bhatt reacts as Ranbir Kapoor makes a big move on his 42nd birthday, launches…

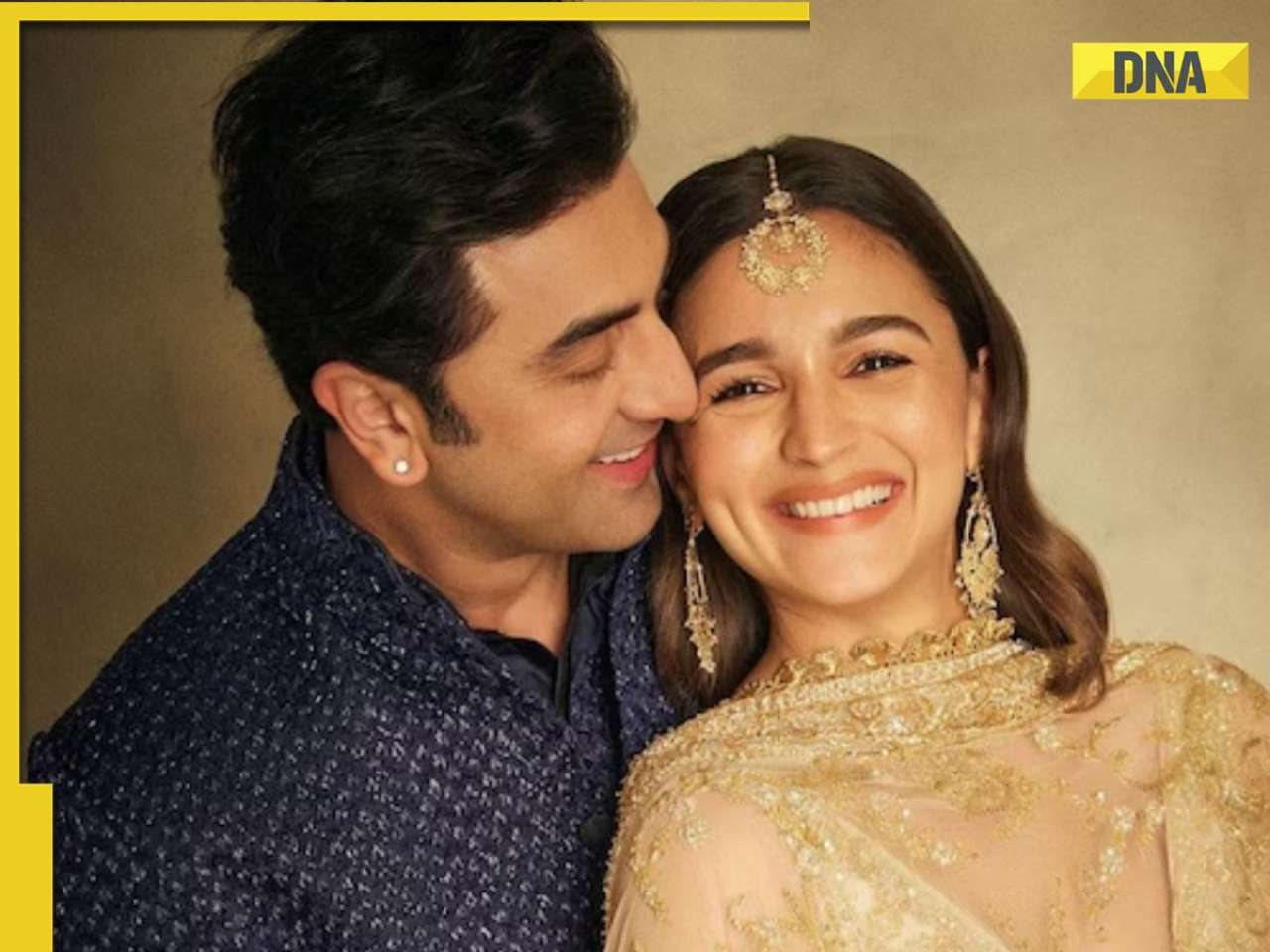

Alia Bhatt reacts as Ranbir Kapoor makes a big move on his 42nd birthday, launches…![submenu-img]() Anil Ambani-owned company's share price hits upper circuit, in 8 days it has surged...

Anil Ambani-owned company's share price hits upper circuit, in 8 days it has surged...![submenu-img]() Central government makes bold move, lifts ban on agricultural sector for…

Central government makes bold move, lifts ban on agricultural sector for…![submenu-img]() Odisha orders Internet shut down for 48 hours in Bhadrak district in order to prevent spread of...

Odisha orders Internet shut down for 48 hours in Bhadrak district in order to prevent spread of...![submenu-img]() Haryana: 3 dead, 9 injured in illegal firecracker factory blast in Sonipat, here's what we know so far

Haryana: 3 dead, 9 injured in illegal firecracker factory blast in Sonipat, here's what we know so far![submenu-img]() Mumbai on high alert after terrorist attack threat, security tightened across city

Mumbai on high alert after terrorist attack threat, security tightened across city![submenu-img]() Meet woman, IIT graduate, UPSC 2015 batch IFS officer, who schooled Pakistan PM at UNGA over…

Meet woman, IIT graduate, UPSC 2015 batch IFS officer, who schooled Pakistan PM at UNGA over…

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)