The promoters of Delhi International Airport (DIAL) have renewed their demand for a 10% increase in aeronautical charges.

The promoters of Delhi International Airport (DIAL) have renewed their demand for a 10% increase in aeronautical charges even as their appeal on airport development fee (ADF) is still under discussion within the ministry of civil aviation.

DIAL is being developed by a consortium led by the GMR Group. It has sought higher aeronautical charges citing the concession agreement which guides the development of the country’s second-busiest airport.

A senior GMR official told DNA Money that, as per the agreement, the developers are entitled to hike charges by 10% in the third year of operation, provided the specified capital works for the first two years have been completed. “We have fulfilled the condition under which charges can be hiked; airport development is very much on track so we have sought 10% increase from the government.”

Mumbai International Airport (MIAL) has already been allowed a similar hike from January 1.

Aeronautical charges generally include landing and parking fees for aircraft, besides ground handling levies. These are decided by the state-run Airports Authority of India (AAI). All these levies have remained constant for the last seven years and only now is a change being contemplated to keep within the concession agreements the government has signed with developers of airports such as Mumbai and Delhi.

Interestingly, DIAL’s plea for hiking aeronautical charges comes close on the heels of the ministry considering its other demand — of levying ADF on domestic and international passengers to partly bridge the Rs 2,750-crore funding gap which is holding up the development of the airport.

The push for ADF comes after it became clear that because of the curious revenue sharing arrangement between GMR and AAI (which holds 26% equity in the project), any user development fee (UDF) would have become meaningless since 46% of such collections would have gone to government coffers.

This also follows several flip-flops by the government over whether commercial development of a part of the airport land can be used for raising the much-needed cash. Another option - fresh equity infusion - was also considered but then rejected by the AAI. GMR had earlier sought a levy of Rs 1,000 on international passengers and Rs 200-300 on domestic passengers.

The ADF should go a long way in helping GMR since no part of the monies so raised need to be shared with the AAI — it would be deployed entirely into capex. But higher aeronautical charges would help in only a very limited way in helping bridge the huge

funding gap.

![submenu-img]() Anil Kapoor, Aditya Roy Kapur's The Night Manager becomes only entry from India to secure nomination at Emmy Awards 2024

Anil Kapoor, Aditya Roy Kapur's The Night Manager becomes only entry from India to secure nomination at Emmy Awards 2024![submenu-img]() Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...

Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...![submenu-img]() This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani

This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani![submenu-img]() Ranbir Kapoor's sister, Riddhima's 'maybe it's a house help' remark leaves netizens furious: 'Uneducated rich brats'

Ranbir Kapoor's sister, Riddhima's 'maybe it's a house help' remark leaves netizens furious: 'Uneducated rich brats'![submenu-img]() Mumbai man orders iPhone 16 online after standing in queue for hours, then..

Mumbai man orders iPhone 16 online after standing in queue for hours, then..![submenu-img]() 'क्यों खत्म की हड़ताल' जूनियर डॉक्टरों ने दी जानकारी, पूर्व प्रिंसिपल संदीप घोष का नार्को टेस्ट कराने कोर्ट पहुंची CBI

'क्यों खत्म की हड़ताल' जूनियर डॉक्टरों ने दी जानकारी, पूर्व प्रिंसिपल संदीप घोष का नार्को टेस्ट कराने कोर्ट पहुंची CBI![submenu-img]() अमेरिका दौरे पर निकले PM Modi, क्वाड की बैठक में लेंगे हिस्सा, राष्ट्रपति बाइडेन से होगी मुलाकात

अमेरिका दौरे पर निकले PM Modi, क्वाड की बैठक में लेंगे हिस्सा, राष्ट्रपति बाइडेन से होगी मुलाकात ![submenu-img]() Aaj Ka Mausam: Delhi-UP में लगेगा बारिश पर ब्रेक! बिहार में भारी बारिश का दौर जारी, जानें आज का वेदर अपडेट

Aaj Ka Mausam: Delhi-UP में लगेगा बारिश पर ब्रेक! बिहार में भारी बारिश का दौर जारी, जानें आज का वेदर अपडेट ![submenu-img]() J-K Assembly Elections 2024: राज्य नहीं अब है केंद्र शासित प्रदेश, क्या 370 की वापसी कर सकती है जम्मू-कश्मीर विधानसभा? जानें उसके अधिकार

J-K Assembly Elections 2024: राज्य नहीं अब है केंद्र शासित प्रदेश, क्या 370 की वापसी कर सकती है जम्मू-कश्मीर विधानसभा? जानें उसके अधिकार![submenu-img]() DNA Verified: Singham Again में चुलबुल पांडे दिखेंगे या नहीं, जानिए क्या है Salman Khan की इस खबर का सच

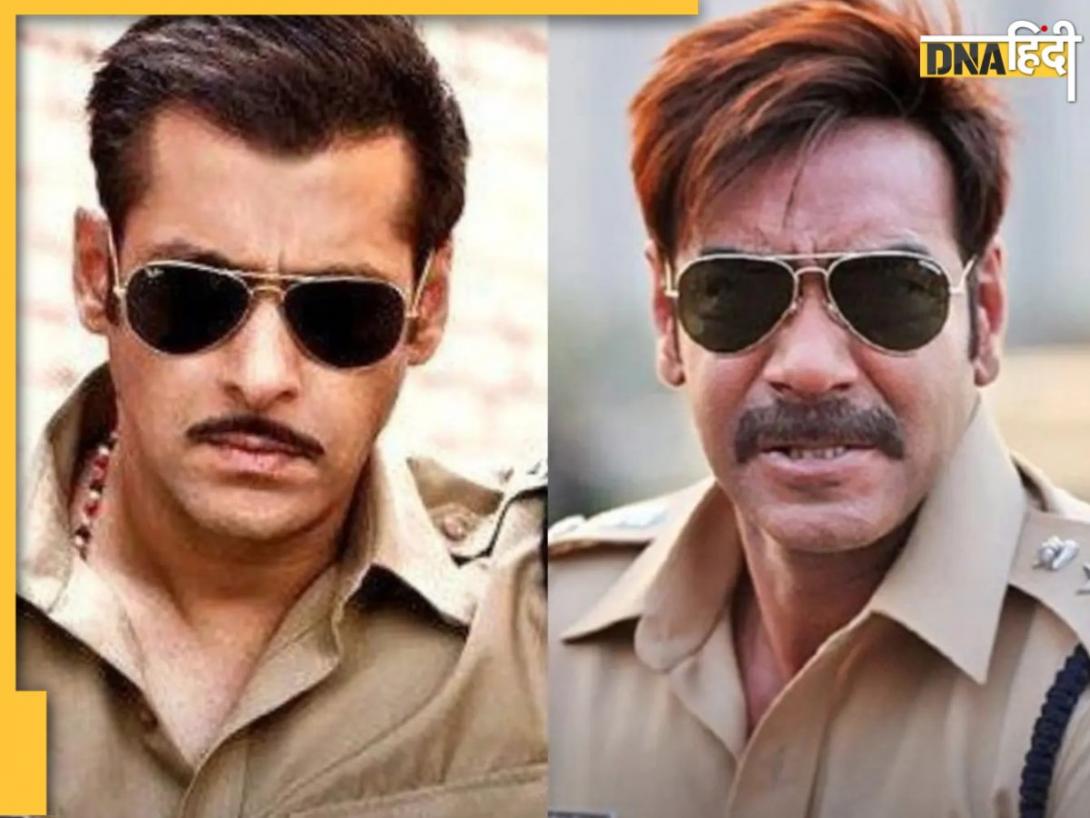

DNA Verified: Singham Again में चुलबुल पांडे दिखेंगे या नहीं, जानिए क्या है Salman Khan की इस खबर का सच![submenu-img]() Ford to return to India after 2 years with reopening of....

Ford to return to India after 2 years with reopening of....![submenu-img]() Maruti Suzuki launches new Swift CNG, check price, mileage, other features

Maruti Suzuki launches new Swift CNG, check price, mileage, other features![submenu-img]() ‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...

‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...![submenu-img]() In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…

In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…![submenu-img]() World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…

World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…![submenu-img]() Meet man who passed JEE Advanced with AIR 1, completed B.Tech from IIT Bombay, is now pursuing…

Meet man who passed JEE Advanced with AIR 1, completed B.Tech from IIT Bombay, is now pursuing…![submenu-img]() Meet man, whose father's death encouraged him to quit IAS job, create multi-crore company, he is...

Meet man, whose father's death encouraged him to quit IAS job, create multi-crore company, he is...![submenu-img]() Meet woman, who scored 97% in class 12, secured 705 out of 720 marks in NEET exam, her AIR is...

Meet woman, who scored 97% in class 12, secured 705 out of 720 marks in NEET exam, her AIR is...![submenu-img]() NEET UG Counselling 2024: Round 2 seat allotment result declared at mcc.nic.in, check direct link here

NEET UG Counselling 2024: Round 2 seat allotment result declared at mcc.nic.in, check direct link here![submenu-img]() Meet IPS officer who has resigned after serving for 18 yrs due to...

Meet IPS officer who has resigned after serving for 18 yrs due to...![submenu-img]() Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical

Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical![submenu-img]() Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval

Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval![submenu-img]() Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?

Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?![submenu-img]() One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0

One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0![submenu-img]() Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed

Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed![submenu-img]() This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani

This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani![submenu-img]() Meet man who started as intern at Nike, is now its CEO after 32 years, his salary is Rs...

Meet man who started as intern at Nike, is now its CEO after 32 years, his salary is Rs...![submenu-img]() Meet man who received gift worth Rs 15000000000 from Mukesh Ambani, is referred to as his 'right hand', he is...

Meet man who received gift worth Rs 15000000000 from Mukesh Ambani, is referred to as his 'right hand', he is...![submenu-img]() Elon Musk, Oracle CEO once begged this company to take their money, know what had happened

Elon Musk, Oracle CEO once begged this company to take their money, know what had happened![submenu-img]() 'Office was filled with…': Ashneer Grover on why he left EY in one day despite having package of Rs…

'Office was filled with…': Ashneer Grover on why he left EY in one day despite having package of Rs…![submenu-img]() Luxurious homes to swanky cars: Most expensive things owned by Virat Kohli

Luxurious homes to swanky cars: Most expensive things owned by Virat Kohli![submenu-img]() Akshay Kumar's biggest flop film was remake of a Malayalam blockbuster, still broke Guinness World Record set by...

Akshay Kumar's biggest flop film was remake of a Malayalam blockbuster, still broke Guinness World Record set by...![submenu-img]() Exploring Uttarakhand: 6 breathtaking destinations in scenic state

Exploring Uttarakhand: 6 breathtaking destinations in scenic state![submenu-img]() From Puga Valley to Hanle: Must-visit places in Ladakh

From Puga Valley to Hanle: Must-visit places in Ladakh![submenu-img]() Meet Himachal officer who has been transferred without posting, as popular as IAS Tina Dabi on social media, she is...

Meet Himachal officer who has been transferred without posting, as popular as IAS Tina Dabi on social media, she is...![submenu-img]() Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...

Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...![submenu-img]() Tirupati Laddoo Row: Jagan Reddy says he will write to PM Modi, CJI to take action against...

Tirupati Laddoo Row: Jagan Reddy says he will write to PM Modi, CJI to take action against...![submenu-img]() AAP demands government accommodation for outgoing Delhi CM Arvind Kejriwal, says he is...

AAP demands government accommodation for outgoing Delhi CM Arvind Kejriwal, says he is...![submenu-img]() 'Samples highly adulterated, we will...': Tirupati Temple Trust issues first statement on laddoo row

'Samples highly adulterated, we will...': Tirupati Temple Trust issues first statement on laddoo row![submenu-img]() NEET UG 2024: CBI files second-chargesheet against six accused in paper leak case

NEET UG 2024: CBI files second-chargesheet against six accused in paper leak case

)

)

)

)

)

)