The average fund dipped 0.71% in January with deeper losses at so-called global macro hedge funds pulling the overall index down.

Global hedge funds started 2010 with small losses after markets fell on fears that the global economic recovery was sputtering, data released on Friday show.

According to the data from industry tracking group Hedge Fund Research, the average fund dipped 0.71% in January with deeper losses at so-called global macro hedge funds pulling the overall index down.

Other research firms are expected to release their numbers early next week. Monthly performance numbers are closely watched in the loosely regulated $2 trillion hedge fund industry where managers are not required to report how much money they oversee or how much money they make or lose each month.

January's declines come on the heels of last year's strong gains -- when the industry's average 20% returns helped restore demand for hedge funds as dozens of managers rode the stock market's strong rally higher.

Last year's gains also helped wipe away concerns that the industry's high fees might not be justified after the average fund lost 19% during the financial crisis in 2008 to post its worst return ever.

Some of the industry's biggest stars suffered losses during January, according to investors who saw their returns.

Paul Tudor Jones' $7 billion Tudor BVI Global Fund was off roughly 1 percent during the first three weeks of January while Kenneth Tropin's $2.8 billion Graham Global Investment Fund II was off 6% through January 26.

John Paulson, whose credit funds had correctly bet on a drop in housing prices to earn billions in 2007, suffered a tough start to the year when his newly launched gold fund lost 14% as gold dropped and the US dollar rallied.

Overall, global macro funds, which take big bets on currencies, commodities and interest rates, fell 2.16% during the month, HFR reported.

But some funds in that space fared well through most of January. The $7 billion Moore Global Investments Fund gained 2.3% though January 21.

As expected, so-called short sellers, funds that bet exclusively that the market will fall, gained by returning 1.68% last month.

Fixed income strategies also performed with the Fixed-Income Convertible Index gaining 2.23% in the wake of last year's 31% gain.

![submenu-img]() Meet actress, Dilip Kumar, Amitabh's heroine who slapped Sanjeev Kumar, filed case against her mom, is related to...

Meet actress, Dilip Kumar, Amitabh's heroine who slapped Sanjeev Kumar, filed case against her mom, is related to...![submenu-img]() IND vs BAN, 1st T20I Dream11 prediction: Fantasy cricket tips for India vs Bangladesh

IND vs BAN, 1st T20I Dream11 prediction: Fantasy cricket tips for India vs Bangladesh![submenu-img]() Zomato CEO Deepinder Goyal reveals he was ‘kicked out’ of Shark Tank India season 4 by…

Zomato CEO Deepinder Goyal reveals he was ‘kicked out’ of Shark Tank India season 4 by…![submenu-img]() Harsh Goenka shares three lessons for success he learnt from Mukesh Ambani, says, 'I have always...'

Harsh Goenka shares three lessons for success he learnt from Mukesh Ambani, says, 'I have always...'![submenu-img]() Nagarjuna Akkineni in trouble? Complaint filed against Telugu star over Hyderabad's Convention centre

Nagarjuna Akkineni in trouble? Complaint filed against Telugu star over Hyderabad's Convention centre![submenu-img]() India Maldives Relation: मालदीव के राष्ट्रपति मुइज्जू का भारत दौरा, क्या दूर होगी रिश्तों में कड़वाहट?

India Maldives Relation: मालदीव के राष्ट्रपति मुइज्जू का भारत दौरा, क्या दूर होगी रिश्तों में कड़वाहट?![submenu-img]() Israel Air Strike: इजरायल ने गाजा पर फिर बरपाया कहर, मस्जिद पर हमले में 18 की मौत

Israel Air Strike: इजरायल ने गाजा पर फिर बरपाया कहर, मस्जिद पर हमले में 18 की मौत![submenu-img]() जम्मू-कश्मीर: चुनावी नतीजों से पहले घाटी में बड़े हमले की साजिश, भारी मात्रा में हथियार और विस्फोटक बरामद

जम्मू-कश्मीर: चुनावी नतीजों से पहले घाटी में बड़े हमले की साजिश, भारी मात्रा में हथियार और विस्फोटक बरामद![submenu-img]() RSS प्रमुख Mohan Bhagwat की हुंकार, 'भारत एक हिंदू राष्ट्र है, हमें एकजुट होना होगा'

RSS प्रमुख Mohan Bhagwat की हुंकार, 'भारत एक हिंदू राष्ट्र है, हमें एकजुट होना होगा'![submenu-img]() UP: 'दर्द बहुत था तो 100 ग्राम पी ली', नशे में धुत पकड़े गए हेड मास्टर BDO से ये क्या �बोल गए, देखें Vedio

UP: 'दर्द बहुत था तो 100 ग्राम पी ली', नशे में धुत पकड़े गए हेड मास्टर BDO से ये क्या �बोल गए, देखें Vedio![submenu-img]() This company overtakes Ratan Tata's firm to become India’s…; it is owned by…

This company overtakes Ratan Tata's firm to become India’s…; it is owned by…![submenu-img]() Mahindra Thar ROXX booking to start from..., check waiting period, details

Mahindra Thar ROXX booking to start from..., check waiting period, details![submenu-img]() BMW launches CE 02 electric scooter in India; price starts at Rs…

BMW launches CE 02 electric scooter in India; price starts at Rs…![submenu-img]() Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…

Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…![submenu-img]() Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...

Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...![submenu-img]() Meet woman, who failed in four UPSC prelims, missed interview, got panic attack, then finally became...

Meet woman, who failed in four UPSC prelims, missed interview, got panic attack, then finally became...![submenu-img]() Meet IIT graduate, who didn't settle for IPS posting, cracked UPSC exam twice to become...

Meet IIT graduate, who didn't settle for IPS posting, cracked UPSC exam twice to become...![submenu-img]() Meet IIT-JEE topper with 355 marks in JEE Advanced, whose father works at Mukesh Ambani's Reliance Jio, aims to join..

Meet IIT-JEE topper with 355 marks in JEE Advanced, whose father works at Mukesh Ambani's Reliance Jio, aims to join..![submenu-img]() Meet woman who begged in childhood, became doctor after 20 years of struggle, now she is...

Meet woman who begged in childhood, became doctor after 20 years of struggle, now she is...![submenu-img]() Meet man, who left govt job as Assistant Excise Officer, used to get Rs 50000000, now works as...

Meet man, who left govt job as Assistant Excise Officer, used to get Rs 50000000, now works as...![submenu-img]() After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon

After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon![submenu-img]() Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War

Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War![submenu-img]() Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain

Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain![submenu-img]() Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts

Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts![submenu-img]() Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir

Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir![submenu-img]() BIG boost for Mukesh Ambani's Jio Financial Services, to challenge ICICI, SBI bank as his company gets SEBI nod for...

BIG boost for Mukesh Ambani's Jio Financial Services, to challenge ICICI, SBI bank as his company gets SEBI nod for...![submenu-img]() Anil Ambani-led company's total debt stands at Rs 40413 crore but...

Anil Ambani-led company's total debt stands at Rs 40413 crore but...![submenu-img]() These siblings overtake Gautam Adani in billionaires list, combined net worth more than Elon Musk, they are…

These siblings overtake Gautam Adani in billionaires list, combined net worth more than Elon Musk, they are…![submenu-img]() Meet wife of famous Indian cricketer, who cracked CS exam, now earns crores by selling cakes, her net worth is...

Meet wife of famous Indian cricketer, who cracked CS exam, now earns crores by selling cakes, her net worth is...![submenu-img]() Success story in every spray: How Toxic Male Perfume captured India's heart and market

Success story in every spray: How Toxic Male Perfume captured India's heart and market![submenu-img]() 10 Aabha Paul photos and videos that rule Instagram

10 Aabha Paul photos and videos that rule Instagram![submenu-img]() India’s most expensive cars and their owners

India’s most expensive cars and their owners![submenu-img]() Who is IIT professor Chetan Solanki aka 'Solar Gandhi'who went viral for his torn socks?

Who is IIT professor Chetan Solanki aka 'Solar Gandhi'who went viral for his torn socks?![submenu-img]() Bigg Boss 18: Step into cave-hotel themed BB house with 107 cameras, luxurious bathroom, scary jail, spacious bedroom

Bigg Boss 18: Step into cave-hotel themed BB house with 107 cameras, luxurious bathroom, scary jail, spacious bedroom![submenu-img]() All about Anupama Parameswaran, who played simpleton in debut film, became famous for bold scenes, dated..

All about Anupama Parameswaran, who played simpleton in debut film, became famous for bold scenes, dated..![submenu-img]() J-K Elections 2024: Exit polls give edge to Congress-NC alliance, BJP likely to win…

J-K Elections 2024: Exit polls give edge to Congress-NC alliance, BJP likely to win…![submenu-img]() Haryana Exit Poll Results 2024: Pollsters predict major win for Congress, setback for BJP

Haryana Exit Poll Results 2024: Pollsters predict major win for Congress, setback for BJP![submenu-img]() Former cricketer and actor Salil Ankola's mother found dead, police say injury...

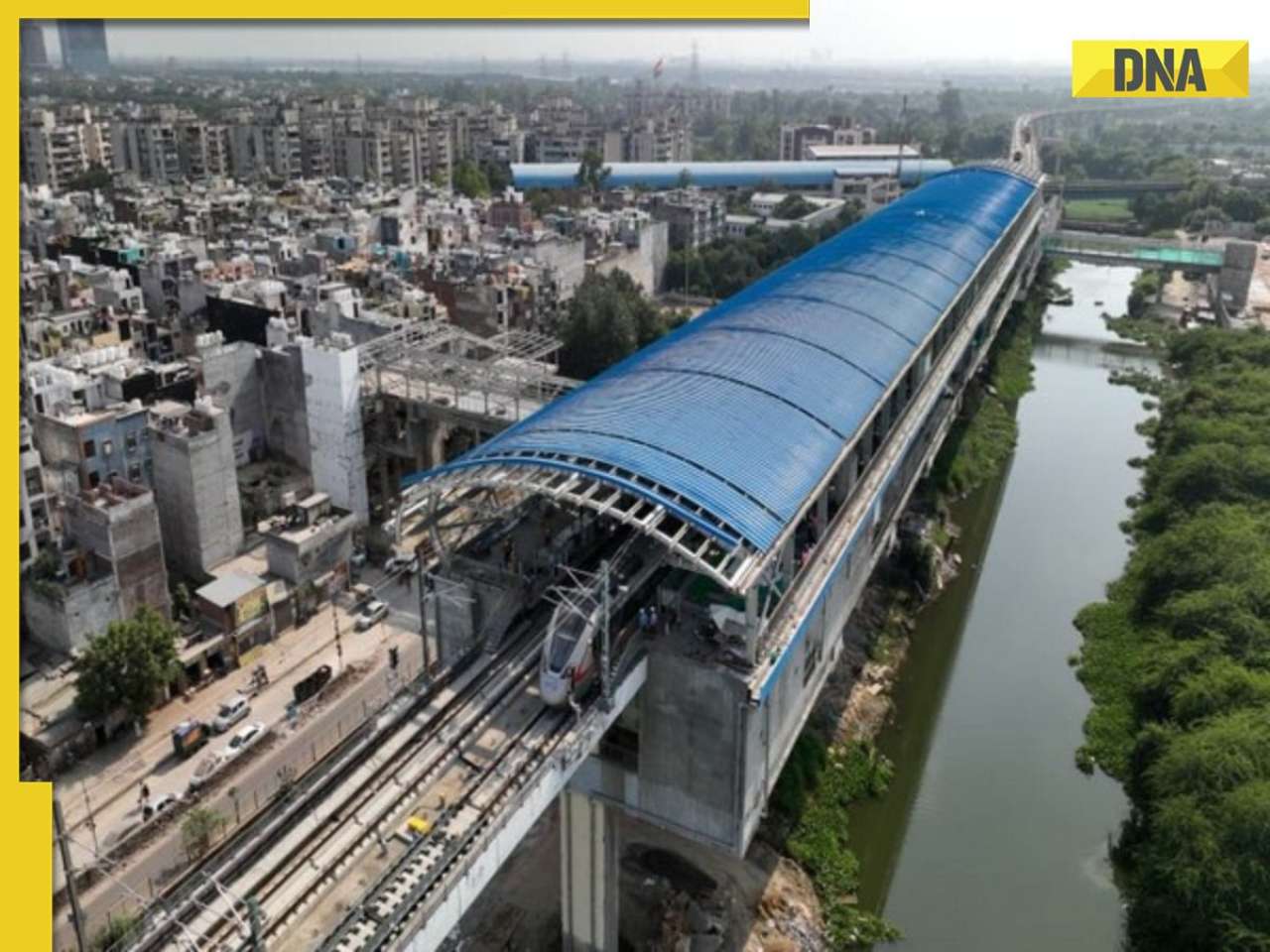

Former cricketer and actor Salil Ankola's mother found dead, police say injury...![submenu-img]() NCRTC kicks off trial runs of Namo Bharat trains on Sahibabad-New Ashok Nagar route: Check speed, timings and distance

NCRTC kicks off trial runs of Namo Bharat trains on Sahibabad-New Ashok Nagar route: Check speed, timings and distance![submenu-img]() 'Gave up arms, adopted Gandhian way of...': Separatist Yasin Malik in court

'Gave up arms, adopted Gandhian way of...': Separatist Yasin Malik in court

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)