- LATEST

- WEBSTORY

- TRENDING

BUSINESS

Meet man, who left high-paying job at Flipkart, built Paytm's biggest rival, now runs Rs 99400 crore company, he is…

Some of the leading FinTechs offering digital payments include Paytm, PhonePe, Cred, Razorpay, BharatPe, and Google Pay.

TRENDING NOW

In terms of digital payments, India is leading the world. India leads the world in digital payments globally, with a commanding 46 percent share of the market. The rise of fintech firms in India has fundamentally altered consumer behaviour. Leading FinTech companies that provide digital payments include Google Pay, Paytm, PhonePe, Cred, Razorpay, and BharatPe. We will discuss the remarkable story of Phone Pay, one of the top FinTech companies in India with a valuation of Rs. 99,000 crore, today.

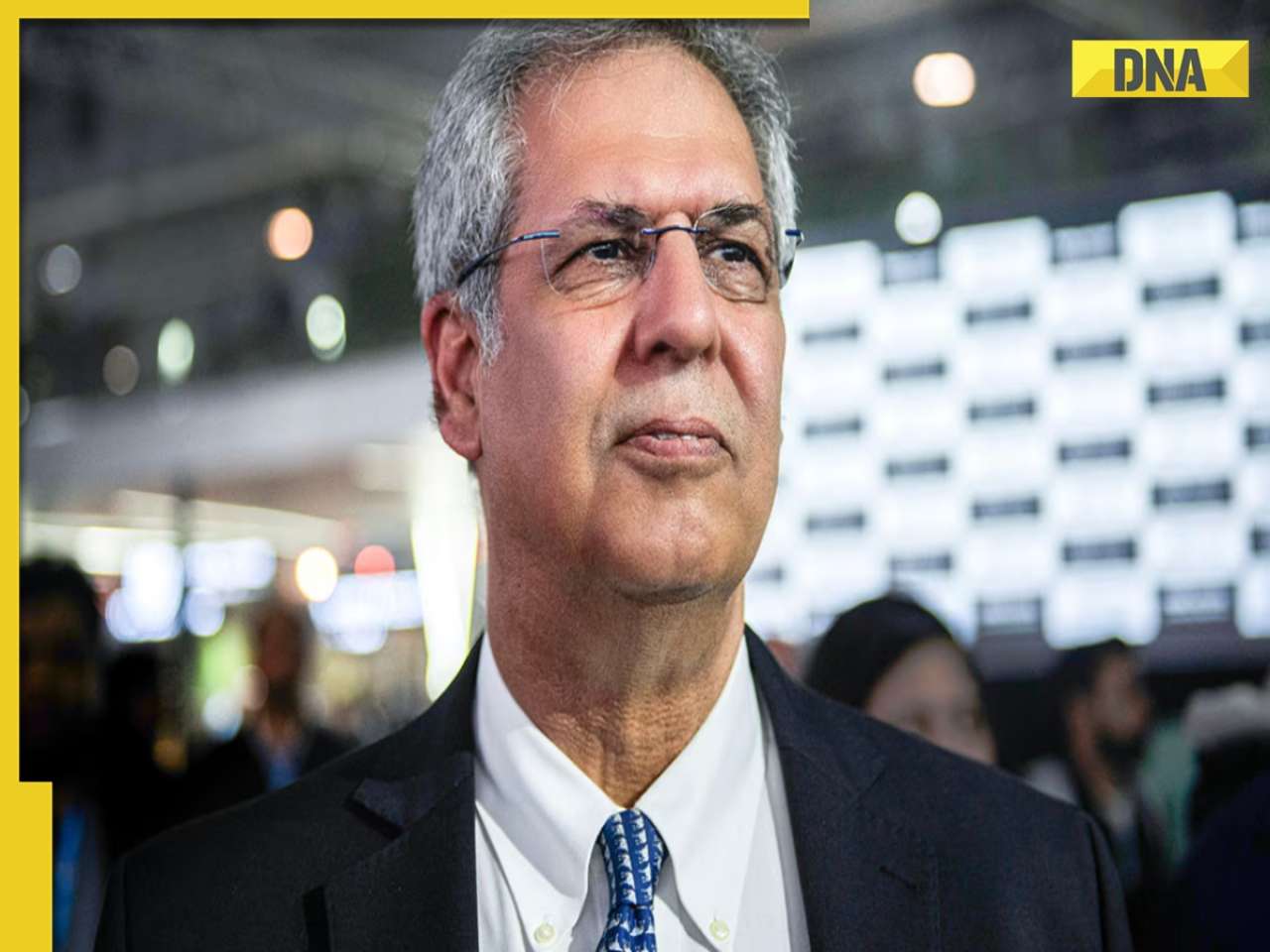

One of the leading businesses in the digital finance sector is Phone Pe. In 2015, Sameer Nigam, Rahul Chari, and Burjin Engineer co-founded PhonePe, which has grown to be a reputable and well-liked provider of financial solutions for millions of users. Before he had the idea to launch PhonePe, all three of them had worked at Flipkart. Sameer Nigam is the CEO of the fintech business. Sameer Nigam graduated with an MBA from the prestigious Wharton Business School and a master's degree in computer technology from the University of Arizona.

An important turning point in PhonePe's history was the latter's acquisition of the former for less than $20 million, which ushered in the company's collaboration with PhonePe. In 2018, Walmart acquired a majority stake in Flipkart, giving the retail giant indirect control over PhonePe. But in 2022, Flipkart and PhonePe made the decision to separate, enabling PhonePe to function on its own.

PhonePe provides a digital wallet and UPI payment services, among other financial services, to both consumers and companies. Users can easily send and receive money, pay bills, and make purchases of products and services using this platform. Furthermore, PhonePe offers cross-border UPI payment services. In 2023, it also introduced Pincode, an app for hyperlocal shopping and commerce that allows users to directly access goods and services in various locations.

PhonePe offers merchant loan services, advertising solutions, PhonePe Switch, offline payment goods, and payment gateway services to businesses. As of November 2023, PhonePe had over 500 million users and 37 million merchants in India. It held over 40% of the UPI market and over 45% of the Bharat Bill Pay System (BBPS). It is estimated that the corporation is worth $12 billion, or more than Rs 99,400 crore.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)