- LATEST

- WEBSTORY

- TRENDING

BUSINESS

Punjab National Bank reports 58% decline in profit to Rs 306 cr in Q1

PNB posted a record loss of Rs 5,367 crore in the earlier quarter.

TRENDING NOW

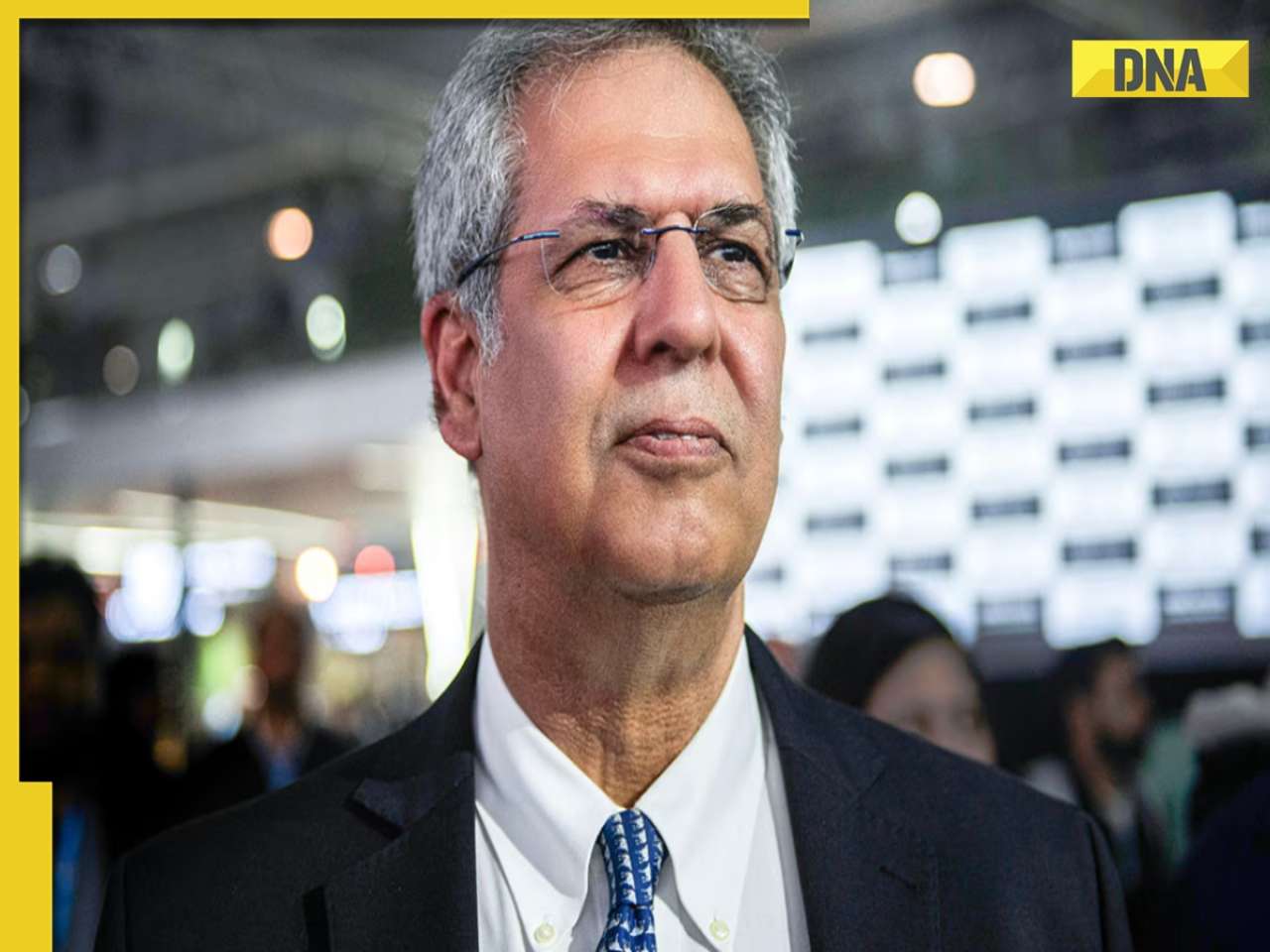

Having posted a record loss of Rs 5,367 crore in the earlier quarter, PNB reported a 58% decline in net profit to Rs 306 crore on Thursday for April-June period of the current fiscal on account of rising bad loans. The bank had a net profit of Rs 721 crore during the corresponding period of the previous fiscal.

During the quarter, provision towards non-performing assets (NPAs) have jumped almost three-fold to Rs 3,620 crore from Rs 1,291 crore in the same period a year ago. The Gross NPAs rose significantly to 13.75% at the end of June 2016, from 12.9% in the year-ago period. The net NPAs too rose to 9.16% against 8.61% in June 2015. In absolute terms, the gross NPAs of the bank more than doubled to Rs 56,654.09 crore from the year-ago levels.

"NPA is Rs 300 crore over the March level...no body can say that we are done with NPA but we think that more or less tapering has happened," Punjab National Bank (PNB) Managing Director Usha Ananthasubramanian said. With the expected credit growth of 10-11% in the current fiscal and robust recovery mechanism in place, the bank expect the gross NPA to come down below 10% in the current fiscal, she added.

Loan growth of 10-11% can happen as wage revision will give traction for retail credit, she said. During the quarter, the bank has made cash recovery and upgradation of Rs 6006 crore as against Rs 2328 crore in the same quarter of the previous fiscal. The total income rose to Rs 13,930 crore as against Rs 13,432 crore in the same quarter a year ago.

However, interest income declined to Rs 11,575 crore against Rs 12,035 crore in the first quarter of the previous fiscal. The bank expects the profitability to increase through cost control, conserving capital and increased focus on recovery of stress assets, she said.

PNB has called Extra Ordinary General Meeting (EGM) on August 31 for issuance and allotment of such number of equity shares of face value of Rs 2 each to government on preferential basis to the tune of Rs 2,112 crore. With the first tranche of infusion of capital the government stake in the bank may rise to 64.18%.

The government has made allocation of Rs 2816 crore of capital in two tranches. Of this, Rs 2,112 crore would be coming as part of first tranche. On selling non-core assets, the managing director said, the family silver would be sold at adequate price as the bank does not need capital immediately. Capital adequacy of the bank at the end of June 2016, as per Basel-III norms, was 11.58%.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)