In September, Anil Ambani Group stocks saw a significant resurgence, with Reliance Infrastructure and Reliance Power rallying 60% each.

Anil Ambani Group stocks experienced a notable resurgence in September, with Reliance Power and Infrastructure rising 60% each. Two companies from the Anil Dhirubhai Ambani Group (ADAG), Reliance Power and Reliance Infrastructure, have seen a surprising surge in the last one month.

With a 69.79% gain over the previous month, Reliance Power's shares have been on the rise. Over the last few days, investors have seen a 23.26% return. The stock saw a significant increase today, reaching Rs 51.09 a share, from Rs 41.45 on September 25. Investor expectations for large future earnings have increased as a result of this steady rise.

Reliance Infrastructure's share price has also been rising, currently trading between one and one and a half percent higher. This increase continues the bullish trend of Reliance Power. The company's shares increased during the trading session on October 1st, just before the Reliance Infrastructure board meeting.

Reliance Infrastructure's share price has also been rising, currently trading between one and one and a half percent higher. This increase continues the bullish trend of Reliance Power. The company's shares increased during the trading session on October 1st, just before the Reliance Infrastructure board meeting.

Reliance Infrastructure's share price has also been rising, currently trading between one and one and a half percent higher. This increase continues the bullish trend of Reliance Power. The company's shares increased during the trading session on October 1st, just before the Reliance Infrastructure board meeting.

On October 1st, Reliance Infrastructure said that its board has approved a proposal to fund Rs 2,930 crore by issuing VFSI Holdings Pte Limited unsecured foreign currency convertible bonds (FCCBs).

According to a regulatory filing made by the company, the FCCBs will have a 10-year maturity period, an ultra-low cost coupon of 5% annually, and be unsecured.

“The Board of Directors of Reliance Infrastructure Limited (Reliance Infrastructure) at its meeting held today has approved raising of funds up to USD 350 million (Rs 2,930 crore) to VFSI Holdings Pte Limited, an affiliate of Varde Investment Partners, LP, a leading global alternative investment firm,” it added.

The Employees Stock Option Scheme was also introduced by the corporation. According to the statement, "ESOS will provide a grant of up to 2.60 crore equity shares of value of over Rs 850 crore - representing 5% of fully diluted capital." It further stated that ESOS will enable employee earning potential in line with the performance and expansion of the business.

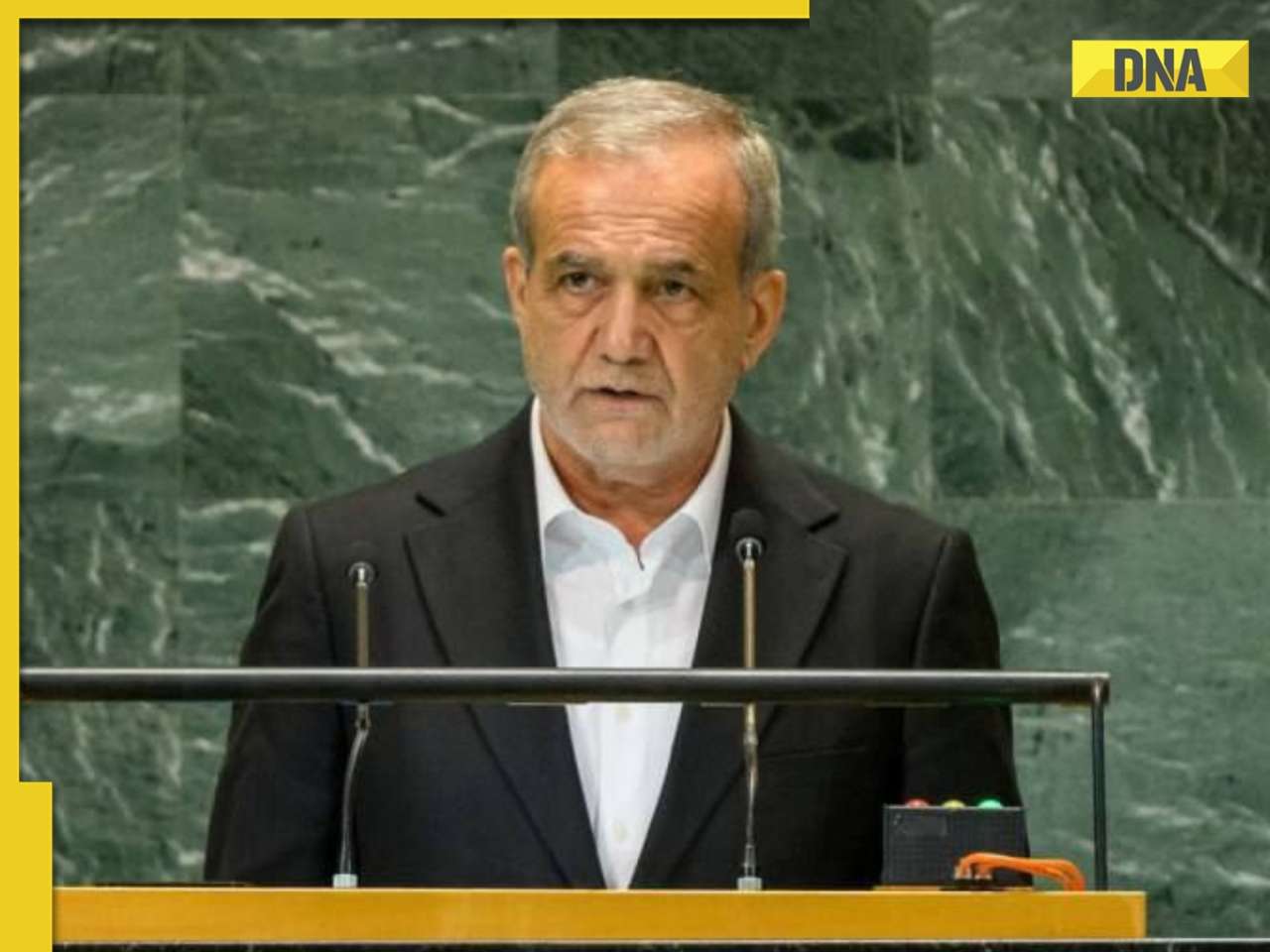

![submenu-img]() Iran launches dozens of ballistics missile at Israel, shelter-in-place order issued

Iran launches dozens of ballistics missile at Israel, shelter-in-place order issued![submenu-img]() Diplomatic Discord: Lebanon's Crisis and Iran's Strategic Posturing

Diplomatic Discord: Lebanon's Crisis and Iran's Strategic Posturing![submenu-img]() Watch: Shark Tank India season 4 starts filming with OG judges and new hosts, netizens ask premiere date

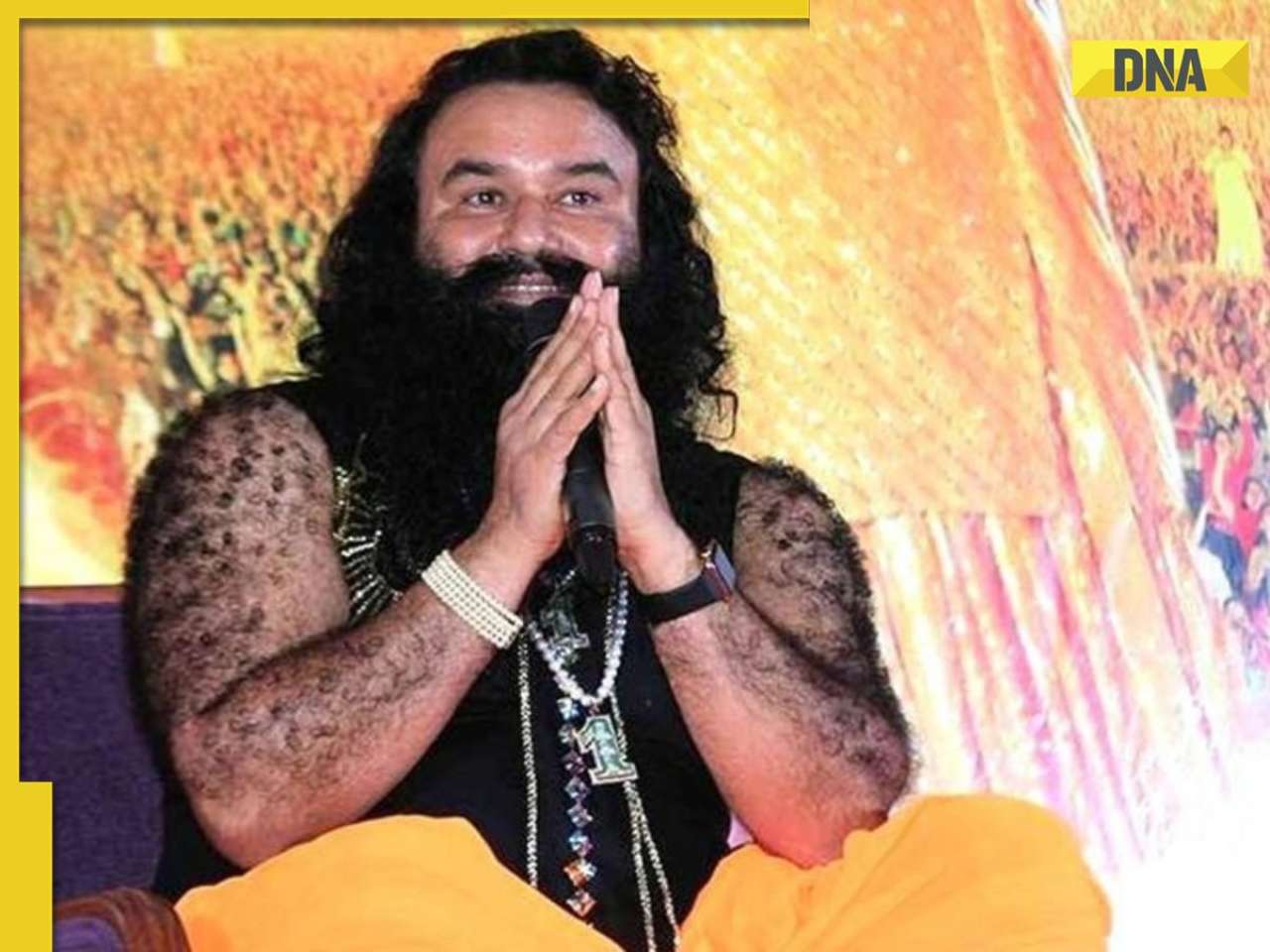

Watch: Shark Tank India season 4 starts filming with OG judges and new hosts, netizens ask premiere date![submenu-img]() Dera chief, rape convict Gurmeet Ram Rahim gets parole ahead of Haryana elections

Dera chief, rape convict Gurmeet Ram Rahim gets parole ahead of Haryana elections![submenu-img]() Top Nephrologists of the country: Redefining excellence in Renal Care

Top Nephrologists of the country: Redefining excellence in Renal Care![submenu-img]() Iran Israel War: भारत पहुंची मिडिल ईस्ट जंग की आहट! दिल्ली में इजरायली दूतावास की बढ़ाई गई सुरक्षा

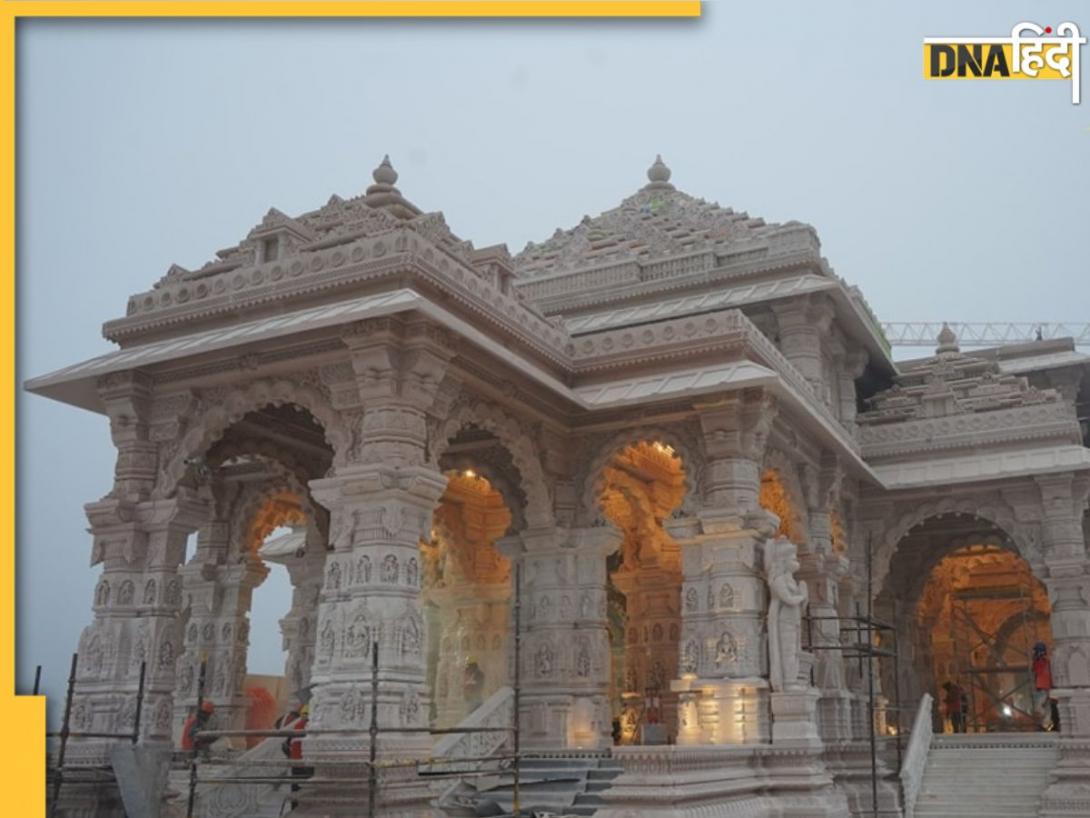

Iran Israel War: भारत पहुंची मिडिल ईस्ट जंग की आहट! दिल्ली में इजरायली दूतावास की बढ़ाई गई सुरक्षा![submenu-img]() Ayodhya Ram Mandir में रामलला के दर्शन का समय बदला, आरती भी नए समय पर होगी, यहां जानें नया टाइम टेबल

Ayodhya Ram Mandir में रामलला के दर्शन का समय बदला, आरती भी नए समय पर होगी, यहां जानें नया टाइम टेबल![submenu-img]() UP: Kanpur में फिर मिला रेलवे ट्रैक पर Cylinder, GRP और RPF की जांच जारी

UP: Kanpur में फिर मिला रेलवे ट्रैक पर Cylinder, GRP और RPF की जांच जारी![submenu-img]() दिल्ली में 2000 करोड़ रुपए से ज्यादा का ड्रग्स बरामद, 4 गिरफ्तार, जानें पूरा मामला

दिल्ली में 2000 करोड़ रुपए से ज्यादा का ड्रग्स बरामद, 4 गिरफ्तार, जानें पूरा मामला![submenu-img]() Helicopter crash in Bihar floods : राहत सामग्री लेकर जा रहा था हेलीकॉप्टर, बाढ़ के पानी में गिरा

Helicopter crash in Bihar floods : राहत सामग्री लेकर जा रहा था हेलीकॉप्टर, बाढ़ के पानी में गिरा![submenu-img]() BMW launches CE 02 electric scooter in India; price starts at Rs…

BMW launches CE 02 electric scooter in India; price starts at Rs…![submenu-img]() Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…

Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…![submenu-img]() Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...

Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...![submenu-img]() Tata launches Nexon iCNG, check price, mileage, other features

Tata launches Nexon iCNG, check price, mileage, other features![submenu-img]() This Indian car brand set to acquire 50% stake in Skoda Auto Volkswagen India, deal will cost Rs…

This Indian car brand set to acquire 50% stake in Skoda Auto Volkswagen India, deal will cost Rs…![submenu-img]() Meet woman, who is social media star, is married to IAS, cracked UPSC exam in first attempt, secured AIR...

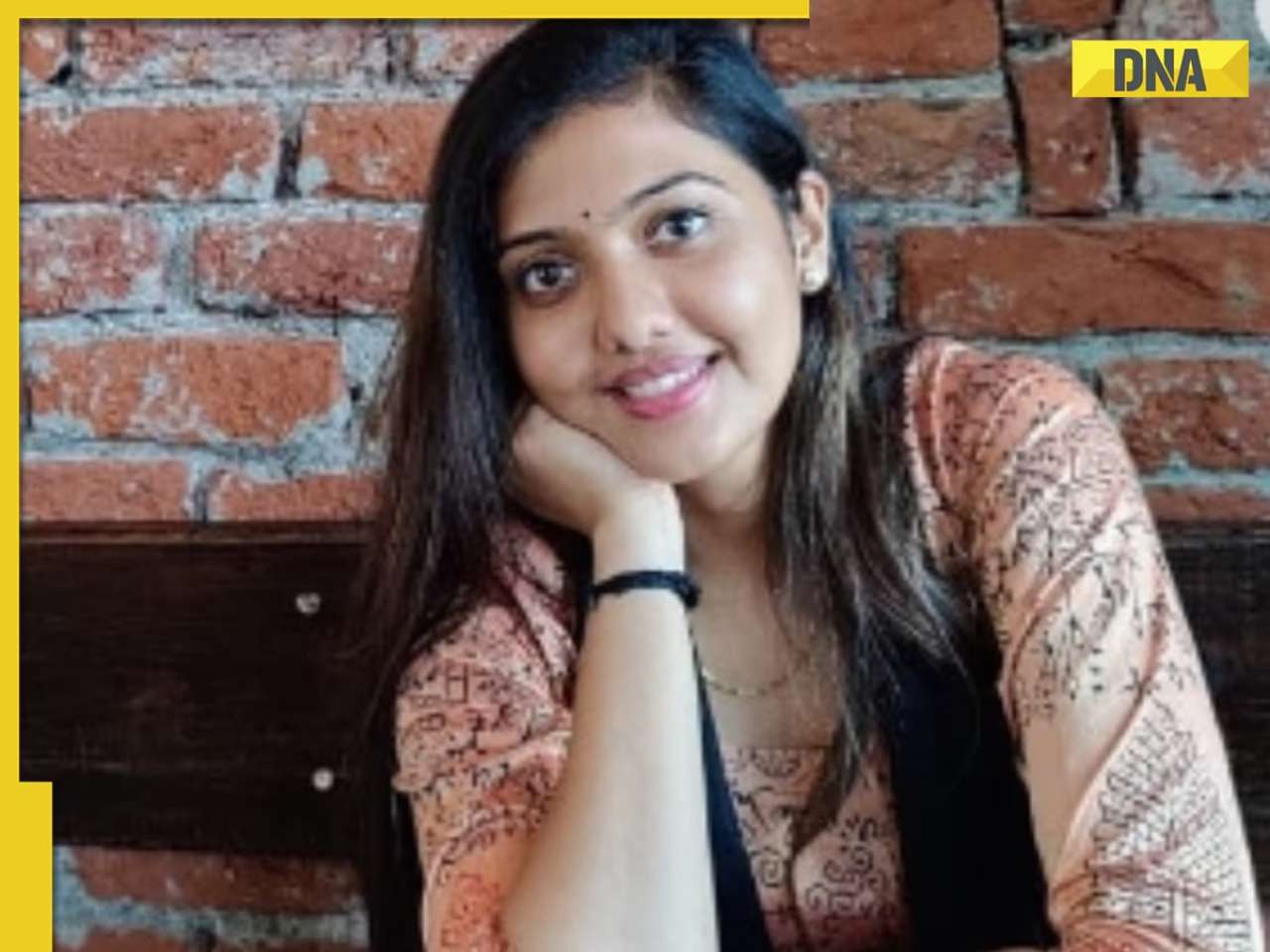

Meet woman, who is social media star, is married to IAS, cracked UPSC exam in first attempt, secured AIR...![submenu-img]() Meet Indian genius who cracked IIT-JEE with AIR 1, joined IIT Bombay, left after 2 years without graduation, he is now…

Meet Indian genius who cracked IIT-JEE with AIR 1, joined IIT Bombay, left after 2 years without graduation, he is now…![submenu-img]() Meet boy who started his company at 13, got inspiration from Mumbai's Dabbawalas, his business is...

Meet boy who started his company at 13, got inspiration from Mumbai's Dabbawalas, his business is...![submenu-img]() CAT 2024 application correction window closes today; check how to make changes, direct link here

CAT 2024 application correction window closes today; check how to make changes, direct link here![submenu-img]() Meet woman who left high-paying job at US govt agency for UPSC exam, became IAS officer with AIR...

Meet woman who left high-paying job at US govt agency for UPSC exam, became IAS officer with AIR...![submenu-img]() After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon

After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon![submenu-img]() Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War

Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War![submenu-img]() Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain

Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain![submenu-img]() Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts

Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts![submenu-img]() Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir

Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir![submenu-img]() Best Nutrition Software in India: Prim Transformed Dt. Renu Puri’s Business

Best Nutrition Software in India: Prim Transformed Dt. Renu Puri’s Business![submenu-img]() Sebi tightens F&O rules to curb speculative trading, to be effective from THIS date

Sebi tightens F&O rules to curb speculative trading, to be effective from THIS date![submenu-img]() Mukesh Ambani's Reliance faces market turbulence as it loses Rs 80000 crore in just 48 hours

Mukesh Ambani's Reliance faces market turbulence as it loses Rs 80000 crore in just 48 hours![submenu-img]() BMW launches CE 02 electric scooter in India; price starts at Rs…

BMW launches CE 02 electric scooter in India; price starts at Rs…![submenu-img]() Anil Ambani ready to SHAKE UP market after board's approval to raise Rs 2,930 crore

Anil Ambani ready to SHAKE UP market after board's approval to raise Rs 2,930 crore![submenu-img]() Dera chief, rape convict Gurmeet Ram Rahim gets parole ahead of Haryana elections

Dera chief, rape convict Gurmeet Ram Rahim gets parole ahead of Haryana elections![submenu-img]() Manoj Gupta: Visionary Leader in IT Distribution

Manoj Gupta: Visionary Leader in IT Distribution![submenu-img]() Sadhguru’s Isha foundation raided by 150 police officers after father alleges daughters being held hostage

Sadhguru’s Isha foundation raided by 150 police officers after father alleges daughters being held hostage![submenu-img]() Tirupati laddu row: SIT probe into 'adulteration' temporarily stalled until SC hearing

Tirupati laddu row: SIT probe into 'adulteration' temporarily stalled until SC hearing![submenu-img]() Expert Insights from Rohit Reddy Chananagari Prabhakar on Advanced Data Management in Medical Education

Expert Insights from Rohit Reddy Chananagari Prabhakar on Advanced Data Management in Medical Education

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)