The FM asked private sector and foreign banks to redress grievances vigorously and said financial inclusion and consumer trust are interlinked.

Worried over a large number of customer complaints, Finance Minister Pranab Mukherjee today asked private sector and foreign banks to redress the grievances "vigorously" and said financial inclusion and consumer trust are interlinked.

"It is heartening to note that, as per the latest Annual Report of the Banking Ombudsman Scheme, the total number of customer complaints received by the Ombudsman in 2010-11 are 11% less than those received in the previous year," Mukherjee said.

"However, the private sector and foreign banks which account for only 12% of the loan and deposits, contribute for 35% of the total complaints. This requires vigorous efforts to redress complaints," he said at a function here to mark the opening of 100 branches of Kerala-based Federal Bank simultaneously all over the country.

During 2010-11, 71,274 complaints were received under Banking Ombudsman Scheme against 79,266 in the previous fiscal.

As per the report, 6,895 complaints were against ICICI Bank and 5,590 against HDFC Bank. There were 2,144 complaints against Standard Chartered Bank, 1,865 against HSBC, 629 against Barclays Bank and 967 against Citibank N.A.

Mukherjee further said, effective and efficient banking system is the backbone of a growing economy.

"As we move ahead on the path of development, a major challenge is to strike a balance between the twin objectives of increasing banking access and improving the quality of customer service and customer protection," he said.

Financial inclusion and consumer trust and protection are interlinked, he added.

"As you all know, the public sector banks have been directed to provide banking access to habitations having population in excess of 2000 persons by March 2012 using various models and technologies including branchless banking through Business Correspondents (BCs)," Mukherjee said.

Banks have covered 63,000 villages by the end of January of the targetted 74000 villages.

"In the next few years, we propose to cover all habitations having population of over 1,000 persons," he said.

Highlighting the need for extending cost effective banking to the poor people of this country, the Finance Minister said they have the potential to spur growth and enhance bank savings.

"Promotion of Financial Inclusion is the key priority of the Government and is critical to our objective of inclusive growth. Through this financial inclusion strategy, we are exploring new delivery channels and models to extend the outreach and penetration of financial services by using technology to give an identity to the poor," he said.

Banks need to develop products to meet the broader spectrum of requirements of the common man like consumption, production, risk mitigation etc., he said.

"Availability of appropriate banking technology now enables much higher penetration of the banking system, increasing its cost effectiveness and making small value transactions viable. Certainly growth and development are spurred by this effective use of technology," he added.

On the issue of subsidy transfer, Mukherjee said the government is in the process of implementing e-payment system for the direct credit of dues from the central government to the beneficiaries of various subsidies.

![submenu-img]() Anil Kapoor, Aditya Roy Kapur's The Night Manager becomes only entry from India to secure nomination at Emmy Awards 2024

Anil Kapoor, Aditya Roy Kapur's The Night Manager becomes only entry from India to secure nomination at Emmy Awards 2024![submenu-img]() Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...

Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...![submenu-img]() This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani

This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani![submenu-img]() Ranbir Kapoor's sister, Riddhima's 'maybe it's a house help' remark leaves netizens furious: 'Uneducated rich brats'

Ranbir Kapoor's sister, Riddhima's 'maybe it's a house help' remark leaves netizens furious: 'Uneducated rich brats'![submenu-img]() Mumbai man orders iPhone 16 online after standing in queue for hours, then..

Mumbai man orders iPhone 16 online after standing in queue for hours, then..![submenu-img]() 'क्यों खत्म की हड़ताल' जूनियर डॉक्टरों ने दी जानकारी, पूर्व प्रिंसिपल संदीप घोष का नार्को टेस्ट कराने कोर्ट पहुंची CBI

'क्यों खत्म की हड़ताल' जूनियर डॉक्टरों ने दी जानकारी, पूर्व प्रिंसिपल संदीप घोष का नार्को टेस्ट कराने कोर्ट पहुंची CBI![submenu-img]() अमेरिका दौरे पर निकले PM Modi, क्वाड की बैठक में लेंगे हिस्सा, राष्ट्रपति बाइडेन से होगी मुलाकात

अमेरिका दौरे पर निकले PM Modi, क्वाड की बैठक में लेंगे हिस्सा, राष्ट्रपति बाइडेन से होगी मुलाकात ![submenu-img]() Aaj Ka Mausam: Delhi-UP में लगेगा बारिश पर ब्रेक! बिहार में भारी बारिश का दौर जारी, जानें आज का वेदर अपडेट

Aaj Ka Mausam: Delhi-UP में लगेगा बारिश पर ब्रेक! बिहार में भारी बारिश का दौर जारी, जानें आज का वेदर अपडेट ![submenu-img]() J-K Assembly Elections 2024: राज्य नहीं अब है केंद्र शासित प्रदेश, क्या 370 की वापसी कर सकती है जम्मू-कश्मीर विधानसभा? जानें उसके अधिकार

J-K Assembly Elections 2024: राज्य नहीं अब है केंद्र शासित प्रदेश, क्या 370 की वापसी कर सकती है जम्मू-कश्मीर विधानसभा? जानें उसके अधिकार![submenu-img]() DNA Verified: Singham Again में चुलबुल पांडे दिखेंगे या नहीं, जानिए क्या है Salman Khan की इस खबर का सच

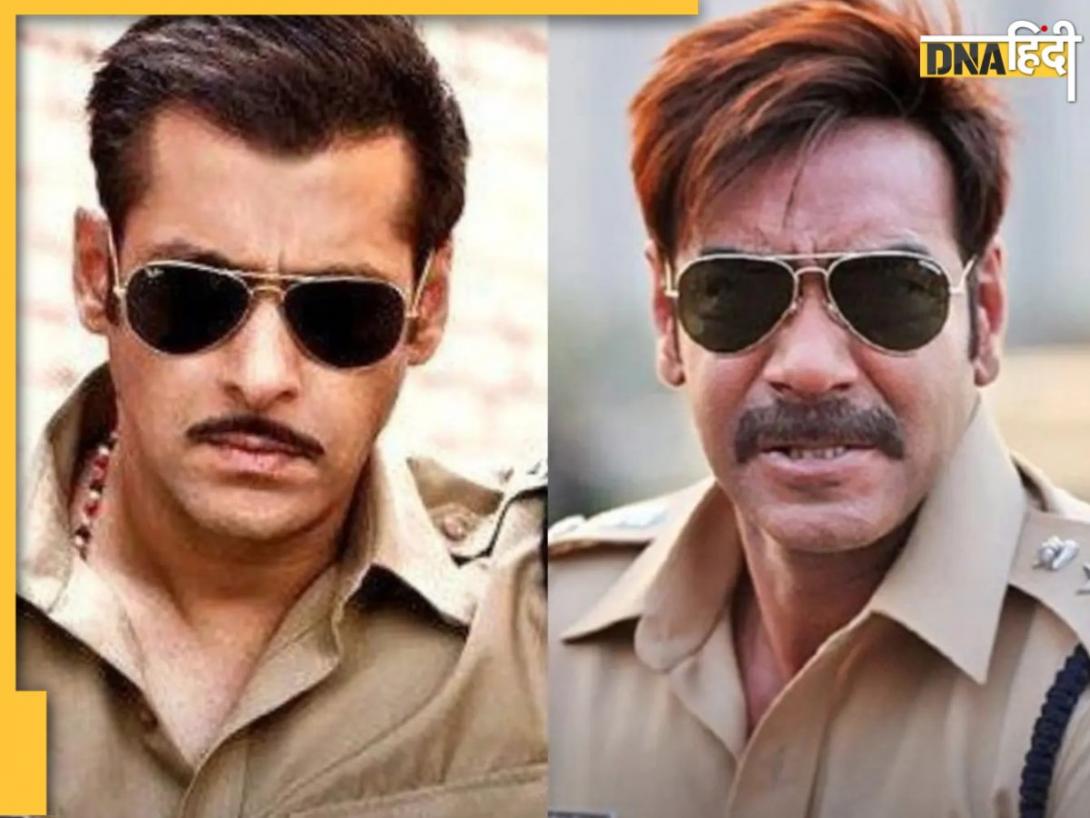

DNA Verified: Singham Again में चुलबुल पांडे दिखेंगे या नहीं, जानिए क्या है Salman Khan की इस खबर का सच![submenu-img]() Ford to return to India after 2 years with reopening of....

Ford to return to India after 2 years with reopening of....![submenu-img]() Maruti Suzuki launches new Swift CNG, check price, mileage, other features

Maruti Suzuki launches new Swift CNG, check price, mileage, other features![submenu-img]() ‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...

‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...![submenu-img]() In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…

In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…![submenu-img]() World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…

World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…![submenu-img]() Meet man who passed JEE Advanced with AIR 1, completed B.Tech from IIT Bombay, is now pursuing…

Meet man who passed JEE Advanced with AIR 1, completed B.Tech from IIT Bombay, is now pursuing…![submenu-img]() Meet man, whose father's death encouraged him to quit IAS job, create multi-crore company, he is...

Meet man, whose father's death encouraged him to quit IAS job, create multi-crore company, he is...![submenu-img]() Meet woman, who scored 97% in class 12, secured 705 out of 720 marks in NEET exam, her AIR is...

Meet woman, who scored 97% in class 12, secured 705 out of 720 marks in NEET exam, her AIR is...![submenu-img]() NEET UG Counselling 2024: Round 2 seat allotment result declared at mcc.nic.in, check direct link here

NEET UG Counselling 2024: Round 2 seat allotment result declared at mcc.nic.in, check direct link here![submenu-img]() Meet IPS officer who has resigned after serving for 18 yrs due to...

Meet IPS officer who has resigned after serving for 18 yrs due to...![submenu-img]() Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical

Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical![submenu-img]() Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval

Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval![submenu-img]() Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?

Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?![submenu-img]() One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0

One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0![submenu-img]() Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed

Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed![submenu-img]() This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani

This billionaire, once world’s richest man, witnesses drop in wealth due to...; not Mukesh Ambani, Adani![submenu-img]() Meet man who started as intern at Nike, is now its CEO after 32 years, his salary is Rs...

Meet man who started as intern at Nike, is now its CEO after 32 years, his salary is Rs...![submenu-img]() Meet man who received gift worth Rs 15000000000 from Mukesh Ambani, is referred to as his 'right hand', he is...

Meet man who received gift worth Rs 15000000000 from Mukesh Ambani, is referred to as his 'right hand', he is...![submenu-img]() Elon Musk, Oracle CEO once begged this company to take their money, know what had happened

Elon Musk, Oracle CEO once begged this company to take their money, know what had happened![submenu-img]() 'Office was filled with…': Ashneer Grover on why he left EY in one day despite having package of Rs…

'Office was filled with…': Ashneer Grover on why he left EY in one day despite having package of Rs…![submenu-img]() Luxurious homes to swanky cars: Most expensive things owned by Virat Kohli

Luxurious homes to swanky cars: Most expensive things owned by Virat Kohli![submenu-img]() Akshay Kumar's biggest flop film was remake of a Malayalam blockbuster, still broke Guinness World Record set by...

Akshay Kumar's biggest flop film was remake of a Malayalam blockbuster, still broke Guinness World Record set by...![submenu-img]() Exploring Uttarakhand: 6 breathtaking destinations in scenic state

Exploring Uttarakhand: 6 breathtaking destinations in scenic state![submenu-img]() From Puga Valley to Hanle: Must-visit places in Ladakh

From Puga Valley to Hanle: Must-visit places in Ladakh![submenu-img]() Meet Himachal officer who has been transferred without posting, as popular as IAS Tina Dabi on social media, she is...

Meet Himachal officer who has been transferred without posting, as popular as IAS Tina Dabi on social media, she is...![submenu-img]() Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...

Land-for-jobs case: President Murmu authorises prosecution of Lalu Prasad Yadav, CBI submits...![submenu-img]() Tirupati Laddoo Row: Jagan Reddy says he will write to PM Modi, CJI to take action against...

Tirupati Laddoo Row: Jagan Reddy says he will write to PM Modi, CJI to take action against...![submenu-img]() AAP demands government accommodation for outgoing Delhi CM Arvind Kejriwal, says he is...

AAP demands government accommodation for outgoing Delhi CM Arvind Kejriwal, says he is...![submenu-img]() 'Samples highly adulterated, we will...': Tirupati Temple Trust issues first statement on laddoo row

'Samples highly adulterated, we will...': Tirupati Temple Trust issues first statement on laddoo row![submenu-img]() NEET UG 2024: CBI files second-chargesheet against six accused in paper leak case

NEET UG 2024: CBI files second-chargesheet against six accused in paper leak case

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)