- LATEST

- WEBSTORY

- TRENDING

PERSONAL FINANCE

Repay your loans, don’t prepay them

Several types of loans charge a penalty if it is prepaid. Ensure that you have accounted for these costs when you decide to repay the loan ahead of the payment schedule

TRENDING NOW

Whenever we take a loan, two things play on our minds; whether to repay or wait for our future income to repay it. Especially, with the increase in bank rates, we want to repay our loans as soon as we can and rid of all the debt and worry that we have taken on. Everywhere we go, we are reminded of the loan we’ve taken, the EMI we have to pay and how in this market it might prove to be more prudent to pay off the loan sooner than scheduled.

Instead of taking an impulsive step towards clearing up the debt, let’s understand what are the common errors that people make when they decide to repay any home or personal loans ahead of the set schedule and avoid them. The common mistakes are as follows:

Ignoring overall financial requirements when looking at loan payments

To illustrate this point, let’s see an example. Sahni had taken a home loan of Rs 1 crore for 20 years at an interest rate of 9% p.a. The EMI payments came up to Rs 89,973 every month. At the end of 20 years, this would result in a total repayment of Rs2.16 crore.

The schedule fit his income and he was confident about repaying his loan on time. Sahni received an unexpected inheritance and thought that he would pay off his home loan sooner by using this windfall. To stay clear of the increasing rates he preferred to use the entire amount of the inheritance to pay off the home loan immediately. His financial advisors explained to him that instead of paying off his loan, he should rather invest the Rs 1 crore into mutual funds, whilst continuing making the EMI payments. Surprised, he asked them to explain why they were advising him to do something that seemed counter-intuitive to him.

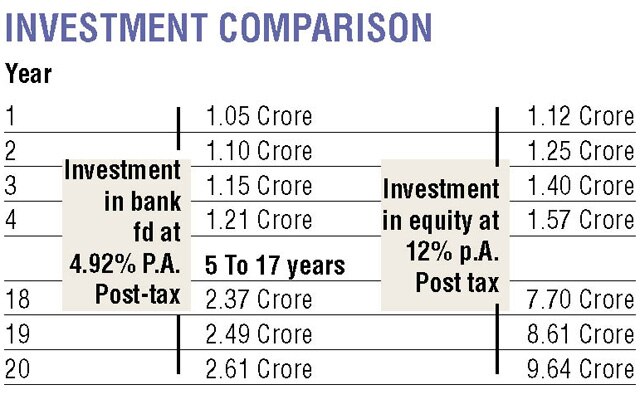

But, if he invested the Rs1 crore into bank fixed deposits and mutual funds for 20 years, this is what his earnings would look like:

As the above table illustrates, if Sahni invests his inheritance in a bank FD instead of hurrying to repay his home loan, he will earn Rs 2.61 crore at the end of 20 years. This is slightly higher than the amount that he requires to recover the home loan EMI payments. If he invests the inheritance in mutual funds, then not only will he recover all his EMI payments but will have also created substantial wealth for himself in 20 years.

The smart thing to do in this case would be to allow your wealth to grow as you continue to make your EMI payments as per the schedule. If you have secured a loan at a low-interest rate then it is senseless to pay off the loan, especially if there any upcoming liquidity requirements.

Ignoring the deduction available on interest payments of home loans

Not many people are aware that they are eligible for an annual deduction of Rs 2 lakh under Section 24(B) of the Income Tax Act, 1961, from the taxable income for the interest paid on the home loan. This in itself is a significant reason to manage your loan amount so that you have an annual interest cost of Rs 2 lakh, thus taking maximum advantage of the available deduction. The rule of thumb is: the higher the interest rate, the lower the loan amount.

Ignoring costs incurred when prepaying a loan

Several types of loans charge a penalty if it is prepaid. Ensure that you have accounted for these costs when you decide to repay the loan ahead of the payment schedule.

When considering loan prepayment look at the bigger picture whilst understanding your liquidity requirements. The prepayment decision based on just absolute numbers might prove to be rushed. Make a habit to regularly review your amortisation schedule to calculate the exact interest plus principal owed over the duration of the loan amount. Keep these pointers in mind and make an educated decision that’s right for your present and your future.

The writer is CFA, founder of Happyness Factory

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)