- LATEST

- WEBSTORY

- TRENDING

PERSONAL FINANCE

Avoid these mistakes while buying life cover

Never buy insurance under obligation as inadvertently you will end up discounting that value

TRENDING NOW

Buying life insurance policy has become imperative for people today. Almost everyone around us is opting to buy life insurance plan to ensure their family is safeguarded against any unforeseen financial problem, when they no longer would be around to cater to their loved ones’ needs.

However, when you choose to buy a life cover, you want to pay for the policy which would be the most beneficial for your family. Here are some tips to pick the appropriate life insurance policy.

Inform your family and near ones that you have bought a policy (keep the policy document in a prominent place and tell them of the same): Traditional ego and pure ignorance prevents a typical Indian from sharing financial information with the family. This pattern is uniform be it cash investments or real estate or something as important as a life insurance policy purchased. What then happens is in case of an unfortunate occurrence, the family has to go through a hassle of sorting out the paperwork/s and in some cases these investments go undetected.

Life insurance being one of the most important investments for financial security should be handled with utmost care. The very purpose of taking a life insurance policy is to safeguard the family financially. Hence, the first thing that one should do is to inform the family (spouse, children and close family) about the purchase.

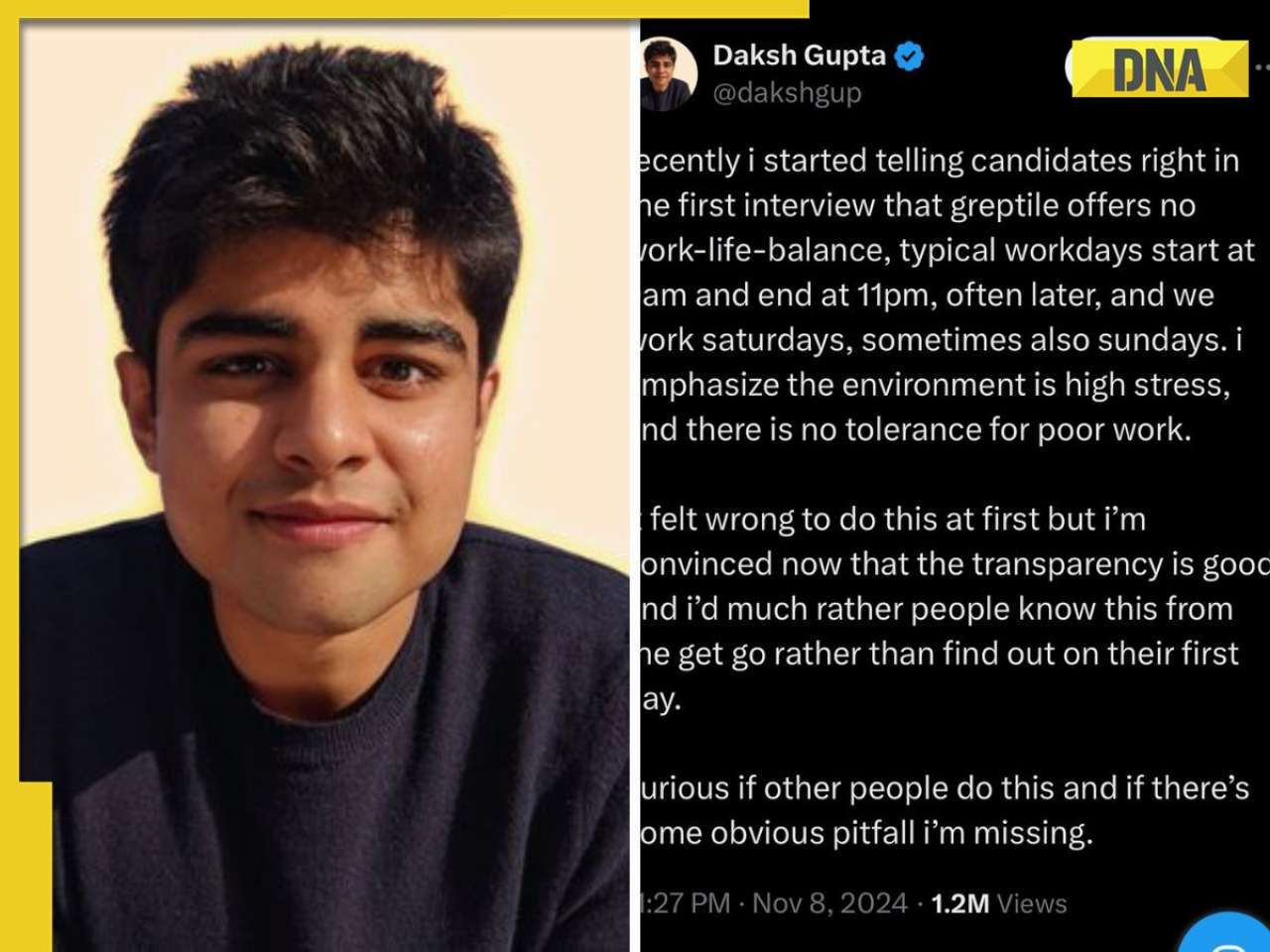

Never opt for lower insurance and hence lower sum assured: What is the value of human life? Taking Life Insurance policy is not obligatory, but a duty. Never buy insurance under obligation as inadvertently you will end up discounting that value. In simple terms Human Life Value can be defined as the life time earning potential of an individual. Hence it is very critical that you calculate your human value & then make a calculated decision on the insurance amount when you purchase a Life Insurance policy.

Do not buy without researching enough (over internet, physical): 'Caveat Emptor' or "Buyer Beware" is something that applies to all purchase decisions including Life Insurance. Simply put, you should be aware of what you are buying. If you need life insurance (which everyone does) one should know the type of policy, level of insurance, duration etc. While researching, please keep following points in mind: human life value - your value; purpose of insurance (protection of standard of living, education/marriage of children, retirement or managing wealth); product type - pure term plan, traditional plan, unit linked plan, group credit protection plans, etc.; affordability - how much premium is affordable/ monthly or annual premiums, etc.; claim ratio and experience; ease of policy servicing; performance of funds - CAGR for Ulip and annual bonuses for traditional plans.

Identify your need first and then buy a solution: Buying Life Insurance is one of the most important decisions of life and should involve your entire family in this decision making. It is the most important tool for financial security and hence it is imperative that they are a part of the decision making process. However, even before that, you should first identify the specific "need".

Generally, life insurance needs are classified into four categories - protection of standard of living for the family; providing for child's education / marriage; planning for your own retirement; plan for smooth hand over of your legacy to the next generation.

For each of the need, there is a specific solution which the range of Life Insurance products offers. It is hence critical that you first identify the need and then look for the most appropriate solution.

Do not lapse your policy ever. This is your primary security: 'Lapse', 'discontinuance', ‘surrender' are not the right words and are best avoided if you have a life insurance policy. This happens when you stop paying your premiums or decide to exit the policy even before the policy duration. Let us understand one thing. 'Life Insurance is not a right but a privilege. It is a privilege because of one's good health (insurable health), one's net worth (insurable interest) and one's trustworthiness (utmost good faith) gets you a policy from an insurer. Simply by discontinuing or lapsing it, you are losing the "privilege". By lapsing, you are depriving your family of their basic right of living. After lapsing, you may not be in good health to take a new policy or your policy might be declined on health grounds. All these are avoidable scenarios and will ultimately lead to your family being deprived of these benefits, after your life.

LIFE ESSENTIALS

- Never buy insurance under obligation as inadvertently you will end up discounting that value

- Always inform the family (spouse, children and close family) about the purchase of life cover

- By lapsing, you are depriving your family of their basic right of living and sabotaging future opportunities

The writer is chief operating officer, Canara HSBC Oriental Bank of Commerce Life Insurance

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)