- LATEST

- WEBSTORY

- TRENDING

PERSONAL FINANCE

Companies line up NCDs. Should you invest?

Check interest rate, credit quality and background of issuing company

TRENDING NOW

Retail investors looking to diversify their debt portfolio and willing to take some additional risk in return for higher interest rate can consider investing some money in non-convertible debentures or NCDs.

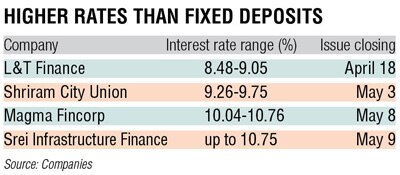

Currently, four non-banking finance companies (NBFCs) are looking to raise funds through NCDs. Let us see how these issues compare with bank FDs or debt mutual funds.

Current offerings

These are by L&T Finance (closing on April 18), Shriram City Union Finance (closing on May 3), Magma Fincorp (closing on May 9) and Srei Infrastructure Finance (closing on May 9).

The interest rates offered by these NBFCs across various maturities, interest payout options and categories of investors are as follows:

L&T Finance – 8.48% to 9.05%, Shriram City Union - 9.26% to 9.75%, Magma Fincorp – 10.04% to 10.76% and Srei up to 10.75%.

L&T Finance – 8.48% to 9.05%, Shriram City Union - 9.26% to 9.75%, Magma Fincorp – 10.04% to 10.76% and Srei up to 10.75%.

All the NCDs are secured. Icra and CARE have rated L&T Finance's instrument as AAA. Magma Fincorp is rated AA by Brickworks and SMERA. Shriram City Union is rated AA+ by CARE and AA by Crisil and Srei NCD has a rating of AA+ by Brickworks.

Why NBFCs are raising funds

They are going through a liquidity crunch post the IL&FS crisis as a large portion of their borrowings which were financed by mutual funds are not getting refinanced. This is the primary reason why these NBFCs are raising money from retail investors, says Raghavendra Nath, MD, Ladderup Wealth Management.

Magma Fincorp will use the funds to diversify its long-term liability profile and for business expansion, says Kailash Baheti, group chief financial officer.

Shriram City Union is raising funds for its various financing, lending, investments and repaying its existing liabilities or loans towards business operations, capital expenditure and working capital requirements, says R Chandrasekar, executive director and chief financial officer.

Should you invest?

NCDs are a good option for retail investors subject to the issuing company's ability to honour its commitment. It provides steady returns and ensures low risk as opposed to higher volatility in the equity markets. "Also, when compared to risk-free debt instruments that offer maximum of 7% annual returns, NCDs offer a premium of approximately 2-3%. The allocation to NCDs as part of an individual's debt portfolio varies as per the risk profile and financial goals," says Tarun Birani, founder CEO of TBNG Capital Advisors.

In the current lot, considering that most of the NBFCs have good quality asset books, retail investors can participate in a limited manner after giving consideration to the credit rating of these NBFCs, says Nath.

Retail investors must look at the credit rating of the NCD, whether it is a secured or unsecured one and the interest rate offered.

"If any instrument is offering higher rate of interest as compared to government securities or FDs, then it could carry higher risk as well. So check what is the alpha in terms of interest rate over FDs before investing,'' says Amit Jain, co-founder Ashika Wealth Advisors. NCDs with AAA or AA+ ratings are good for retail investors, but not below that. If the NCD offers 1-1.5% higher rate than bank FDs, then one can take a calculated risk and invest in them. But if the difference is less than 1%, it is not the worth the risk, he adds.

Factors to watch out for

"Antecedents of the issuer, the industry the issuer belongs to, issuer's credit rating and past track-record are some important points to analyse while considering investing in NCDs,'' says Chandrasekar.

NCDs generally offer better yields than FDs. Another advantage is that they are listed and traded on the stock exchanges. Though retail NCD trading is currently at a nascent stage, the market has been developing, says Baheti.

However, liquidity can be an issue, points out Jain. "If the market corrects within one year, then I can liquidate my FD investment and move it into equity. But in NCD, my money will be stuck for the long run. Even if I trade on the exchange, it will be a panic sale and I will not get my price because it is an illiquid market,'' he explains.

Nath agrees that liquidity in NCDs is fairly limited, and therefore, investors may not be able to get out before maturity. But considering that the rate of return these NCDs are offering is much higher when compared to other similar investment options, retail investors can take limited exposure.

Nath also advises avoiding NBFCs with large wholesale exposure to the real estate sector. "It is common knowledge that the real estate sector is going through stress, and hence, there is a higher probability of defaults,'' he says.

Currently, State Bank of India is offering 6.8% for a three to five years FD. And the category average three-year return from medium duration debt funds is 7.26%.

In the current interest rate scenario, anything that offers above 9-9.5% is good to block money for the long term, says Jain. "Understand that NCD will not give you a tax benefit. Instead, if I invest in a debt mutual fund, it will give an indexation benefit after three years. Debt MFs will get the benefit of a downward interest rate cycle as well, because as the rate of interest goes down, the income fund's NAV will go up," he adds.

In case of ratings downgrade

An NCD's credit quality is downgraded if the company is unable to service its debt obligation. As a corrective measure, one should look at the company's future outlook before panicking and assess its ability to fulfil future commitments," says Birani.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)