Government has amended the section 270A of the Income Tax Act after demonetisation in order to make sure that any sort of mis-reporting or under-reporting is penalised heavily

Most of the salaried taxpayers must have come across the recently issued warning from the tax department which alerts them not to follow any unlawful practice of evading taxes either by way of under-reporting any income or claiming excess deductions like House Rent Allowance (HRA), Leave Travel Allowance (LTA) etc. Similarly, the department also wants the taxpayers to file their tax returns in time and avoid any delay and in order to ensure the same, new penalty provisions have been brought in to rule book. Let us understand both these new changes, in detail.

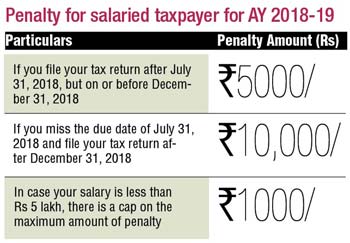

Penalty for late filing

The due date for filing your tax returns for the previous financial year, that is, April 1, 2017 to March 31, 2018 is July 31, 2018. This applies to the individuals who are not supposed to get their accounts audited. Basically it covers all the salaried class taxpayers. For all other class of taxpayers, the due date is September 30, unless it gets extended.

The Income Tax Act has added a new section called section 234F which levies a penalty for filing your return beyond the due date as specified, the same will be effective from the Assessment Year 2018-19.

What is section 234F

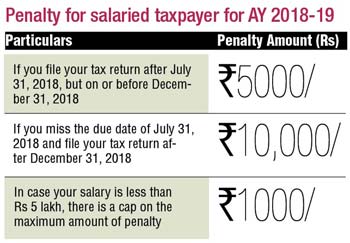

If being a salaried person, you don't file your tax return by July 31, 2018, but you file it by, say, on or before December 31, 2018 then the government will levy a penalty of Rs 5000. If the return is filed post December 31, 2018 then the same amount would be Rs 10,000.

If being a salaried person, you don't file your tax return by July 31, 2018, but you file it by, say, on or before December 31, 2018 then the government will levy a penalty of Rs 5000. If the return is filed post December 31, 2018 then the same amount would be Rs 10,000.

There is one exception to this rule. In case your total income is less than Rs 5 lakh, then the same penalty amount will be restricted to Rs 1000 only.

Penalty for under-reporting

Now let us discuss the second important point about under-reporting your income, claiming excess deductions or exemptions. Very recently there were several cases of frauds reported by salaried employees working in major multi-national companies. People had claimed excess deductions while filing their tax returns and ultimately claimed higher tax refunds. These particular cases was unearthed by the income tax department in Bengaluru. Many employees had claimed losses under house property income tax head, which were based on forged documents.

The income tax department then issued an advice cautioning salaried taxpayers against under-reporting or making fraudulent claims. Now as per section 270A, these things will be penalised and can lead to prosecution as well.

What is Section 270A

Section 270A puts a penalty in case where the income is under-reported. This could be due to not reporting the same at all or by way of some mis-representation. The penalty applicable is 200% of the total tax payable on that particular under-reported income. But in case the income is under-reported because of any other reason, then the penalty will be 50% of the total tax payable on that under-reported income. Government has amended the section 270A of the Income Tax Act after demonetisation in order to make sure that any sort of mis-reporting or under-reporting is penalised heavily.

Some cases of misreporting transactions as per Income Tax Act:

1. Misrepresentation or suppressing any material facts

2. Not recording investments in the books of account

3. Claiming expenses without substantiating with proper documentary evidence

4. Recording false entries in the books of account

5. Fails to record receipts having an impact on total income

There are various changes made in your tax return form, wherein you need to fill multiple details about your salary and house property income as compared to earlier. Income tax forms ask for various details of your salary and its breakup unlike earlier.

You need to disclose the the breakup of your salary like showing allowances which are not exempt, perquisites or profit in lieu of your salary and many other deductions as claimed in your Form 16.

Likewise, your income from house property also needs to be given in detail like total rent received by you or receivable, municipal taxes paid to the municipal corporation and interest payable on your home loans, etc. In fact, taxpayers have started getting lots of notices due to mismatch in their Form 16 income, income as declared by them while filing their tax return and in comparison, to their Form 26AS. The department tracks it all and issues intimations or notices ranging from simple inquiries to grave scrutiny notices.

There are many incidents of salaried taxpayers not filing their income tax returns correctly, either due to lack of time or ignorance of law. They also end up making mistakes like not matching their Form 26AS and income received from all sources or, say, delaying filing their tax returns, which lands them in trouble.

The writer is chief gardener, Money Plant Consultancy

![submenu-img]() Central government makes bold move, lifts ban on agricultural sector for…

Central government makes bold move, lifts ban on agricultural sector for…![submenu-img]() BCCI announces 15-member squad for Bangladesh T20Is, pace sensation Mayank Yadav earns maiden call-up

BCCI announces 15-member squad for Bangladesh T20Is, pace sensation Mayank Yadav earns maiden call-up![submenu-img]() Meet man, who started company after sending drunk text to boss, not from IIT, IIM, his worth is Rs...

Meet man, who started company after sending drunk text to boss, not from IIT, IIM, his worth is Rs...![submenu-img]() Sanjay Gandhi, Bhindranwale's conversation to Sikhs firing: CBFC wants these cuts from Kangana Ranaut's Emergency

Sanjay Gandhi, Bhindranwale's conversation to Sikhs firing: CBFC wants these cuts from Kangana Ranaut's Emergency ![submenu-img]() Watch: Karisma Kapoor recreates ‘Sona Kitna Sona’ song with Zaheer Iqbal, Sonakshi Sinha's reaction goes viral

Watch: Karisma Kapoor recreates ‘Sona Kitna Sona’ song with Zaheer Iqbal, Sonakshi Sinha's reaction goes viral![submenu-img]() 'PoK खाली किए बगैर नहीं सुलझेगा...', UNGA में पाकिस्तान पर जमकर बरसे विदेश मंत्री जयशंकर

'PoK खाली किए बगैर नहीं सुलझेगा...', UNGA में पाकिस्तान पर जमकर बरसे विदेश मंत्री जयशंकर![submenu-img]() Team India Squad: बांग्लादेश के छक्के छुड़ाएगा IPL का ये तूफानी गेंदबाज, BCCI ने पहली बार दिया टीम में मौका, नए चेहरों की भरमार

Team India Squad: बांग्लादेश के छक्के छुड़ाएगा IPL का ये तूफानी गेंदबाज, BCCI ने पहली बार दिया टीम में मौका, नए चेहरों की भरमार![submenu-img]() पिता सीएम, बेटा डिप्टी CM... तमिलनाडु कैबिनेट में बड़ा फेरबदल, उदयनिधि स्टालिन मिली ये जिम्मेदारी

पिता सीएम, बेटा डिप्टी CM... तमिलनाडु कैबिनेट में बड़ा फेरबदल, उदयनिधि स्टालिन मिली ये जिम्मेदारी![submenu-img]() Maharashtra Assembly Elections 2024: महाराष्ट्र में 22 फीसदी बढ़ीं महिला वोटर, कब होंगे चुनाव? निर्वाचन आयोग ने बताई डेडलाइन

Maharashtra Assembly Elections 2024: महाराष्ट्र में 22 फीसदी बढ़ीं महिला वोटर, कब होंगे चुनाव? निर्वाचन आयोग ने बताई डेडलाइन![submenu-img]() Jammu-Kashmir Encounter: कुलगाम मुठभेड़ में 2 आंतकी ढेर, ASP समेत 5 सुरक्षाकर्मी हुए घायल

Jammu-Kashmir Encounter: कुलगाम मुठभेड़ में 2 आंतकी ढेर, ASP समेत 5 सुरक्षाकर्मी हुए घायल![submenu-img]() Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…

Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…![submenu-img]() Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...

Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...![submenu-img]() Tata launches Nexon iCNG, check price, mileage, other features

Tata launches Nexon iCNG, check price, mileage, other features![submenu-img]() This Indian car brand set to acquire 50% stake in Skoda Auto Volkswagen India, deal will cost Rs…

This Indian car brand set to acquire 50% stake in Skoda Auto Volkswagen India, deal will cost Rs…![submenu-img]() Ford to return to India after 2 years with reopening of....

Ford to return to India after 2 years with reopening of....![submenu-img]() Meet India's youngest woman to crack UPSC exam at age 21, secured AIR 13, but didn't become IAS due to...

Meet India's youngest woman to crack UPSC exam at age 21, secured AIR 13, but didn't become IAS due to...![submenu-img]() Meet India’s first female IAS officer, also second woman to crack UPSC exam, she was posted at...

Meet India’s first female IAS officer, also second woman to crack UPSC exam, she was posted at...![submenu-img]() Meet man, bangle seller who cracked UPSC exam despite being specially abled, becomes IAS officer with AIR...

Meet man, bangle seller who cracked UPSC exam despite being specially abled, becomes IAS officer with AIR...![submenu-img]() Meet man who passed AIIMS exam at 16, cracked UPSC exam at 22, later resigned as IAS officer to build...

Meet man who passed AIIMS exam at 16, cracked UPSC exam at 22, later resigned as IAS officer to build...![submenu-img]() Meet man who lost his legs, cracked JEE Advanced, completed B.Tech from IIT Madras, is now working at…

Meet man who lost his legs, cracked JEE Advanced, completed B.Tech from IIT Madras, is now working at…![submenu-img]() IIFA Awards 2024: Date, Time, Venue And Where To Watch - All You Need To Know

IIFA Awards 2024: Date, Time, Venue And Where To Watch - All You Need To Know![submenu-img]() Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical

Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical![submenu-img]() Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval

Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval![submenu-img]() Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?

Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?![submenu-img]() One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0

One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0![submenu-img]() Meet man, who started company after sending drunk text to boss, not from IIT, IIM, his worth is Rs...

Meet man, who started company after sending drunk text to boss, not from IIT, IIM, his worth is Rs...![submenu-img]() Meet woman, who started business with two sewing machines, now styles Nita Ambani, Alia Bhatt, Priyanka Chopra

Meet woman, who started business with two sewing machines, now styles Nita Ambani, Alia Bhatt, Priyanka Chopra![submenu-img]() Ratan Tata's iPhone manufacturing company plans to take big step, as they are about to hire....

Ratan Tata's iPhone manufacturing company plans to take big step, as they are about to hire....![submenu-img]() Alia Bhatt reacts as Ranbir Kapoor makes a big move on his 42nd birthday, launches…

Alia Bhatt reacts as Ranbir Kapoor makes a big move on his 42nd birthday, launches…![submenu-img]() Anil Ambani-owned company's share price hits upper circuit, in 8 days it has surged...

Anil Ambani-owned company's share price hits upper circuit, in 8 days it has surged...![submenu-img]() Central government makes bold move, lifts ban on agricultural sector for…

Central government makes bold move, lifts ban on agricultural sector for…![submenu-img]() Odisha orders Internet shut down for 48 hours in Bhadrak district in order to prevent spread of...

Odisha orders Internet shut down for 48 hours in Bhadrak district in order to prevent spread of...![submenu-img]() Haryana: 3 dead, 9 injured in illegal firecracker factory blast in Sonipat, here's what we know so far

Haryana: 3 dead, 9 injured in illegal firecracker factory blast in Sonipat, here's what we know so far![submenu-img]() Mumbai on high alert after terrorist attack threat, security tightened across city

Mumbai on high alert after terrorist attack threat, security tightened across city![submenu-img]() Meet woman, IIT graduate, UPSC 2015 batch IFS officer, who schooled Pakistan PM at UNGA over…

Meet woman, IIT graduate, UPSC 2015 batch IFS officer, who schooled Pakistan PM at UNGA over…

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

If being a salaried person, you don't file your tax return by July 31, 2018, but you file it by, say, on or before December 31, 2018 then the government will levy a penalty of Rs 5000. If the return is filed post December 31, 2018 then the same amount would be Rs 10,000.

If being a salaried person, you don't file your tax return by July 31, 2018, but you file it by, say, on or before December 31, 2018 then the government will levy a penalty of Rs 5000. If the return is filed post December 31, 2018 then the same amount would be Rs 10,000.

)

)

)

)

)

)