They strike when least expected, and if you are not prepared, what might otherwise be a highly distressing situation can turn into a spiraling disaster.

Imagine this: You are on a business trip to Paris. After a long day in meetings, you go into the streets to enjoy the view, only to realise your wallet has been misplaced. Your cash, cards—everything—is gone. Panic starts to creep in: how will you pay for the hotel and the meals, or how will you even return to the airport? Those experiences sound extreme, but many tourists have had to go through them. A lost wallet, an unforeseen medical emergency, or an impromptu change in plans can make it worthwhile to have a fallback plan for accessing funds. This is where an online forex exchange platform might come in handy!

Realities of Travel Emergencies

Travel emergencies can range from the straightforward but expensive loss of a wallet to a sudden medical need or urgent last-minute booking of a flight—all requiring immediate access to foreign currency. In normal circumstances, you engage directly in currency exchange either by going to a bank or any other available physical exchange counter. However, this is usually out of the question during an emergency, especially when you are in a different time zone or somewhere where those services are not easily accessible.

Immediate Things-to-do in Case of an Emergency:

When it comes to an emergency, time is of the essence. Here are a few ways that you can quickly get currency if you have to exchange it online in the event of an emergency:

- Immediately contact your bank:

Chances are that your bank will have an emergency provision for such times. This may get you access to your currency soon, but remember—unless you are lucky, it is usually difficult and time-consuming to get currency quickly.

- Using a Forex Card:

If you have pre-planned and topped up your Forex card, then currency withdrawal can be easily done through any ATM. But what if your card is lost or stolen?

- Online Forex Exchange Platforms:

Online currency exchange platforms provide an effective solution for gaining access to foreign currency immediately in the event of an emergency. They help you convert money fast and often offer options for receiving money in cash within hours.

- Contacting Friends or Family:

In the worst-case scenario, you can contact your friends or family in the originating country and ask them to transfer money immediately. Though this is one of the most efficient ways, it takes some time and may not prove to be the fastest way out for you.

Top #5 Points to Remember When You Need to Exchange Currency Online in an Emergency:

Now, it's time to understand how to do a speedy currency exchange online in an emergency.

.

- Find a Reputable Online Forex Exchange Platform:

This is where the first measure of any kind of emergency is to check into a reputed online currency exchange. In India, there are many firms that provide services to exchange currency instantly and without hassle. The Reserve Bank of India licenses this firm and works under stringent policies, thus making every one of your requisitions safe, and it also comes with these additional benefits:

- Instant Currency Exchange:

Some platforms offer instant currency exchange services, by which you can obtain an international currency of your choice within several hours.

- 24/7 Service:

An emergency does not wait for business days or hours, so you should choose a platform that operates around the clock.

- Home delivery:

If you are in a fix, home delivery of currency can be your lifesaver. Most platforms offer same-day or next-day deliveries, so by the time you need the money, it will be in your hands.

- Verify Current Exchange Rates:

Just before the exchange, verify the current real-time exchange rates of the various schemes on offer across different platforms. Exchange rates keep changing, and some platforms might offer better rates than others. Compare and settle for the best rate available and get maximum value for your money.

- Verify Your KYC Documents for an Online Forex Exchange:

Currency exchange services are quite strict in India, even in an emergency. So, even if you want your currency exchanged, you still need to provide KYC documents. Carefully confirm that you have all the necessary documents before initiating an online exchange. The most common are:

- Aadhar Card or Voter ID: This is a government-issued photo ID.

- PAN Card: A PAN card is required in any financial transaction.

- Passport and Visa: Especially if you are already abroad or are converting a huge amount of money.

- Confirmed Air Ticket: This is requested at times, especially if you are changing close to your travel date

When these documents are available, the processing time will be greatly shortened, and you'll be able to finalise the transaction quickly.

- Select the Fastest Payment Option for your Online Forex Exchange:

Different platforms have different payment options, but when time comes to call, time becomes of the essence. On most online currency exchanges, the units allow for payment through:

- Net Banking:

This is usually the fastest option, and the money can instantly be transferred.

- UPI (Unified Payments Interface):

Another fast way, this one is particularly common in India

- Credit/Debit Cards:

These are easy and user-friendly but may be high in charges, and the processing time can be longer.

Select the payment option that transfers your money the fastest, ensuring that you get your converted money in the minimum time.

- Go for Digital Delivery or Instant Collection:

Time becomes critical during such emergencies. In an emergency, always opt for digital delivery of your funds as soon as possible.

For example, you may load the exchanged currency in a prepaid Forex card or a digital wallet, which can be immediately used for making purchases or withdrawals. Some platforms even offer you the option to pick up cash from a nearby authorised partner; this may take a little more time.

- Look at Forex Cards for Emergency:

When cash and cards are lost, certain online destinations provide an emergency forex card when the absolute need for money arises. The cards can be added to the online platform with the desired currency and can be placed in a maximum of a few hours. The main advantage of the Forex card is that it allows you to withdraw money.

Some Other Handy Tips to Curtail Currency Emergencies:

- Preload a Forex Card:

Before commencing your journey, you could preload your Forex card with multi-currency. This could be a safety backup in case of an emergency where access to funds is required quickly, not allowing time for transactions to be made online.

- Keep your International Debit/Credit Cards active by Enabling International Transactions:

Before the round, if you are going on a tour, make sure that your account, debit, and credit cards are allowed for international transactions; it may lead to faster access to money, and without any trouble, you can pay as much as you intend.

- Alerts to Be Tuned:

Create SMS and e-mail alerts for every debit or credit in the bank accounts to trace any accidental or illegal transactions, mainly if card theft or card loitering cases come to light, and to take speedy steps in such cases.

To Wrap it up:

Currency crises can be difficult, but you can easily manage them with the right information and means. Use online forex exchange platforms to access your needed funds at the speed of light, irrespective of your location in the world. Keep yourself informed, stay prepared, and ensure an unexpected event is okay with your travel plans.

(This article is part of DMCL Consumer Connect Initiative, a paid publication programme. DMCL claims no editorial involvement and assumes no responsibility, liability or claims for any errors or omissions in the content of the article. The DMCL Editorial team is not responsible for this content.)

![submenu-img]() J-K Assembly Polls: Engineer Rashid's AIP, ex-Jamaat members form alliance

J-K Assembly Polls: Engineer Rashid's AIP, ex-Jamaat members form alliance![submenu-img]() Ishan Kishan likely to get picked for Bangladesh T20Is if....

Ishan Kishan likely to get picked for Bangladesh T20Is if....![submenu-img]() Ratan Tata's company earned Rs 23427 crore in 5 days after...

Ratan Tata's company earned Rs 23427 crore in 5 days after...![submenu-img]() GNSS: Here's how India’s new GPS-based toll system will change your highway travel

GNSS: Here's how India’s new GPS-based toll system will change your highway travel![submenu-img]() 'He wasn't a friend, he was very...': Former India cricketer makes bold claim about Gautam Gambhir

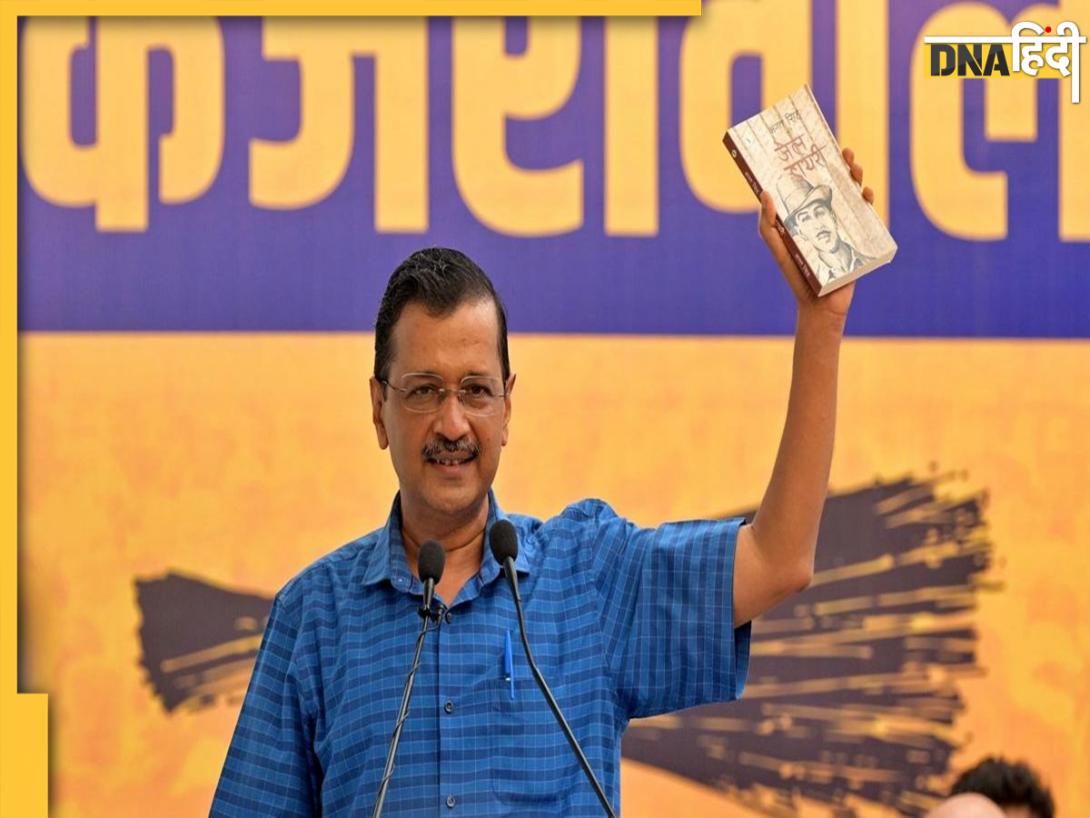

'He wasn't a friend, he was very...': Former India cricketer makes bold claim about Gautam Gambhir![submenu-img]() Arvind Kejriwal के इस्तीफे के पीछे है मास्टर प्लान, दिल्ली में समय से पहले होंगे चुनाव?

Arvind Kejriwal के इस्तीफे के पीछे है मास्टर प्लान, दिल्ली में समय से पहले होंगे चुनाव?![submenu-img]() कश्मीर के बारामूला में सुरक्षाबलों और आतंकी के बीच मुठभेड़, अभी तक तीन आंतकी ढ़ेर

कश्मीर के बारामूला में सुरक्षाबलों और आतंकी के बीच मुठभेड़, अभी तक तीन आंतकी ढ़ेर![submenu-img]() Gujarat News: आईसीयू में जाने से पहले जूते उतारने के लिए कहने पर डॉक्टर की कर दी पिटाई, अस्पताल में भारी बवाल

Gujarat News: आईसीयू में जाने से पहले जूते उतारने के लिए कहने पर डॉक्टर की कर दी पिटाई, अस्पताल में भारी बवाल![submenu-img]() लाखों के बिक गए कॉन्सर्ट के टिकट, जेब में आए करोड़ों रुपये, अब Diljit Dosanjh की नेट वर्थ भी जान लें

लाखों के बिक गए कॉन्सर्ट के टिकट, जेब में आए करोड़ों रुपये, अब Diljit Dosanjh की नेट वर्थ भी जान लें![submenu-img]() Indore Hit And Run Case: इंदौर में रफ्तार का कहर, BMW कार ने स्कूटी को मारी टक्कर, 2 लड़कियों की मौत

Indore Hit And Run Case: इंदौर में रफ्तार का कहर, BMW कार ने स्कूटी को मारी टक्कर, 2 लड़कियों की मौत![submenu-img]() Ford to return to India after 2 years with reopening of....

Ford to return to India after 2 years with reopening of....![submenu-img]() Maruti Suzuki launches new Swift CNG, check price, mileage, other features

Maruti Suzuki launches new Swift CNG, check price, mileage, other features![submenu-img]() ‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...

‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...![submenu-img]() In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…

In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…![submenu-img]() World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…

World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…![submenu-img]() Meet woman, daughter of vegetable vendor who mortgaged mother’s jewellery to pay fees, then cracked UPSC exam with AIR…

Meet woman, daughter of vegetable vendor who mortgaged mother’s jewellery to pay fees, then cracked UPSC exam with AIR…![submenu-img]() Meet IIT-JEE topper Chirag Falor, who secured 100 percentile, didn't take admission in IIT due to...

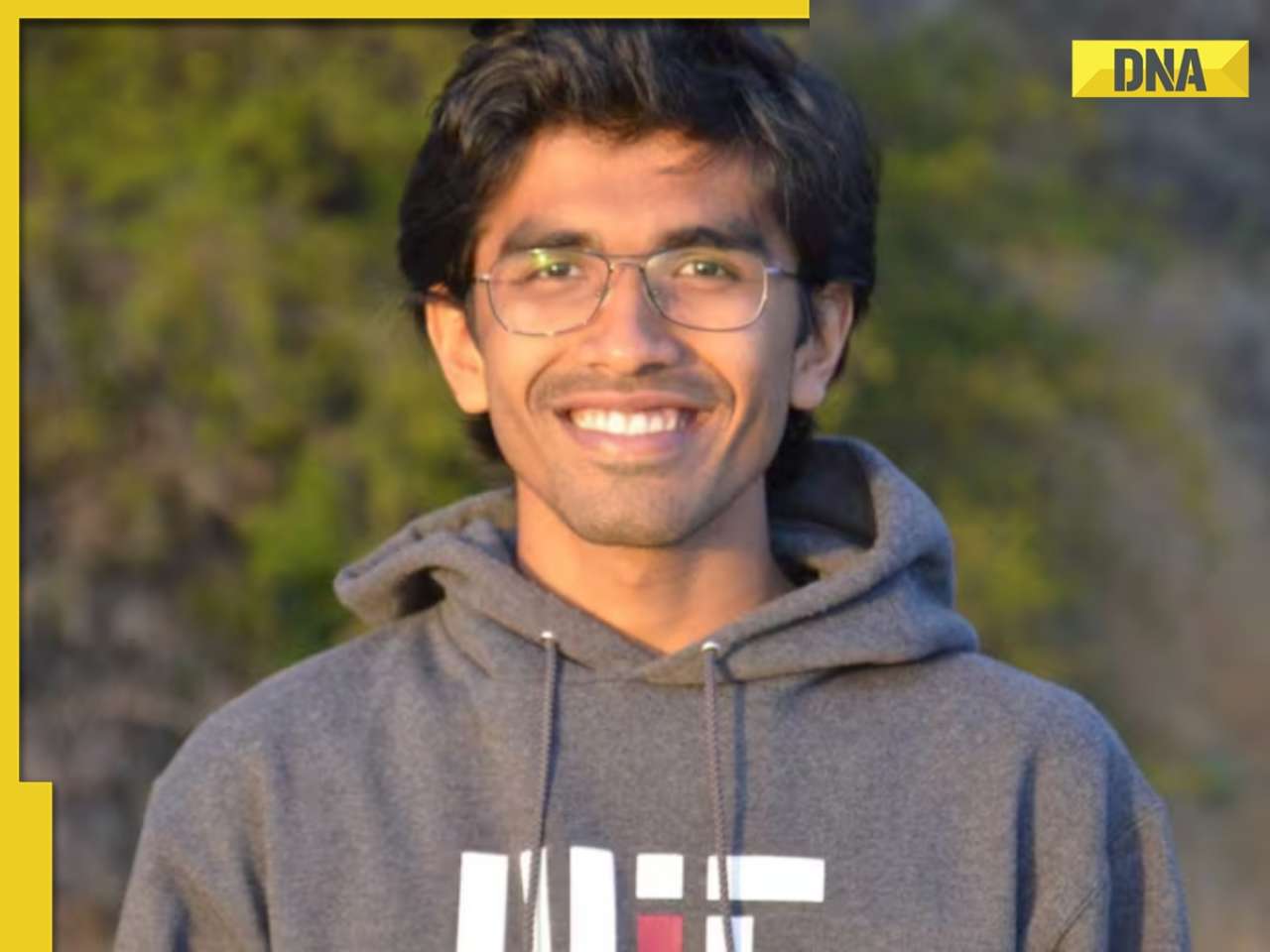

Meet IIT-JEE topper Chirag Falor, who secured 100 percentile, didn't take admission in IIT due to...![submenu-img]() Meet man, who secured AIR 2 in JEE, studied at IIT Bombay, got gold medal in Olympiad, worked with Google, he is...

Meet man, who secured AIR 2 in JEE, studied at IIT Bombay, got gold medal in Olympiad, worked with Google, he is...![submenu-img]() NEET SS 2024: Tentative schedule out, exam likely on...

NEET SS 2024: Tentative schedule out, exam likely on...![submenu-img]() Meet man, popular online tutor who cracked UPSC in 1st attempt, resigned as IAS officer after 1 year due to…

Meet man, popular online tutor who cracked UPSC in 1st attempt, resigned as IAS officer after 1 year due to…![submenu-img]() Kolkata Doctor Case: Protesting Doctors React After CBI Arrests Sandip Ghosh And Abhijit Mondal

Kolkata Doctor Case: Protesting Doctors React After CBI Arrests Sandip Ghosh And Abhijit Mondal![submenu-img]() Nitin Gadkari: Union Minister Nitin Gadkari Reveals He Was Offered Support For PM Post But Declined

Nitin Gadkari: Union Minister Nitin Gadkari Reveals He Was Offered Support For PM Post But Declined![submenu-img]() Kolkata Doctor Case: Junior Doctors Protest For 5th Night As Talks With CM Mamata Fail Again

Kolkata Doctor Case: Junior Doctors Protest For 5th Night As Talks With CM Mamata Fail Again![submenu-img]() Muslim Sculptor Crafts Tiny Ganesh Idols On Pencil Graphite #shorts #viralvideo #ganesh

Muslim Sculptor Crafts Tiny Ganesh Idols On Pencil Graphite #shorts #viralvideo #ganesh![submenu-img]() Jaishankar: EAM Dr. S. Jaishankar On India-China Relations & Disengagement Problems | Ladakh

Jaishankar: EAM Dr. S. Jaishankar On India-China Relations & Disengagement Problems | Ladakh![submenu-img]() Ratan Tata's company earned Rs 23427 crore in 5 days after...

Ratan Tata's company earned Rs 23427 crore in 5 days after...![submenu-img]() Gautam Adani beats rivals, wins bid to supply 6600 MW of electricity to...

Gautam Adani beats rivals, wins bid to supply 6600 MW of electricity to...![submenu-img]() Meet man, who owns private jets, Rs 5000 crore house in Mumbai, not Mukesh Ambani, Ratan Tata, Adani, he is...

Meet man, who owns private jets, Rs 5000 crore house in Mumbai, not Mukesh Ambani, Ratan Tata, Adani, he is...![submenu-img]() Meet Indian who once studied under tree, lacked basic amenities, now has Rs 96960 crore net worth, is world’s richest...

Meet Indian who once studied under tree, lacked basic amenities, now has Rs 96960 crore net worth, is world’s richest...![submenu-img]() Mukesh Ambani's new move to improve margins in this business, now increases...

Mukesh Ambani's new move to improve margins in this business, now increases...![submenu-img]() WAGs of Indian cricketers and their professions

WAGs of Indian cricketers and their professions ![submenu-img]() This actress, Madhuri Dixit’s rival, starred in Yash Chopra’s ‘biggest gamble of his life’, saved him from bankruptcy

This actress, Madhuri Dixit’s rival, starred in Yash Chopra’s ‘biggest gamble of his life’, saved him from bankruptcy![submenu-img]() Meet Ludhiyana's richest man with net worth of Rs 13280 crore, he is...

Meet Ludhiyana's richest man with net worth of Rs 13280 crore, he is...![submenu-img]() Meet Ludhiana's richest man with net worth of Rs 13280 crore, he is..

Meet Ludhiana's richest man with net worth of Rs 13280 crore, he is..![submenu-img]() Meet man who once worked as a stone breaker, borrowed ration, then cracked PSC exam, now posted as...

Meet man who once worked as a stone breaker, borrowed ration, then cracked PSC exam, now posted as...![submenu-img]() J-K Assembly Polls: Engineer Rashid's AIP, ex-Jamaat members form alliance

J-K Assembly Polls: Engineer Rashid's AIP, ex-Jamaat members form alliance![submenu-img]() GNSS: Here's how India’s new GPS-based toll system will change your highway travel

GNSS: Here's how India’s new GPS-based toll system will change your highway travel![submenu-img]() Kolkata rape-murder case: RG Kar hospital ex-principal Sandip Ghosh, one SHO sent to CBI custody till...

Kolkata rape-murder case: RG Kar hospital ex-principal Sandip Ghosh, one SHO sent to CBI custody till...![submenu-img]() Nipah virus: 24-year-old succumbs to virus in Kerala, all close contacts isolated

Nipah virus: 24-year-old succumbs to virus in Kerala, all close contacts isolated![submenu-img]() After Lulu Mall, this will be India's biggest mall, spread over 28 lakh sq ft, parking for 8000 cars, to open in...

After Lulu Mall, this will be India's biggest mall, spread over 28 lakh sq ft, parking for 8000 cars, to open in...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)