- LATEST

- WEBSTORY

- TRENDING

PERSONAL FINANCE

Loan against securities is cheaper, but has riders

Loan amount is subject to securities’ value and lenders can attach them in case of default

TRENDING NOW

Pledging shares or other investments is an option that retail borrowers can consider if they have an urgent requirement of funds, as it is cheaper than a personal loan. Such loans include those against fixed deposits (FDs), shares, insurance policies, mutual funds, etc.

According to the Reserve Bank of India's November Bulletin advances against FDs had seen a year-on-year growth of 12.8%, while loans against shares and bonds had grown by 10.6%.

Why take loan against a security

Ambuj Chandna, senior executive vice-president and head, consumer assets, Kotak Mahindra Bank, says, "From a customer's perspective, the choice of loan depends on the envisaged holding period of the underlying security. For instance, if the customer wishes to hold securities for the medium term and needs funds, then it is advisable to apply for loan against securities instead of selling those securities."

Another advantage is that while you cannot sell the security, you can still get the benefit from interest, bonus and dividends, says Pradeep Agarwal, CEO, Meri Punji.

"When you pledge a security, you get steady cash easily in the time of need. But one must avail this loan only in emergency. Do not take this loan for share trading, etc," he says.

These are are best for tiding over short-term immediate financial emergencies, says Navin Chandani, chief business development officer, BankBazaar.com

Features of loans against securities

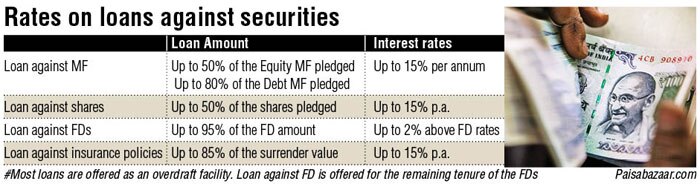

Broadly, the loan amount and interest rate would depend on the type of security pledged as collateral and the creditworthiness of the borrower.

Loan against shares: You can take this loan as an overdraft or demand loan against the eligible list of securities. This keeps you invested in the equities and at the same time helps you raise a loan during a financial emergency. Your loan amount fluctuates with the market volatility. In case the value of the share drops, the lender may ask you to raise the value of the security by pledging more shares or replenishing by putting requisite cash funds. You can typically raise raise up to 50% of the value of the shares pledged.

Loan against MFs: The loan amount sanctioned against MFs is determined on the basis of the value of the MF units you hold. Typically, the loan offer goes up to 50% of the market value for MFs and up to 70% of the net asset value of the MF pledged at the time of applying for the loan. Funds that have a lock-in period, such as equity-linked savings schemes, cannot be pledged. The MF would be under a lien by the bank, which gives the bank the right to recover the loan amount in case of a default. You cannot sell the funds that are under a lien.

Loan against insurance: Banks and insurance companies allow loan against insurance. But it is allowed only against traditional life insurance policies such as endowment and money-back plans and not against Unit Linked Insurance Plans (Ulips) or term insurance policies. The loan amount is in the range of 60% to 90% of the surrender value of the insurance policy. You can apply for a loan against an insurance policy only if you purchased your policy at least three years prior to the loan application.

Loan against FDs: Most banks offer loans against FDs. As they are secured instruments, banks would be willing to lend as much as 80-95% of the FD amount as loan. The loan rates would be usually 1-2% over and above the FD rates. Banks typically levy no processing charge for loans against FDs. The tenure would be the remaining tenure of the FDs.

Conditions to keep in mind

"The most important condition to keep in mind is that if the loan amount exceeds the set Loan To Value (LTV) ratio due to price declines in the collateral, the borrower would need to deposit the difference amount in his loan account. Failure to do so attracts penal charges," points out Naveen Kukreja - CEO and co-founder, Paisabazaar.com.

Also, remember that not all stocks will get you a loan. "Banks have their own list of the securities they take as collateral. They usually consider parameters like market capitalisation, volatility in stock price, and liquidity of the stock. Usually, most large company stocks qualify for pledging with a bank, however, the list varies from bank to bank,'' says Chandani of BankBazaar.com.

Since customers cannot sell the securities that are pledged or lien in favour of the lender, one should keep in mind the investment objective of the underlying securities before taking the loan, says Chandna of Kotak Bank.

In fact, since the lender has the option to sell these instruments if margins fall, if caught in bad cycle the borrower may lose the instrument even if the market value recovers at a later date, warns Agarwal.

"If this is your only option, before you pledge your shares and MFs, raise funds against your FDs and small saving options. Then take the help of insurance policies. This is because their value is not as volatile, and at the same time, returns from these are usually lower compared to, say, a mutual fund. Nevertheless, the key is to get rid of this loan as soon as possible,'' says Chandani.

Customers should ensure that they are getting the lowest rate of interest, maximum LTV and written proofs of all details regarding assets provided as securities for the loan. Also, customers need to be extremely cautious about the exit clause and should prefer taking a loan which can be closed without any foreclosure charges, says Rachit Chawla, founder and CEO, Finway.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)