- LATEST

- WEBSTORY

- TRENDING

PERSONAL FINANCE

Safeguard yourself from banking frauds

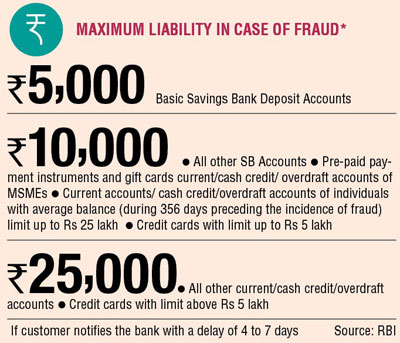

If neither customer nor bank is at fault, customer’s liability is limited

TRENDING NOW

On the corporate side banks reported Rs 70,000 crore loss due to frauds in last three fiscals. On the consumer banking side according to a May 2018 study by payment company FIS, conducted across multiple countries, 18% Indian consumers became victims to banking frauds. No one knows what will happen about corporate frauds, DNA Money lists some things you could keep in mind while safe guarding yourself from consumer banking frauds. But the most important thing is to be vigilant.

According to a 2017 Reserve Bank of India guideline, your liability as a victim of fraudulent banking transaction is zero in certain cases and limited in certain cases. For instance, when fraud, negligent or deficiency is bank's fault if you report such a transaction to the bank or no, your liability will be zero.

But if its's a third-party breach, then your liability only if you notify the bank within three working days of receiving the communication regarding the transaction from the bank. So, make sure your track your account closely.

But if its's a third-party breach, then your liability only if you notify the bank within three working days of receiving the communication regarding the transaction from the bank. So, make sure your track your account closely.

Offline Frauds: Offline frauds happen at ATMs or in the bank. For instance, earlier this month 78 customers from Kolkata allegedly lost over Rs 20 lakh, through ATM frauds in leading banks.

Radha Rama Dorai, Managing Director- ATM & Allied Services, FIS Payment Solutions & Services India said, "To avoid your card being skimmed at the ATM, you need to check the card reader and the PIN entry pad of the ATM machine before starting a transaction. Does the card reader seem to protrude, does it seem loose or wobbly? Does the PIN pad seem different than usual? The best way to avoid your PIN from getting compromised is to cover the PIN entry action with your other hand so that no hidden camera can capture the numbers being entered."

Another offline fraud is when a dishonest bank employee robs customers. There have been instances where bank employees have embezzled small amounts of money from inoperative or dormant accounts. Identifying a fraud in an unused account isn't easy. Hence, close your unused accounts as soon as possible. Such accounts are easy targets for money laundering activities or simply siphon off money.

Online Banking: Giving tips on safe net banking habits, Surinder Chawla – Head - Geography, Branch & Business Banking, RBL bank, said "Frequently change your password and security setting and do not share your login credentials or OTP with anyone. Bank will never ask for these details over call, email or SMS. If you get an alert for login or transaction on internet banking which was not initiated by you, contact your bank immediately and inform them."

Avoid a proper word as password, which can be guessed easily or cracked using a password software; instead use an acronym. A poem, for instance: Mary had a little Lamb, can be made into a password MhalL@100. Add a number and a special character.

Ritesh Pai, Chief Digital Officer, YES Bank said, "Do not access net banking from shared or unprotected computers in public places. Do not access net banking using public Wi-Fi."

Such public Wi-Fi can easily be broken into by fraudsters. It is important that you track all your transactions and monitor your account regularly.

Pai said, "Subscribe to email and SMS alerts for your net banking account for all transactions. Do not click on any link receive over emails/SMS. Check the address (URL) of the website before entering your credentials."

In fact, when you do net banking it makes sense to avoid clicking links and type them yourself. Chawla said, "Always visit your bank's secure internet banking directly from bank's website. Avoid accessing it through third party link or via emails. Verify the domain name before your login."

This will prevent you from becoming victims of phishing attacks. Phishing attack is when the fraudster sends a fraudulent email/SMS, which looks like it's coming from your bank. It tricks you to providing your login credentials or other sensitive information.

Ritesh Saxena, Head - Direct Banking, Consumer Banking, IndusInd Bank, said, "Check for the bank's certificate to confirm genuineness of the site; keep your online credentials safe in your memory only. Use virtual keyboards for entering your credentials or use additional security features that your bank may provide."

Mobile banking: When it comes to mobile banking, always lock your device, never save MPINs or card data in mobile apps; it's risky. Pai said, "Stay alert about your mobile connectivity. Enquire with your mobile operator if you have no network connectivity for unusually long period." Always install the app from trusted source only. Keep your app updated with the latest version.

Chawla said, "Frequently change your MPIN and do not share your MPIN or OTP with anyone. Bank will never ask for these details over call, email or SMS. If you get an alert for login or transaction on internet banking which was not initiated by you, contact your bank immediately and inform them."

Chawla said, "Just like your net banking password, frequently change your MPIN, too. Do not share your MPIN or OTP with anyone. If you get an alert for login or transaction on internet banking that was not initiated by you, contact your bank immediately and inform them."

Another option is to use finger print access. Saxena said, "Mobile banking customers can use their fingerprints for authenticating themselves, making password and their safekeeping completely redundant."

In case you lose your mobile, inform your bank immediately to disable the baking app. Install a mobile anti-malware/ anti-virus software on your smartphone.

Saxena said, "Keep your mobile, email id and address updated in the bank records, so that you are notified of all bank communications related to your account and general security advisories etc."

Some banks have introduced a feature of 'locking' your card or setting spend limits on your card. It is advisable to subscribe to such a service, said Dorai.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)