High operating and distribution costs, and hospital expenses as indirect costs could be the reasons affecting the insurance pricing.

Health insurance scheme is a costly affair for various sections of the society and technology needs to be leveraged to bring down the costs and enhance penetration, according to the chairman of Insurance Regulatory and Development Authority of India(IRDAI).

While addressing the 'Health Insurance Summit 2022' he said that high operating and distribution costs, and hospital expenses as indirect costs could be the reasons affecting the insurance pricing.

"We have to look at ways of reducing the expenses in order to make insurance affordable”, Panda said.

The head of Irdai suggested that adopting cutting-edge technical solutions to create customised health insurance policies using artificial intelligence may be the answer.

The official also nudged the industry to come up with pocket-friendly solutions as many times the out-of-pocket expenses for the consumables become painful for the insured despite

having a policy.

"In hospital bills, a lot of consumables are used in patient treatment. It's a small amount but painful for the customers. How do we stop that out of pocket expenses, what needs to be done...how do we take care of that? Can we come up with some kind of a solution?"

Moreover, he says that he understands the concerns of insurance providers about providing cover in such cases. Something can be done around the risk pool to cover risks. “It is time to ponder and come up with solutions,” he said, adding that the regulator is working on easing the caps on expenses management as demanded by the industry.

Health insurance providers are not able to sell insurance products because of inadequate hospital infrastructure, terming it a chicken-and egg situation, Panda said in tier II cities.

“Insurance companies and hospitals need to work together and investors need to invest in both these sectors,” he added.

Vinod Paul, member of Niti Ayog emphasised the importance of creating the best health insurance plans that exclude no one and include both the old and those with pre-existing conditions.

The Ayog in its report said that they have the ability to pay a nominal insurance premium but lack awareness of health insurance, or do not have access to suitably priced products.

According to Lav Agarwal, assistant secretary in the Ministry of Health and Family Welfare, the government is working with all stakeholders to ensure that India strengthens its position as a more desirable destination for medical tourism.

“The government is building a ‘Heel in India’ portal that will have the details of all accredited hospitals on a common portal to ensure hassle-free experience for the patients. The portal will also help in assessing the quality of service provided to the patient from his arrival up to post-discharge care. The focus has shifted from providing information to providing services and monitoring these services,” he added.

![submenu-img]() Men in this Indian village have two wives, living under one roof due to…

Men in this Indian village have two wives, living under one roof due to…![submenu-img]() Meet Allah Ghazanfar, Afghanistan's 18-year-old mystery spinner who destroyed South African batting in 1st ODI

Meet Allah Ghazanfar, Afghanistan's 18-year-old mystery spinner who destroyed South African batting in 1st ODI![submenu-img]() Fired techie LinkedIn post goes viral, shares his 'survival' story after working as Swiggy delivery agent

Fired techie LinkedIn post goes viral, shares his 'survival' story after working as Swiggy delivery agent![submenu-img]() Not Soham Shah, but this actor was leading Tumbbad, took no money, gave two months, then hurled abuses on director for..

Not Soham Shah, but this actor was leading Tumbbad, took no money, gave two months, then hurled abuses on director for..![submenu-img]() IND vs BAN 1st Test: Predicted playing XIs, live streaming, pitch report and weather forecast of Chennai

IND vs BAN 1st Test: Predicted playing XIs, live streaming, pitch report and weather forecast of Chennai![submenu-img]() Ajit Doval को यूएस कोर्ट के समन पर भड़का भारत, खालिस्तानी आतंकी Gurpatwant Singh Pannu से जुड़ा है केस

Ajit Doval को यूएस कोर्ट के समन पर भड़का भारत, खालिस्तानी आतंकी Gurpatwant Singh Pannu से जुड़ा है केस![submenu-img]() दिल्ली के बुराड़ी जैसा महाराष्ट्र के धुले में कांड, फंदे से लटकी मिली लाश, जमीन पर पड़े थे 3 शव

दिल्ली के बुराड़ी जैसा महाराष्ट्र के धुले में कांड, फंदे से लटकी मिली लाश, जमीन पर पड़े थे 3 शव![submenu-img]() Jammu and Kashmir Assembly Elections 2024: 'कोई ताकत नहीं लौटा सकती अनुच्छेद 370' PM Modi ने दिया पाकिस्तान को चैलेंज

Jammu and Kashmir Assembly Elections 2024: 'कोई ताकत नहीं लौटा सकती अनुच्छेद 370' PM Modi ने दिया पाकिस्तान को चैलेंज![submenu-img]() IND vs BAN 1st Test Day 1 Highlights: अश्विन का शतक, जडेजा ने भी जमाया रंग; चेन्नई टेस्ट के पहले दिन टीम इंडिया ने बनाए 339 रन

IND vs BAN 1st Test Day 1 Highlights: अश्विन का शतक, जडेजा ने भी जमाया रंग; चेन्नई टेस्ट के पहले दिन टीम इंडिया ने बनाए 339 रन![submenu-img]() इतना आसान नहीं है ‘एक देश-एक चुनाव’, क्या धारा 370 और GST की तरह ��हो सकता है प्रदर्शन?

इतना आसान नहीं है ‘एक देश-एक चुनाव’, क्या धारा 370 और GST की तरह ��हो सकता है प्रदर्शन?![submenu-img]() Ford to return to India after 2 years with reopening of....

Ford to return to India after 2 years with reopening of....![submenu-img]() Maruti Suzuki launches new Swift CNG, check price, mileage, other features

Maruti Suzuki launches new Swift CNG, check price, mileage, other features![submenu-img]() ‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...

‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...![submenu-img]() In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…

In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…![submenu-img]() World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…

World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…![submenu-img]() Meet man, who secured record-breaking package, not from IIT, IIM, NIT, his salary is...

Meet man, who secured record-breaking package, not from IIT, IIM, NIT, his salary is...![submenu-img]() Meet India's first billionaire, who controlled 25% of world's GDP, had 50 Rolls-Royce, way richer than Mukesh Ambani

Meet India's first billionaire, who controlled 25% of world's GDP, had 50 Rolls-Royce, way richer than Mukesh Ambani![submenu-img]() IAS vs IPS: Who earns more? Differences in power, role, responsibilities

IAS vs IPS: Who earns more? Differences in power, role, responsibilities![submenu-img]() Meet boy who got record-breaking salary package from Google, was former Amazon employee, not from IIT, IIM…

Meet boy who got record-breaking salary package from Google, was former Amazon employee, not from IIT, IIM…![submenu-img]() Meet man who became IPS, then cracked UPSC to become IAS officer with AIR 52, is now DM of...

Meet man who became IPS, then cracked UPSC to become IAS officer with AIR 52, is now DM of...![submenu-img]() Delhi New CM: Why Delhi CM Atishi Marlena Singh Dropped Her Middle Name, Fascinating Story Behind It

Delhi New CM: Why Delhi CM Atishi Marlena Singh Dropped Her Middle Name, Fascinating Story Behind It![submenu-img]() Haryana Assembly Election 2024: Congress Announces Seven Guarantees, Check Full List Here I Politics

Haryana Assembly Election 2024: Congress Announces Seven Guarantees, Check Full List Here I Politics![submenu-img]() Lebanon Pager Explosion Update: 8 Killed, 2,750 Injured; Hezbollah Blames Israel For Pager Attack

Lebanon Pager Explosion Update: 8 Killed, 2,750 Injured; Hezbollah Blames Israel For Pager Attack![submenu-img]() Pakistani Intruder Shot Dead By BSF Along International Border In Amritsar, Punjab

Pakistani Intruder Shot Dead By BSF Along International Border In Amritsar, Punjab![submenu-img]() Kolkata Doctor Case: Protesting Doctors React After CBI Arrests Sandip Ghosh And Abhijit Mondal

Kolkata Doctor Case: Protesting Doctors React After CBI Arrests Sandip Ghosh And Abhijit Mondal![submenu-img]() Gautam Adani breaks silence on reports of Kenya Airport Authority accepting his company's proposal in 17 days

Gautam Adani breaks silence on reports of Kenya Airport Authority accepting his company's proposal in 17 days![submenu-img]() Mukesh Ambani's gift for Reliance customers, 1-year Jio AirFiber connection for free but on one condition

Mukesh Ambani's gift for Reliance customers, 1-year Jio AirFiber connection for free but on one condition![submenu-img]() Deepika Padukone buys 1845 sq ft apartment near her mother-in-law's house in Mumbai, it worth Rs...

Deepika Padukone buys 1845 sq ft apartment near her mother-in-law's house in Mumbai, it worth Rs...![submenu-img]() Meet man, who got Rs 30 crore salary hike, leads Rs 1572 crore company that once offered job to Ratan Tata, he is...

Meet man, who got Rs 30 crore salary hike, leads Rs 1572 crore company that once offered job to Ratan Tata, he is...![submenu-img]() Mukesh Ambani buys India’s first Boeing 737 MAX 9, it’s priced over Rs…

Mukesh Ambani buys India’s first Boeing 737 MAX 9, it’s priced over Rs…![submenu-img]() Meet actor who became superstar with blockbuster debut, signed 47 films in 11 days; never gave another hit, is now...

Meet actor who became superstar with blockbuster debut, signed 47 films in 11 days; never gave another hit, is now...![submenu-img]() 7 unsung women scientists whose discoveries changed the world

7 unsung women scientists whose discoveries changed the world![submenu-img]() This controversial film was banned during Emergency, prints were burnt, was reshot but...

This controversial film was banned during Emergency, prints were burnt, was reshot but...![submenu-img]() 10 amazing images captured by Hubble Space Telescope

10 amazing images captured by Hubble Space Telescope![submenu-img]() From Kilimanjaro National Park to Aldabra Atoll: 7 UNESCO world heritage sites that have high entry fees

From Kilimanjaro National Park to Aldabra Atoll: 7 UNESCO world heritage sites that have high entry fees![submenu-img]() Mpox Scare: Man tests positive in Kerala after returning from...

Mpox Scare: Man tests positive in Kerala after returning from...![submenu-img]() Indus Water Treaty: India serves formal notice to Pakistan, seeking...

Indus Water Treaty: India serves formal notice to Pakistan, seeking...![submenu-img]() 'One Nation, One Election' approved by Centre: What it means for India's election system?

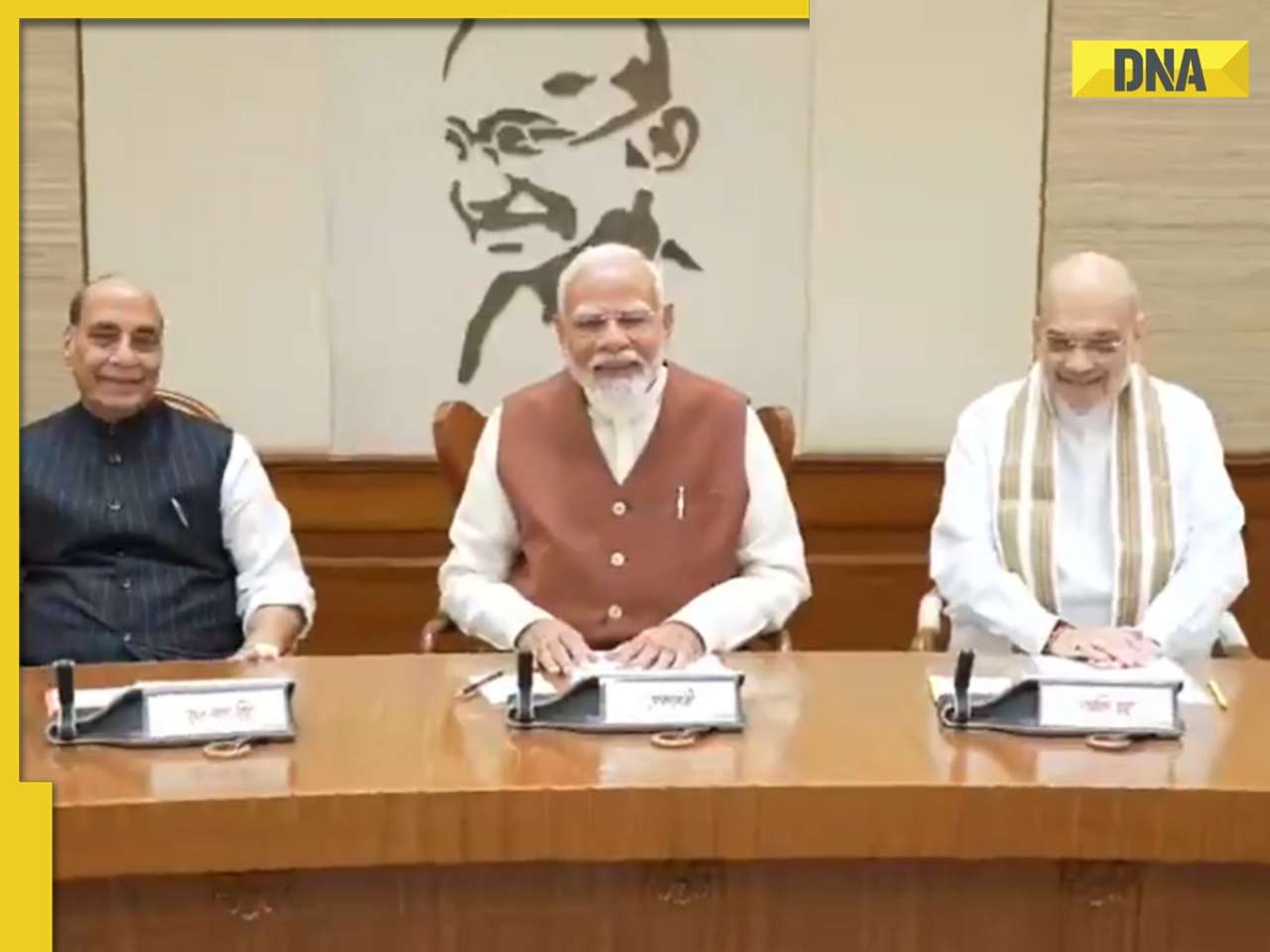

'One Nation, One Election' approved by Centre: What it means for India's election system?![submenu-img]() Kolkata doctor rape-murder case: TMC MP Abhishek Banerjee demands CBI's..., says...

Kolkata doctor rape-murder case: TMC MP Abhishek Banerjee demands CBI's..., says...![submenu-img]() Union Cabinet approves 'One Nation, One Election' proposal, Bill likely in winter session

Union Cabinet approves 'One Nation, One Election' proposal, Bill likely in winter session

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)