In a groundbreaking move set to reshape India’s rental market, RentenPe is launching the country’s first Rent Credit Score and Residence Card (R-Card).

In a groundbreaking move set to reshape India’s rental market, RentenPe is launching the country’s first Rent Credit Score and Residence Card (R-Card). This innovative platform, validated by market research undertaken by the global consultancy Ernst & Young, aims to address a significant gap in the financial ecosystem by recognizing and rewarding tenants for their consistent rent payments, a crucial yet undervalued financial commitment.

Revolutionizing the Rental Market

With nearly 50% of India’s population under the age of 40, many young professionals relocate from smaller towns to major cities, contributing significantly to the nation’s GDP. These individuals often dedicate a substantial portion of their income—up to 30%—to rent, while aspiring to own a home, a symbol of status and security in Indian society.

Despite the regularity and significance of these payments, they remain unacknowledged in traditional financial metrics. Unlike credit card payments or loan EMIs, which contribute to building a positive credit score, rent payments have historically been overlooked, leaving renters without the financial recognition they deserve.

Unlocking the Power of Rent

RentenPe aims to change this by introducing the Rent Credit Score—a pioneering metric specifically designed for the residential rental market. Developed using an advanced algorithm, this score considers a variety of financial, qualitative, and quantitative factors. It enables tenants to build a credit profile based on their rental history, paving the way for better rental agreements, rent loans, pre-approved home loans, and potential savings on rent.

Sarika Shetty, Founder of RentenPe, explains, “We believe that rent, a significant monthly financial commitment, should be recognized in the same way that EMIs and credit card payments are. Our Rent Credit Score and R-Card are designed to empower tenants, giving them the financial recognition they deserve and helping them achieve their long-term goals, including homeownership.”

Validation and Local Impact

RentenPe’s approach is backed by extensive research conducted in partnership with Ernst & Young, which revealed the potential of integrating rent payment data into financial assessments. The research highlighted that India’s residential rental market, valued at INR 1.85 lakh crores across the top seven cities, is expected to grow at a compound annual growth rate (CAGR) of 8-10% over the next five years.

The R-Card: India’s First Digital Rental Identity

Complementing the Rent Credit Score is the R-Card, India’s first digital rental identity. Unlike traditional financial tools, the R-Card acts as a digital ID, offering tenants access to better rental deals, quicker approval processes, and potential rent discounts. For landlords, it provides instant access to verified tenant profiles, early rent facilities, and more, streamlining the rental process and fostering trust.

A Paradigm Shift in India’s Rental Market

As RentenPe prepares for its official launch, the platform is set to drive a fundamental shift in how rent is perceived and valued in India. By turning rent payments into a powerful financial tool, RentenPe is not just launching a new product—it is revolutionizing the rental landscape, creating a more secure and equitable future for tenants and landlords alike.

![submenu-img]() Squid Game 'copied' Sanjay Dutt-starrer Luck, alleges director Soham Shah; Netflix shoots back: 'We intend to...'

Squid Game 'copied' Sanjay Dutt-starrer Luck, alleges director Soham Shah; Netflix shoots back: 'We intend to...'![submenu-img]() Maharashtra govt reschedules Eid-e-Milad holiday in Mumbai from Sept 16 to…

Maharashtra govt reschedules Eid-e-Milad holiday in Mumbai from Sept 16 to…![submenu-img]() 'Vinesh Phogat didn't want to...': Lawyer Harish Salve on wrestler's Paris Olympics medal saga

'Vinesh Phogat didn't want to...': Lawyer Harish Salve on wrestler's Paris Olympics medal saga![submenu-img]() PM Modi welcomes baby calf at his residence, names it 'Deepjyoti': Know what it means

PM Modi welcomes baby calf at his residence, names it 'Deepjyoti': Know what it means![submenu-img]() Longest railway station name in India has 57 letters, it is located in…

Longest railway station name in India has 57 letters, it is located in…![submenu-img]() Bengal में खत्म नहीं हुआ गतिरोध, Mamata Banerjee के साथ डॉक्टरों की मीटिंग फिर फेल

Bengal में खत्म नहीं हुआ गतिरोध, Mamata Banerjee के साथ डॉक्टरों की मीटिंग फिर फेल![submenu-img]() भरे मंच पर रोए Brij Bhushan, जानिए क्यों बोले- मोबाइल में प्रेमानंद महाराज का प्रवचन और नेहा राठौड़ का गाना भी, चुनना आपको है

भरे मंच पर रोए Brij Bhushan, जानिए क्यों बोले- मोबाइल में प्रेमानंद महाराज का प्रवचन और नेहा राठौड़ का गाना भी, चुनना आपको है![submenu-img]() दिल्ली शूटआउट मामले में 5 आरोपी गिरफ्तार, 10 दिन की पुलिस हिरासत में खुलेंगे कई राज

दिल्ली शूटआउट मामले में 5 आरोपी गिरफ्तार, 10 दिन की पुलिस हिरासत में खुलेंगे कई राज![submenu-img]() भारतीय टीम में कौन है सबसे फिट? जसप्रीत बुमराह ने विराट कोहली का नहीं लिया नाम तो सोशल मीडिया पर मचा बवाल

भारतीय टीम में कौन है सबसे फिट? जसप्रीत बुमराह ने विराट कोहली का नहीं लिया नाम तो सोशल मीडिया पर मचा बवाल![submenu-img]() Albert Einstein Letter Auction: 32 करोड़ रुपये में नी��लाम हुआ आइंस्टीन का लेटर, जानें क्या है पूरा माजरा

Albert Einstein Letter Auction: 32 करोड़ रुपये में नी��लाम हुआ आइंस्टीन का लेटर, जानें क्या है पूरा माजरा![submenu-img]() Ford to return to India after 2 years with reopening of....

Ford to return to India after 2 years with reopening of....![submenu-img]() Maruti Suzuki launches new Swift CNG, check price, mileage, other features

Maruti Suzuki launches new Swift CNG, check price, mileage, other features![submenu-img]() ‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...

‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...![submenu-img]() In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…

In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…![submenu-img]() World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…

World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…![submenu-img]() NEET SS 2024: Tentative schedule out, exam likely on...

NEET SS 2024: Tentative schedule out, exam likely on...![submenu-img]() Meet man, popular online tutor who cracked UPSC in 1st attempt, resigned as IAS officer after 1 year due to…

Meet man, popular online tutor who cracked UPSC in 1st attempt, resigned as IAS officer after 1 year due to…![submenu-img]() Meet man, who worked as coolie, later cracked UPSC exam to become IAS officer, he was killed by...

Meet man, who worked as coolie, later cracked UPSC exam to become IAS officer, he was killed by...![submenu-img]() Meet IIT-JEE topper with AIR 1, went to IIT Bombay, got job with Rs 70 lakh salary, left it for...

Meet IIT-JEE topper with AIR 1, went to IIT Bombay, got job with Rs 70 lakh salary, left it for...![submenu-img]() Meet man, who lost father at 5, grew up in orphanage, didn't crack UPSC exam but became IAS officer, is posted at..

Meet man, who lost father at 5, grew up in orphanage, didn't crack UPSC exam but became IAS officer, is posted at..![submenu-img]() Jaishankar: EAM Dr. S. Jaishankar On India-China Relations & Disengagement Problems | Ladakh

Jaishankar: EAM Dr. S. Jaishankar On India-China Relations & Disengagement Problems | Ladakh![submenu-img]() Trump vs Harris: Donald Trump Says He Will Not Debate Kamala Harris Again | US Presidential Debate

Trump vs Harris: Donald Trump Says He Will Not Debate Kamala Harris Again | US Presidential Debate![submenu-img]() Delhi Gym News: Afghan-Origin Gym Owner Shot Dead In Delhi | Caught On CCTV

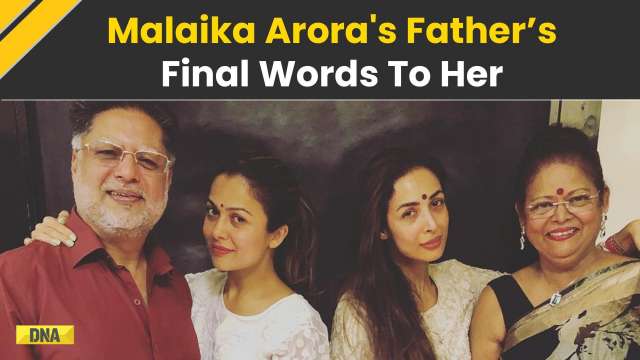

Delhi Gym News: Afghan-Origin Gym Owner Shot Dead In Delhi | Caught On CCTV![submenu-img]() Malaika Arora Father Death: Anil Mehta's Final Words To His Daughter Malaika Arora

Malaika Arora Father Death: Anil Mehta's Final Words To His Daughter Malaika Arora![submenu-img]() Chandigarh Blast: Grenade Explosion In Sector 10; Auto Driver Arrested, Investigation Ongoing

Chandigarh Blast: Grenade Explosion In Sector 10; Auto Driver Arrested, Investigation Ongoing![submenu-img]() Meta CEO Mark Zuckerberg reveals biggest mistake of his career, claims it is...

Meta CEO Mark Zuckerberg reveals biggest mistake of his career, claims it is...![submenu-img]() Meet Indian man, who left his job in US, started business from Rs 40000, now leads company worth Rs 18765 crore, he is..

Meet Indian man, who left his job in US, started business from Rs 40000, now leads company worth Rs 18765 crore, he is..![submenu-img]() Meet man, a billionaire, who hosts Kim Kardashian, Leonardo DiCaprio, Katy Perry on his superyacht for...

Meet man, a billionaire, who hosts Kim Kardashian, Leonardo DiCaprio, Katy Perry on his superyacht for...![submenu-img]() Meet Indian-born engineer behind Amazon's Alexa, now among TIME100 most influential people in AI 2024 list, he is...

Meet Indian-born engineer behind Amazon's Alexa, now among TIME100 most influential people in AI 2024 list, he is...![submenu-img]() Meet Indian genius, went to IIT, studied with Shah Rukh Khan, tragically lost his life due to...

Meet Indian genius, went to IIT, studied with Shah Rukh Khan, tragically lost his life due to...![submenu-img]() Bollywood's highest-paid bodyguards earn in crores each year; here's how much Salman, SRK pay their trusted protectors

Bollywood's highest-paid bodyguards earn in crores each year; here's how much Salman, SRK pay their trusted protectors![submenu-img]() 6 most haunted places in the world

6 most haunted places in the world![submenu-img]() Good news for Reliance Jio users: Mukesh Ambani offers 5 best Jio plans under Rs 300 with unlimited...

Good news for Reliance Jio users: Mukesh Ambani offers 5 best Jio plans under Rs 300 with unlimited...![submenu-img]() This Bollywood outsider sang at weddings, in trains, was rejected from TV shows; now gives Rs 100-crore blockbusters

This Bollywood outsider sang at weddings, in trains, was rejected from TV shows; now gives Rs 100-crore blockbusters ![submenu-img]() In pics: Priyanka Chopra dons sizzling bikinis, enjoys yacht time with Nick Jonas, Malti Marie on European vacation

In pics: Priyanka Chopra dons sizzling bikinis, enjoys yacht time with Nick Jonas, Malti Marie on European vacation![submenu-img]() Maharashtra govt reschedules Eid-e-Milad holiday in Mumbai from Sept 16 to…

Maharashtra govt reschedules Eid-e-Milad holiday in Mumbai from Sept 16 to…![submenu-img]() Lucknow: Section 163 imposed in UP capital till this date, reason is...

Lucknow: Section 163 imposed in UP capital till this date, reason is...![submenu-img]() Ayushman Bharat health insurance for senior citizens: Eligibility, benefits, how to apply

Ayushman Bharat health insurance for senior citizens: Eligibility, benefits, how to apply![submenu-img]() Picture of Lord Ganesha’s idol in police van sparks row in Bengaluru: Here's what we know so far

Picture of Lord Ganesha’s idol in police van sparks row in Bengaluru: Here's what we know so far![submenu-img]() Delhi records year's cleanest air quality as AQI drops to...

Delhi records year's cleanest air quality as AQI drops to...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)