But chief minister says cost will be recovered by raising revenue from sales tax, stamp duty.

The state government which boasted of a surplus budget at the start of the financial year on Wednesday feared that the tax concessions extended by the state government and the Centre will lead to a deficit budget. The tax relief given on diesel and kerosene prices will cost the state exchequer almost Rs1,400 crore.

Chief minister Prithviraj Chavan said, “The state decision to enforce a 2% cut on VAT to bring down prices of diesel and kerosene will cause state treasury a revenue loss of Rs438 crore. And the Centre’s decision to cut down excise and customs duties will directly bring down the state tax share by Rs800 to Rs1,000 crore.”

Responding to harsh reactions from the people, the state cabinet decided to reduce the sales tax on diesel by 2%. This would result in the loss of Rs438 crore to the state exchequer. Apart from this, the devolution of state tax share by the Centre will reduce by Rs820 crore due to the reduction in the excise and customs duty.

“The loss to the Centre due to the reduction is nearly Rs49,000 crore per annum. Of that the devolution to Maharashtra would have been 5.16% or nearly Rs820 crore. This may result in defusing our plan of surplus budget for the current financial year,” Chavan said.

Though Chavan asserted that his government would not let the development projects hit, he admitted that it would be a tough task before him. “Our endeavour would be to utilise plan and non-plan allocation at its fullest on development projects. We will try to raise the revenue from other heads like sales tax, stamp duty,” he said.

However, the question being raised is the reduction of 72 paise per litre on diesel was only amount that was resulted as the unexpected windfall to the state revenue due to the hike of Rs3 per liter by the Centre four days ago. “26% VAT on Rs3 results in the revenue of 72 paise to the state exchequer. Today’s announcement was nothing but state’s act of giving up the additional income resulted due to the hike,” said an observer.

“It cannot be termed as the unexpected windfall as when we plan the annual budget, we anticipate some hike in the fuel prices and hence the rise in the revenue through taxes. The hike was expected and hence it’s a loss to the revenue,” said Sudhir Srivatsava, principal secretary, finance department.

Justifying the decision of not reducing the domestic cylinder prices, Chavan put the ball in Centre’s court saying that the state government has proposed the dual subsidy on the domestic cylinders.

![submenu-img]() DNA TV Show: Indian Army's 'Operation All-Out' in J-K ahead of Assembly Polls

DNA TV Show: Indian Army's 'Operation All-Out' in J-K ahead of Assembly Polls![submenu-img]() Deepinder Goyal's Zomato gets Rs 45900000 notices from two states for...

Deepinder Goyal's Zomato gets Rs 45900000 notices from two states for...![submenu-img]() 'Going on record...': Zaheer Khan bats for controversial rule in IPL amid mixed reactions from Rohit, Kohli

'Going on record...': Zaheer Khan bats for controversial rule in IPL amid mixed reactions from Rohit, Kohli![submenu-img]() Paris Paralympics: Archer Sheetal Devi finishes second in compound ranking round, misses world record by...

Paris Paralympics: Archer Sheetal Devi finishes second in compound ranking round, misses world record by...![submenu-img]() ‘Come quickly...': Audio clips of phone calls from RG Kar Hospital to victim's father spark fresh controversy

‘Come quickly...': Audio clips of phone calls from RG Kar Hospital to victim's father spark fresh controversy![submenu-img]() गुजरात में बारिश का तांडव, अब तक 32 लोगों की मौत, बाढ़ की चपेट में 18 जिले, हेलिकॉप्टर से रेस्क्यू

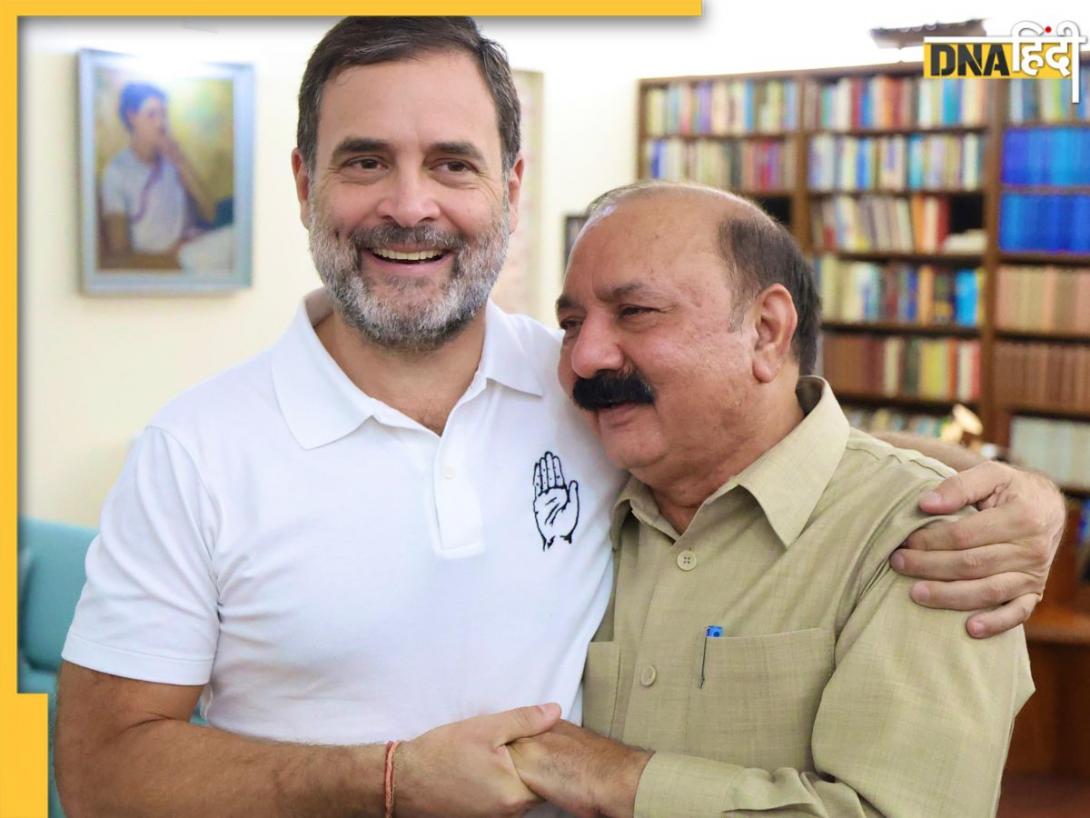

गुजरात में बारिश का तांडव, अब तक 32 लोगों की मौत, बाढ़ की चपेट में 18 जिले, हेलिकॉप्टर से रेस्क्यू![submenu-img]() राहुल गांधी से किशोरी लाल शर्मा तक... लोकसभा चुनाव में कांग्रेस के किस नेता पर कितना पैसा हुआ खर्च, जानें

राहुल गांधी से किशोरी लाल शर्मा तक... लोकसभा चुनाव में कांग्रेस के किस नेता पर कितना पैसा हुआ खर्च, जानें![submenu-img]() शिवाजी स्टैच्यू विवाद ने महायुति के बीच बढ़ाई टेंशन, शिंदे-अजीत मांग रहे माफी, BJP फोड़ रही ठीकरा

शिवाजी स्टैच्यू विवाद ने महायुति के बीच बढ़ाई टेंशन, शिंदे-अजीत मांग रहे माफी, BJP फोड़ रही ठीकरा![submenu-img]() Farrukhabad Death Case : 'जिसका वजन ज्यादा वो ऊपर कैसे है...' पेड़ पर लटकी मिली दो लड़कियों के शव पर पिता के आरोप

Farrukhabad Death Case : 'जिसका वजन ज्यादा वो ऊपर कैसे है...' पेड़ पर लटकी मिली दो लड़कियों के शव पर पिता के आरोप ![submenu-img]() राहुल गांधी को लेकर स्मृति ईरानी के बदले सुर, कांग्रेस नेता की राजनीति और 'सफेद टी-शर्ट' पर कही ये बात

राहुल गांधी को लेकर स्मृति ईरानी के बदले सुर, कांग्रेस नेता की राजनीति और 'सफेद टी-शर्ट' पर कही ये बात![submenu-img]() Days after ex-IAS trainee Puja Khedkar case, UPSC to use this method for candidates’ verifications

Days after ex-IAS trainee Puja Khedkar case, UPSC to use this method for candidates’ verifications![submenu-img]() Meet IITian, who left his high-paying job at Samsung for UPSC exam, became IAS officer, secured AIR...

Meet IITian, who left his high-paying job at Samsung for UPSC exam, became IAS officer, secured AIR...![submenu-img]() Meet woman who cracked UPSC exam twice, her husband and brother are IAS officers, she is now posted as…

Meet woman who cracked UPSC exam twice, her husband and brother are IAS officers, she is now posted as…![submenu-img]() Meet girl, bus driver's daughter who cracked NEET-UG in second attempt, she scored...

Meet girl, bus driver's daughter who cracked NEET-UG in second attempt, she scored...![submenu-img]() Meet woman who cracked UPSC exam in third attempt, became IPS officer, known as 'Lady Singham' for...

Meet woman who cracked UPSC exam in third attempt, became IPS officer, known as 'Lady Singham' for...![submenu-img]() Tripura Floods: 12 Killed, Over 300 Rescued As Heavy Rains Causes Severe Flooding In Tripura

Tripura Floods: 12 Killed, Over 300 Rescued As Heavy Rains Causes Severe Flooding In Tripura![submenu-img]() Kolkata Doctor Murder: Are Indian Rape Laws Enough? Public Opinion On Stricter Measures

Kolkata Doctor Murder: Are Indian Rape Laws Enough? Public Opinion On Stricter Measures![submenu-img]() PM Modi In Poland: Calls For 'Restoration Of Peace' Amid Russia-Ukraine War | Warsaw

PM Modi In Poland: Calls For 'Restoration Of Peace' Amid Russia-Ukraine War | Warsaw![submenu-img]() Neeraj Chopra Bags Second Spot In Lausanne Diamond League 2024, Surpasses Paris Olympic Throw

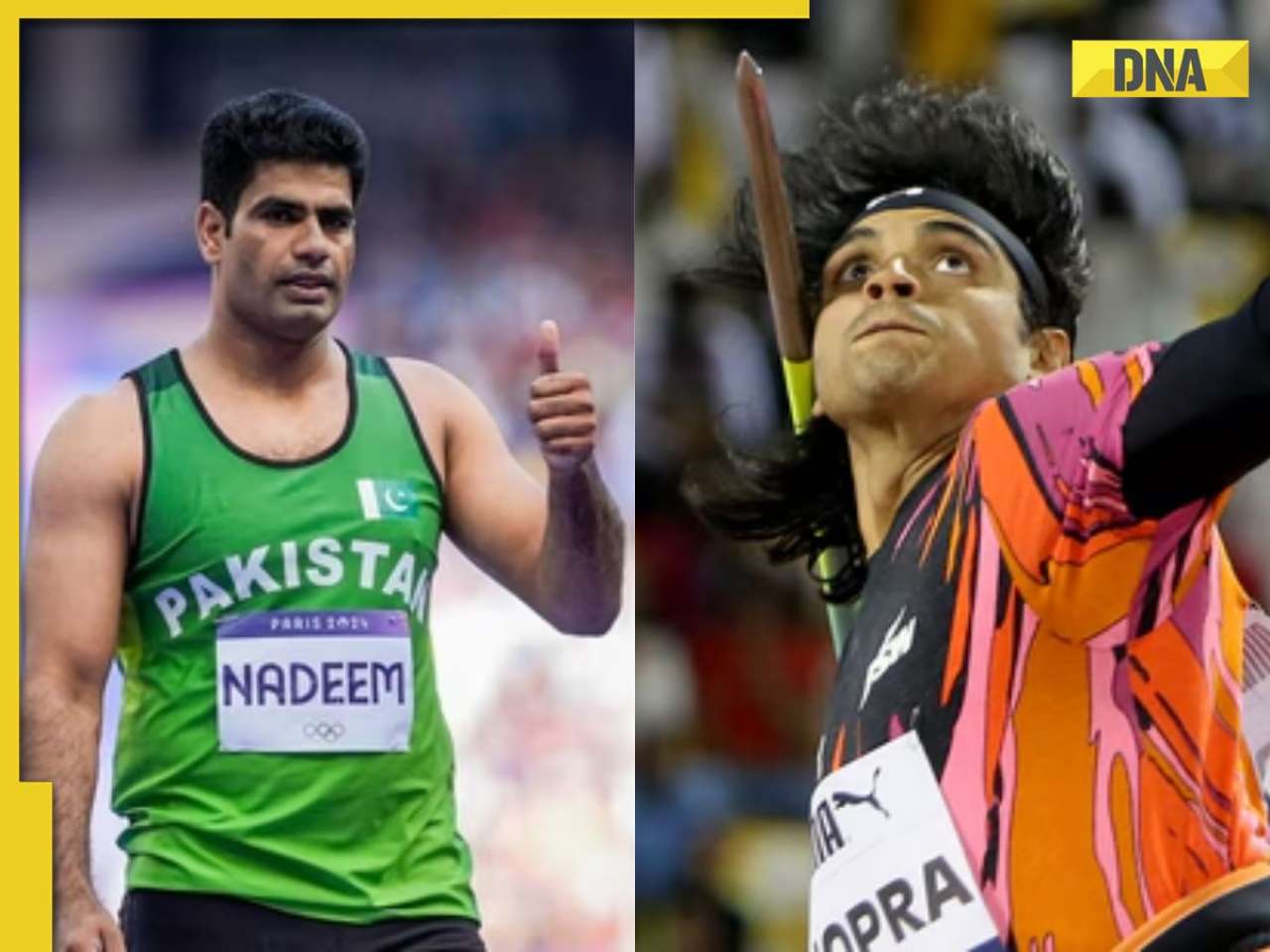

Neeraj Chopra Bags Second Spot In Lausanne Diamond League 2024, Surpasses Paris Olympic Throw![submenu-img]() Surat Metro Construction Mishap: Crane Topples Onto Vacant Building, No Casualties Reported

Surat Metro Construction Mishap: Crane Topples Onto Vacant Building, No Casualties Reported![submenu-img]() Neeraj Chopra, Manu Bhaker, Vinesh Phogat: How much did brand value of star athletes jump after Paris Olympics?

Neeraj Chopra, Manu Bhaker, Vinesh Phogat: How much did brand value of star athletes jump after Paris Olympics?![submenu-img]() Manu Bhaker wants to spend time with this Indian sportsperson and it's not Neeraj Chopra

Manu Bhaker wants to spend time with this Indian sportsperson and it's not Neeraj Chopra![submenu-img]() Neeraj Chopra's net worth before Olympics was Rs 25 cr, Arshad's net worth was Rs 80 lakh, their current net worth is...

Neeraj Chopra's net worth before Olympics was Rs 25 cr, Arshad's net worth was Rs 80 lakh, their current net worth is...![submenu-img]() Vinesh Phogat's net worth was just Rs 5 crore before Paris Olympics, her current net worth is Rs…

Vinesh Phogat's net worth was just Rs 5 crore before Paris Olympics, her current net worth is Rs…![submenu-img]() What is the price, length and weight of Neeraj Chopra and Olympic gold medalist Arshad Nadeem's javelin?

What is the price, length and weight of Neeraj Chopra and Olympic gold medalist Arshad Nadeem's javelin?![submenu-img]() Called first lady of Indian cinema, this actress left husband to elope with her co-star, married Russian painter; then..

Called first lady of Indian cinema, this actress left husband to elope with her co-star, married Russian painter; then..![submenu-img]() 5 symptoms of colon cancer to never ignore

5 symptoms of colon cancer to never ignore![submenu-img]() From Naukuchital to Solan: Top 5 hill stations in North India for a weekend rewind

From Naukuchital to Solan: Top 5 hill stations in North India for a weekend rewind![submenu-img]() Foods that can develop cancer-causing chemicals when overcooked

Foods that can develop cancer-causing chemicals when overcooked ![submenu-img]() One of the biggest box office flops lost Rs 1100 crore, studio boss was fired, director went in hiding, star disappeared

One of the biggest box office flops lost Rs 1100 crore, studio boss was fired, director went in hiding, star disappeared![submenu-img]() ‘Come quickly...': Audio clips of phone calls from RG Kar Hospital to victim's father spark fresh controversy

‘Come quickly...': Audio clips of phone calls from RG Kar Hospital to victim's father spark fresh controversy![submenu-img]() Pakistan formally invites PM Modi to Islamabad for SCO meeting

Pakistan formally invites PM Modi to Islamabad for SCO meeting![submenu-img]() Gujarat rains: IMD predicts extremely heavy rainfall in Saurashtra, Kutch, several other regions till...; check forecast

Gujarat rains: IMD predicts extremely heavy rainfall in Saurashtra, Kutch, several other regions till...; check forecast![submenu-img]() INS Arighat: India's second nuclear-powered submarine commissioned, check specifications here

INS Arighat: India's second nuclear-powered submarine commissioned, check specifications here![submenu-img]() Assam passes Bill abolishing Muslim marriages, divorce act, mandates govt registration, CM Himanta says ‘next target..'

Assam passes Bill abolishing Muslim marriages, divorce act, mandates govt registration, CM Himanta says ‘next target..'![submenu-img]() Malayalam cinema's sexual abuse scandal explained: How sexual assault of star in 2017 led to Mollywood's #MeToo moment

Malayalam cinema's sexual abuse scandal explained: How sexual assault of star in 2017 led to Mollywood's #MeToo moment![submenu-img]() Jammu and Kashmir Assembly elections: What is delimitation that paved the road for these Elections?

Jammu and Kashmir Assembly elections: What is delimitation that paved the road for these Elections?![submenu-img]() Wings of Refuge: Rafales escort Hasina to safety

Wings of Refuge: Rafales escort Hasina to safety![submenu-img]() Bangladesh in a crisis: A coup, protests and a fleeing Prime Minister

Bangladesh in a crisis: A coup, protests and a fleeing Prime Minister![submenu-img]() DNA Explainer: What is Waqf Board Act and why does Modi government want to amend it?

DNA Explainer: What is Waqf Board Act and why does Modi government want to amend it?

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)