- LATEST

- WEBSTORY

- TRENDING

BUSINESS

‘General Motors should not be bailed out’

General Motors (GM), the largest American automobile company, had been telling the world that things were fine with it.

TRENDING NOW

General Motors (GM), the largest American automobile company, had been telling the world that things were fine with it. After all it was sitting on $30 billion of cash, so where was the question of going bankrupt.

Then came the shocker in October. Vehicle sales in the US fell by 45% over the same period last year. Reports suggest that the company is losing $2 billion a month and now has around $16 billion left. Auto experts believe that the company will not be able to survive unless the US Federal Reserve comes to its rescue.

Moreover, GM also expects to be bailed out. GM president Fritz Henderson, in a conference call with analysts to announce a third quarter loss of $2.5 billion, said, “Immediate federal funding is essential in order for the US automotive industry to weather this downturn.”

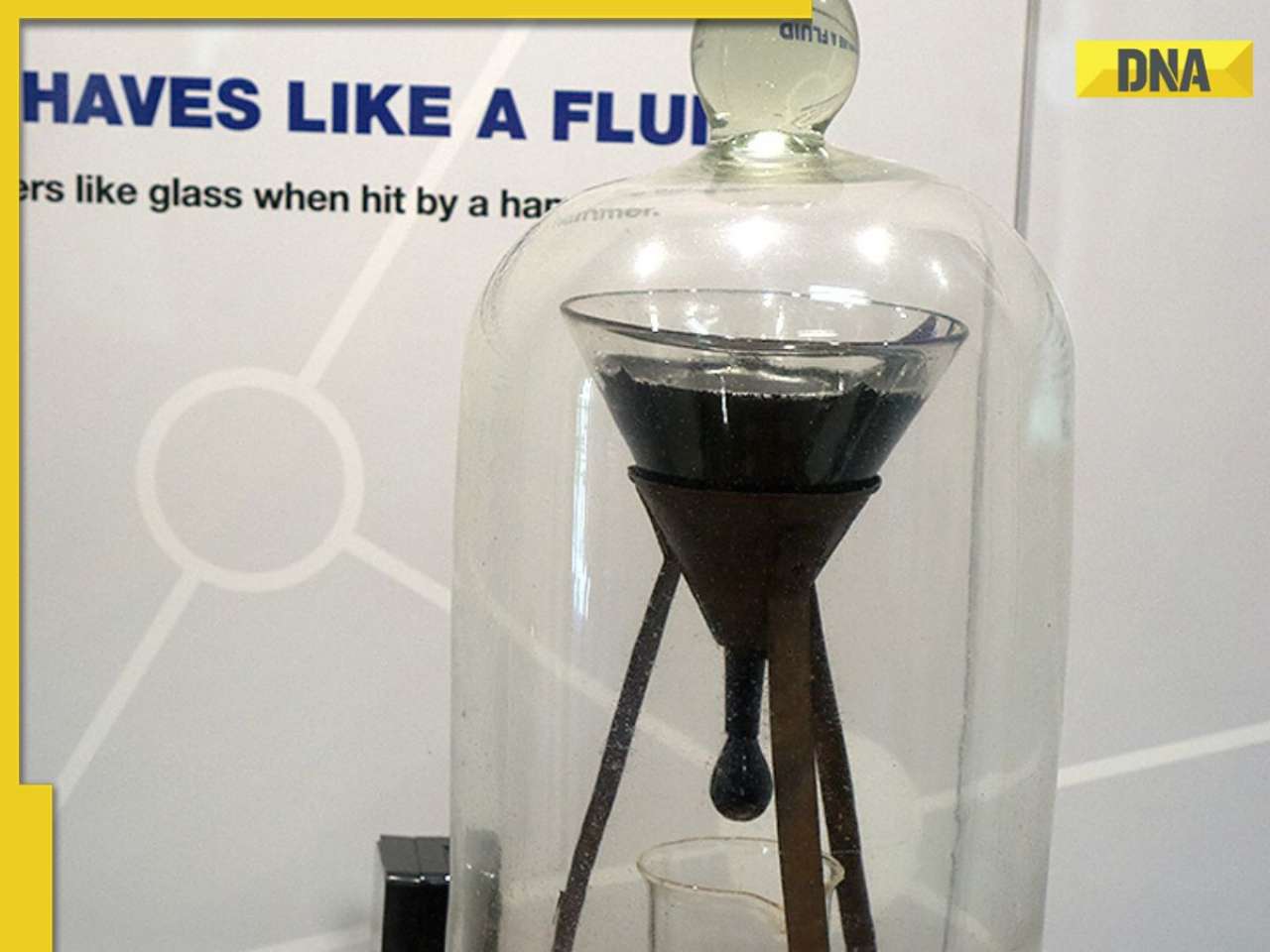

But would that be a wise thing to do? “If you start spending on General Motors it will be a black hole,” says Anil Kashyap, Edward Eagle Brown professor of economics and finance at the University of Chicago Booth School of Business (formerly the Graduate School of Business (GSB), University of Chicago). “General Motors has been in trouble for years. It is just pure fiction to say that the reason why the auto industry is now in trouble is because of the financial crisis,” he tells DNA Money’s Vivek Kaul in an interview. Excerpts:

The US Federal Reserve came to the rescue of Bears Stearns, Fannie Mae, Freddie Mac and AIG, but let Lehman Brothers go under. Why did they do that?

Lehman Brothers was in a much worse shape than it was publicly admitting. I think the narrow lawyerly answer that Ben Bernanke has given is that when Lehman Brothers went to ask for a loan they couldn’t convince themselves that Lehman Brothers was actually solvent and that they would have been breaking the law by making a loan to these guys. That’s a part of it.

And I think the subtext there is that right before Lehman asked the Fed and Treasury for assistance, they were shopping themselves to other buyers and no one was willing to buy them, when they (prospective buyers) saw how aggressively they (Lehman) had valued their assets. Other buyers came away convinced that the value wasn’t there.

Also, partly the Fed and the Treasury thought that if we reward these guys essentially for lying about the condition of their balance-sheet and bail them out, we were going to set a precedent where everybody has a strong incentive to try to mislead people and say that things are okay, knowing that even if you get caught, you are going to be safe.

There was also the idea that they thought maybe they could contain the damage. They had six months to think about how Bears Stearns had caused them to have to make an immediate rescue. So they had some time to set up some institutional back stops to try to make it possible for Lehman go under without the money markets having to freeze up. That ended up working not as well as they would have hoped.

Now the critics would say by not rescuing them they (US Fed and Treasury) broke the promise that people thought they had made with the market that anybody that was bigger than Bears Stearns was going to be gently bailed out in one way or another. I think that created a shock. That led to a lot of people becoming more cautious.

Do you feel we will see more financial institutions going bust in the days to come?

The history of these crises suggests that we probably haven’t seen the last one to go. But if you look around who is left, they will all tell you that they are very healthy and safe. If the economy keeps sliding the way it is, some of these guys are going to take losses on parts of their portfolio that had nothing to do with the original subprime and real-estate lending.

Credit card losses in United States are going to be quite high. Some people who lose their jobs are going to stop paying their credit card dues. When that comes, some of these organisations that said “oh we thought we were fine” are going to discover that they have more exposure to the business cycle than they had cared to admit.

So, basically what you are saying is that now the problems will spill to other kinds of securitised assets like credit card receivables, auto loans etc?

Yes, I certainly think there is a risk of that. The government needs to be careful that it doesn’t essentially trigger some of this. I mean headlines today are things like Treasury bailouts, shifts to consumer focus etc.

With this, people start getting the idea that if you stop paying your bills the government is going to help you. There is a real risk of the government actually giving people incentives to stop following the rules.

What does it mean for the Fed and Treasury going ahead? Do you see them rescuing more distressed institutions?

I don’t know whether they will rescue them, but we can’t assume that no one else will fail. We are going to get a very strong test case with the auto industry in the United States. General Motors has been in trouble for years. It is just pure fiction to say that the reason why the auto industry is now in trouble is because of the financial crisis.

These companies have had huge problems with their product offerings, labour contracts and management direction. If the government still goes in and gives them a big bailout, the line is going to be huge. And the amount of money that could be handed out could be huge. So, the money that might be available for the financial system could dry quite quickly. This could change the dynamics.

Do you feel that a temporary freeze on foreclosures could avoid an even more severe financial crisis?

Maybe then you have an incentive to stop repaying your mortgages. Once you start rewarding people who have gotten themselves into trouble, it is very tricky to keep everybody else behaving to the normal rule. People say that no one is going to wreck their credit rating and stop paying if they could. I am not confident that is true.

If you get into a situation where the widespread view becomes that everybody is getting a handout, here is what I need to get mine, then you could really trigger a huge shift in behaviour with fairly disastrous consequences for the economy. So, I am very nervous about these holidays that essentially reward people who did reckless things. Most of the people did not do reckless things. There is already a lot of anger about the assistance given to the financial institutions because I think that was explained very badly.

Henry Paulson on Wednesday said that he was scrapping the plan to use money from the troubled asset relief programme (popularly referred to as the bailout package) to buy troubled mortgaged assets. What do you have to say about that?

He could never explain how it was going to help and that would have been a potential big waste of money. Also, it would be better if they weren’t talking about using that money to rescue auto makers. The reason for wanting to rescue the financial system is quite clear.

When one bank fails or gets into trouble, it’s possible that you get this domino effect that kind of spreads and it spreads much more quickly than it does for non-financial firms. And, as soon as you get credit availability drying up which has happened quite abruptly in the United States, you can take something that would be a mild downturn and turn it into a very serious recession.

So, focusing like a laser in trying to fix the financial system, I think, makes a great deal of sense. By not focusing, you end up wasting money on firms that are going to fail anyway. This can lead to the banking system still being undercapitalised and not intermediating. So you get the worst of both worlds.

And if we bail out General Motors and other auto makers now, I don’t think we are going to turn them around. We are going to put off the day of reckoning and we will end up spending the taxpayers’ money that will not be repaid because they will again go bankrupt in a year or two.

Will the $700 billion rescue package be enough?

If you start spending it on General Motors that is a black hole. Also, if some private participation in distressed institutions is allowed that would help. If you can’t get some assistance from the private sector maybe that means that you are not really viable. I would like to see them doing audits of those financial institutions. In these audits, same prices should be used to evaluate the assets of all the different financial institutions so they can’t cherry pick the prices that they like. So that there is some confidence that the firms you are helping are clearly solvent. They haven’t announced that part yet.

What do you think should be the priorities of the new US Treasury secretary when he takes over?

Stabilising the financial system and making sure that these bailouts are kind of focused and not just across the board. There is going to be intense political pressure to bail out anything that moves or anything or anyone that can lobby.

What is your take on the US dollar? Will this crisis accelerate the decline of the dollar?

The problem is if you don’t want to put your money in the dollar, where do you think it’s safer? I think whether or not the US is still viewed as the safest place depends on a few issues.

If we regulate our financial system in a dreadful way or we issue a bunch of government debt to bail out these failing industries, then you could make US a much less attractive place to invest. But I think you know US looks good relative to many other major economies.

If we were talking about Japan we could be spending a lot of time looking at the risks there. If we were talking about Europe they have got many of these same problems. For the next few months dollar should be okay. At some point some part of the world is going to get its policy in order and stabilise and start growing again and then the question is whether people will start moving their money there.

When do you see the current turmoil ending?

If we can get the financial system stabilised and we can get people thinking growth will resume again by the spring and businesses start hiring again, we can kind of avoid this double death and maybe by the next summer US can start going back to trend levels of growth. If the financial system is still screwed up, if businesses are still being super cautious with their hiring, then I think, you are going to get this protracted decline in consumption and we could be in for a really dreadful 2009. I don’t think the die is cast whatsoever. We have to wait and see what Barack Obama’s priorities are, once he gets into office. That is going to be a big difference.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)