For many college students, finding ways to earn extra income while studying is a priority. Forex trading has emerged as an appealing option due to its potential for profit and the flexibility it offers.

However, diving into the world of Forex trading requires careful consideration, especially when balancing it with academic commitments. A critical question to address first is, "Is Forex trading legal in India?" Understanding the legal framework and developing a thoughtful approach are essential steps for students looking to explore Forex trading safely alongside their studies. This article provides insights on how to manage both effectively.

Understanding the Basics of Forex Trading

Forex, or foreign exchange trading, involves buying and selling currencies with the aim of making a profit. The Forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6.6 trillion. However, it’s also a complex and volatile market, which makes understanding the basics essential for anyone considering this form of investment.

For college students, the first step is education. Numerous online resources, including free courses, webinars, and tutorials, are available to help beginners understand how the market operates. Students should focus on learning about currency pairs, market trends, and trading strategies. It’s also essential to understand the risks involved, as Forex trading can lead to significant losses if not approached carefully.

Time Management: Balancing Studies and Trading

One of the biggest challenges for college students interested in Forex trading is time management. Balancing studies with trading requires discipline and a structured schedule. Students should prioritise their academics and ensure that trading activities do not interfere with their studies.

A practical approach is to set specific trading times that do not clash with classes or study sessions. The Forex market operates 24 hours a day, five days a week, allowing students to trade at times that suit their academic schedule. Using tools like trading alerts and automated trading platforms can also help manage time more effectively, enabling students to focus on their studies while staying informed about market movements.

Starting Small: Minimising Risk in Forex Trading

For college students, it’s wise to start small when venturing into Forex trading. This means investing only a small amount of money initially and gradually increasing it as they gain more experience and confidence.

Risk management tools such as stop-loss orders are also crucial in protecting investments. These tools automatically close a trade when the market moves against the trader, limiting potential losses. Students should also avoid using high leverage, which can amplify both gains and losses, making it a risky choice for beginners.

Conclusion: A Balanced Approach to Forex Trading

Forex trading offers college students a unique opportunity to earn extra income while developing valuable financial skills. However, it’s essential to approach this venture with caution, prioritising education, time management, and risk minimisation. By understanding the legal aspects and starting small, students can safely explore Forex trading without compromising their academic responsibilities.

(This article is part of DMCL Consumer Connect Initiative, a paid publication programme. DMCL claims no editorial involvement and assumes no responsibility, liability or claims for any errors or omissions in the content of the article. The DMCL Editorial team is not responsible for this content.)

![submenu-img]() Olivia Munn, John Mulaney welcome their second child via surrogacy; reveal face of their newborn baby daughter

Olivia Munn, John Mulaney welcome their second child via surrogacy; reveal face of their newborn baby daughter![submenu-img]() Meet man, one of youngest Indian CEOs, has net worth of Rs 4300 crore, runs company worth Rs...

Meet man, one of youngest Indian CEOs, has net worth of Rs 4300 crore, runs company worth Rs...![submenu-img]() Harnessing Predictive Analytics to Transform Credit Risk Assessment: Insights from Saugat Nayak

Harnessing Predictive Analytics to Transform Credit Risk Assessment: Insights from Saugat Nayak![submenu-img]() WTC 2023-25 Points Table: Updated World Test Championship standings after Sri Lanka stun New Zealand in Galle

WTC 2023-25 Points Table: Updated World Test Championship standings after Sri Lanka stun New Zealand in Galle![submenu-img]() Aamir Khan reacts after Laapataa Ladies is selected as India's official entry for Oscars 2025: 'So proud of Kiran'

Aamir Khan reacts after Laapataa Ladies is selected as India's official entry for Oscars 2025: 'So proud of Kiran'![submenu-img]() बदलापुर रेपकांड के आरोपी अक्षय शिंदे की मौत, पुलिस की रिवॉल्वर छीनकर की थी फायरिंग

बदलापुर रेपकांड के आरोपी अक्षय शिंदे की मौत, पुलिस की रिवॉल्वर छीनकर की थी फायरिंग![submenu-img]() Israel ने Hezbollah के ठिकानों पर की एयरस्ट्राइक, 100 की मौत और 400 के घायल होने का अनुमान

Israel ने Hezbollah के ठिकानों पर की एयरस्ट्राइक, 100 की मौत और 400 के घायल होने का अनुमान ![submenu-img]() 'पहले जैसा कॉन्फिडेंस नहीं, अब 56 इंच का सीना भी...' राहुल गांधी का PM मोदी पर तंज

'पहले जैसा कॉन्फिडेंस नहीं, अब 56 इंच का सीना भी...' राहुल गांधी का PM मोदी पर तंज![submenu-img]() तिरुपति लड्डू विवाद: मोदी सरकार का एक्शन, घी सप्लाई करने वाली कंपनी को भेजा नोटिस

तिरुपति लड्डू विवाद: मोदी सरकार का एक्शन, घी सप्लाई करने वाली कंपनी को भेजा नोटिस![submenu-img]() Stock Market: शेयर बाजार ने बनाया नया रिकॉर्ड, Sensex 85000 के करीब, ये 10 शेयर बने रॉकेट

Stock Market: शेयर बाजार ने बनाया नया रिकॉर्ड, Sensex 85000 के करीब, ये 10 शेयर बने रॉकेट![submenu-img]() Ford to return to India after 2 years with reopening of....

Ford to return to India after 2 years with reopening of....![submenu-img]() Maruti Suzuki launches new Swift CNG, check price, mileage, other features

Maruti Suzuki launches new Swift CNG, check price, mileage, other features![submenu-img]() ‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...

‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...![submenu-img]() In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…

In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…![submenu-img]() World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…

World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…![submenu-img]() Meet woman, IIT graduate, who left bank job to become state topper in UPSC, now working as...

Meet woman, IIT graduate, who left bank job to become state topper in UPSC, now working as...![submenu-img]() Meet IPS officer, who has resigned after 10 yrs of service to work in...

Meet IPS officer, who has resigned after 10 yrs of service to work in...![submenu-img]() Meet IAS officer Tina Dabi, Ria Dabi’s mother, who cleared UPSC, became IES officer, later resigned due to...

Meet IAS officer Tina Dabi, Ria Dabi’s mother, who cleared UPSC, became IES officer, later resigned due to...![submenu-img]() Meet man, who cleared JEE twice but left IIT, cracked UPSC exam with AIR 38, resigned as IAS officer to become…

Meet man, who cleared JEE twice but left IIT, cracked UPSC exam with AIR 38, resigned as IAS officer to become…![submenu-img]() IAS officer Tina Dabi’s schedule shows she studied 11-hour a day; check UPSC topper's marksheet and time table

IAS officer Tina Dabi’s schedule shows she studied 11-hour a day; check UPSC topper's marksheet and time table![submenu-img]() Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical

Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical![submenu-img]() Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval

Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval![submenu-img]() Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?

Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?![submenu-img]() One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0

One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0![submenu-img]() Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed

Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed![submenu-img]() Meet man, one of youngest Indian CEOs, has net worth of Rs 4300 crore, runs company worth Rs...

Meet man, one of youngest Indian CEOs, has net worth of Rs 4300 crore, runs company worth Rs...![submenu-img]() Harnessing Predictive Analytics to Transform Credit Risk Assessment: Insights from Saugat Nayak

Harnessing Predictive Analytics to Transform Credit Risk Assessment: Insights from Saugat Nayak![submenu-img]() Sebi imposes Rs 10000000 fine on Anil Ambani's son Anmol Ambani for...

Sebi imposes Rs 10000000 fine on Anil Ambani's son Anmol Ambani for...![submenu-img]() ‘He challenged us to…’: Google CEO Sundar Pichai on meeting PM Modi in New York

‘He challenged us to…’: Google CEO Sundar Pichai on meeting PM Modi in New York![submenu-img]() Meet man, who was Rakesh Jhunjhunwala's 'right hand', bought luxury apartment for Rs 123.3 crore, his net worth is...

Meet man, who was Rakesh Jhunjhunwala's 'right hand', bought luxury apartment for Rs 123.3 crore, his net worth is...![submenu-img]() 7 most expensive paintings in the world, Mona Lisa not in list

7 most expensive paintings in the world, Mona Lisa not in list![submenu-img]() Meet singer-actor who is also doctor, one song changed his life, debuted with flop, stayed away from Bollywood because..

Meet singer-actor who is also doctor, one song changed his life, debuted with flop, stayed away from Bollywood because..![submenu-img]() 7 most expensive bags in world

7 most expensive bags in world![submenu-img]() This was India's most hated actor, parents wouldn't name kids after him, he was richer than superstars but...

This was India's most hated actor, parents wouldn't name kids after him, he was richer than superstars but...![submenu-img]() Kerala tops food safety index 2024 list, check where other states stand

Kerala tops food safety index 2024 list, check where other states stand![submenu-img]() Badlapur school sexual assault case: Accused fires at cop with police revolver, killed in retaliatory firing

Badlapur school sexual assault case: Accused fires at cop with police revolver, killed in retaliatory firing![submenu-img]() The Impact of Machine Learning on Microservice Architecture: Praveen Kumar Thopalle’s Perspective

The Impact of Machine Learning on Microservice Architecture: Praveen Kumar Thopalle’s Perspective![submenu-img]() 8 people, including 6 children, killed in lightning strike in Chhattisgarh's Rajnandgaon

8 people, including 6 children, killed in lightning strike in Chhattisgarh's Rajnandgaon![submenu-img]() Mpox Outbreak: India reports first Mpox 'Clade 1b' case in...

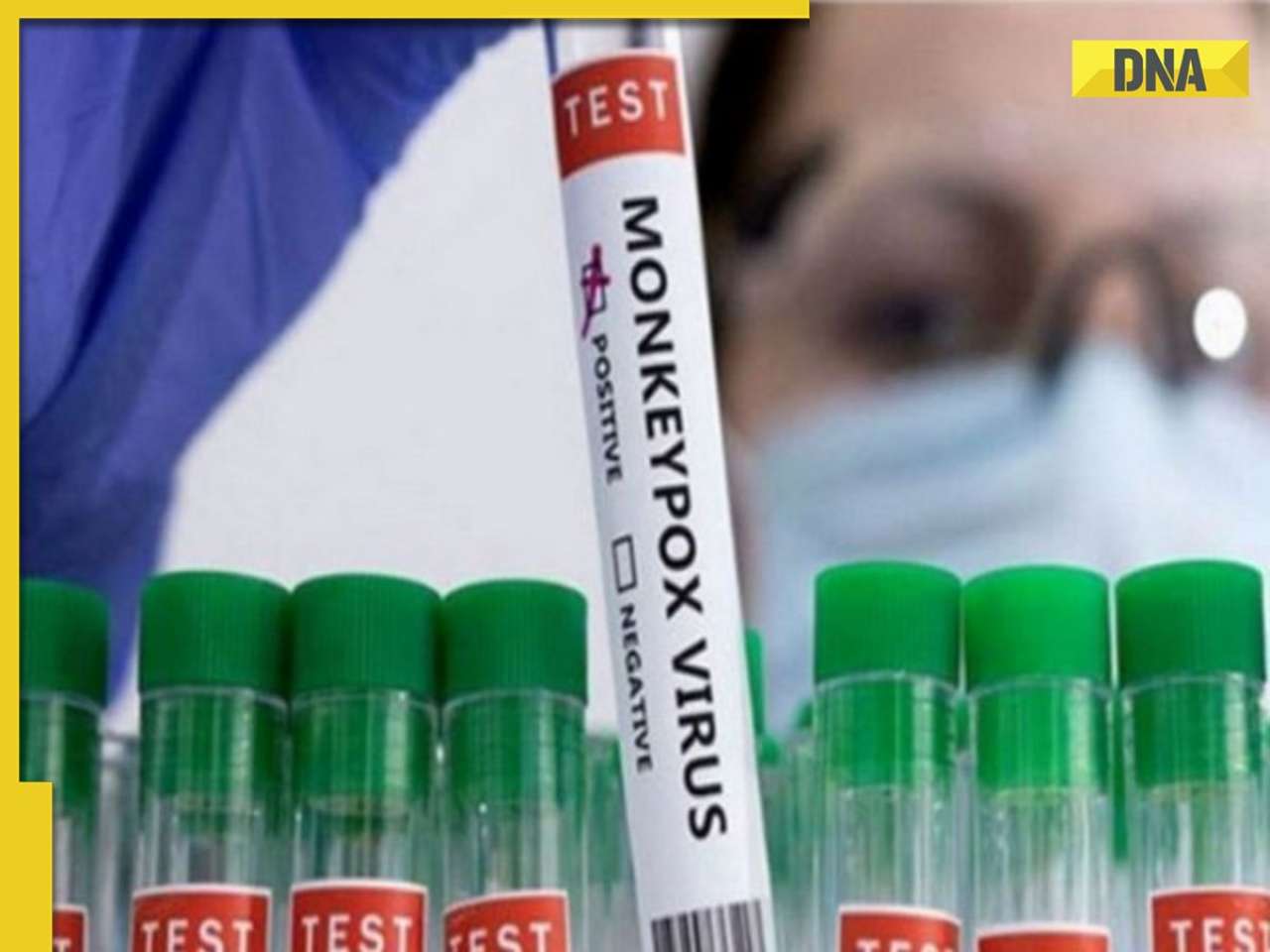

Mpox Outbreak: India reports first Mpox 'Clade 1b' case in...![submenu-img]() Mumbai: Rs 58000 crore plan approved to cut travel time across city; check details

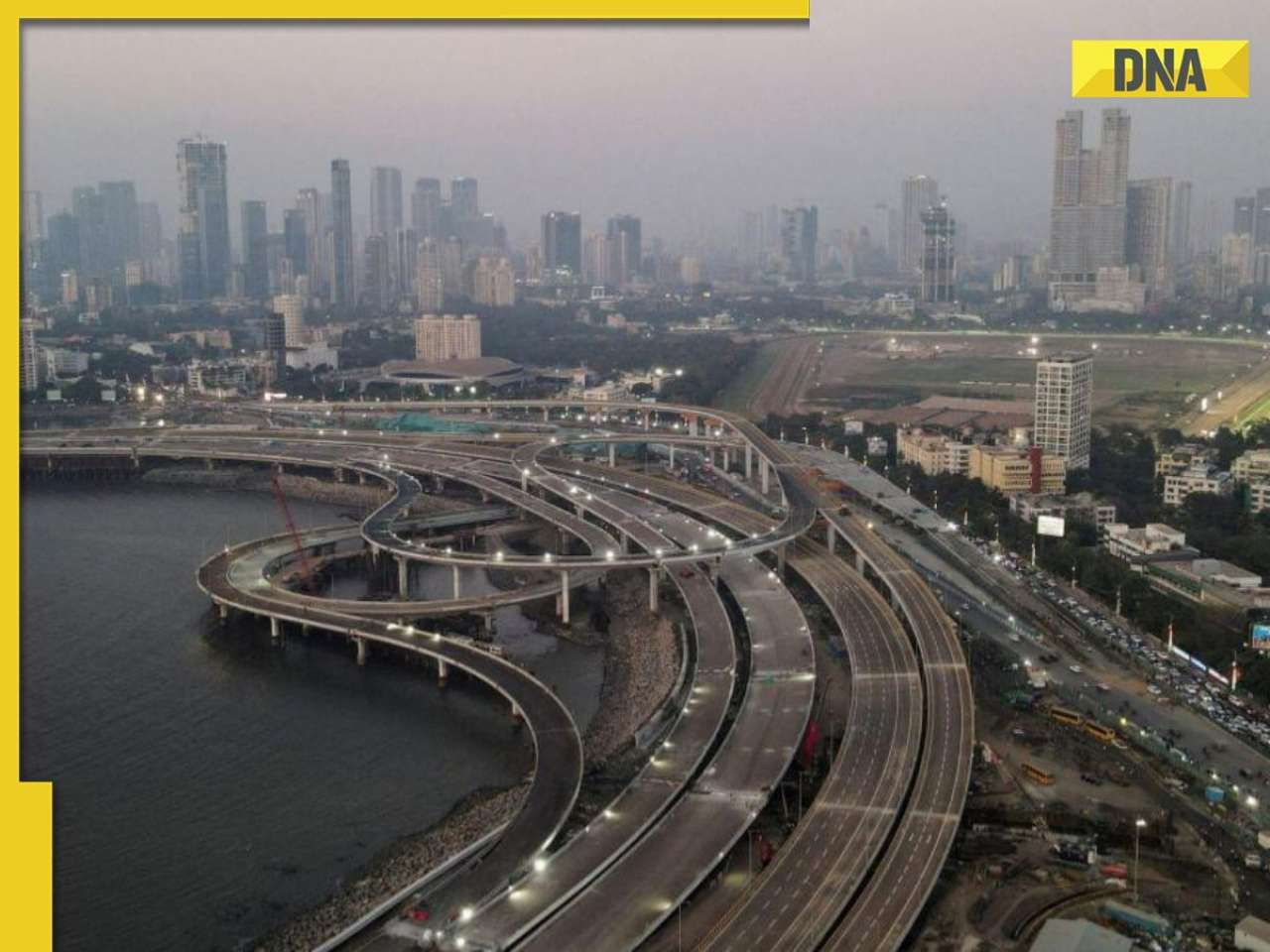

Mumbai: Rs 58000 crore plan approved to cut travel time across city; check details

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)