Saugat Nayak, a data analyst and scientist specializing in financial risk management, is playing a key role in this transformation.

In today’s rapidly evolving financial landscape, accurate credit risk assessment is more crucial than ever. With the rise of data-driven technologies, financial institutions are moving away from traditional models and embracing innovative methods that harness predictive analytics. Saugat Nayak, a data analyst and scientist specializing in financial risk management, is playing a key role in this transformation. He highlights how the integration of machine learning models into risk assessment is not only improving accuracy but also fostering a more proactive and responsible approach to lending.

The Limitations of Traditional Credit Risk Assessment

Traditional credit risk assessment methods rely heavily on static models that use historical data and predefined criteria to evaluate a borrower’s creditworthiness. While these models—such as the FICO score—have been widely used for decades, they often fail to adapt to the complexities of modern finance. They tend to focus on factors like credit history, income, and employment status, ignoring the full picture of a borrower’s financial behavior.

Saugat Nayak argues that these methods are inherently limited because they lack the capacity to adapt to real-time changes in a borrower’s financial health. Furthermore, traditional models often produce inaccurate or delayed results, leading to missed opportunities for responsible lending or the approval of risky loans. The financial crisis of 2008 is a prime example of how outdated credit risk models can result in systemic failure.

According to Nayak, the key to overcoming these limitations is to shift towards predictive analytics. By employing machine learning models that continuously learn and adapt, financial institutions can improve the precision of credit risk assessments and make more informed lending decisions.

The Role of Predictive Models in Credit Risk Assessment

Predictive analytics leverages vast amounts of data to predict future outcomes, making it particularly valuable in assessing credit risk. Nayak emphasizes that models such as logistic regression, decision trees, random forests, and gradient boosting machines are transforming how financial institutions approach credit scoring and risk management.

Logistic Regression

One of the most common predictive models used in credit risk assessment is logistic regression. This model estimates the probability that a borrower will default on their loan based on a variety of input variables. While simple, logistic regression provides valuable insight, especially when combined with other data-driven method.

Decision Trees

Decision treesprovide a more intuitive approach to understanding borrower risk. These models split data into branches based on specific criteria, creating a clear pathway that highlights the likelihood of different outcomes, such as loan default. While decision trees are straightforward, their power increases when combined with ensemble methods like random forests.

Random Forests

Random forests take decision trees a step further by combining the results of multiple trees to generate more accurate predictions. This method helps reduce the problem of overfitting, which can occur when a model is too finely tuned to the data. In credit risk assessment, random forests help provide a more robust and reliable analysis of a borrower’s risk profile.

Gradient Boosting Machines

Lastly, gradient boosting machines (GBMs) are increasingly used in credit risk assessment. GBMs improve on decision trees by iteratively refining the model to reduce prediction errors. According to Nayak, this model is highly effective at identifying complex patterns in data, making it ideal for assessing credit risk in dynamic financial environments.

Proactive Risk Management for Financial Stability

A key benefit of incorporating machine learning and predictive models into credit risk assessment is the ability to engage in proactive risk management. Traditional models are reactive, often identifying risks after they have already materialized. In contrast, predictive models analyze real-time data to forecast potential risks and enable lenders to take action before problems arise.

By proactively identifying at-risk borrowers, financial institutions can adjust lending strategies, offer loan restructuring options, or take preventive measures to minimize defaults. This not only reduces the financial institution’s exposure to bad debt but also supports responsible lending, ensuring that borrowers are not extended credit they cannot afford.

Saugat Nayak points out that this proactive approach contributes to a more stable financial system overall. When lenders can predict risks before they occur, they can better manage their portfolios, reduce defaults, and maintain liquidity. Moreover, borrowers benefit from a more personalized approach, where lenders can tailor their services based on the borrower’s specific risk profile.

The Future of Data-Driven Decision-Making in Finance

As the financial industry continues to evolve, the growing importance of data-driven decision-making cannot be understated. According to Nayak, the future of credit risk assessment lies in the ability to leverage big data and machine learning to create adaptive, scalable models that reflect the complexities of modern borrowers.

The rise of alternative data sources, such as social media activity, utility payments, and even mobile phone usage, is providing financial institutions with new ways to evaluate creditworthiness. These non-traditional data points offer valuable insights into a borrower’s financial behavior, allowing for more inclusive lending practices, especially for individuals who lack a formal credit history.

Furthermore, Nayak foresees the integration of automated decision-making into lending practices, where machine learning models can approve or deny loan applications with minimal human intervention. This shift towards automation will streamline lending processes and enhance operational efficiency, ultimately driving better outcomes for both lenders and borrowers.

The integration of predictive analytics into credit risk assessment is not just a trend, but a paradigm shift that is reshaping the financial industry. Through advanced models like logistic regression, decision trees, random forests, and gradient boosting machines, financial institutions are gaining the ability to assess risk more accurately and proactively. For Saugat Nayak, this transformation represents an opportunity to promote responsible lending and build a more resilient financial ecosystem.

As predictive analytics continues to evolve, the financial industry will increasingly rely on data-driven insights to navigate the complexities of modern lending. By staying ahead of the curve and embracing these innovations, financial institutions can better serve their clients while safeguarding their own stability. Saugat Nayak’s work in this area is helping to lead the way, ensuring that the future of credit risk assessment is both efficient and equitable.

![submenu-img]() US proposes to ban Chinese software after President Biden and PM Modi's summit

US proposes to ban Chinese software after President Biden and PM Modi's summit![submenu-img]() 'Humanity's success lies in collective strength, not on...': PM Modi's strong message at UN Summit

'Humanity's success lies in collective strength, not on...': PM Modi's strong message at UN Summit![submenu-img]() Nita Ambani, Anant Ambani seen singing along in Lucky Ali concert, pics surface

Nita Ambani, Anant Ambani seen singing along in Lucky Ali concert, pics surface![submenu-img]() Ashraf cuts Mahalaxmi into 30 pieces: Truth behind horrifying Bengaluru incident out

Ashraf cuts Mahalaxmi into 30 pieces: Truth behind horrifying Bengaluru incident out![submenu-img]() This actress named first female superstar of Bollywood, husband won’t allow biopic on her, remake found her glory

This actress named first female superstar of Bollywood, husband won’t allow biopic on her, remake found her glory![submenu-img]() बेंगलुरु महिला हत्याकांड में पुलिस को मिला बड़ा सुराग, 30 टुकड़ों में काटकर फ्रिज में रखा था शव

बेंगलुरु महिला हत्याकांड में पुलिस को मिला बड़ा सुराग, 30 टुकड़ों में काटकर फ्रिज में रखा था शव![submenu-img]() Mpox के खतरनाक वेरिएंट की भारत में एंट्री, केरल में मिला पहला केस, WHO ने घोषित थी की इमरजेंसी

Mpox के खतरनाक वेरिएंट की भारत में एंट्री, केरल में मिला पहला केस, WHO ने घोषित थी की इमरजेंसी ![submenu-img]() बदलापुर रेपकांड के आरोपी अक्षय शिंदे की मौत, पुलिस की रिवॉल्वर छीनकर की थी फायरिंग

बदलापुर रेपकांड के आरोपी अक्षय शिंदे की मौत, पुलिस की रिवॉल्वर छीनकर की थी फायरिंग![submenu-img]() Israel ने Hezbollah के ठिकानों पर की एयरस्ट्राइक, 100 की मौत और 400 के घायल होने का अनुमान

Israel ने Hezbollah के ठिकानों पर की एयरस्ट्राइक, 100 की मौत और 400 के घायल होने का अनुमान ![submenu-img]() 'पहले जैसा कॉन्फिडेंस नहीं, अब 56 इंच का सीना भी...' राहुल गांधी का PM मोदी पर तंज

'पहले जैसा कॉन्फिडेंस नहीं, अब 56 इंच का सीना भी...' राहुल गांधी का PM मोदी पर तंज![submenu-img]() Ford to return to India after 2 years with reopening of....

Ford to return to India after 2 years with reopening of....![submenu-img]() Maruti Suzuki launches new Swift CNG, check price, mileage, other features

Maruti Suzuki launches new Swift CNG, check price, mileage, other features![submenu-img]() ‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...

‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...![submenu-img]() In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…

In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…![submenu-img]() World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…

World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…![submenu-img]() Meet woman, IIT graduate, who left bank job to become state topper in UPSC, now working as...

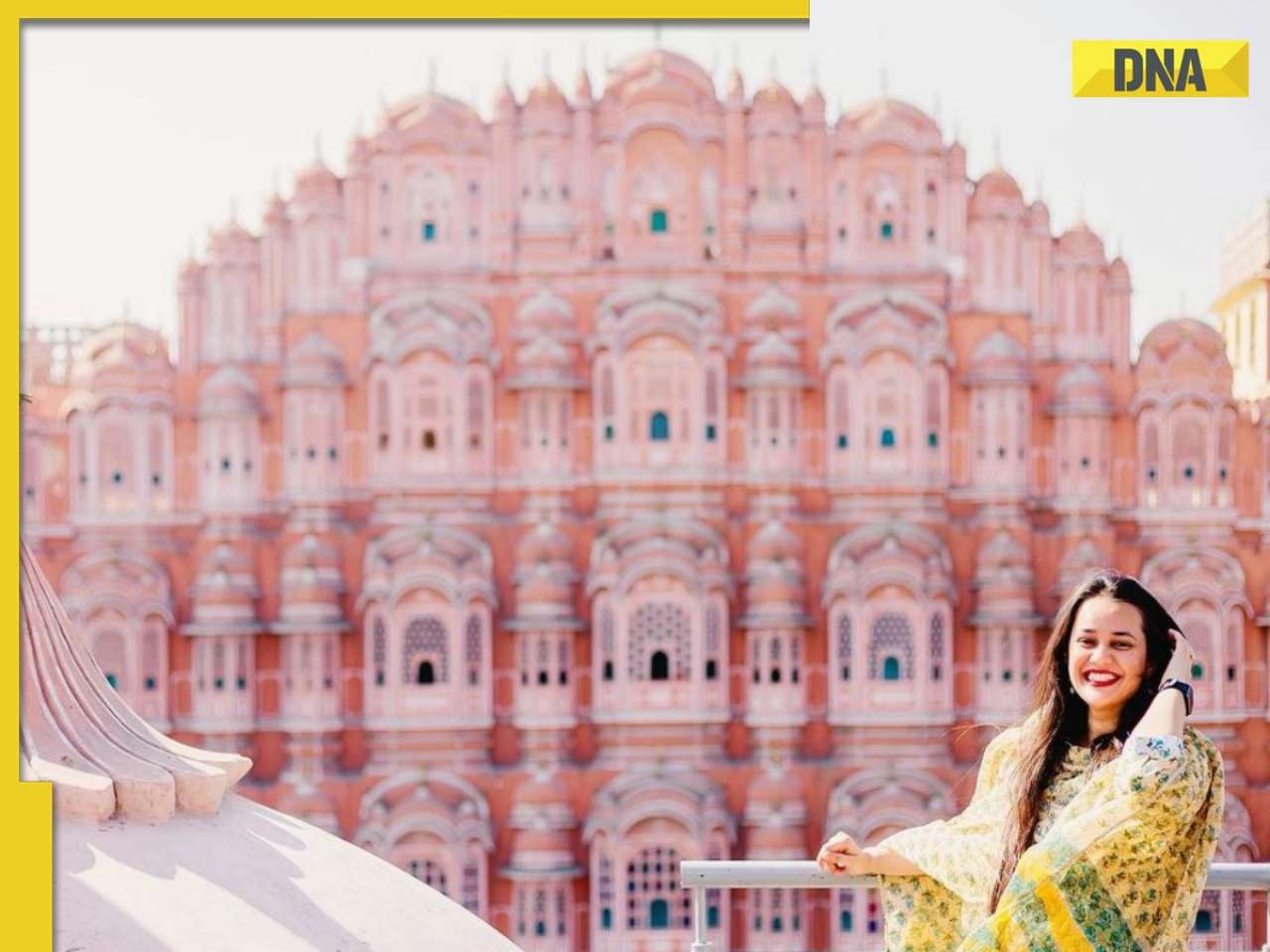

Meet woman, IIT graduate, who left bank job to become state topper in UPSC, now working as...![submenu-img]() Meet IPS officer, who has resigned after 10 yrs of service to work in...

Meet IPS officer, who has resigned after 10 yrs of service to work in...![submenu-img]() Meet IAS officer Tina Dabi, Ria Dabi’s mother, who cleared UPSC, became IES officer, later resigned due to...

Meet IAS officer Tina Dabi, Ria Dabi’s mother, who cleared UPSC, became IES officer, later resigned due to...![submenu-img]() Meet man, who cleared JEE twice but left IIT, cracked UPSC exam with AIR 38, resigned as IAS officer to become…

Meet man, who cleared JEE twice but left IIT, cracked UPSC exam with AIR 38, resigned as IAS officer to become…![submenu-img]() IAS officer Tina Dabi’s schedule shows she studied 11-hour a day; check UPSC topper's marksheet and time table

IAS officer Tina Dabi’s schedule shows she studied 11-hour a day; check UPSC topper's marksheet and time table![submenu-img]() Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical

Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical![submenu-img]() Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval

Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval![submenu-img]() Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?

Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?![submenu-img]() One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0

One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0![submenu-img]() Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed

Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed![submenu-img]() After becoming debt-free, Anil Ambani's company approves Rs 1525 crore plan for...

After becoming debt-free, Anil Ambani's company approves Rs 1525 crore plan for...![submenu-img]() Mukesh Ambani's Reliance teams up with govt company for India's biggest...

Mukesh Ambani's Reliance teams up with govt company for India's biggest...![submenu-img]() Meet man, one of youngest Indian CEOs, has net worth of Rs 4300 crore, runs company worth Rs...

Meet man, one of youngest Indian CEOs, has net worth of Rs 4300 crore, runs company worth Rs...![submenu-img]() Harnessing Predictive Analytics to Transform Credit Risk Assessment: Insights from Saugat Nayak

Harnessing Predictive Analytics to Transform Credit Risk Assessment: Insights from Saugat Nayak![submenu-img]() Sebi imposes Rs 10000000 fine on Anil Ambani's son Anmol Ambani for...

Sebi imposes Rs 10000000 fine on Anil Ambani's son Anmol Ambani for...![submenu-img]() Top sports bikes to buy under Rs 3 lakh: Check prices, features and more

Top sports bikes to buy under Rs 3 lakh: Check prices, features and more![submenu-img]() How was universe created as per Hinduism?

How was universe created as per Hinduism?![submenu-img]() Ananya Panday poses with Orry, Faye D'Souza in BTS pics from Call Me Bae; Vir Das, Varun Sood also make appearance

Ananya Panday poses with Orry, Faye D'Souza in BTS pics from Call Me Bae; Vir Das, Varun Sood also make appearance![submenu-img]() 5 most reliable electric cars in the world

5 most reliable electric cars in the world![submenu-img]() 7 most expensive paintings in the world, Mona Lisa not in list

7 most expensive paintings in the world, Mona Lisa not in list![submenu-img]() 'Humanity's success lies in collective strength, not on...': PM Modi's strong message at UN Summit

'Humanity's success lies in collective strength, not on...': PM Modi's strong message at UN Summit![submenu-img]() Ashraf cuts Mahalaxmi into 30 pieces: Truth behind horrifying Bengaluru incident out

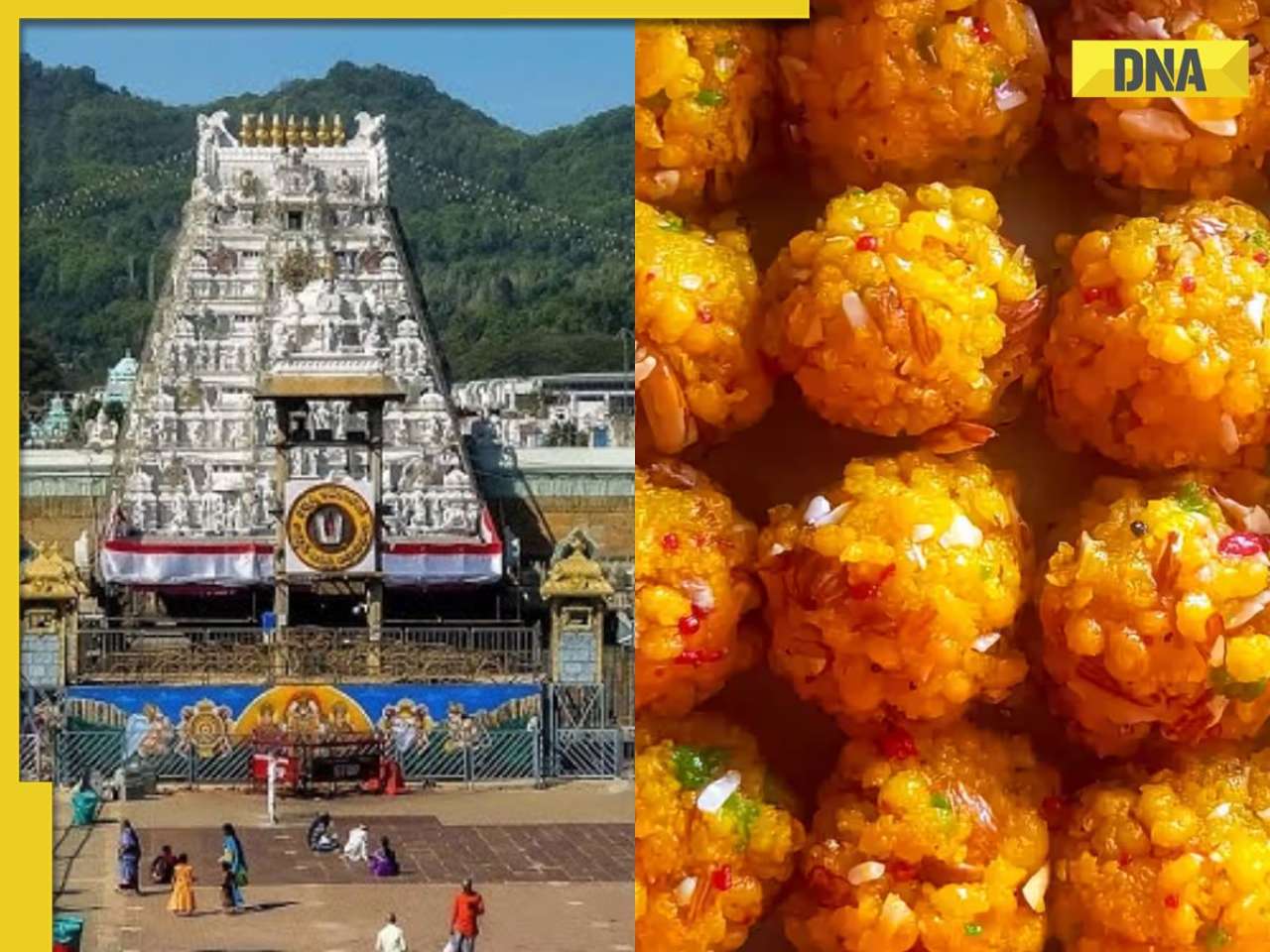

Ashraf cuts Mahalaxmi into 30 pieces: Truth behind horrifying Bengaluru incident out![submenu-img]() Amid Tirupati laddu row, this temple in UP bans 'prasad' from market for offering

Amid Tirupati laddu row, this temple in UP bans 'prasad' from market for offering![submenu-img]() Badlapur school sexual assault case: Accused fires at cop with police revolver, killed in retaliatory firing

Badlapur school sexual assault case: Accused fires at cop with police revolver, killed in retaliatory firing![submenu-img]() The Impact of Machine Learning on Microservice Architecture: Praveen Kumar Thopalle’s Perspective

The Impact of Machine Learning on Microservice Architecture: Praveen Kumar Thopalle’s Perspective

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)