SBI chairman, OP Bhatt, said recently that this would not be the right time for a CRR hike as credit growth is likely to pick-up in coming months.

Zooming inflation, a build-up of inflationary pressures and cues from global markets could impel the Reserve Bank of India (RBI) to further tighten its monetary policy stance by hiking the cash reserve ratio (CRR) and policy rates, bankers said.

The apex bank's third-quarter quarter review of its monetary policy, scheduled for Friday, is therefore being keenly watched as any hike in the CRR or policy rates will push up lending rates in the banking system making home, auto and retail advances dearer to the common man, bankers said.

"Signals of monetary policy tightening in the US and China may add to pressure on the RBI to hike rates. Also, inflationary pressures are high. One can expect a 0.5% hike in the CRR," IDBI Bank's executive director, RK Bansal, told PTI.

Bansal said that a marginal hike in the repo and reverse repo rates (at which RBI lends and borrows) also cannot be ruled out as the apex bank may want to signal an upward movement in interest rates going forward.

Skyrocketing prices of essential commodities and food items pushed up consumer price inflation to 16.81% for the week ended January 9. WPI-based inflation expanded to a year's high of 7.31% in December. UCO Bank's chairman and managing director, SK Goel, said that a hike in CRR--the amount which banks have to park with the central bank--could be as high as 1-2% and may be effected in multiple tranches.

"At this point, RBI is focusing only on inflation. The may come with a 1-2% CRR increase. As far as policy rates are concerned, there may be a slight increase," he said.

Taking a cue from the RBI, banks could jack-up their lending rates in the near future, Goel said, adding, however, that this would depend upon the liquidity conditions of individual banks.

"Interest rates are always linked to the liquidity in the system. Once the apex bank absorbs the liquidity, bank lending rates tend to move up," Goel said.

With the economy on the recovery path, credit demand in the system has started picking up and is likely to improve significantly in the next few months, he said.

SBI chairman, OP Bhatt, however put forward a different view when he said recently that this would not be the right time for a CRR hike as credit growth is likely to pick-up in coming months.

Regardless of the apex bank's monetary policy actions, interest rates in the system are unlikely to go up in the next six-months, Bhatt had said.

![submenu-img]() 'Maa ki yaad dila di': PM Modi writes to Neeraj Chopra's mother, expresses gratitude for homemade 'churma'

'Maa ki yaad dila di': PM Modi writes to Neeraj Chopra's mother, expresses gratitude for homemade 'churma'![submenu-img]() Who is changing Anil Ambani's fortune? How are Reliance Group companies becoming debt-free?

Who is changing Anil Ambani's fortune? How are Reliance Group companies becoming debt-free?![submenu-img]() Watch: Aamir Khan visits ex-wife Reena Dutta after her father's death

Watch: Aamir Khan visits ex-wife Reena Dutta after her father's death![submenu-img]() ICC Test Rankings: Major setback for Rohit Sharma, Virat Kohli re-enters top 10

ICC Test Rankings: Major setback for Rohit Sharma, Virat Kohli re-enters top 10![submenu-img]() The Great Kapil Show: Rohit Sharma reveals what team India was up to after winning T20 World Cup, says 'every player...'

The Great Kapil Show: Rohit Sharma reveals what team India was up to after winning T20 World Cup, says 'every player...'![submenu-img]() Jammu And Kashmir Encounter: चुनावी सुरक्षा के बीच किश्तवाड़ में 20 दिन में दूसरा Terror Attack, सुरक्षा बलों के साथ एनकाउंटर चालू

Jammu And Kashmir Encounter: चुनावी सुरक्षा के बीच किश्तवाड़ में 20 दिन में दूसरा Terror Attack, सुरक्षा बलों के साथ एनकाउंटर चालू![submenu-img]() 'Marital Rape को अपराध घोषित करना जरूरी नहीं', Supreme Court में केंद्र सरकार का हलफनामा

'Marital Rape को अपराध घोषित करना जरूरी नहीं', Supreme Court में केंद्र सरकार का हलफनामा![submenu-img]() Israel पर Iran के हमले के बाद क्या 'बैलिस्टिक मिसाइल युद्ध' की जद में आ गया है Middle East?

Israel पर Iran के हमले के बाद क्या 'बैलिस्टिक मिसाइल युद्ध' की जद में आ गया है Middle East?![submenu-img]() 500 करोड़ की धोखाधड़ी, Elvish Yadav से लेकर Bharti Singh तक तलब, रिया चक्रवर्ती भी रडार पर

500 करोड़ की धोखाधड़ी, Elvish Yadav से लेकर Bharti Singh तक तलब, रिया चक्रवर्ती भी रडार पर![submenu-img]() Women's T20 World Cup 2024 Highlights: बांग्लादेश ने रचा इतिहास... टी20 वर्ल्ड कप में 10 साल बाद किया ये करिश्मा

Women's T20 World Cup 2024 Highlights: बांग्लादेश ने रचा इतिहास... टी20 वर्ल्ड कप में 10 साल बाद किया ये करिश्मा![submenu-img]() This company overtakes Ratan Tata's firm to become India’s…; it is owned by…

This company overtakes Ratan Tata's firm to become India’s…; it is owned by…![submenu-img]() Mahindra Thar ROXX booking to start from..., check waiting period, details

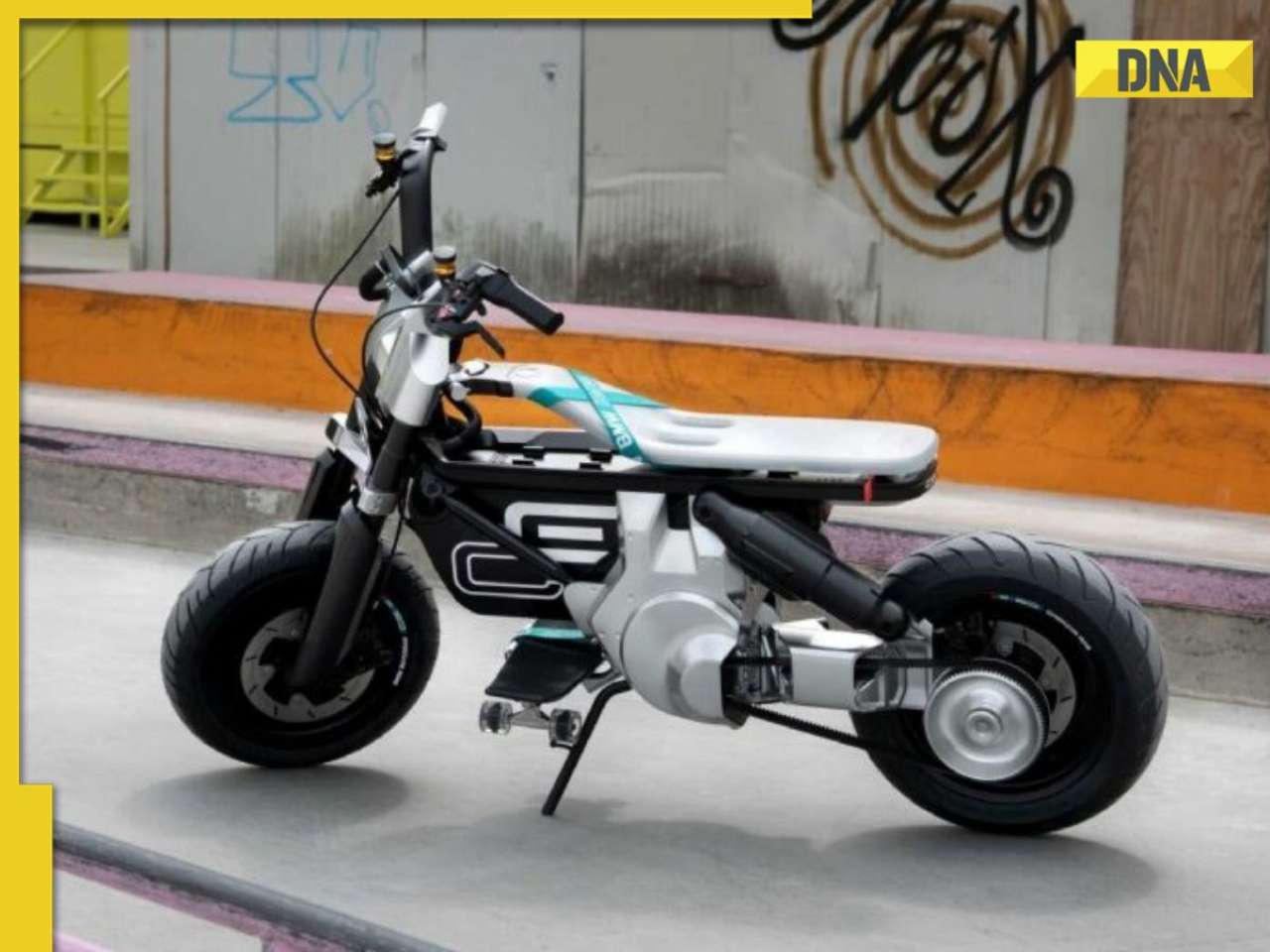

Mahindra Thar ROXX booking to start from..., check waiting period, details![submenu-img]() BMW launches CE 02 electric scooter in India; price starts at Rs…

BMW launches CE 02 electric scooter in India; price starts at Rs…![submenu-img]() Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…

Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…![submenu-img]() Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...

Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...![submenu-img]() RRB Railway Recruitment 2024: Sarkari naukri alert for 14298 posts, know how to apply online at rrbapply.gov.in before..

RRB Railway Recruitment 2024: Sarkari naukri alert for 14298 posts, know how to apply online at rrbapply.gov.in before..![submenu-img]() Meet IAS officer, BITS graduate who left high-paying job at Google, got highest marks in UPSC exam, he is...

Meet IAS officer, BITS graduate who left high-paying job at Google, got highest marks in UPSC exam, he is...![submenu-img]() Meet man who quit his job at ISRO, then began taxi company, its turnover is Rs...

Meet man who quit his job at ISRO, then began taxi company, its turnover is Rs...![submenu-img]() Meet woman, who is social media star, is married to IAS, cracked UPSC exam in first attempt, secured AIR...

Meet woman, who is social media star, is married to IAS, cracked UPSC exam in first attempt, secured AIR...![submenu-img]() Meet Indian genius who cracked IIT-JEE with AIR 1, joined IIT Bombay, left after 2 years without graduation, he is now…

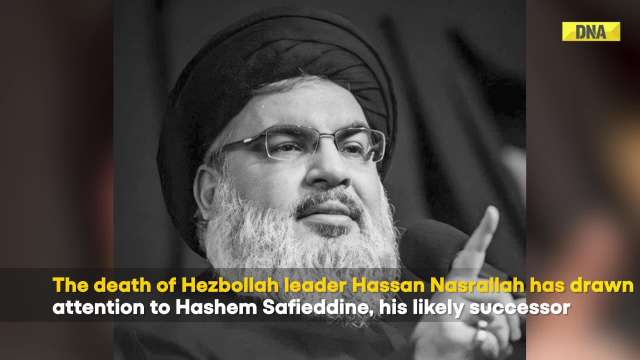

Meet Indian genius who cracked IIT-JEE with AIR 1, joined IIT Bombay, left after 2 years without graduation, he is now…![submenu-img]() After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon

After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon![submenu-img]() Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War

Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War![submenu-img]() Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain

Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain![submenu-img]() Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts

Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts![submenu-img]() Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir

Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir![submenu-img]() Who is changing Anil Ambani's fortune? How are Reliance Group companies becoming debt-free?

Who is changing Anil Ambani's fortune? How are Reliance Group companies becoming debt-free?![submenu-img]() After India's independence, Mahatma Gandhi wasn't the first choice for currency notes, they initially featured...

After India's independence, Mahatma Gandhi wasn't the first choice for currency notes, they initially featured...![submenu-img]() Meet woman, who got Rs 6400000 job in IT tech giant of Bill Gates, not from IIT, IIM, she is...

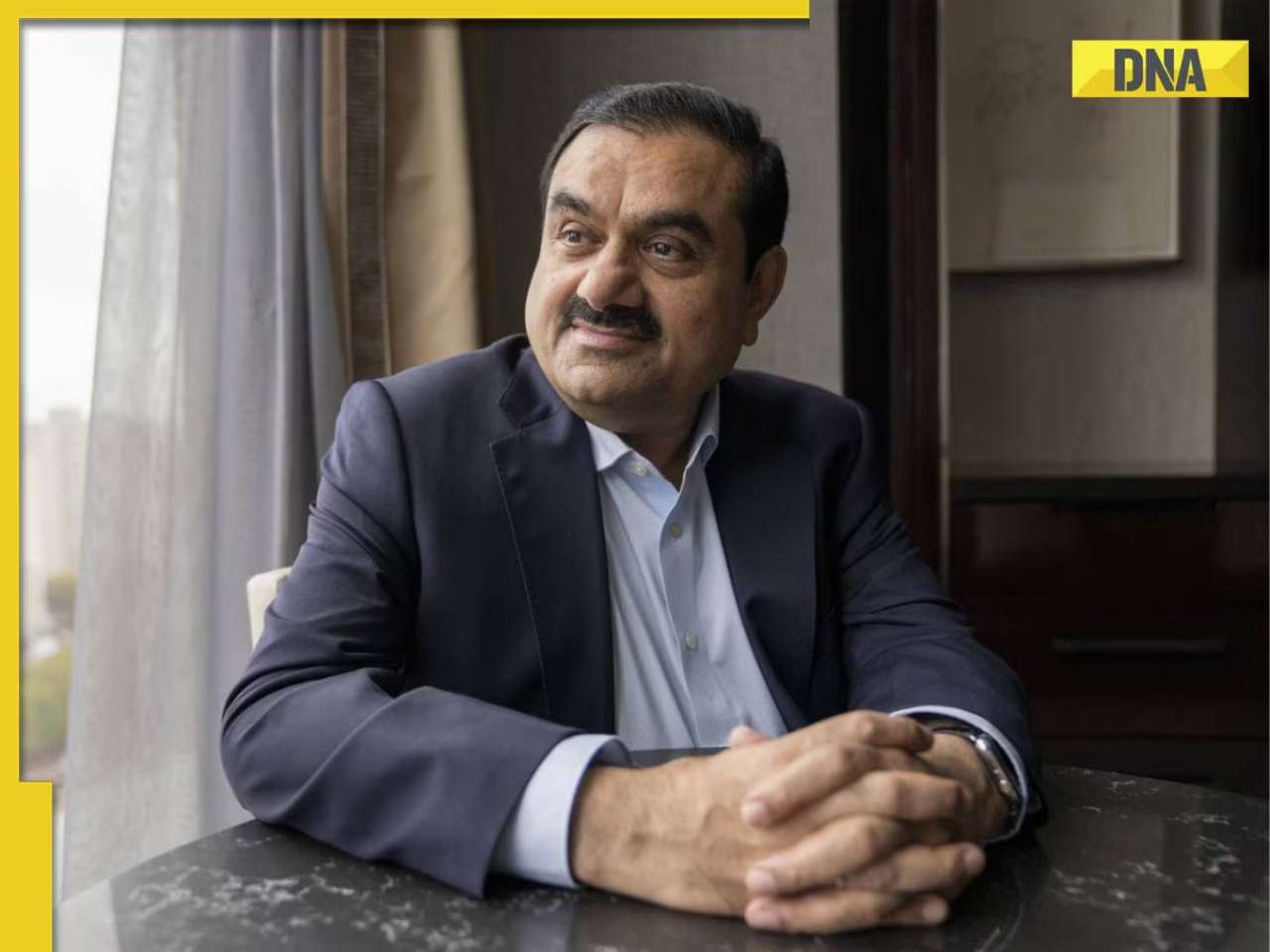

Meet woman, who got Rs 6400000 job in IT tech giant of Bill Gates, not from IIT, IIM, she is... ![submenu-img]() Big move by Gautam Adani as this Adani company likely to earn Rs 109159505000 by selling shares

Big move by Gautam Adani as this Adani company likely to earn Rs 109159505000 by selling shares![submenu-img]() Mukesh Ambani's Reliance Jio Rs 899 recharge plan is better than Rs 999 plan, as it offers...

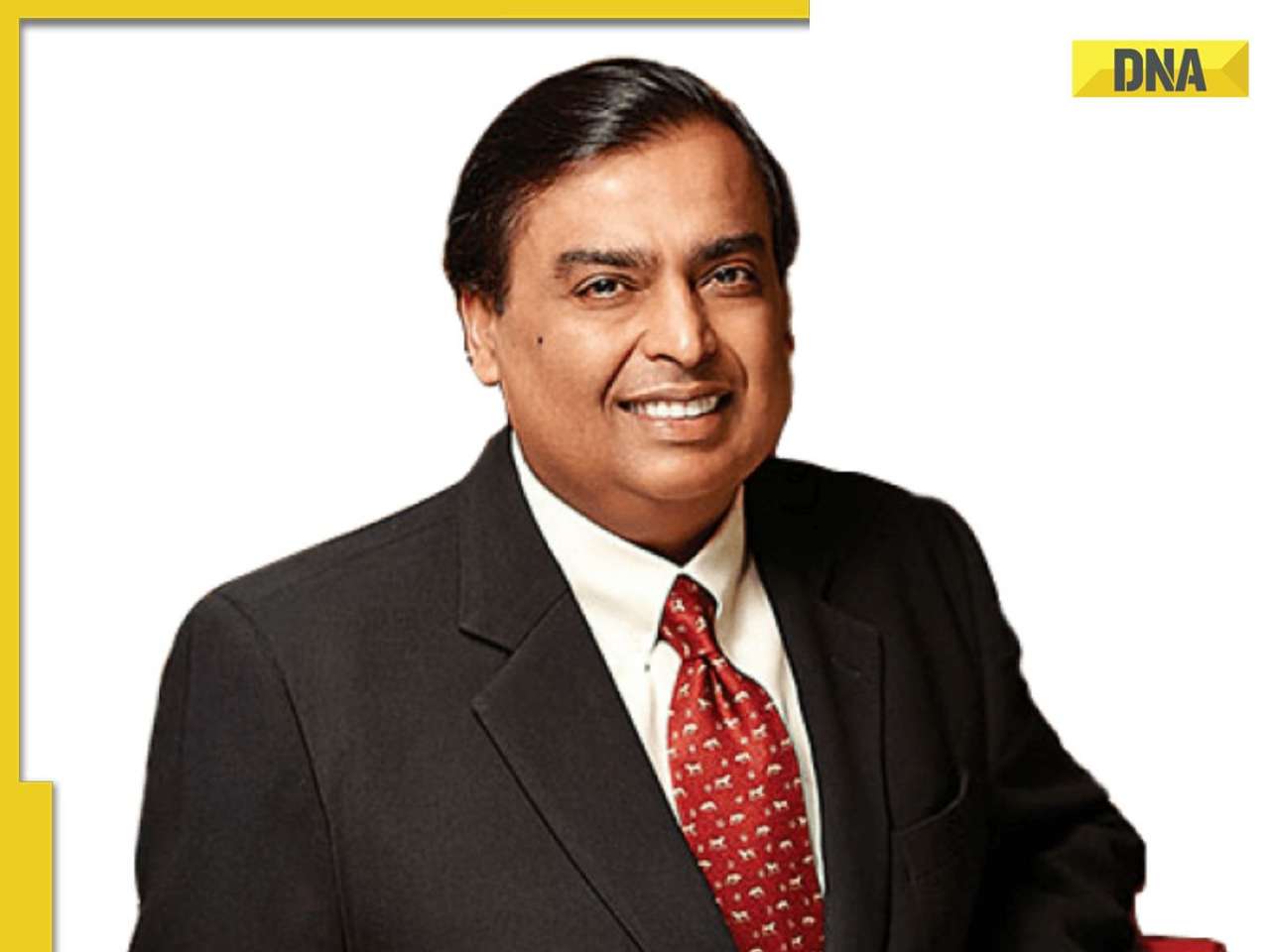

Mukesh Ambani's Reliance Jio Rs 899 recharge plan is better than Rs 999 plan, as it offers...![submenu-img]() Who is Manoj Bharti, ex-diplomat appointed as working president of Prashant Kishor's Jan Suraaj Party?

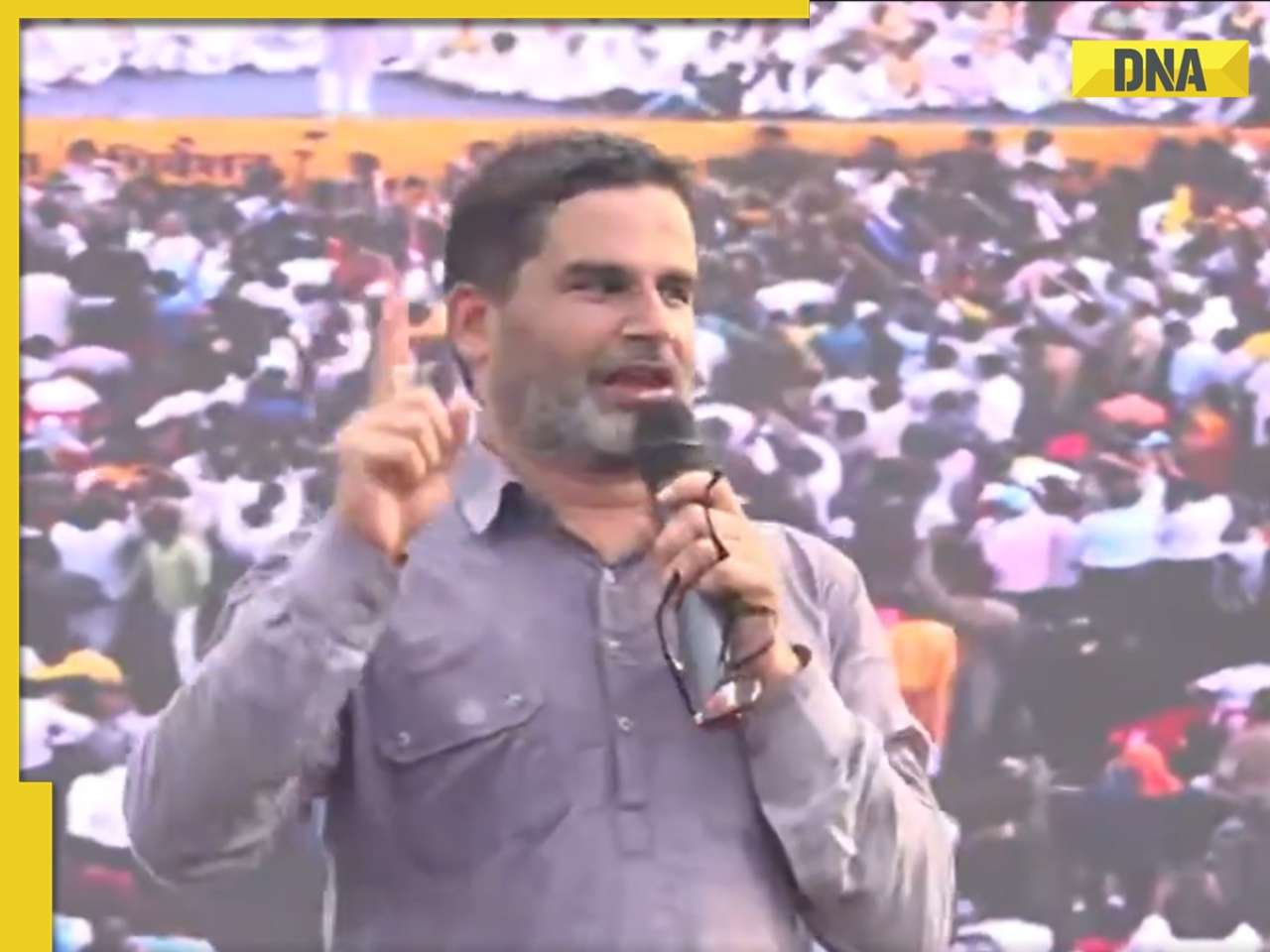

Who is Manoj Bharti, ex-diplomat appointed as working president of Prashant Kishor's Jan Suraaj Party?![submenu-img]() Delhi: Biggest drug bust in capital, 500 kg cocaine worth Rs 2000 crore seized

Delhi: Biggest drug bust in capital, 500 kg cocaine worth Rs 2000 crore seized![submenu-img]() Anant Ambani meets Uddhav Thackeray at Matoshree, sparks speculations ahead of Maharashtra polls

Anant Ambani meets Uddhav Thackeray at Matoshree, sparks speculations ahead of Maharashtra polls![submenu-img]() Prashant Kishor launches Jan Suraaj Party, vows to end liquor ban in Bihar

Prashant Kishor launches Jan Suraaj Party, vows to end liquor ban in Bihar![submenu-img]() 'We do not ask people to get married or...': Sadhguru's Isha Foundation on charges of ‘forcing women to become hermits’

'We do not ask people to get married or...': Sadhguru's Isha Foundation on charges of ‘forcing women to become hermits’

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)