A mid the financial crisis still looming in some parts of the world and other issues like increase in oil prices and inflation, not much was expected this year from the finance minister.

A mid the financial crisis still looming in some parts of the world and other issues like increase in oil prices and inflation, not much was expected this year from the finance minister.

Also, several tax reforms in the form of Direct Taxes Code, Goods and Services Tax are in the pipeline, which aim for moderation of rates, simplification of laws and better compliance.

Some of the key provisions announced in budget 2011 which would affect acquisitions and corporate restructuring include:

LLPs

Since LLPs enjoyed the benefits of a partnership firm, it had tax advantages in the form of non-applicability of surcharge, Minimum Alternate Tax (MAT) and Dividend Distribution Tax. The Finance Bill, 2011 has announced a partial rollback in the form of introducing Alternate Minimum Taxes (AMT) i.e. tax on certain incomes of an LLP at 18.5%. The income for AMT would include incomes on which deduction is claimed under Chapter VI-A Part C and Section 10AA. Clearly, the intention seems to be plugging conversion of companies claiming such tax benefits to mitigate MAT.

Overseas investments

In order to attract repatriation of dividends into the country, the budget proposes a lower tax rate of 15% on dividends from overseas subsidiaries, as compared to normal rate of 30%. This will be a positive move for several Indian companies, before Controlled Foreign Corporation regime sets in under the Direct Tax Code.

However, the fine print offers some surprises while laying down mechanism for taxing such dividends. As per proposed Section 115BBD, such dividends are to be taxed on “gross” basis and no expenditure in respect of such dividends shall be allowed.

A question could thus arise on deductibility of interest expenses on borrowings made for overseas investments.

Section 72A of the Income Tax Act, 1961 enables transferee companies to avail tax benefits in form of availability of losses of transferor companies. Amendments in these provisions in line with Direct Taxes Code would have given significant boost to corporate restructuring, acquisitions and consolidation. Further, an amendment or a clarification on tax neutrality in hands of Indian investors on global mergers/amalgamations would have been welcome.

Overall, the finance minister appears to have adopted a balanced approach while framing the budget proposals but seems to have restrained to get into major shift — considering perhaps the roll-out of a few new statutes soon.

Hemal Uchat is executive director, PwC India

![submenu-img]() Malayalam actor Mohan Raj, known for playing iconic villain Keerikadan Jose in Mohanlal's Kireedam, passes away

Malayalam actor Mohan Raj, known for playing iconic villain Keerikadan Jose in Mohanlal's Kireedam, passes away![submenu-img]() Anil Ambani's Reliance Power approves Rs 4200 crore plan as shares hit over...

Anil Ambani's Reliance Power approves Rs 4200 crore plan as shares hit over...![submenu-img]() Vijay Kiragandur, producer who made blockbusters KGF, Kantara possible, turns 48

Vijay Kiragandur, producer who made blockbusters KGF, Kantara possible, turns 48![submenu-img]() Amitabh Bachchan arranged Anil Ambani's private plane after Aishwarya Rai was injured: 'For two nights, I couldn't...'

Amitabh Bachchan arranged Anil Ambani's private plane after Aishwarya Rai was injured: 'For two nights, I couldn't...'![submenu-img]() 'Absolute rubbish': CSK physio slams Harbhajan Singh for saying MS Dhoni 'punched screen' after loss to RCB in IPL

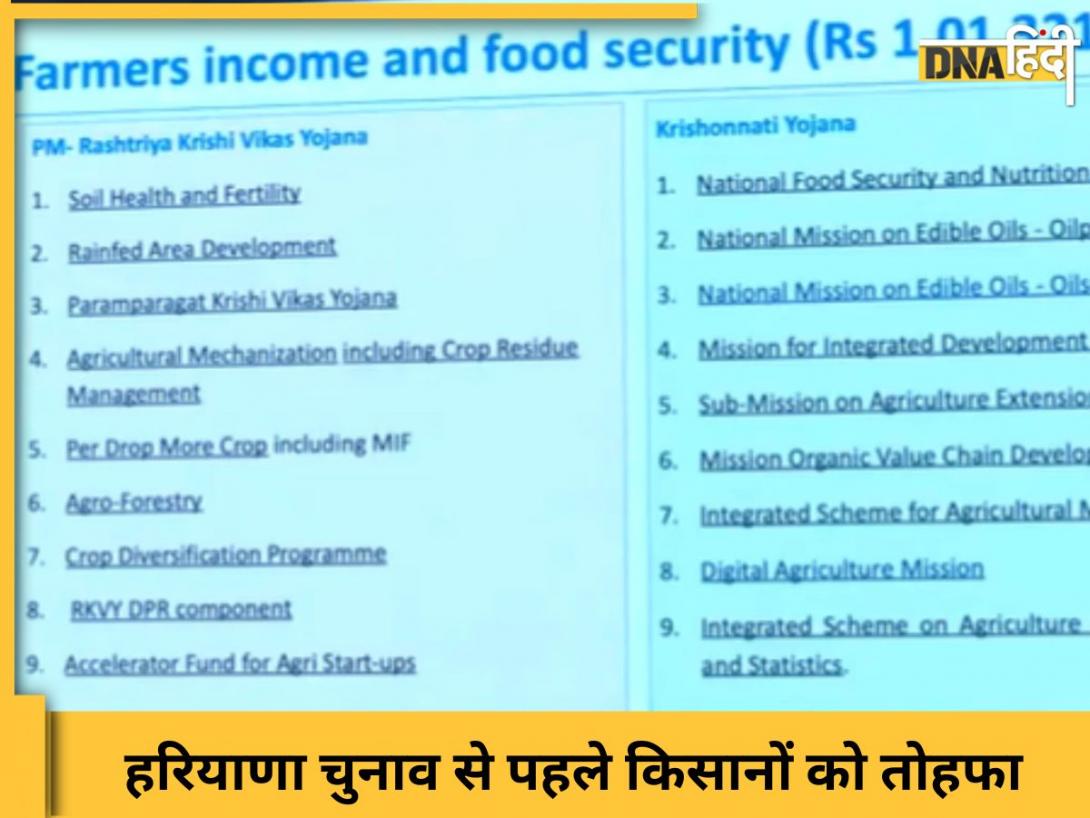

'Absolute rubbish': CSK physio slams Harbhajan Singh for saying MS Dhoni 'punched screen' after loss to RCB in IPL![submenu-img]() Cabinet Decisions: मोदी सरकार किसानों के लिए खर्च करेगी 1 लाख करोड़, हरियाणा में मतदान से पहले खोला पिटारा

Cabinet Decisions: मोदी सरकार किसानों के लिए खर्च करेगी 1 लाख करोड़, हरियाणा में मतदान से पहले खोला पिटारा![submenu-img]() Indian Railways: रेल कर्मचारियों के लिए Diwali से पहले बड़ा तोहफा, मोदी सरकार 78 दिनों का देगी बोनस

Indian Railways: रेल कर्मचारियों के लिए Diwali से पहले बड़ा तोहफा, मोदी सरकार 78 दिनों का देगी बोनस![submenu-img]() Jammu And Kashmir Encounter: चुनावी सुरक्षा के बीच किश्तवाड़ में 20 दिन में दूसरा Terror Attack, सुरक्षा बलों के साथ एनकाउंटर चालू

Jammu And Kashmir Encounter: चुनावी सुरक्षा के बीच किश्तवाड़ में 20 दिन में दूसरा Terror Attack, सुरक्षा बलों के साथ एनकाउंटर चालू![submenu-img]() Digital Arrest: आपकी बेटी सेक्स रैकेट में पकड़ी गई!, फोन करने वाले ने कहा, सुनते ही मां ने तोड़ा दम

Digital Arrest: आपकी बेटी सेक्स रैकेट में पकड़ी गई!, फोन करने वाले ने कहा, सुनते ही मां ने तोड़ा दम![submenu-img]() 'Marital Rape को अपराध घोषित करना जरूरी नहीं', Supreme Court में केंद्र सरकार का हलफनामा

'Marital Rape को अपराध घोषित करना जरूरी नहीं', Supreme Court में केंद्र सरकार का हलफनामा![submenu-img]() This company overtakes Ratan Tata's firm to become India’s…; it is owned by…

This company overtakes Ratan Tata's firm to become India’s…; it is owned by…![submenu-img]() Mahindra Thar ROXX booking to start from..., check waiting period, details

Mahindra Thar ROXX booking to start from..., check waiting period, details![submenu-img]() BMW launches CE 02 electric scooter in India; price starts at Rs…

BMW launches CE 02 electric scooter in India; price starts at Rs…![submenu-img]() Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…

Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…![submenu-img]() Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...

Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...![submenu-img]() Meet man, who bagged AIR 1 in JEE Advance, studied at IIT Bombay, now pursuing PhD at prestigious college in...

Meet man, who bagged AIR 1 in JEE Advance, studied at IIT Bombay, now pursuing PhD at prestigious college in...![submenu-img]() This was India's most educated man, had 20 degrees, cracked UPSC twice but quit IAS job due to...

This was India's most educated man, had 20 degrees, cracked UPSC twice but quit IAS job due to...![submenu-img]() RRB Railway Recruitment 2024: Sarkari naukri alert for 14298 posts, know how to apply online at rrbapply.gov.in before..

RRB Railway Recruitment 2024: Sarkari naukri alert for 14298 posts, know how to apply online at rrbapply.gov.in before..![submenu-img]() Meet IAS officer, BITS graduate who left high-paying job at Google, got highest marks in UPSC exam, he is...

Meet IAS officer, BITS graduate who left high-paying job at Google, got highest marks in UPSC exam, he is...![submenu-img]() Meet man who quit his job at ISRO, then began taxi company, its turnover is Rs...

Meet man who quit his job at ISRO, then began taxi company, its turnover is Rs...![submenu-img]() After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon

After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon![submenu-img]() Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War

Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War![submenu-img]() Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain

Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain![submenu-img]() Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts

Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts![submenu-img]() Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir

Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir![submenu-img]() Anil Ambani's Reliance Power approves Rs 4200 crore plan as shares hit over...

Anil Ambani's Reliance Power approves Rs 4200 crore plan as shares hit over...![submenu-img]() Good news for these central govt employees, Cabinet approves Rs 2029 crore bonus ahead of Diwali; check details

Good news for these central govt employees, Cabinet approves Rs 2029 crore bonus ahead of Diwali; check details![submenu-img]() Mukesh Ambani's Reliance loses Rs 77606 crore in just one day, market cap drops to...

Mukesh Ambani's Reliance loses Rs 77606 crore in just one day, market cap drops to...![submenu-img]() Meet woman whose father once owned private airlines in India, her connection with Lalit Modi was...

Meet woman whose father once owned private airlines in India, her connection with Lalit Modi was...![submenu-img]() Mukesh Ambani adds another aircraft to his flying fleet, buys India’s first Boeing 737 MAX 9 for Rs...

Mukesh Ambani adds another aircraft to his flying fleet, buys India’s first Boeing 737 MAX 9 for Rs...![submenu-img]() 10 times Aabha Paul brought the internet down with her sultry photos, sexy videos

10 times Aabha Paul brought the internet down with her sultry photos, sexy videos![submenu-img]() OTT Releases This Week: The Greatest of All Time, CTRL, The Signature, The Tribe, latest films, series to binge-watch

OTT Releases This Week: The Greatest of All Time, CTRL, The Signature, The Tribe, latest films, series to binge-watch![submenu-img]() 10 thirst trap, sizzling hot photos of Avneet Kaur

10 thirst trap, sizzling hot photos of Avneet Kaur![submenu-img]() 6 mesmerising images of Nebula captured by NASA's Hubble Telescope

6 mesmerising images of Nebula captured by NASA's Hubble Telescope![submenu-img]() From Har Ki Pauri to Shivpuri: 6 places to visit in Haridwar and Rishikesh

From Har Ki Pauri to Shivpuri: 6 places to visit in Haridwar and Rishikesh![submenu-img]() 'Biased and agenda-driven': India dismisses USCIRF report on religious freedom

'Biased and agenda-driven': India dismisses USCIRF report on religious freedom![submenu-img]() Bank fraud: Fake SBI branch uncovered in Chhattisgarh, locals duped with fake recruitment drives and bank services

Bank fraud: Fake SBI branch uncovered in Chhattisgarh, locals duped with fake recruitment drives and bank services![submenu-img]() This politician was seeking votes for BJP in a speech, an hour later joined Congress, he is…

This politician was seeking votes for BJP in a speech, an hour later joined Congress, he is…![submenu-img]() Halal meat exports: India rolls out fresh guidelines with effect from October 16

Halal meat exports: India rolls out fresh guidelines with effect from October 16![submenu-img]() Isha Foundation row: SC transfers plea from Madras High Court to itself, asks police not to...

Isha Foundation row: SC transfers plea from Madras High Court to itself, asks police not to...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)