- LATEST

- WEBSTORY

- TRENDING

BUSINESS

Expect fourth consecutive RBI rate cut next month

Central bank likely to reduce repo rate by 25 bps to 5.50% to push growth

TRENDING NOW

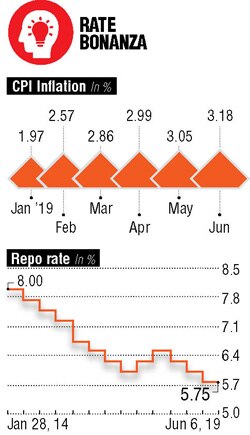

Despite inflation rising in June, Reserve Bank of India (RBI) is likely to cut its repo rate by 25 basis points (bps) for the fourth consecutive time, bringing down to 5.50% when it unveils the third credit policy of the current financial year on August 7.

The thrust of the Monetary Policy Committee (MPC) will continue to be on boosting growth in the economy. Repo rate is considered to be a signaling rate, at which banks borrow short-term (overnight) money from the central bank by pledging government bonds.

"RBI is definitely going to cut the rate by 25 bps when they unveil the monetary policy in August. They have the room to lower rates as inflation has not inched beyond RBI's target, and besides the central bank will focus on propelling growth," said Abheek Barua, chief economist, HDFC Bank.

The only worry is the inching up of Consumer Price Index (CPI), which rose to an eight-month high at 3.18%, higher than the 3.05% reported in the preceding month. The retail inflation calculated on the basis of CPI has been rising since January. But inflation continues to be weak when compared to the figure in the year-ago period in June 2018, when it had touched 4.92%. It is also lower than the central bank's medium-term target of 4% for almost a year, and is not expected to rise significantly.

The only worry is the inching up of Consumer Price Index (CPI), which rose to an eight-month high at 3.18%, higher than the 3.05% reported in the preceding month. The retail inflation calculated on the basis of CPI has been rising since January. But inflation continues to be weak when compared to the figure in the year-ago period in June 2018, when it had touched 4.92%. It is also lower than the central bank's medium-term target of 4% for almost a year, and is not expected to rise significantly.

Ashutosh Khajuria, executive director, Federal Bank, said, "We are expecting a 25 bps cut in rates, exactly in line with what the market is expecting. RBI will continue to give thrust on growth when inflation remains within manageable limits."

In its last meet on June 6, 2019, the MPC had lowered the key repo rate by 25 bps to 5.75%, its third consecutive policy rate cut, and changed its stance to "accommodative".

India's inflation has remained below the central bank's medium-term target of 4% for almost a year and is not expected to rise significantly above that until at least 2021.

Bank of America Merrill Lynch said in a report, "We continue to expect the MPC to cut rates by 0.25% on August 7, pause with inflation going up temporarily on base effects and drought, and cut by another 0.25% in the March quarter again as inflation abates."

RBI governor Shaktikanta Das has been holding meetings with bankers, asking them to reduce rates in tandem with the reduction in policy rates. While RBI has cut rates by 75 bps in this calendar year, banks have been slow in revising the rates, justifying their stand by saying a reduction in repo rate is only part of their costs.

State Bank of India has put in place an innovative home loan product that is linked to the repo rate which will show an immediate reduction once RBI cuts the signalling rate.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)