Ruloans, India’s leading loan distribution company, is pioneering a new standard in the industry by becoming the first Direct Selling Agent (DSA) to offer free CIBIL scores.

This groundbreaking move underscores Ruloans' commitment to enhancing financial literacy and empowering customers with the knowledge they need to understand their credit standing better.

A CIBIL score, often referred to as a credit score, is a crucial numerical value that reflects your creditworthiness based on factors such as credit history, repayment behavior, and outstanding debts. In India, these credit scores are maintained by four RBI-authorized Credit Information Companies (CICs): CRIF High Mark, Experian, Equifax, and TransUnion (CIBIL). Each of these bureaus has its unique approach to assessing credit history, resulting in slight variations in scores.

- CRIF High Mark is known for its extensive reach across diverse segments.

- Experian brings global expertise to the Indian market.

- Equifax provides advanced methods for assessing credit risk.

- CIBIL, being the oldest and most recognized, provides valuable insights that financial institutions heavily rely on when evaluating creditworthiness.

Your CIBIL score is a key indicator of your financial health, influencing various aspects of your financial life, from loan approvals to interest rates and credit limits. Here’s how a high CIBIL score can benefit you:

●Loan Approvals: A high CIBIL score is crucial for securing loan approvals, as it reflects a reliable repayment history. Lenders view applicants with strong scores as low-risk, making them more likely to approve loans swiftly.

●Better Interest Rates: With a higher CIBIL score, you can negotiate lower interest rates on loans and credit cards. This reduces your financial burden and saves you money over the life of the loan.

●Increased Credit Limits: A solid CIBIL score can lead to higher credit limits on credit cards and loans. This provides you with more financial freedom and the capacity to manage larger expenses without struggles.

●Improved Financial Monitoring: Regularly checking your CIBIL score allows you to stay informed about your credit health. It enables you to identify errors or discrepancies that could negatively impact your score, allowing you to take corrective action promptly.

●Preferred by Lenders: CIBIL has been a trusted credit bureau in India for many years, making its scores highly preferred by financial institutions. Many lenders use CIBIL scores as a primary criterion for evaluating loan and credit applications, which makes maintaining a good score essential for favorable terms.

●Access to Premium Credit Products: Individuals with higher CIBIL ratings are frequently eligible for premium credit products such as high-limit credit cards, personal loans with better terms, and exclusive offers that may be unavailable to those with lower scores.

●Impact on Employment Opportunities: Some employers in the financial sector may check CIBIL scores as part of their hiring process. A good score can reflect positively on your financial responsibility, potentially influencing hiring decisions.

●Insurance Premiums: In some cases, insurers may consider your credit score when determining premiums. A higher CIBIL score could lead to lower insurance costs, as it suggests a lower risk of defaulting on payments.

●Peace of Mind: Knowing that you have a strong CIBIL score gives you peace of mind since it demonstrates sound financial management and opens the door to greater financial prospects when you need them.

CIBIL scores are crucial because they reflect your creditworthiness and play a major role in securing loans and credit. Understanding and monitoring your CIBIL score is essential for maintaining financial health and achieving your financial goals.

Recognizing the importance of accessible credit information, Ruloans' initiative to offer free CIBIL scores empowers individuals to monitor their credit health regularly, enabling informed financial decisions and greater financial well-being.

(This article is part of DMCL Consumer Connect Initiative, a paid publication programme. DMCL claims no editorial involvement and assumes no responsibility, liability or claims for any errors or omissions in the content of the article. The DMCL Editorial team is not responsible for this content.)

![submenu-img]() India's first horror comedy came years before Stree, Bhediya, Bhool Bhulaiyaa; had no hero, Akshay Kumar borrowed its...

India's first horror comedy came years before Stree, Bhediya, Bhool Bhulaiyaa; had no hero, Akshay Kumar borrowed its...![submenu-img]() Weather Update: IMD predicts extremely heavy rain in this state, light to moderate rain in these states; check forecast

Weather Update: IMD predicts extremely heavy rain in this state, light to moderate rain in these states; check forecast![submenu-img]() Meet India's box office king, only star with 8 consecutive 200-crore hits, bigger than Shah Rukh, Salman, Rajni, Prabhas

Meet India's box office king, only star with 8 consecutive 200-crore hits, bigger than Shah Rukh, Salman, Rajni, Prabhas![submenu-img]() Jeff Bezos' fiancee Lauren Sanchez reveals surprising morning rule, says, 'Just us...'

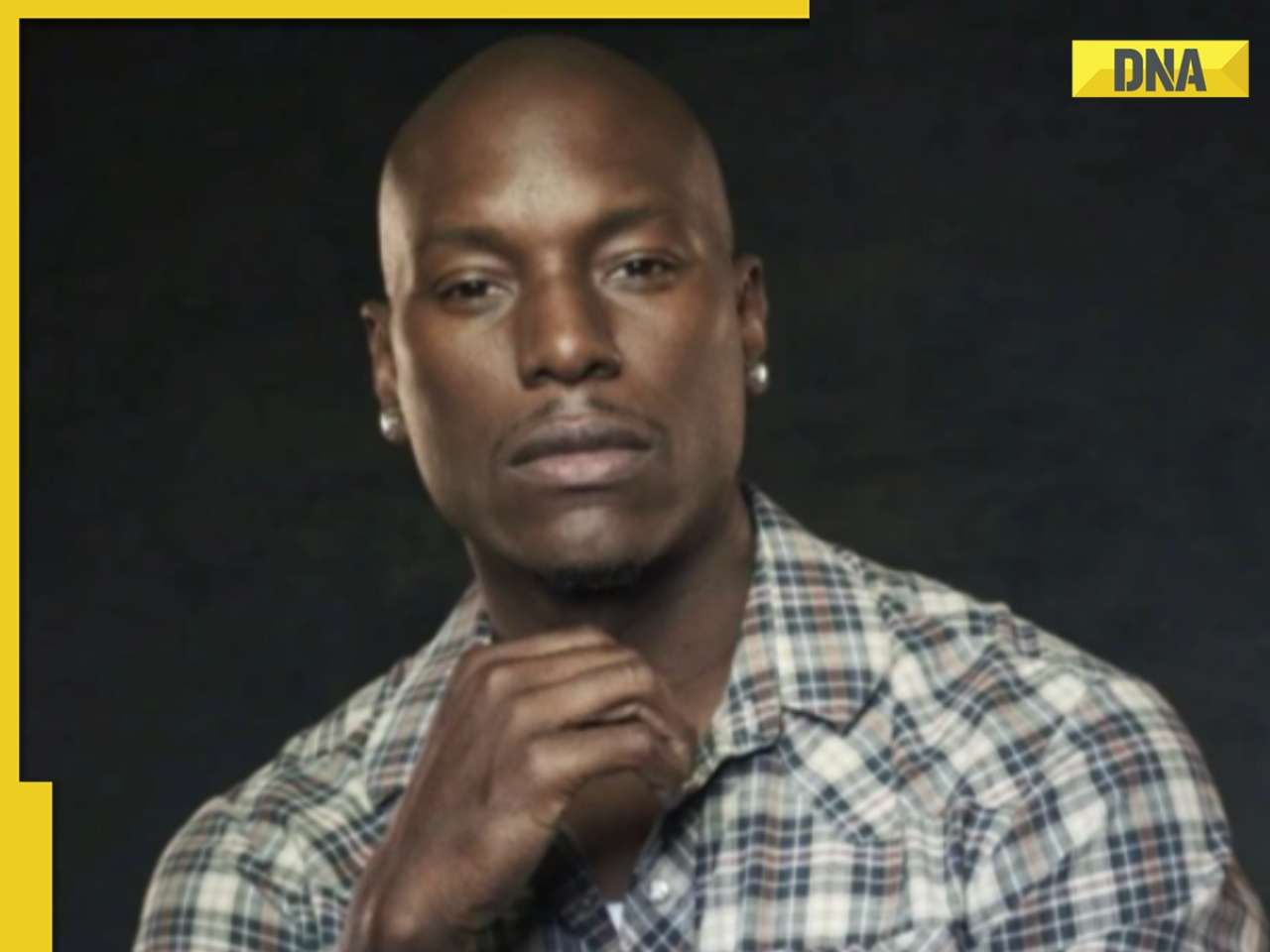

Jeff Bezos' fiancee Lauren Sanchez reveals surprising morning rule, says, 'Just us...'![submenu-img]() Fast & Furious star Tyrese Gibson arrested in Georgia, details inside

Fast & Furious star Tyrese Gibson arrested in Georgia, details inside![submenu-img]() Trump-Harris Debate: 'मैं रोकूंगा रूस-यूक्रेन युद्ध', ट्रंप का बड़ा दावा, कमला बोलीं- 'पुतिन आपको लंच में खा जाएंगे'

Trump-Harris Debate: 'मैं रोकूंगा रूस-यूक्रेन युद्ध', ट्रंप का बड़ा दावा, कमला बोलीं- 'पुतिन आपको लंच में खा जाएंगे'![submenu-img]() 'इस साल कोई दुर्गा पूजा नहीं मनाएगा...' कोलकाता RG कर हॉस्पिटल रेप-मर्डर पीड़िता के पिता ने क्यों कही ये बात

'इस साल कोई दुर्गा पूजा नहीं मनाएगा...' कोलकाता RG कर हॉस्पिटल रेप-मर्डर पीड़िता के पिता ने क्यों कही ये बात![submenu-img]() Trump-Harris Debate : अबॉर्शन पर जोरदार बहस, कमला हैरिस बोलीं-'महिलाओं को मत बताइए वे अपने शरीर के साथ क्या करें?'

Trump-Harris Debate : अबॉर्शन पर जोरदार बहस, कमला हैरिस बोलीं-'महिलाओं को मत बताइए वे अपने शरीर के साथ क्या करें?' ![submenu-img]() Bangladesh मांग रहा भारत से Sheikh Hasina को वापस, क्या कहती है दोनों देशों की प्रत्यर्पण संधि?

Bangladesh मांग रहा भारत से Sheikh Hasina को वापस, क्या कहती है दोनों देशों की प्रत्यर्पण संधि?![submenu-img]() AFG vs NZ Test: BCCI ने लगा दिया था बैन, फिर भी अफगानिस्तान ने क्यों चुना नोएडा स्टेडियम; जानें क्या है मामला

AFG vs NZ Test: BCCI ने लगा दिया था बैन, फिर भी अफगानिस्तान ने क्यों चुना नोएडा स्टेडियम; जानें क्या है मामला![submenu-img]() Auto giant gifts Olympic medallist Manu Bhaker this car, it costs Rs...

Auto giant gifts Olympic medallist Manu Bhaker this car, it costs Rs...![submenu-img]() Union Minister Nitin Gadkari says this big carmaker ignored his advice on EVs, 'now they've…'

Union Minister Nitin Gadkari says this big carmaker ignored his advice on EVs, 'now they've…'![submenu-img]() Tata Safari, rival to Hyundai Alcazar Facelift gets massive discount, save up to Rs…

Tata Safari, rival to Hyundai Alcazar Facelift gets massive discount, save up to Rs…![submenu-img]() Hyundai Alcazar facelift launched in India: Check price, design and other features

Hyundai Alcazar facelift launched in India: Check price, design and other features![submenu-img]() Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared

Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared ![submenu-img]() Meet man, who cracked UPSC twice, has 20 degrees, resigned as IAS officer due to...

Meet man, who cracked UPSC twice, has 20 degrees, resigned as IAS officer due to...![submenu-img]() Meet woman, daughter of widow labourer who cleared UPSC twice, became IPS at 21, IAS at 22, she is famous as India’s...

Meet woman, daughter of widow labourer who cleared UPSC twice, became IPS at 21, IAS at 22, she is famous as India’s...![submenu-img]() Meet Indian genius, son of IIT-JEE topper, who won gold at world’s toughest...

Meet Indian genius, son of IIT-JEE topper, who won gold at world’s toughest...![submenu-img]() AIAPGET 2024: Counselling registration starts today, check details here

AIAPGET 2024: Counselling registration starts today, check details here![submenu-img]() Meet woman who topped class 10, 12, CLAT, law school, cleared UPSC in 1st try, got AIR 60 with self-study, now posted...

Meet woman who topped class 10, 12, CLAT, law school, cleared UPSC in 1st try, got AIR 60 with self-study, now posted...![submenu-img]() Manipur Violence: Curfew Imposed In Three Manipur Districts Amid Drone, Rocket Attacks By Insurgents

Manipur Violence: Curfew Imposed In Three Manipur Districts Amid Drone, Rocket Attacks By Insurgents![submenu-img]() Kolkata Doctor Case: Victim's Mother Blasts CM Mamata Banerjee's 'Insensitive' Durga Puja call

Kolkata Doctor Case: Victim's Mother Blasts CM Mamata Banerjee's 'Insensitive' Durga Puja call![submenu-img]() Apple Watch Series 10 Launch: Key Highlights & Specs | All-New Apple Watch Unveiled

Apple Watch Series 10 Launch: Key Highlights & Specs | All-New Apple Watch Unveiled![submenu-img]() Ukraine-Russia War: Airports Shut, One Dead As Ukraine Launches Massive Drone Attack On Moscow

Ukraine-Russia War: Airports Shut, One Dead As Ukraine Launches Massive Drone Attack On Moscow![submenu-img]() Kolkata Doctor Case: 'CM Wanted To Strangle The Protest', Victim’s Mother Rejects CM Mamata's Claim

Kolkata Doctor Case: 'CM Wanted To Strangle The Protest', Victim’s Mother Rejects CM Mamata's Claim![submenu-img]() Mukesh Ambani's Reliance ties up with Israeli company to launch....

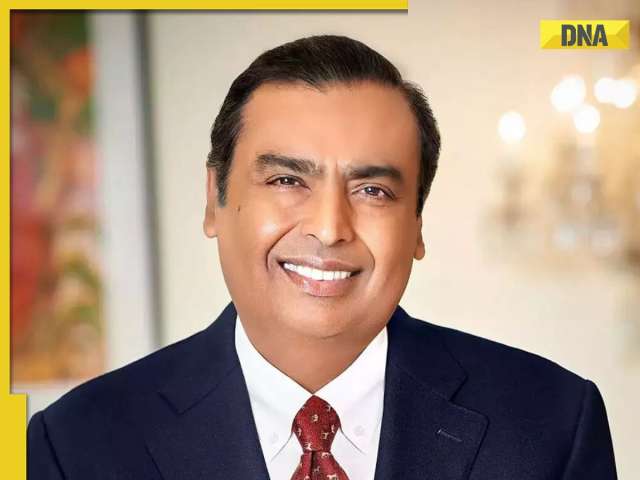

Mukesh Ambani's Reliance ties up with Israeli company to launch....![submenu-img]() Auto giant gifts Olympic medallist Manu Bhaker this car, it costs Rs...

Auto giant gifts Olympic medallist Manu Bhaker this car, it costs Rs...![submenu-img]() Meet woman, daughter of an Indian billionaire, she leads Rs 20335 crore company, Mukesh Ambani is her…

Meet woman, daughter of an Indian billionaire, she leads Rs 20335 crore company, Mukesh Ambani is her…![submenu-img]() Meet man, who worked at Mukesh Ambani's company for 5 yrs, resigned to launch Rs 1091 crore...

Meet man, who worked at Mukesh Ambani's company for 5 yrs, resigned to launch Rs 1091 crore...![submenu-img]() Meet man, an IITian, who is richer than Infosys founder Narayana Murthy, Sudha Murthy, his net worth...

Meet man, an IITian, who is richer than Infosys founder Narayana Murthy, Sudha Murthy, his net worth...![submenu-img]() Meet Salman Khan’s ‘sister’, who became star at 10, left Bollywood after giving Rs 400-crore hit, now earns through…

Meet Salman Khan’s ‘sister’, who became star at 10, left Bollywood after giving Rs 400-crore hit, now earns through…![submenu-img]() Rs 4000 crore palace, 8 jets, 700 cars: All about Abu Dhabi royal family

Rs 4000 crore palace, 8 jets, 700 cars: All about Abu Dhabi royal family![submenu-img]() Mukesh Ambani's fitness secret: From morning yoga to simple lunch, here are all details

Mukesh Ambani's fitness secret: From morning yoga to simple lunch, here are all details![submenu-img]() Top Tata Motors cars to buy in India

Top Tata Motors cars to buy in India![submenu-img]() Meet actress, who was linked to superstar, quit Bollywood to marry Pakistani cricketer, got divorced, is now...

Meet actress, who was linked to superstar, quit Bollywood to marry Pakistani cricketer, got divorced, is now...![submenu-img]() Weather Update: IMD predicts extremely heavy rain in this state, light to moderate rain in these states; check forecast

Weather Update: IMD predicts extremely heavy rain in this state, light to moderate rain in these states; check forecast![submenu-img]() J&K terror funding case: Baramulla MP Engineer Rashid gets bail till October 2 due to…

J&K terror funding case: Baramulla MP Engineer Rashid gets bail till October 2 due to…![submenu-img]() RG Kar ex-principal Sandip Ghosh sent to 14-day judicial custody till...

RG Kar ex-principal Sandip Ghosh sent to 14-day judicial custody till...![submenu-img]() Adapting to Climate Challenges: The Role of Systems Engineering in Modern Insurance and Financial Services

Adapting to Climate Challenges: The Role of Systems Engineering in Modern Insurance and Financial Services![submenu-img]() Manipur: Internet suspended in state for 5 days amid students' agitation

Manipur: Internet suspended in state for 5 days amid students' agitation

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)