SEBI had slapped a fine totaling Rs 25 crore on Mukesh Ambani, Anil Ambani, Nita Ambani, Tina Ambani and other entities in April 2021 for non-compliance with takeover norms in a Reliance Industries case dating back to 2000.

A SEBI order imposing Rs 25 crore penalty on industrialists Mukesh Ambani, Anil Ambani and other entities, over non-compliance with takeover norms in case of Reliance Industries, was set aside by the Securities Appellate Tribunal (SAT) on Friday. The order followed Ambanis’ appeal in the appellate tribunal against the directive of Securities and Exchange Board of India (SEBI).

"We find that the appellant has not violated ... The SAST (Substantial Acquisition of Shares and Takeovers) Regulations. The imposition of penalty upon the appellant is without any authority of law. Consequently, the impugned order cannot be sustained and is quashed," the SAT said in its 124-page order.

The case is related to alleged failure to comply with takeover rules. SAT noted that the penalty amount following SEBI's order was deposited by the appellants. It directed the markets regulator to refund the Rs 25 crore amount within four weeks.

SEBI had slapped a fine totalling Rs 25 crore on Mukesh Ambani, Anil Ambani, Nita Ambani, Tina Ambani and other entities in April 2021 for non-compliance with takeover norms in a Reliance Industries case dating back to 2000.

The SEBI order had stated that RIL promoters and Persons Acting in Concert (PAC) failed to disclose the acquisition of more than 5 per cent stake in the company way back in 2000. Mukesh Ambani and Anil Ambani had split the business empire built by their father Dhirubhai Ambani in 2005.

Sebi noted that 6.83 percent stake was acquired by RIL promoters together with PACs consequent to exercise of option on warrants attached with non-convertible secured redeemable debentures were in excess of the ceiling of 5 per cent prescribed under the takeover regulations.

Thus, the obligation to make a public announcement about acquiring the shares arose on January 7, 2000. This was the date on which the PACs were allotted RIL equity shares on exercise of warrants issued in January 1994, the order had mentioned.

However, Sebi had found that the promoters and PACs did not make any public announcement for acquiring the shares. Since the promoters and PACs did not make any public announcement for acquiring shares, it was alleged that they violated the provisions of the takeover regulations.

(Inputs from PTI)

![submenu-img]() DNA TV Show: Why Opposition is contesting Lok Sabha Speaker election

DNA TV Show: Why Opposition is contesting Lok Sabha Speaker election![submenu-img]() When Reena Roy broke her silence on her uncanny resemblance with rumoured ex Shatrughan Sinha's daughter Sonakshi Sinha

When Reena Roy broke her silence on her uncanny resemblance with rumoured ex Shatrughan Sinha's daughter Sonakshi Sinha![submenu-img]() Kangana Ranaut announces new release date of Emergency with new poster, fans say 'fifth National Award loading'

Kangana Ranaut announces new release date of Emergency with new poster, fans say 'fifth National Award loading'![submenu-img]() Makeover of homeless woman leaves internet stunned, netizens says...

Makeover of homeless woman leaves internet stunned, netizens says...![submenu-img]() Beginner SARM Cycle Guide: Best SARMs Stack For Beginners (Bulking, Cutting, Strength)

Beginner SARM Cycle Guide: Best SARMs Stack For Beginners (Bulking, Cutting, Strength)![submenu-img]() Meet Indian genius who saved lakhs of lives with his discovery, received six Nobel nominations, but never won due to…

Meet Indian genius who saved lakhs of lives with his discovery, received six Nobel nominations, but never won due to…![submenu-img]() What is 'space hairdryer' technique which can save million lives amid rise in heart attack cases?

What is 'space hairdryer' technique which can save million lives amid rise in heart attack cases?![submenu-img]() India's most educated man earned 20 degrees, cracked UPSC twice, later resigned as IAS officer due to…

India's most educated man earned 20 degrees, cracked UPSC twice, later resigned as IAS officer due to…![submenu-img]() NEET PG 2024: NBE President Abhijat Sheth makes big announcement, reveals exam date will be declared on..

NEET PG 2024: NBE President Abhijat Sheth makes big announcement, reveals exam date will be declared on..![submenu-img]() Meet engineer who quit job to crack UPSC, took up a part-time job to pay coaching fees, failed prelims 5 times then...

Meet engineer who quit job to crack UPSC, took up a part-time job to pay coaching fees, failed prelims 5 times then...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'

Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'![submenu-img]() Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception

Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception![submenu-img]() Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...

Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...![submenu-img]() From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala

From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala![submenu-img]() In pics: Bigg Boss OTT 3 house with dragons, two-sided walls is all about fantasy coming alive

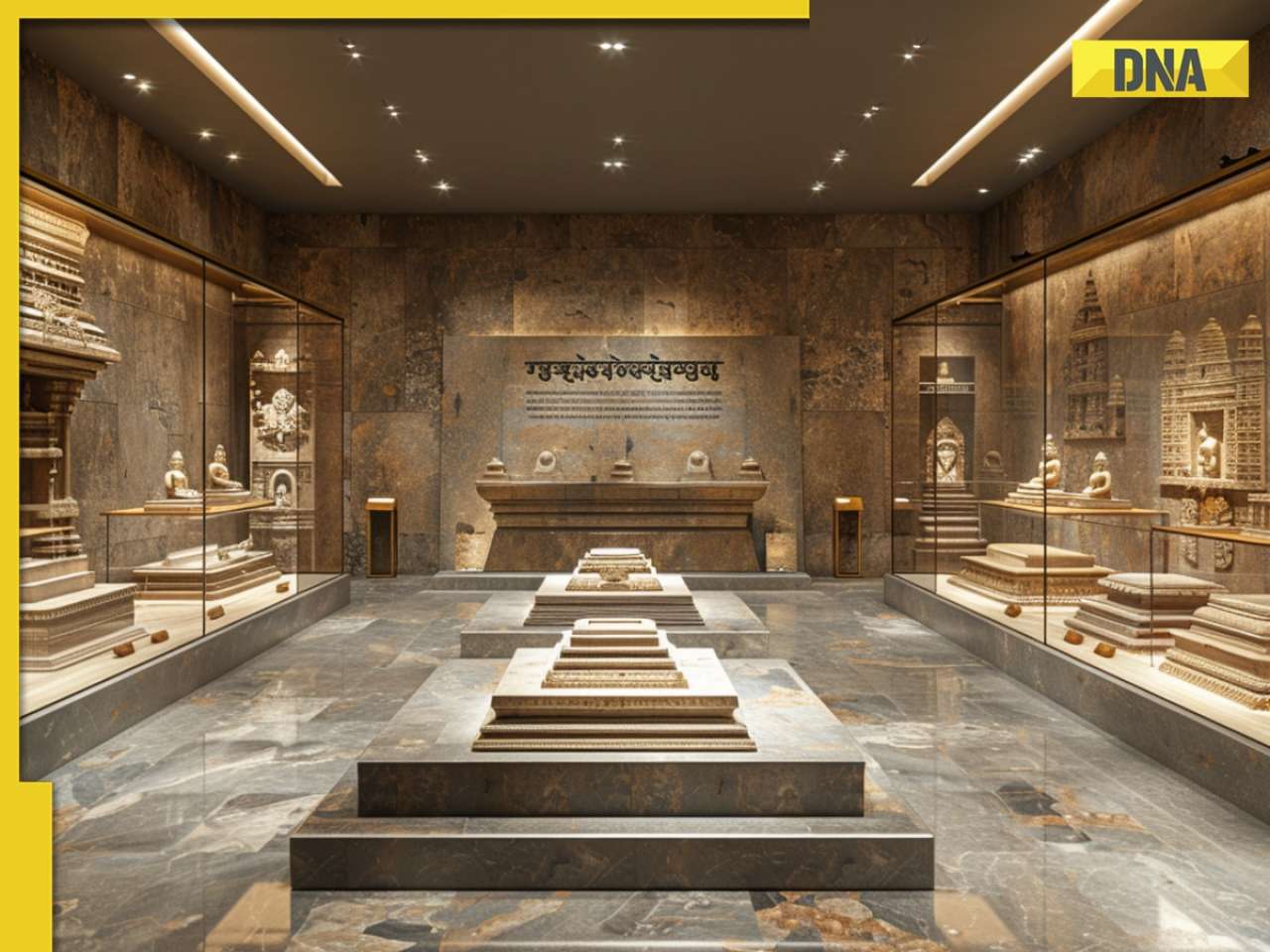

In pics: Bigg Boss OTT 3 house with dragons, two-sided walls is all about fantasy coming alive![submenu-img]() Explained: Why is Kerala demanding to change its name to Keralam?

Explained: Why is Kerala demanding to change its name to Keralam?![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() When Reena Roy broke her silence on her uncanny resemblance with rumoured ex Shatrughan Sinha's daughter Sonakshi Sinha

When Reena Roy broke her silence on her uncanny resemblance with rumoured ex Shatrughan Sinha's daughter Sonakshi Sinha![submenu-img]() Kangana Ranaut announces new release date of Emergency with new poster, fans say 'fifth National Award loading'

Kangana Ranaut announces new release date of Emergency with new poster, fans say 'fifth National Award loading'![submenu-img]() Indian 2 trailer: Kamal Haasan's Senapathy leads second war of independence, fans say 'Rs 1000 crore confirmed'

Indian 2 trailer: Kamal Haasan's Senapathy leads second war of independence, fans say 'Rs 1000 crore confirmed'![submenu-img]() Watch: Jaideep Ahlawat loses more than 26 kgs in 5 months for Maharaj, his amazing physical tranformation stuns fans

Watch: Jaideep Ahlawat loses more than 26 kgs in 5 months for Maharaj, his amazing physical tranformation stuns fans![submenu-img]() Meet Rachit Singh, Huma Qureshi's rumoured boyfriend, has worked with Anushka, Alia, Ranveer, was last seen in...

Meet Rachit Singh, Huma Qureshi's rumoured boyfriend, has worked with Anushka, Alia, Ranveer, was last seen in...![submenu-img]() Makeover of homeless woman leaves internet stunned, netizens says...

Makeover of homeless woman leaves internet stunned, netizens says...![submenu-img]() Mango for Rs 2400, Ladyfinger for Rs 650: Common Indian food items are selling for whopping price in.....

Mango for Rs 2400, Ladyfinger for Rs 650: Common Indian food items are selling for whopping price in.....![submenu-img]() Meet British-Indian who drove 18300 km from London to Maharashtra to meet..

Meet British-Indian who drove 18300 km from London to Maharashtra to meet..![submenu-img]() Elon Musk confirms birth of his 12th child, welcomed baby with Neuralink executive earlier this year

Elon Musk confirms birth of his 12th child, welcomed baby with Neuralink executive earlier this year![submenu-img]() Isha Ambani did something which Shloka Mehta, Radhika Merchant are yet to do, she used 6-year-old...

Isha Ambani did something which Shloka Mehta, Radhika Merchant are yet to do, she used 6-year-old...

)

)

)

)

)

)

)