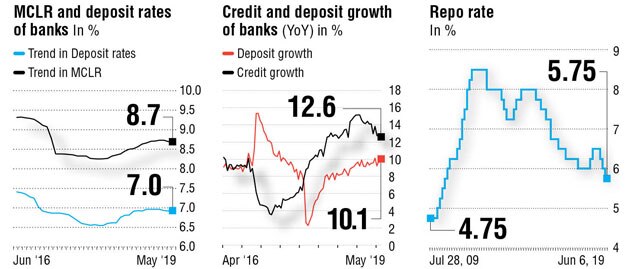

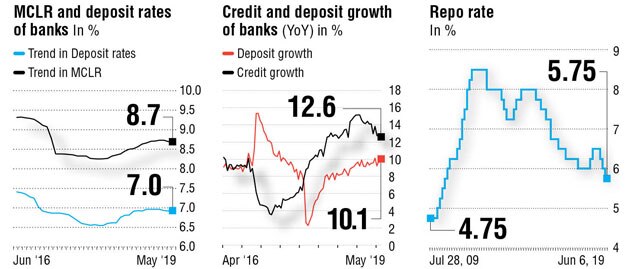

Reserve Bank of India (RBI) has signalled more rate cuts by changing its monetary policy stance from neutral to accommodative. It cut the repo rate by 25 basis points to 5.75%, the lowest in nine years, to push growth. All six members of Monetary Policy Committee (MPC) voted unanimously for a cut. The accommodative stance will also help in bringing down the government's borrowing cost. The yields on 10-year government bonds fell 10 basis points to close at 6.93% on Thursday.

"We are cutting rates when the inflation is still under control to take care of the growth concerns. With inflation under control, RBI has changed its stance to accommodative from neutral. Rate hikes are off the table for now," said Shaktikanta Das, RBI governor, at a press conference.

For this fiscal, GDP growth forecast has been cut by 20 bps to 7.0%, owing to the weak investment activity, weak global demand and moderation in private consumption "The RBI policy decision to change the policy stance to 'accommodative' will simultaneously help the financial system to navigate to a lower term structure of interest rates and also accommodate growth concerns. On the regulatory front, the decision to lower the Basel III leverage ratio will augment the lendable resources of the banks," said Rajnish Kumar chairman, State Bank of India.

- Repo rate reduced by 25 bps to 5.75%

- Reverse repo rate now stands at 5.50%

- Marginal standing facility (MSF) rate 6%

- RBI changes policy stance to accommodative from neutral

- Cuts GDP growth forecast to 7% from 7.2% for FY20

- Raises retail inflation forecast for Apr-Sept to 3-3.1% and 3.4-3.7% in Oct-Mar

- Waives RTGS and NEFT charges to promote digital transactions

- Sets up a panel to review ATM charges, fees levied by banks

- To issue draft guidelines for ‘on tap’ licensing of small finance banks by Aug

- Average daily surplus liquidity in system at Rs 66,000 crore in early June

- Foreign exchange reserves at $421.9 billion on May 31, 2019

|

The silver lining includes political stability, high capacity utilisation and uptick in business expectations. In the last two policies, RBI cut its growth forecast by 40 bps. RBI kept CPI inflation for FY20 at the same level with 3.0-3.1% in H1 of this fiscal (earlier 2.9-3.0%) and 3.4-3.7% in H2 of this fiscal (earlier 3.5-3.8%)," said SBI Ecowrap, the report put out by the economics wing of State Bank of India

Zarin Daruwala, CEO, Standard Chartered Bank, India, said, "The combination of the repo rate cut, the change to an accommodative stance and the resolve to provide adequate liquidity, will provide the impetus to counter growth and investment headwinds. A review of the liquidity should aid monetary transmission. Additionally, the easing of the leverage ratio requirement will boost bank lending and should serve as the much-needed counter-cyclical stimulus."

The cut in the leverage ratio (LR capital buffers) under the Basel III norms will also free up additional liquidity of Rs 1 lakh crore if they have lower risk weight assets and enough capital to meet the capital adequacy ratio, according to an analysis done by SBI Ecowrap. Most of the banks were maintaining a higher LR ratio of 4% to 4.8%, which now stands reduced to 3.5%

Kotak Securities in a report said, "MPC's accommodative policy stance amid a benign growth-inflation outlook has strengthened our case for another 25 bps cut in August. Rate cuts beyond August would, however, hinge on any downward surprises to the RBI's growth-inflation trajectory."

Even though the MPC believes that the recent pick-up in food prices has imparted an upward bias to the inflation trajectory, subdued global and domestic demand will result in further softening of core inflation during this fiscal, keeping the headline inflation broadly in check.

![submenu-img]() Verantes Living Awarded as India’s No.1 Stainless Steel Modular Kitchen Brand

Verantes Living Awarded as India’s No.1 Stainless Steel Modular Kitchen Brand![submenu-img]() Narayana Murthy’s Infosys set to invest Rs 170000000 in this startup

Narayana Murthy’s Infosys set to invest Rs 170000000 in this startup![submenu-img]() 'Towards reducing pollution..': Delhi govt approves replacement, induction of electric vehicles in 'Gramin Sewa'

'Towards reducing pollution..': Delhi govt approves replacement, induction of electric vehicles in 'Gramin Sewa'![submenu-img]() Discover Stainless France, the Leading Supplier of Cobalt Chrome

Discover Stainless France, the Leading Supplier of Cobalt Chrome![submenu-img]() Kritika Kamra says men should take responsibility for fighting sexism: 'There's a thin line between...'

Kritika Kamra says men should take responsibility for fighting sexism: 'There's a thin line between...'![submenu-img]() हाईकोर्ट के जज ने मुस्लिम इलाके को बताया 'मिनी पाकिस्तान', सुप्रीम कोर्ट ने लगाई कड़ी फटकार, जानें पूरी बात

हाईकोर्ट के जज ने मुस्लिम इलाके को बताया 'मिनी पाकिस्तान', सुप्रीम कोर्ट ने लगाई कड़ी फटकार, जानें पूरी बात![submenu-img]() SC का यूट्यूब चैनल हुआ हैक, चलने लगा अमेरिकी क्रिप्टोकरेंसी का ऐड, कोर्ट ने NIC से मांगी मदद

SC का यूट्यूब चैनल हुआ हैक, चलने लगा अमेरिकी क्रिप्टोकरेंसी का ऐड, कोर्ट ने NIC से मांगी मदद![submenu-img]() Astronaut sunita williams ने अंतरिक्ष में मनाया बर्थडे, पढ़ाई और स्पेस स्टेशन की मरम्मत कर खास बनाया दिन

Astronaut sunita williams ने अंतरिक्ष में मनाया बर्थडे, पढ़ाई और स्पेस स्टेशन की मरम्मत कर खास बनाया दिन![submenu-img]() पाकिस्तानी सेना पर दक्षिणी वजीरिस्तान में बड़ा हमला, 6 जवानों की मौत, कई जख्मी

पाकिस्तानी सेना पर दक्षिणी वजीरिस्तान में बड़ा हमला, 6 जवानों की मौत, कई जख्मी![submenu-img]() RITES shares: रेलवे PSU के शेयर में आज 48% की गिरावट क्यों देखी जा रही है, समझें पूरा मामला

RITES shares: रेलवे PSU के शेयर में आज 48% की गिरावट क्यों देखी जा रही है, समझें पूरा मामला![submenu-img]() Ford to return to India after 2 years with reopening of....

Ford to return to India after 2 years with reopening of....![submenu-img]() Maruti Suzuki launches new Swift CNG, check price, mileage, other features

Maruti Suzuki launches new Swift CNG, check price, mileage, other features![submenu-img]() ‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...

‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...![submenu-img]() In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…

In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…![submenu-img]() World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…

World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…![submenu-img]() Meet IPS officer who has resigned after serving for 18 yrs due to...

Meet IPS officer who has resigned after serving for 18 yrs due to...![submenu-img]() Meet Indian man, who got hired whopping Rs 12000000 crore salary job, not from IIT, IIM he is...

Meet Indian man, who got hired whopping Rs 12000000 crore salary job, not from IIT, IIM he is...![submenu-img]() Meet woman who left medical career for UPSC exam , became IPS with AIR 165 then left job due to...

Meet woman who left medical career for UPSC exam , became IPS with AIR 165 then left job due to...![submenu-img]() Meet man, who left NDA due to depression, then cracked UPSC exam to become IAS officer, his AIR was...

Meet man, who left NDA due to depression, then cracked UPSC exam to become IAS officer, his AIR was...![submenu-img]() Meet youngest CEO of India, who created first app at 9, began his own company at 13, now he is…

Meet youngest CEO of India, who created first app at 9, began his own company at 13, now he is…![submenu-img]() Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical

Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical![submenu-img]() Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval

Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval![submenu-img]() Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?

Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?![submenu-img]() One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0

One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0![submenu-img]() Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed

Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed![submenu-img]() Verantes Living Awarded as India’s No.1 Stainless Steel Modular Kitchen Brand

Verantes Living Awarded as India’s No.1 Stainless Steel Modular Kitchen Brand![submenu-img]() Narayana Murthy’s Infosys set to invest Rs 170000000 in this startup

Narayana Murthy’s Infosys set to invest Rs 170000000 in this startup![submenu-img]() Discover Stainless France, the Leading Supplier of Cobalt Chrome

Discover Stainless France, the Leading Supplier of Cobalt Chrome![submenu-img]() ITR filing: Haven’t received your income tax refund yet? Here’s what you should do

ITR filing: Haven’t received your income tax refund yet? Here’s what you should do![submenu-img]() Meet ‘delivery boy’ who beats Mukesh Ambani in world’s billionaire list, his net worth is…

Meet ‘delivery boy’ who beats Mukesh Ambani in world’s billionaire list, his net worth is…![submenu-img]() In pics: Saiyami Kher conquers Ironman triathlon in Germany, swims, cycles, runs to complete endurance races

In pics: Saiyami Kher conquers Ironman triathlon in Germany, swims, cycles, runs to complete endurance races![submenu-img]() Meet IAS officer, who cracked in UPSC exam along with full-time job, her AIR was...

Meet IAS officer, who cracked in UPSC exam along with full-time job, her AIR was...![submenu-img]() In pics | India vs Bangladesh 1st Test, Day 1

In pics | India vs Bangladesh 1st Test, Day 1![submenu-img]() From Mechuka to Hayuliang village: Explore lesser-known destinations of Arunachal Pradesh

From Mechuka to Hayuliang village: Explore lesser-known destinations of Arunachal Pradesh![submenu-img]() From Simlipal National Park to Mahendragiri: Top 6 hidden gems to discover in Odisha

From Simlipal National Park to Mahendragiri: Top 6 hidden gems to discover in Odisha![submenu-img]() 'Towards reducing pollution..': Delhi govt approves replacement, induction of electric vehicles in 'Gramin Sewa'

'Towards reducing pollution..': Delhi govt approves replacement, induction of electric vehicles in 'Gramin Sewa'![submenu-img]() More trouble for ex-RG Kar principal Sandip Ghosh, Bengal medical body now...

More trouble for ex-RG Kar principal Sandip Ghosh, Bengal medical body now...![submenu-img]() Tirupati Laddu row: Lab report confirms prasada contains beef fat, fish oil

Tirupati Laddu row: Lab report confirms prasada contains beef fat, fish oil![submenu-img]() Delhi: Water supply to be shut down in capital for 12 hours tomorrow due to…; check list of affected areas

Delhi: Water supply to be shut down in capital for 12 hours tomorrow due to…; check list of affected areas![submenu-img]() FATF says India faces severe 'terrorist financing threats' from...

FATF says India faces severe 'terrorist financing threats' from...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)