- LATEST

- WEBSTORY

- TRENDING

BUSINESS

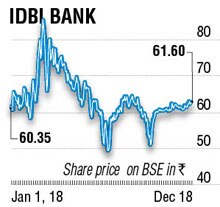

IDBI Bank writes off Rs 30,000 cr loans

IDBI Bank’s total outstanding NPAs at the end of the second quarter were Rs 60,875 crore, which is 31.78% of its gross advances

TRENDING NOW

IDBI Bank, which is one of the 11 public sector banks restricted by Reserve Bank of India (RBI) from lending due to its messy balance-sheet, has revealed that it has written off close to Rs 30,000 crore of loans in the last three-and-a-half years.

The bank, which has been brought under RBI’s prompt corrective action (PCA) framework, has recently informed the Parliamentary Standing Committee on Finance that the first half of the current fiscal saw a Rs 9,052 crore loan write-off. Coming mostly from the infrastructure and metals space, this has already touched 72.32% of the last fiscal’s record Rs 12,515 crore loan write-off.

IDBI Bank’s write-off stands at a whopping Rs 29,894 crore during the last three-and-a-half years ended September 2018, a source in the parliamentary committee said. In FY2017, the bank’s write-off dropped to Rs 2,868 crore from Rs 5,459 crore a year ago.

IDBI Bank told the house panel that it was after the asset quality review (AQR), introduced by the RBI in 2015-16, that the non-performing asset (NPA) situation deteriorated significantly for the banking sector.

IDBI Bank told the house panel that it was after the asset quality review (AQR), introduced by the RBI in 2015-16, that the non-performing asset (NPA) situation deteriorated significantly for the banking sector.

AQR, the bank told the house panel, led to recognition of several loans as NPAs, which the banks had considered to be standard assets. Banking sector’s NPAs shot up from 7.79% of its gross advances in 20151-16 to 11.8% by March 2018.

The rising NPAs in IDBI were also the result of the AQR exercise that led to decline in the profitability of the bank, IDBI submitted the report to the panel on December 4, 2018.

IDBI Bank’s total outstanding NPAs at the end of the second quarter were Rs 60,875 crore, which is 31.78% of its gross advances.

For the second quarter, the bank reported an incremental growth in advances, for the first time in nearly a year.

The total outstanding advances of the bank at the end of the quarter was Rs 2,05670 crore, about Rs 3,710 crore higher than the trailing quarter.

“The stressed assets in the banking sector is due to the general slowdown in the economy and sector-specific constraints. However, the situation deteriorated significantly after 2015-16 when RBI took up the AQR,” IDBI Bank said in its report.

The write-offs are part of the clean-up exercise that the bank has been implementing for many quarters to strengthen its balance-sheet. The write-offs help the bank to take off the loans off its balance-sheet and also help it to save taxes. The bank has also been referring cases to the National Company Law Tribunal (NCLT). But the NCLT process has also not been fast enough for banks, with many lenders waiting for settlement of many cases, largest of which is the Essar Steel case that is still stuck in litigations.

Until the end of September 30, the bank has referred 280 cases involving a principal of Rs 49,912 crore to NCLT. Of this, 128 cases involving IDBI exposure of Rs 31,850 crore have been admitted in the NCLT. Resolutions came about only in four cases with a principal amount of Rs 2,082 crore. Out of this, the bank has received only Rs 1,333 crore.

IDBI said that it has appointed CRIF High Mark Credit Information Services, a credit information company, to receive early warning signals (EWS) solution on its retail borrowers on a pilot basis. The bank is also monitoring the accounts on a weekly basis through its credit monitoring group.

IDFC Bank and non-banking financial company Capital First announced completion of their merger Tuesday, creating a combined loan asset book of Rs 1.03 lakh crore for the merged entity IDFC First Bank.

AWASH IN RED

- Rs 60,875 cr – IDBI Bank’s total outstanding NPAs at the end of the second quarter

- 31.78% – Bad loans form of its gross advances

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)