- LATEST

- WEBSTORY

- TRENDING

BUSINESS

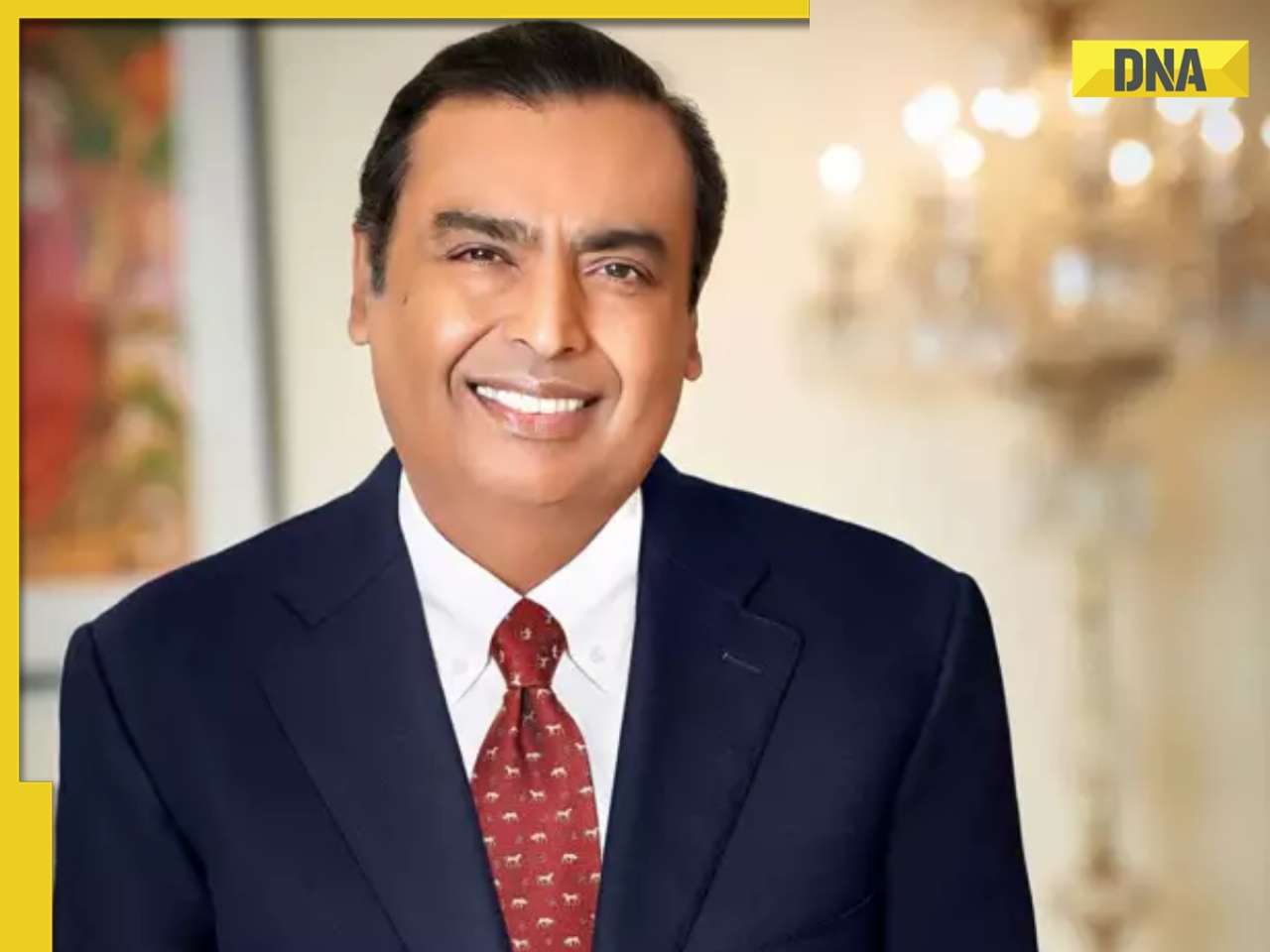

KG bounty to drive RIL exploration, retail biz

On Tuesday, company chairman and India’s richest man Mukesh Ambani laid out an ambitious revival and expansion plan across the company’s multifarious empire.

TRENDING NOW

“This has undoubtedly been a challenging year for Reliance. The global financial meltdown took its toll on communities, companies and countries... The crisis has fundamentally changed the world of business. The best of India is yet to come. And the best of Reliance is yet to come,” he told shareholders at the annual general meeting. RIL is aiming global scales in its core business of conventional energy - petrochemicals, refining and oil and gas exploration — even as it invests in new ventures like retailing and alternative energy.

“Global growth by acquisitions” is key to growing the energy business, Ambani said. “Our efforts would be to grow the conventional energy” business through greater “global scale.”

Mukesh Ambani, however, completely side-stepped the ongoing gas controversy with younger brother Anil, disappointing those who expected a rebuttal to Anil’s fiery speech at one of his companies’ annual general meeting.

Instead, he chose to focus on the road ahead for RIL, which is recovering from arguably its most financially challenging period in decades. Hit by a double whammy of a drop in refining margins and petrochemical prices, and made worse by a slump in retail sector, RIL has had only one piece of good news during 2008-09 — the commencement of gas production.

Eschewing fancy businesses that create “make-believe value,” the RIL chairman chose to base his revival plan on the solid fundamentals of his energy business. Gas sales from the two of the 19 discoveries in the D6 basin in the Krishna Godavari basin are expected to double RIL’s annual profits to nearly Rs 30,000 crore ($6.6 billion) during calendar year 2010.

“We are now engaged in realising a renewed five-platform roadmap for value creation. The conventional energy platform is undoubtedly the bedrock of this value creation pathway,” he said, listing out further hydrocarbon exploration, modern retail, renewable energy and rural as the beneficiaries of RIL’s new investments in the new year.

In exploration, for example, RIL has nearly 3.25 lakh square km of land and sea to explore (this it had bid for and won over the last decade). It also has around 100,000 square km of exploration acreage abroad. However, out of the 33 exploration blocks it holds in India, it has reached the drilling stage only in three or four. Tenty-nine blocks are still under seismic exploration. Even in a lucrative and proven KG D6 block, it has reportedly explored just 6% of the total area.

“We plan to drill in a majority of our blocks. We also propose to accelerate our campaign in the Krishna-Godavari basin,” Ambani said, promising an “aggressive exploration campaign” for new hydrocarbons over the next three years.

The new cash-flows will also be used for restarting some of the stalled ‘sun rise’ projects like retail and a multi-billion expansion of its petrochem business pending since 2007.

It will also invest Rs 500-1000 crore in a non-profit ‘Reliance Foundation’ over the coming years as part of its corporate social responsibility thrust.

Ambani said the company may become debt-free in less than two years. “In 21 months, at this scale and size, Reliance has the potential to be debt-free,” he said. Reliance has a current cash balance of nearly Rs 19420 crore, Ambani said.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)