Insurance firms and MFs innovate products that appeal psychologically, rather than financially

Akhilesh Tilotia

There is a great joy in receiving money and if it comes on its own, we feel elated! Whether what we received was already rightfully our own, becomes secondary to the pleasure of the receipt. Insurance companies and dividend-distributing mutual funds make use of this feeling of joy to innovate products that appeal psychologically, rather than financially to the consumer. Let us take the case of money-back insurance policies.

A money-back insurance policy is a combination of investment and insurance. In a conventional endowment insurance policy, if the policy holder survives the tenure of the policy, he gets the sum assured (the amount for which his life was insured at) along with the bonuses that have accumulated over the years. If he dies in between, his nominee gets the sum assured plus the accumulated bonus. Unlike the conventional policies where the “sum assured” plus accumulated bonuses are payable at the end of the policy, in case of a money back policy, there is staggered payment through the tenure of the policy.

A friend of mine called me to celebrate the first birthday of his kid and proudly told me that he has become a good father for this kid, at least financially. Further probing revealed that he had purchased a children’s money-back policy. He was happy that his son would get Rs 50 lakh at the age of 24, which will finance his higher education.

“And do you know what the best thing is,” he continued, “I will start getting back money from the insurance company! The starting premium is Rs 126,321 (Rs 123,150 as investment and Rs 3,171 as payor rider premium) which reduces from 4th year onwards such that I get back Rs 39,500 in the last year of the policy! Also, a payor rider ensures that even if I am not around or incapacitated due to some reasons, the policy will continue”. The payor rider is attached to a child policy to ensure that if the person paying the premium (my friend in this case) dies or faces a permanent disability of some kind, then all future premiums on the policy are waived off till the child reaches 21 years or the person paying the premium turns 60, whichever comes earlier.

Is it really good?

IRDA guidelines require that all illustrations shown by insurance firms show growth of either 6% or 10% p.a. on a non-volatile basis. We will look at the guaranteed and the 10% returns only. Note, however, that the 10% return is highly unlikely given that the company will invest - by the design and the bye-laws of the policy - in government and secure securities. Other than this they would have to pay out huge commissions to their agents. These two things will ensure that even 10% growth on a money back policy is difficult to achieve. Also as we shall see, 10% growth, does not mean a 10% return.

The company is guaranteeing my friend Rs 50 lakh, when his son turns 24. This guaranteed payment essentially ensures an annual return of 4% p.a. “There is a guaranteed return - something that MFs don’t promise me,” said my friend. “I understand that the returns guaranteed are only 4%, but still I know for sure that I will make that return.” At such low rates of return, you are eroding your capital!

Now let us look at the money back part of the policy: The company says that if it makes profits on the investment it makes, it will share it with the policy holder. Assuming the 10% return, the company expects a schedule as shown in the exhibit. The company declares a bonus, which is netted off against the premium payable by the investor. Hence, in the year 3, when the bonus of Rs 23,050 is announced, the premium for the next year is reduced by that amount. Given that we do not know how much bonus the company will declare, the premium every year will be a fluctuating number.

Now note the rate of return when the insurance company is “earning 10%”. The return in this case works out to 7.19% on a maturity amount of around Rs 51.74 lakh, which is lower than 10% due to adjustment of “payor rider premium”, company administration charges, agent’s commission, etc. Note that this is lower than the return from PPF, which guarantees a return of 8%.

The interesting part of the policy is the payor rider which waives the premium in case some unfortunate event happens to my friend. There is no separate life cover in this policy. However, if my friend were to take a term life cover for himself, then even if something were to happen to him, his son would get the sum assured, which he can invest such that the amount grows till he reaches 24.

What is a better option?

Consider getting a term insurance (for a 30 year male, a Rs 50 lakh cover should cost around Rs 15,000 a year). Ideally my friend should invest the remaining amount of Rs 1,11,321 per year into PPF, but current regulations do not allow an individual to invest more than Rs 70,000 p.a. into a single PPF account. What can be done is that my friend can invest another Rs 30,000 p.a. into a PPF account opened in his wife’s name. Doing this will allow him to claim the maximum benefit of Rs 1 lakh under Section 80 C.

After 23 years, this investment of Rs 1 lakh p.a. will amount to Rs 65.76 lakh, which is higher than what the insurance firms promises - and yes, all of this is tax free! So we see that by investing Rs 1,15,000 p.a. (Rs 1,00,000 towards PPF + Rs 15,000 towards term insurance), which is around Rs 11,000 lesser than the premium being paid in case of the money-back policy, he can build a greater corpus. Also, if something unfortunate were to happen to my friend, then his son gets the Rs 50 lakh life cover.

Un-bundle insurance and investments

This should be your guiding mantra in almost every financial decision involving insurance and investment. Else you will end up with a policy where your own money is returned to you as money back!

tilotia.akhilesh@parkfa.com

![submenu-img]() Vicky Vidya Ka Woh Wala Video: 90s' news readers Rajkummar Rao, Triptii Dimri announce ‘parivarik’ film in hilarious way

Vicky Vidya Ka Woh Wala Video: 90s' news readers Rajkummar Rao, Triptii Dimri announce ‘parivarik’ film in hilarious way![submenu-img]() Weather Update: IMD predicts rainfall in Delhi till this day; issues red alert for these states; check full forecast

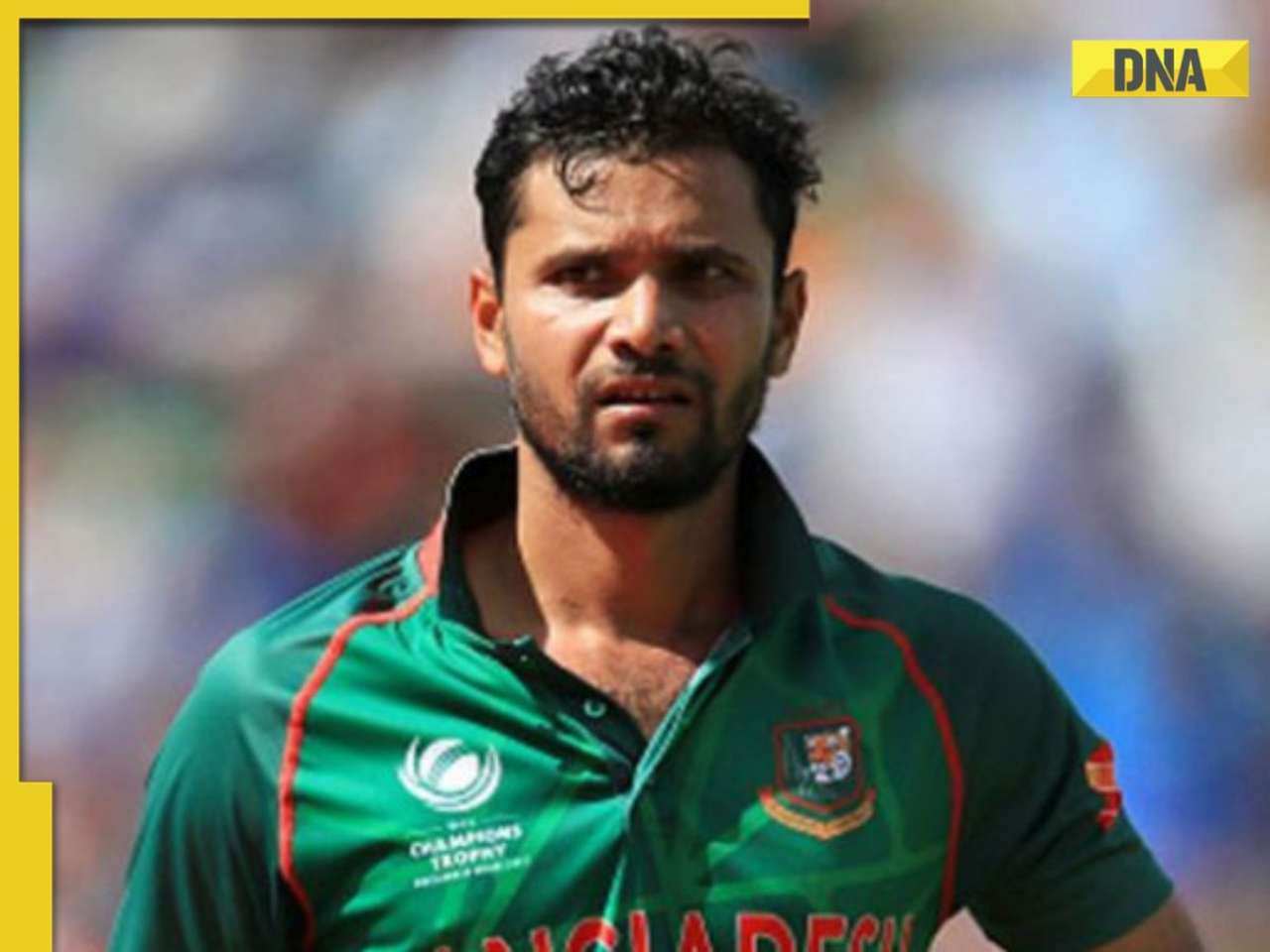

Weather Update: IMD predicts rainfall in Delhi till this day; issues red alert for these states; check full forecast![submenu-img]() After Shakib Al Hasan, Ex-Bangladesh captain Mashrafe Mortaza booked for...

After Shakib Al Hasan, Ex-Bangladesh captain Mashrafe Mortaza booked for...![submenu-img]() AlphaVision Management Consultants LLP Aims to Propel India's Economy to $5 Trillion Milestone

AlphaVision Management Consultants LLP Aims to Propel India's Economy to $5 Trillion Milestone![submenu-img]() Premium Pet House Sells 300 Golden Retriever Puppies In August; Addresses The Breed’s Increasing Demand In India

Premium Pet House Sells 300 Golden Retriever Puppies In August; Addresses The Breed’s Increasing Demand In India![submenu-img]() मोदी सरकार का बड़ा फैसला, 70 साल से ऊपर के सभी बुजुर्गों को मिलेगा 5 लाख तक फ्री इलाज

मोदी सरकार का बड़ा फैसला, 70 साल से ऊपर के सभी बुजुर्गों को मिलेगा 5 लाख तक फ्री इलाज![submenu-img]() GNSS Rule: ना FasTag, ना Cash और ना Toll Booth पर कतार, इतने किमी Toll Free होगा सफर, जानें क्या नियम लाई है सरकार

GNSS Rule: ना FasTag, ना Cash और ना Toll Booth पर कतार, इतने किमी Toll Free होगा सफर, जानें क्या नियम लाई है सरकार![submenu-img]() Shocking News: 'मौत का घर' हैं देश के टॉप हॉस्पिटल, ICMR की जांच में मिले डेडली वायरस के 'सुपरबग्स'

Shocking News: 'मौत का घर' हैं देश के टॉप हॉस्पिटल, ICMR की जांच में मिले डेडली वायरस के 'सुपरबग्स'![submenu-img]() 'उनकी लड़ाई कुर्सी की, मेरे लिए कश्मीर...' तिहाड़ से छूटते NC-PDP पर बरसे राशिद इंजीनियर

'उनकी लड़ाई कुर्सी की, मेरे लिए कश्मीर...' तिहाड़ से छूटते NC-PDP पर बरसे राशिद इंजीनियर![submenu-img]() Haryana Elections: जुलाना में कांग्रेस-AAP के बीच 'दंगल', पहलवान विनेश फोगाट के खिलाफ WWE रेसलर को उतारा

Haryana Elections: जुलाना में कांग्रेस-AAP के बीच 'दंगल', पहलवान विनेश फोगाट के खिलाफ WWE रेसलर को उतारा ![submenu-img]() This car sets new Guinness world record for becoming longest driving EV on a single charge; it cost Rs…

This car sets new Guinness world record for becoming longest driving EV on a single charge; it cost Rs…![submenu-img]() MG Windsor EV launched in India: Check price, features, design of India’s first ‘CUV’

MG Windsor EV launched in India: Check price, features, design of India’s first ‘CUV’![submenu-img]() Nikhil Kamath-backed company to compete with Ola Electric as it plans to launch…

Nikhil Kamath-backed company to compete with Ola Electric as it plans to launch…![submenu-img]() Auto giant gifts Olympic medallist Manu Bhaker this car, it costs Rs...

Auto giant gifts Olympic medallist Manu Bhaker this car, it costs Rs...![submenu-img]() Union Minister Nitin Gadkari says this big carmaker ignored his advice on EVs, 'now they've…'

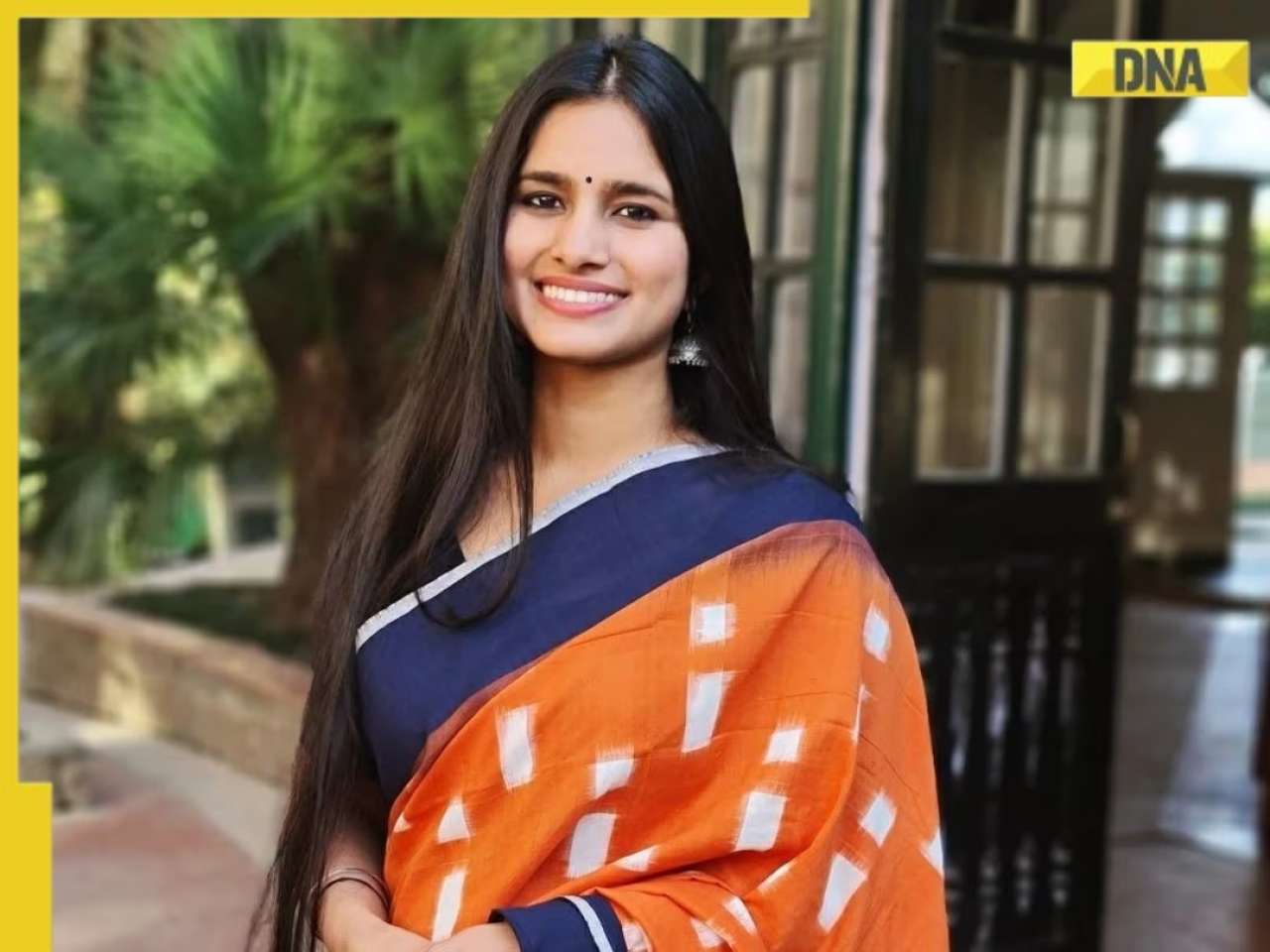

Union Minister Nitin Gadkari says this big carmaker ignored his advice on EVs, 'now they've…'![submenu-img]() Meet Alankrita Shakshi, hired for record-breaking package at Google, not from IIT, IIM, her whopping salary is…

Meet Alankrita Shakshi, hired for record-breaking package at Google, not from IIT, IIM, her whopping salary is…![submenu-img]() Meet woman who left high-paying engineering job to crack UPSC exam, got AIR 6 with self-study, she is now posted as…

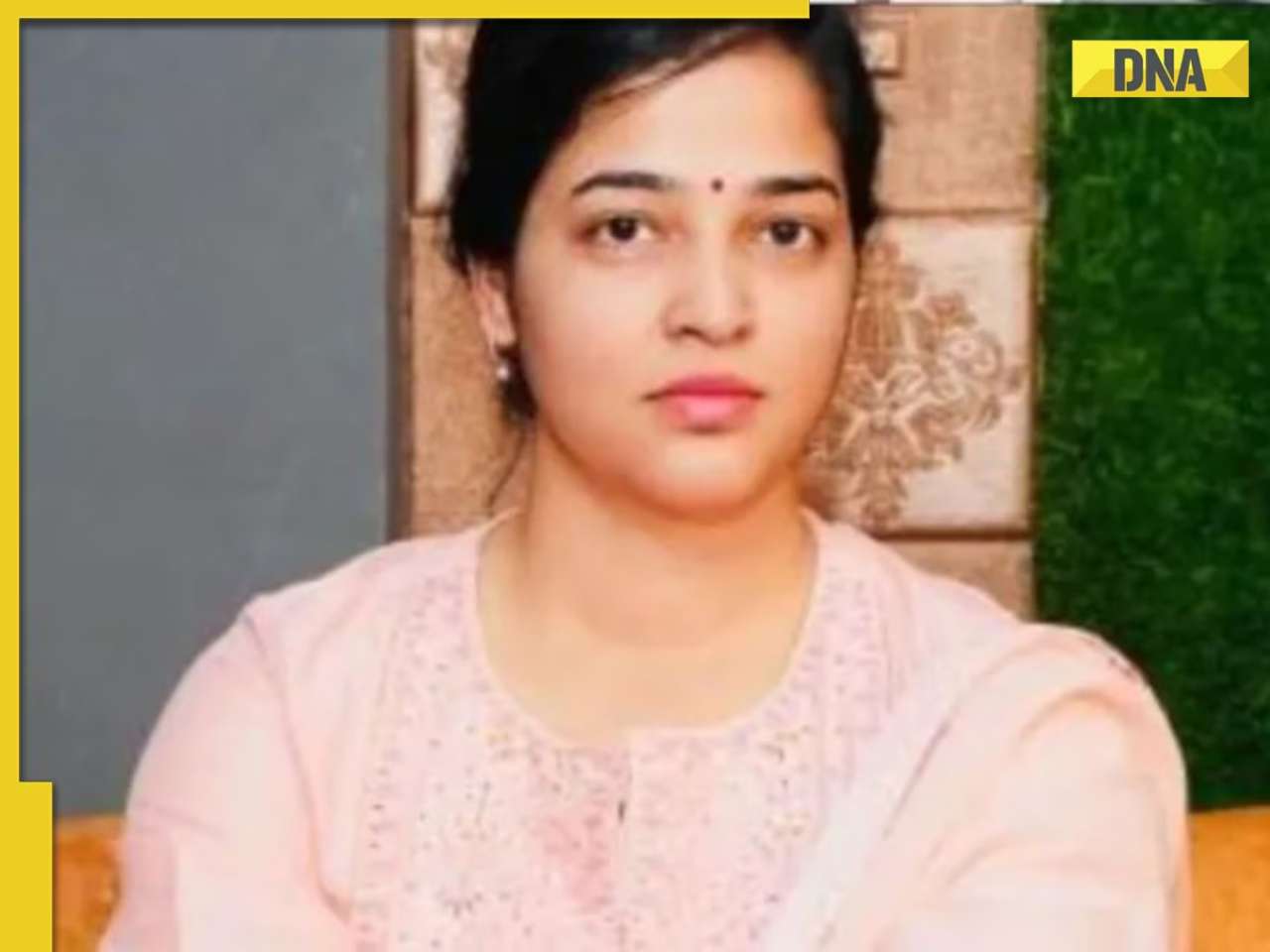

Meet woman who left high-paying engineering job to crack UPSC exam, got AIR 6 with self-study, she is now posted as…![submenu-img]() Meet man, who was forced to marry at 11, had first child at 20, cracked NEET exam in 5th attempt, he is now...

Meet man, who was forced to marry at 11, had first child at 20, cracked NEET exam in 5th attempt, he is now...![submenu-img]() Meet woman, who worked as an assistant professor, cracked UPSC exam in fifth attempt, got AIR...

Meet woman, who worked as an assistant professor, cracked UPSC exam in fifth attempt, got AIR...![submenu-img]() Meet Indian genius who completed PhD at 21, became IIT professor at 22, was sacked from job after few years due to...

Meet Indian genius who completed PhD at 21, became IIT professor at 22, was sacked from job after few years due to...![submenu-img]() BSF Jawan Injured As Pakistan Violates Ceasefire Near LoC Days Before Jammu Kashmir Elections 2024

BSF Jawan Injured As Pakistan Violates Ceasefire Near LoC Days Before Jammu Kashmir Elections 2024![submenu-img]() Rahul Gandhi US Visit: Rahul Gandhi Criticizes BJP And RSS At National Press Club, US | INDIA

Rahul Gandhi US Visit: Rahul Gandhi Criticizes BJP And RSS At National Press Club, US | INDIA![submenu-img]() Kolkata Doctor Case: ED Reveals Properties Of RG Kar Ex-Principal Sandip Ghosh Found In Raids

Kolkata Doctor Case: ED Reveals Properties Of RG Kar Ex-Principal Sandip Ghosh Found In Raids![submenu-img]() Manipur Violence: Curfew Imposed In Three Manipur Districts Amid Drone, Rocket Attacks By Insurgents

Manipur Violence: Curfew Imposed In Three Manipur Districts Amid Drone, Rocket Attacks By Insurgents![submenu-img]() Kolkata Doctor Case: Victim's Mother Blasts CM Mamata Banerjee's 'Insensitive' Durga Puja call

Kolkata Doctor Case: Victim's Mother Blasts CM Mamata Banerjee's 'Insensitive' Durga Puja call![submenu-img]() AlphaVision Management Consultants LLP Aims to Propel India's Economy to $5 Trillion Milestone

AlphaVision Management Consultants LLP Aims to Propel India's Economy to $5 Trillion Milestone![submenu-img]() This car sets new Guinness world record for becoming longest driving EV on a single charge; it cost Rs…

This car sets new Guinness world record for becoming longest driving EV on a single charge; it cost Rs…![submenu-img]() Ratan Tata's company loses Rs 21881 crore in 6 hrs due to...

Ratan Tata's company loses Rs 21881 crore in 6 hrs due to...![submenu-img]() Meet man, who was abandoned as child, runs Rs 3608487 crore company, richer than Mark Zuckerberg, his net worth is...

Meet man, who was abandoned as child, runs Rs 3608487 crore company, richer than Mark Zuckerberg, his net worth is...![submenu-img]() Meet woman who became CEO at 30, has this Mukesh Ambani, Isha Ambani link, she is...

Meet woman who became CEO at 30, has this Mukesh Ambani, Isha Ambani link, she is...![submenu-img]() This actress became star at 11, was shot dead by husband on son's birthday; then her daughter...

This actress became star at 11, was shot dead by husband on son's birthday; then her daughter...![submenu-img]() Carlos Alcaraz to Aryna Sabalenka: World’s highest-paid Tennis players of 2024

Carlos Alcaraz to Aryna Sabalenka: World’s highest-paid Tennis players of 2024![submenu-img]() Made in Rs 6 lakh, grossed Rs 800 crore, bigger than RRR, Jawan: Why most profitable film ever paid actors just Rs 20000

Made in Rs 6 lakh, grossed Rs 800 crore, bigger than RRR, Jawan: Why most profitable film ever paid actors just Rs 20000![submenu-img]() Priyanka Chopra stuns in black, poses with Kim Kardashian, Julianne Moore, Salma Hayek at Caring for Women dinner

Priyanka Chopra stuns in black, poses with Kim Kardashian, Julianne Moore, Salma Hayek at Caring for Women dinner![submenu-img]() US 9/11 attack: 7 lesser known facts about September 11 terror attack

US 9/11 attack: 7 lesser known facts about September 11 terror attack![submenu-img]() Weather Update: IMD predicts rainfall in Delhi till this day; issues red alert for these states; check full forecast

Weather Update: IMD predicts rainfall in Delhi till this day; issues red alert for these states; check full forecast![submenu-img]() Premium Pet House Sells 300 Golden Retriever Puppies In August; Addresses The Breed’s Increasing Demand In India

Premium Pet House Sells 300 Golden Retriever Puppies In August; Addresses The Breed’s Increasing Demand In India![submenu-img]() J-K: Two terrorists killed in intense encounter near Kathua-Udhampur border

J-K: Two terrorists killed in intense encounter near Kathua-Udhampur border![submenu-img]() BJP members protest against Rahul Gandhi over his 'Sikh remarks' in US, seeking...

BJP members protest against Rahul Gandhi over his 'Sikh remarks' in US, seeking...![submenu-img]() J&K terror funding case: ‘My fight is for…’, says MP Engineer Rashid after walking out of Tihar jail on bail ahead of…

J&K terror funding case: ‘My fight is for…’, says MP Engineer Rashid after walking out of Tihar jail on bail ahead of…

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)