Limited liability partnerships will now invite alternate minimum tax.

In one fell swoop, the government has rid limited liability partnerships (LLPs) of their tax-friendly aspect, thereby putting a few Indian businessmen including Mukesh Ambani, promoter of Reliance Industries (RIL), India’s largest private sector firm, on the MAT (minimum alternate tax).

In his budget speech, finance minister Pranab Mukherjee explained the new measure — “to preserve the tax base vis-a-vis profit-linked deductions.”

Revenue secretary Sunil Mitra reaffirmed his boss’ views on Tuesday: “I am protecting my tax base as I am trying to remove any arbitrage between companies and LLPs.”

The amendment will take effect from April 1, 2012, thereby giving businessmen a leeway of one year.

Going by experts, New Delhi moved in to plug this loophole after promoters of the two family-run businesses (RIL and Piramal Healthcare) restructured their ownership in the company in favour of LLPs, thereby saving on both MAT and dividend distribution tax (DDT).

An RIL spokesperson did not respond to a DNA Money query on the issue.

A spokesperson of Piramal Healthcare also did not comment.

According to Girish Vanvari, executive director at KPMG, LLPs had two advantages until February 28: they were not liable to MAT and they did not have to pay DDT.

“Now, LLPs are liable to pay MAT, so you can say that one of the advantages has been taken away,” said Vanvari.

LLPs will pay MAT at 18.5%, but will be exempt from DDT of 17% on the dividend declared.

According to a document prepared by PwC post budget, the MAT provisions, currently applicable only to companies, have now been extended to LLPs in a modified form —- alternate minimum tax, or AMT.

“AMT will be applicable to LLPs at a rate of 18.5%. However, in the case of LLPs, AMT will apply to the adjusted total income (as per the income-tax provisions) rather than the adjusted book profits, as is the case for companies. AMT credit is available to an LLP for 10 years.”

“The economic rationale (to impose MAT) is clear —- the government does not want LLPs that have been used by some corporates to save on tax to have any arbitrage,” Mukesh Butani, a partner at law firm BMR Advisors, said, adding that “this arbitrage seems to have been partly taken away”

Butani said the imposition of MAT has put professional firms like his in an “awkward position” and calls the measure more as an “afterthought.” According to him, the government should have thought of the taxation when it brought the legislation in 2009.

RIL’s adept promoters created 29 LLPs in August that owned 32.75% of India’s largest private sector company in terms of value under imaginatively named firms such as Kamalakar, Chakresh, Chakradhar and others. The 29 firms collectively earned Rs750.77 crore as dividend income. When the new alternate minimum tax norm becomes effective, and in the scenario of RIL maintaining dividends at the same level, the tax outgo could be as much as Rs139 crore.

Later in that same month, Ajay Piramal-run Piramal Healthcare Ltd, too informed the Bombay Stock Exchange about the restructuring process, which saw the promoter groups transferring 51% stake into private companies, which were later converted into limited liability partnerships.

The restructuring was done primarily to save dividend distribution tax for the promoters, who were in for huge windfall after Piramal Healthcare sold its domestic formulations to US drugmaker Abbott Laboratories Inc. for $3.72 billion.

Many family-controlled companies and promoters of other firms hold stakes in the parent company through a clutch of private limited firms that are liable to pay taxes such as the dividend distribution tax and minimum alternate tax. New Delhi introduced the concept of Limited Liability Partnership in 2009 as it helped professionals and entrepreneurs to conduct business easily.

“(Under LLPs) You can form and dissolve a partnership in relatively quicker time and you can also do the documentation work more easily,” said Jayant Thakur, a chartered accountant at Mumbai-based Jayant M Thakur and Co.

Thakur said only a few companies until now had been able to use the benefits for taxation purpose although he does acknowledge that the tax savings are “considerable.

![submenu-img]() Malayalam actor Mohan Raj, known for playing iconic villain Keerikadan Jose in Mohanlal's Kireedam, passes away

Malayalam actor Mohan Raj, known for playing iconic villain Keerikadan Jose in Mohanlal's Kireedam, passes away![submenu-img]() Anil Ambani's Reliance Power approves Rs 4200 crore plan as shares hit over...

Anil Ambani's Reliance Power approves Rs 4200 crore plan as shares hit over...![submenu-img]() Vijay Kiragandur, producer who made blockbusters KGF, Kantara possible, turns 48

Vijay Kiragandur, producer who made blockbusters KGF, Kantara possible, turns 48![submenu-img]() Amitabh Bachchan arranged Anil Ambani's private plane after Aishwarya Rai was injured: 'For two nights, I couldn't...'

Amitabh Bachchan arranged Anil Ambani's private plane after Aishwarya Rai was injured: 'For two nights, I couldn't...'![submenu-img]() 'Absolute rubbish': CSK physio slams Harbhajan Singh for saying MS Dhoni 'punched screen' after loss to RCB in IPL

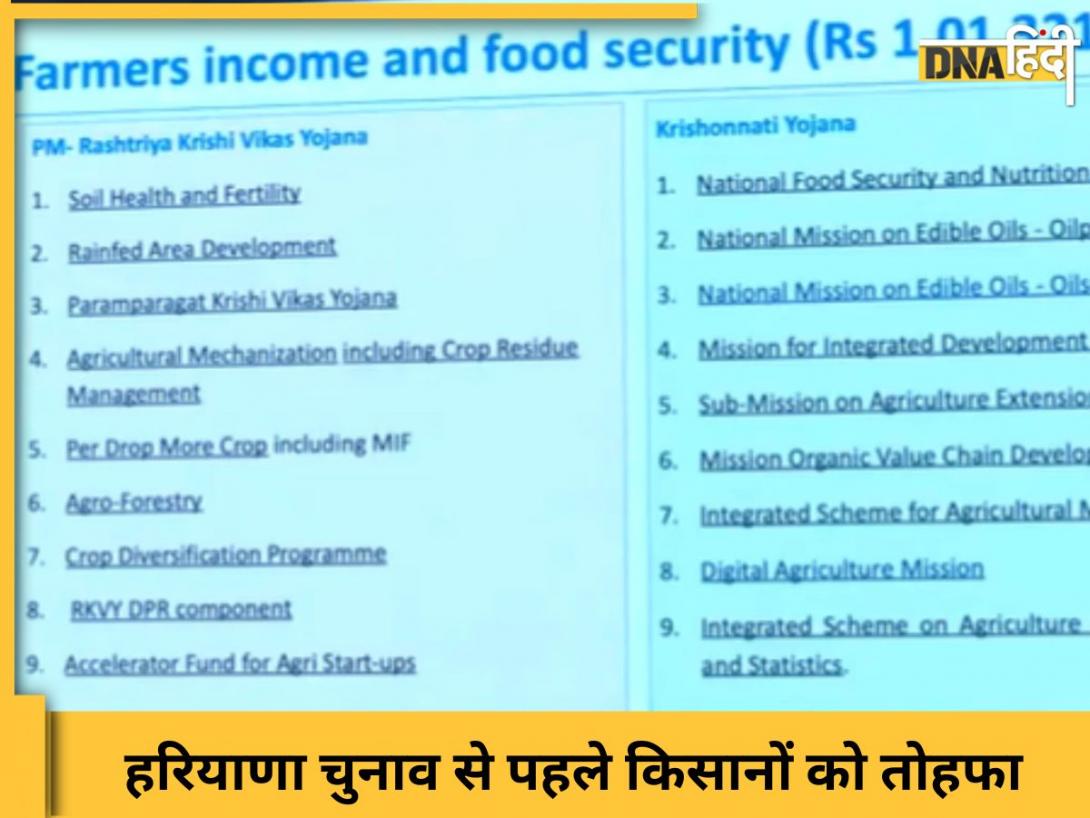

'Absolute rubbish': CSK physio slams Harbhajan Singh for saying MS Dhoni 'punched screen' after loss to RCB in IPL![submenu-img]() Cabinet Decisions: मोदी सरकार किसानों के लिए खर्च करेगी 1 लाख करोड़, हरियाणा में मतदान से पहले खोला पिटारा

Cabinet Decisions: मोदी सरकार किसानों के लिए खर्च करेगी 1 लाख करोड़, हरियाणा में मतदान से पहले खोला पिटारा![submenu-img]() Indian Railways: रेल कर्मचारियों के लिए Diwali से पहले बड़ा तोहफा, मोदी सरकार 78 दिनों का देगी बोनस

Indian Railways: रेल कर्मचारियों के लिए Diwali से पहले बड़ा तोहफा, मोदी सरकार 78 दिनों का देगी बोनस![submenu-img]() Jammu And Kashmir Encounter: चुनावी सुरक्षा के बीच किश्तवाड़ में 20 दिन में दूसरा Terror Attack, सुरक्षा बलों के साथ एनकाउंटर चालू

Jammu And Kashmir Encounter: चुनावी सुरक्षा के बीच किश्तवाड़ में 20 दिन में दूसरा Terror Attack, सुरक्षा बलों के साथ एनकाउंटर चालू![submenu-img]() Digital Arrest: आपकी बेटी सेक्स रैकेट में पकड़ी गई!, फोन करने वाले ने कहा, सुनते ही मां ने तोड़ा दम

Digital Arrest: आपकी बेटी सेक्स रैकेट में पकड़ी गई!, फोन करने वाले ने कहा, सुनते ही मां ने तोड़ा दम![submenu-img]() 'Marital Rape को अपराध घोषित करना जरूरी नहीं', Supreme Court में केंद्र सरकार का हलफनामा

'Marital Rape को अपराध घोषित करना जरूरी नहीं', Supreme Court में केंद्र सरकार का हलफनामा![submenu-img]() This company overtakes Ratan Tata's firm to become India’s…; it is owned by…

This company overtakes Ratan Tata's firm to become India’s…; it is owned by…![submenu-img]() Mahindra Thar ROXX booking to start from..., check waiting period, details

Mahindra Thar ROXX booking to start from..., check waiting period, details![submenu-img]() BMW launches CE 02 electric scooter in India; price starts at Rs…

BMW launches CE 02 electric scooter in India; price starts at Rs…![submenu-img]() Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…

Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…![submenu-img]() Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...

Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...![submenu-img]() Meet man, who bagged AIR 1 in JEE Advance, studied at IIT Bombay, now pursuing PhD at prestigious college in...

Meet man, who bagged AIR 1 in JEE Advance, studied at IIT Bombay, now pursuing PhD at prestigious college in...![submenu-img]() This was India's most educated man, had 20 degrees, cracked UPSC twice but quit IAS job due to...

This was India's most educated man, had 20 degrees, cracked UPSC twice but quit IAS job due to...![submenu-img]() RRB Railway Recruitment 2024: Sarkari naukri alert for 14298 posts, know how to apply online at rrbapply.gov.in before..

RRB Railway Recruitment 2024: Sarkari naukri alert for 14298 posts, know how to apply online at rrbapply.gov.in before..![submenu-img]() Meet IAS officer, BITS graduate who left high-paying job at Google, got highest marks in UPSC exam, he is...

Meet IAS officer, BITS graduate who left high-paying job at Google, got highest marks in UPSC exam, he is...![submenu-img]() Meet man who quit his job at ISRO, then began taxi company, its turnover is Rs...

Meet man who quit his job at ISRO, then began taxi company, its turnover is Rs...![submenu-img]() After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon

After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon![submenu-img]() Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War

Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War![submenu-img]() Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain

Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain![submenu-img]() Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts

Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts![submenu-img]() Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir

Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir![submenu-img]() Anil Ambani's Reliance Power approves Rs 4200 crore plan as shares hit over...

Anil Ambani's Reliance Power approves Rs 4200 crore plan as shares hit over...![submenu-img]() Good news for these central govt employees, Cabinet approves Rs 2029 crore bonus ahead of Diwali; check details

Good news for these central govt employees, Cabinet approves Rs 2029 crore bonus ahead of Diwali; check details![submenu-img]() Mukesh Ambani's Reliance loses Rs 77606 crore in just one day, market cap drops to...

Mukesh Ambani's Reliance loses Rs 77606 crore in just one day, market cap drops to...![submenu-img]() Meet woman whose father once owned private airlines in India, her connection with Lalit Modi was...

Meet woman whose father once owned private airlines in India, her connection with Lalit Modi was...![submenu-img]() Mukesh Ambani adds another aircraft to his flying fleet, buys India’s first Boeing 737 MAX 9 for Rs...

Mukesh Ambani adds another aircraft to his flying fleet, buys India’s first Boeing 737 MAX 9 for Rs...![submenu-img]() 10 times Aabha Paul brought the internet down with her sultry photos, sexy videos

10 times Aabha Paul brought the internet down with her sultry photos, sexy videos![submenu-img]() OTT Releases This Week: The Greatest of All Time, CTRL, The Signature, The Tribe, latest films, series to binge-watch

OTT Releases This Week: The Greatest of All Time, CTRL, The Signature, The Tribe, latest films, series to binge-watch![submenu-img]() 10 thirst trap, sizzling hot photos of Avneet Kaur

10 thirst trap, sizzling hot photos of Avneet Kaur![submenu-img]() 6 mesmerising images of Nebula captured by NASA's Hubble Telescope

6 mesmerising images of Nebula captured by NASA's Hubble Telescope![submenu-img]() From Har Ki Pauri to Shivpuri: 6 places to visit in Haridwar and Rishikesh

From Har Ki Pauri to Shivpuri: 6 places to visit in Haridwar and Rishikesh![submenu-img]() 'Biased and agenda-driven': India dismisses USCIRF report on religious freedom

'Biased and agenda-driven': India dismisses USCIRF report on religious freedom![submenu-img]() Bank fraud: Fake SBI branch uncovered in Chhattisgarh, locals duped with fake recruitment drives and bank services

Bank fraud: Fake SBI branch uncovered in Chhattisgarh, locals duped with fake recruitment drives and bank services![submenu-img]() This politician was seeking votes for BJP in a speech, an hour later joined Congress, he is…

This politician was seeking votes for BJP in a speech, an hour later joined Congress, he is…![submenu-img]() Halal meat exports: India rolls out fresh guidelines with effect from October 16

Halal meat exports: India rolls out fresh guidelines with effect from October 16![submenu-img]() Isha Foundation row: SC transfers plea from Madras High Court to itself, asks police not to...

Isha Foundation row: SC transfers plea from Madras High Court to itself, asks police not to...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)